KPI Green Energy Q2 FY26 Results: PAT up 67%, On-track FY26 Guidance

Guidance of 60% revenue CAGR for FY25-27 with stable margins. Concerns around quality of growth and earnings of KPIGREEN. Available at attractive valuations

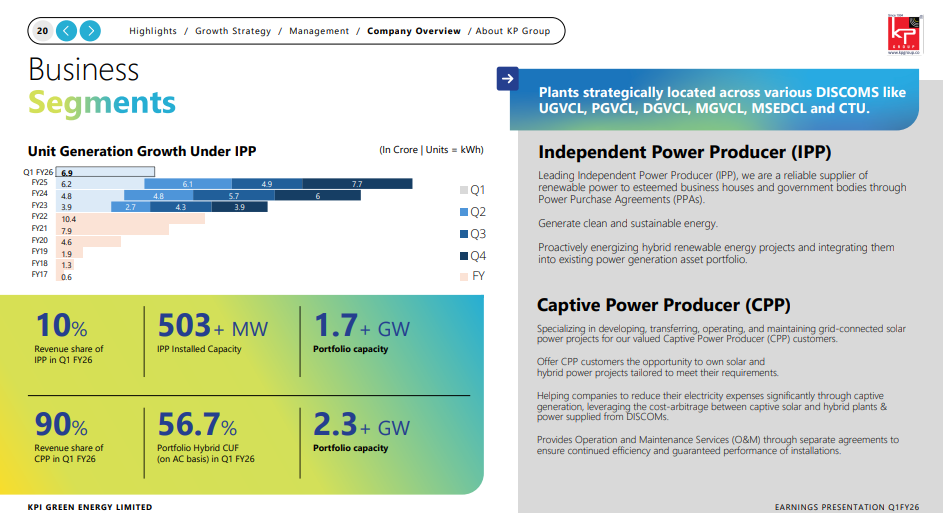

1. Renewable power generating company in Gujarat

kpigreenenergy.com | NSE: KPIGREEN

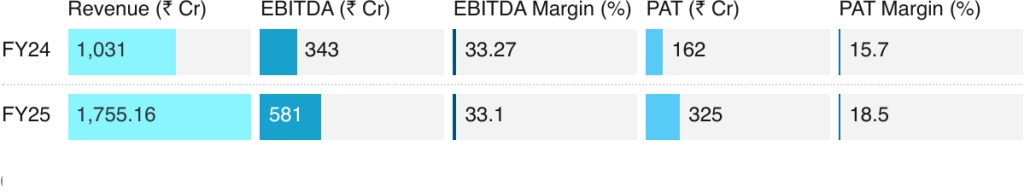

2. FY21–25: PAT CAGR of 111% & Total Income CAGR of 67%

3. FY25: PAT up 101% & Total Income up 70% YoY

Guidance Out-performance: Revenue growth at 70% vs guidance of ~60%

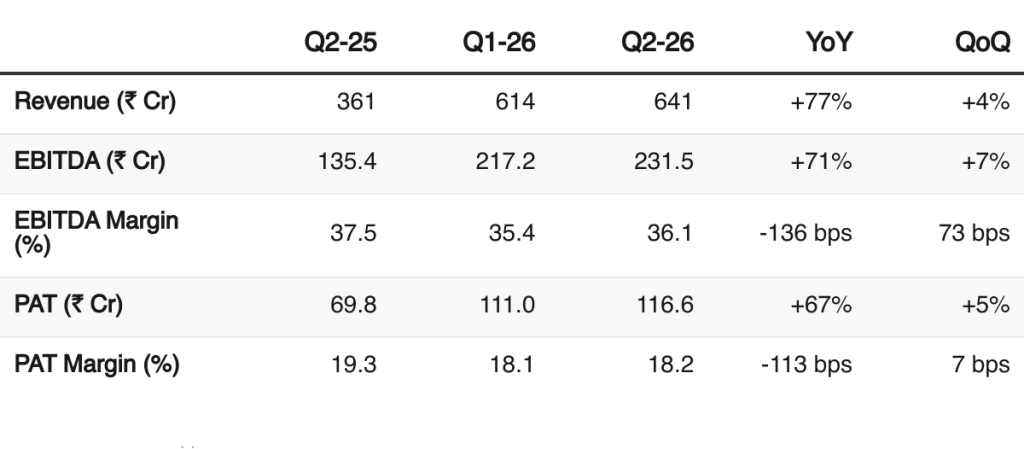

4. Q2-26: PAT up 67% & Revenue up 77% YoY

PAT up 5% & Revenue up 4% QoQ

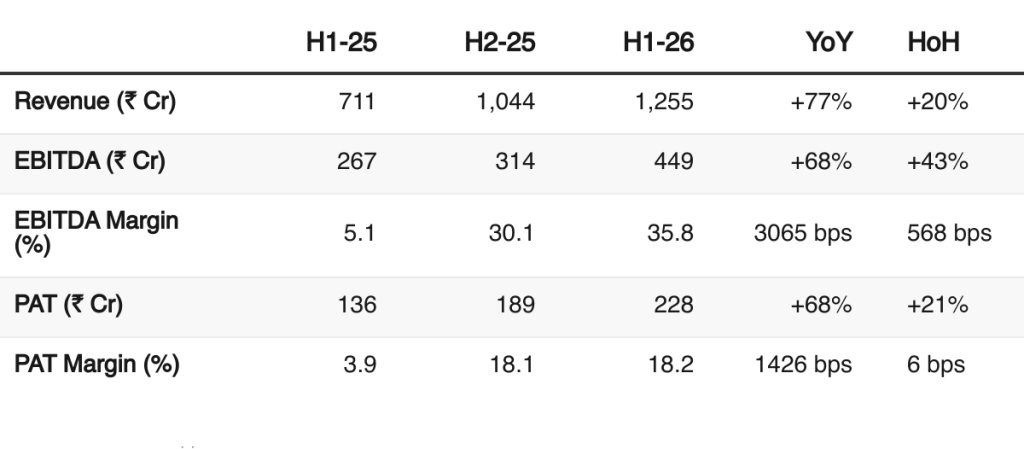

5. H1-26: PAT up 68% & Revenue up 77% YoY

PAT up 21% & Revenue up 20% QoQ

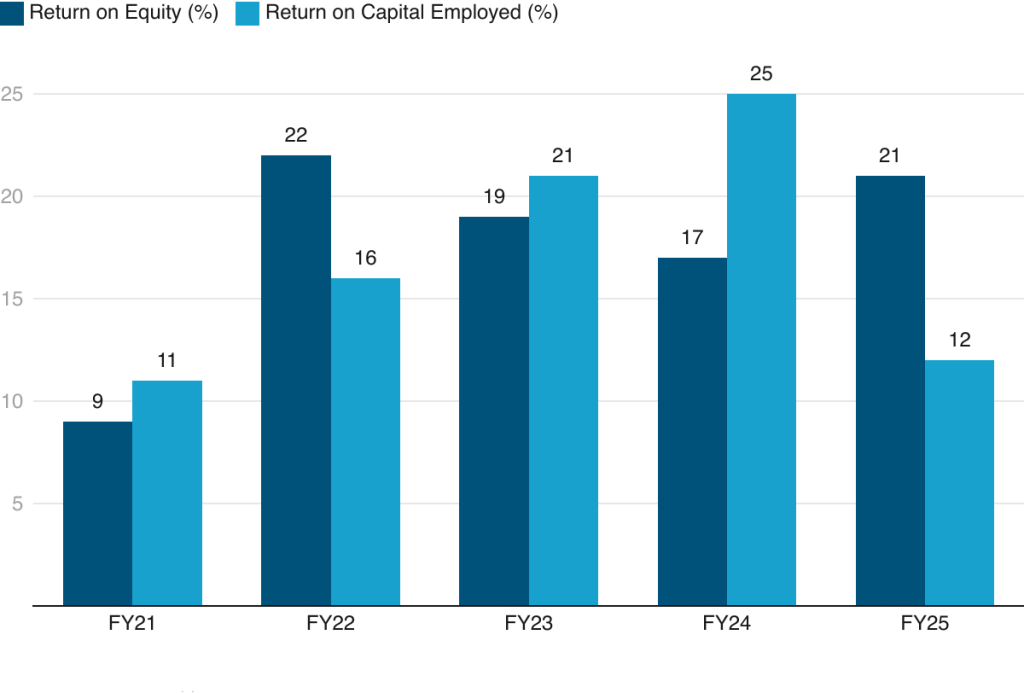

6. Business metrics: Steady Return Ratios

FY25 Return Compression: Returns moderated in FY25 due to higher capital employed, with equity tripling YoY as the company scaled.

Healthy Profitability Maintained: Even with equity dilution, KPI delivered high-teen ROE and double-digit ROCE, reflecting efficient asset monetization.

7. Outlook: Revenue CAGR of 60%

7.1 Management Guidance

Continuation of Guidance set in Q4-25 earnings call

Revenue: 50% to 70% growth for FY26

FY27: 60% growth

Margins: Sustain profitability margins despite aggressive growth:

PAT: 15-20%

EBITDA: 30-33%

Captive Power Producer (CPP) segment ~20-22%

IPP segment ~85-90%

Fundraising and Debt Management: Keep debt-to-equity ratio, not exceeding 2:1.

Do not expect needing to raise further equity or dilute promoter holding for the next couple of years

To maintain this ratio, as profitability is strong.

