Krystal Integrated Services: PAT growth of 76% & Revenue growth of 18% in Q1-25 at a PE of 20

Revenue CAGR guidance of 25-30% for FY24-27. Margin profile will be maintained during the period of growth. Outlook of growth for the next 3 years is not captured in the current valuations

1. Why is KRYSTAL interesting?

krystal-group.com | NSE: KRYSTAL

Krystal is attractive based on valuations. Outlook of 25-30% revenue growth while maintaining margins for the next 3 years is not captured in current valuations.2. Integrated Facility Management (IFM) company

Portfolio of services

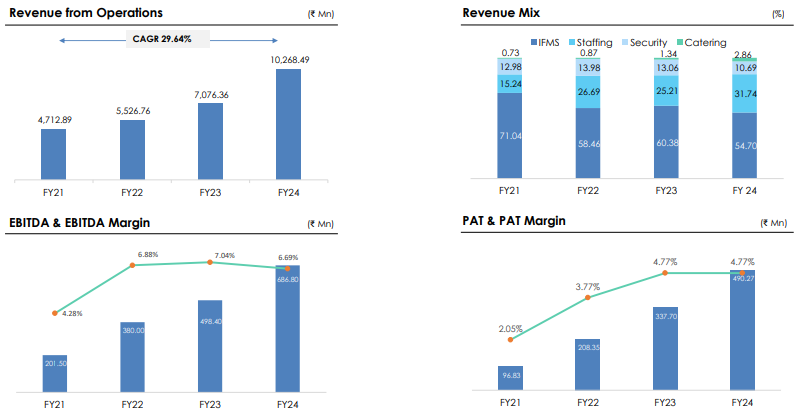

3. FY21-24: PAT CAGR of 72% & Revenue CAGR of 30%

4. FY24: PAT up 45% & Revenue up 45% YoY

** Excluding profit from discontinued operations5. Strong Q1-25: PAT up 76% & Revenue up 18% YoY

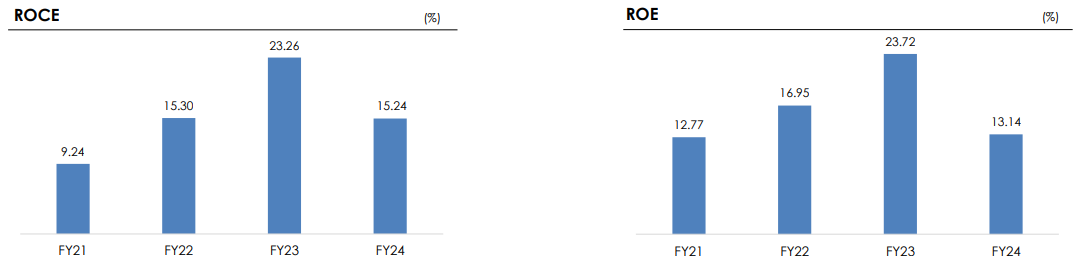

6. Business metrics: Strong return ratios

7. Outlook: 25-30% revenue CAGR for FY24-27 with margin expansion

i. FY24-27: 25-30% revenue CAGR

Krystal Integrated eyes 30% revenue growth over next three years

We are going to continue our growth by 25% to 30% year after year

ii. FY24-27: Margins will be sustained around current levels

our zone and the range of margin profile is going to continue in the same way.

we will continue all the growth points in the similar zone and the endeavor is to make it better and better only.

8. PAT growth of 76% & Revenue of 18% in Q1-25 at a PE of 20

9. Do I stay?

If I hold the stock then one may continue holding on to KRYSTAL

KRYSTAL delivered a strong FY24 followed by an equally strong Q1-25 where bottom-line performance has been quite strong. This has increased confidence in the management to deliver top-line growth of 25-30% with sustainable margins.

Overall, we have entered the new fiscal year on an optimistic note and aim to sustain this momentum in the coming quarters.

The net 3 year outlook for KRYSTAL is very strong and one should hold on to KRYSTAL as long as the underlying business momentum is sustained.

KRYSTAL has moved from a Tier2 supplier to a Tier1 supplier as it crossed the Rs 1,000 cr revenue mark in FY24. The transition to a Tier1 supplier would open up opportunities for KRYSTAL

10. Do I enter?

If I am looking to enter KRYSTAL then

KRYSTAL has delivered a PAT growth of 78% on a revenue growth of 18% in Q1-25, the PE of 20 looks quite attractive.

KRYSTAL is guiding for FY24-27 revenue CAGR of 25-30% while sustaining margins at a PE of 20 which makes the valuations quite attractive in the long term.

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer