KPI Green Energy: PAT growth of 86% & revenue growth of 60% in 9M-25 at a PE of 33

Guidance of up to 60% revenue CAGR till FY30 with sustainable margins. 9M-25 performance in line with guidance. Strong revenue visibility based on orders in hand at ~2X of FY25 revenue.

1. Renewable power generating company in Gujarat

kpigreenenergy.com | NSE: KPIGREEN

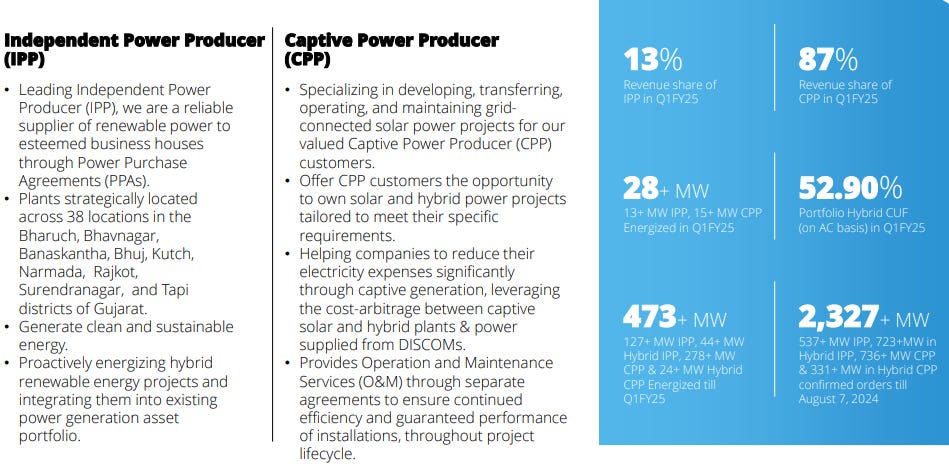

Business Segments

2. FY20-24: Revenue CAGR of 124% & PAT CAGR of 104%

3. Strong FY24: PAT up 48% & Revenue up 59% YoY

4. Strong Q3-25: PAT up 68% & Revenue up 39% YoY

PAT up 22% & Revenue up 27% QoQ

5. Strong 9M-25: PAT up 86% & Revenue up 60% YoY

6. Business metrics: Strong return ratios

7. Outlook: Revenue CAGR of up to 60%

i. FY24-30: Revenue CAGR of up to 60%

ii. Strong revenue visibility - Order book ~2X FY25 expected revenue

Assuming a FY25 revenue of close to Rs 1,600 cr given the Rs 1,177 cr run rate in 9M-25. An order book of Rs 3,200 cr is 2X of FY25 expected revenue.

iii. Margins are sustainable

8. PAT growth of 86% & revenue growth of 60% in 9M-25 at a PE of 33

9. Hold?

If I hold the stock then one may continue holding on to KPIGREEN

The strong business momentum from FY24 continues into the first nine months of FY25, with growth in-line with the 60% outlook given by the management.

Strong order book is providing confidence of a strong FY25 and providing revenue visibility in to FY26. One can keep riding the business momentum as long as it lasts.

60% growth target till FY30 seems ambitious. It should be viewed with caution.

However, the 60% growth outlook for FY26 appears reasonable based on the current order book.

It's best to reassess the growth outlook annually.

The price stock price is seriously down from its 52 wk high which is creating a lot of doubts. However, the business momentum and execution in FY25 continues uninterrupted.

10. Buy?

If I am looking to enter KPIGREEN then

KPIGREEN has delivered PAT growth of 86% & Revenue growth of 60% in 9M-25 at a PE of 33 which makes valuations fairly priced in the short term.

The revenue CAGR outlook of up to 60% until FY30 presents an opportunity in KPIGREEN at a PE of 33. However, it’s important to assess this outlook based on year-to-year performance.

Strong revenue visibility for FY26 is supported by the current order book, which is nearly twice the expected revenue for FY25. This order book boosts confidence in KPIGREEN's management outlook of delivering 60% growth, making the PE of 33 reasonable from a FY26 perspective.

With a 60% growth target, the margin of safety is low. A weak quarter could lead to disappointment, raising doubts about the target and negatively impacting the stock price. Strong execution is crucial to sustain the growth story till FY30.

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer