Krystal Integrated Services: PAT growth of 48% & Revenue growth of 16% in H1-25 at a PE of 18

Revenue CAGR guidance of 25-30% for FY24-27. Revenue growth of 25% in FY25. Margins to be sustained. Outlook for next 3 years is not captured in the current valuations

1. Why is KRYSTAL interesting?

krystal-group.com | NSE: KRYSTAL

Krystal is attractive based on valuations. Outlook of 25-30% revenue growth while maintaining margins for the next 3 years is not captured in current valuations.2. Integrated Facility Management (IFM) company

Portfolio of services

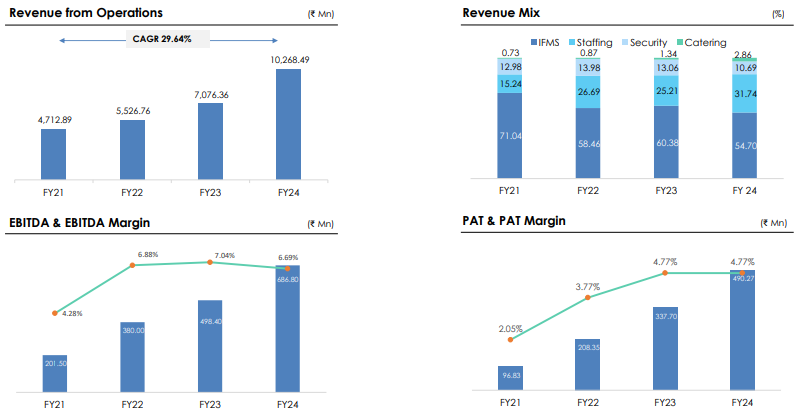

3. FY21-24: PAT CAGR of 72% & Revenue CAGR of 30%

4. FY24: PAT up 45% & Revenue up 45% YoY

** Excluding profit from discontinued operations5. Strong Q2-25: PAT up 27% & Revenue up 13% YoY

6. Strong H1-25: PAT up 48% & Revenue up 16% YoY

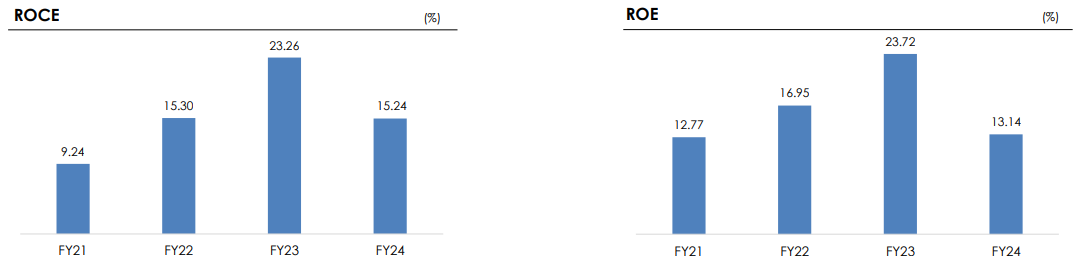

7. Business metrics: Strong return ratios

8. Outlook: 25-30% revenue CAGR for FY24-27 with margin expansion

Management believes Krystal will continue to grow annually at a rate of 25% year-on-year.

They are confident they have enough work lined up to achieve this goal, despite what they called a “muted” performance in Q2. They expect to see more progress toward the target in the second half of the year

Krystal will continue to pursue government contracts and private sector contracts. Management believes the 70% government, 30% corporate revenue mix they currently have is healthy and will take the company a long way

They do not plan to drastically disturb this ratio, but they will continue to acquire new customers in the corporate sector

i. FY24-27: 25-30% revenue CAGR

Krystal Integrated eyes 30% revenue growth over next three years

We are going to continue our growth by 25% to 30% year after year

ii. FY24-27: Margins will be sustained around current levels

our zone and the range of margin profile is going to continue in the same way.

we will continue all the growth points in the similar zone and the endeavor is to make it better and better only.

9. PAT growth of 48% & Revenue of 16% in H1-25 at a PE of 20

10. Hold?

If I hold the stock then one may continue holding on to KRYSTAL

KRYSTAL delivered a strong FY24 followed by an equally strong H1-25 where bottom-line performance has been quite strong. This has increased confidence in the management to deliver top-line growth of 25-30% with sustainable margins. Management is indicating towards a strong H2-24 specially in the last quarter of the year.

I think it is good towards the second and the last quarter where you will see

us coming absolutely on target in terms of our performance.

The net 3 year outlook for KRYSTAL is very strong and one should hold on to KRYSTAL as long as the underlying business momentum is sustained.

KRYSTAL has moved from a Tier2 supplier to a Tier1 supplier as it crossed the Rs 1,000 cr revenue mark in FY24. The transition to a Tier1 supplier would open up opportunities for KRYSTAL

11. Buy?

If I am looking to enter KRYSTAL then

KRYSTAL has delivered a PAT growth of 48% on a revenue growth of 16% in H1-25, the PE of 18 looks reasonable.

KRYSTAL is guiding for FY25 revenue growth of 25% with growth coming in H2-25 while sustaining margins at a PE of 18 which makes the valuations reasonable.

KRYSTAL is guiding for FY24-27 revenue CAGR of 25-30% while sustaining margins at a PE of 18 which makes the valuations quite attractive in the long term.

Previous coverage of KRYSTAL

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Q2 PBT growth is just 5%.

Bad Q3. And the company has neither released earnings presentation nor conducting a investors call.

Most companies after IPOs somehow magically put in a bad performance after listing.