7.2 H1 FY26 Performance vs FY26 Guidance

Revenue: On-track to deliver 60%+ growth

Margins: Both H1-26 EBITDA and PAT are in-line with the guidance given

Overall: Expecting the momentum of FY25 to continue into FY26 and carry over to FY27

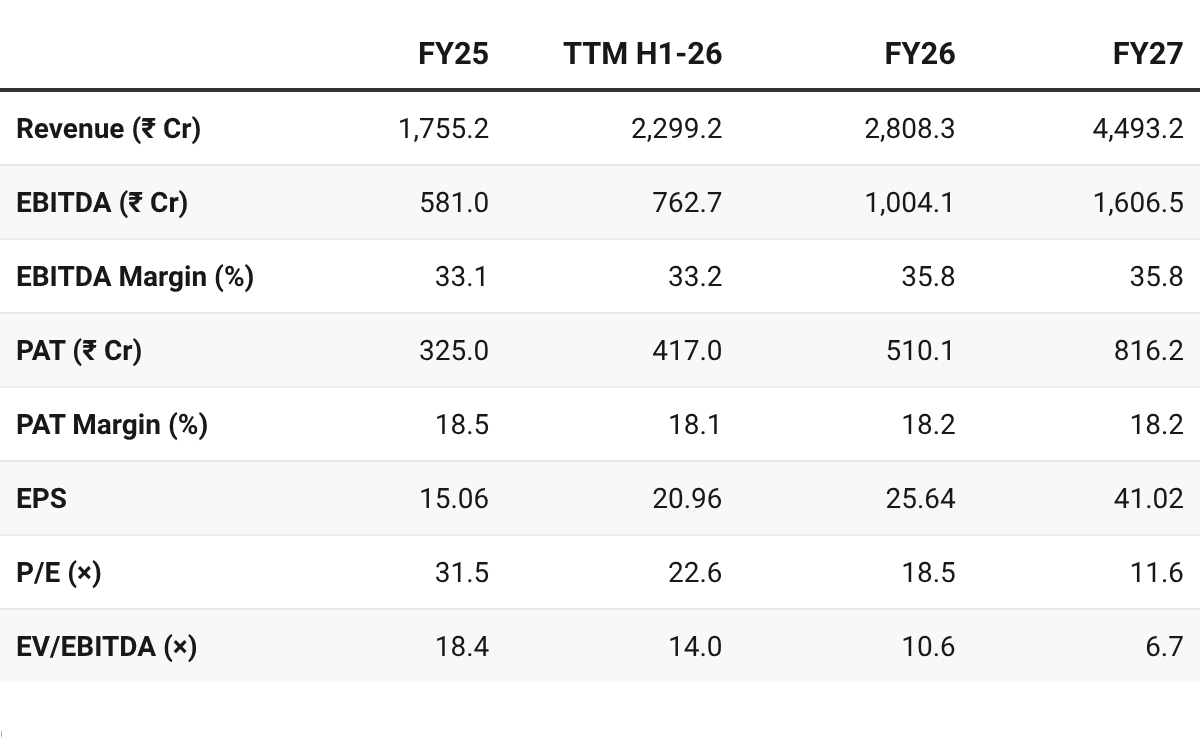

8. Valuation Analysis

8.1 Valuation Snapshot – KPI Green Energy Ltd.

Current Market Price = ₹474.15 | Market Cap = ₹9,376.2 Cr

Assuming 60% growth till FY27 with stable margins

Forward looking analysis is restricted to FY27 as one needs to watch execution play out.

However if growth plays out as per management guidance till FY30 — current valuations implies that KPIGREEN is available at throw away valuations

Valuations are attractive based on FY26 expected earnings

Market has not discounted FY26 and FY27 earnings

Past track record of diluting equity

Concerns on debt-equity as debt has risen the fund the growth

8.2 Opportunity at Current Valuation

Valuations: Markets are not discounting FY26 and FY27 execution

Creates opportunity of re-rating of valuations

Margin of safety: The forward valuations have a margin of safety to support one or two weak quarters

New Business Optionality: New business not considered in valuations till FY27. Beyond FY27 they could another axis of growth

Some initial progress seen in BESS in Jan-26

8.3 Risk at Current Valuation

Based on forward valuations — Markets does not believe the numbers and will not believe in it for a long period of time.

Delivering 60% growth CAGR FY25-27 for any company is a challenge though the management is confident on delivering on it.

Conversion of profits to cash is a concern

Increase in receivables – customers haven’t paid

Profit is being used to build inventories

Quality of growth needs to be watched

Historically growth driven by equity dilutions

Growth fueled by increasing debts

High Execution Risk on Capital Expenditure

A power producer ties up a large amount of capital in projects not yet complete. These projects are not yet generating revenue. This situation poses a significant execution risk.

Execution-heavy: Lumpy EPC revenue; project delays (permits, monsoon, logistics) can disrupt growth.

IPP still scaling: Cash flows growing but still small vs EPC; full annuity benefits yet to kick in.

Sector risks: Policy changes (ALMM, grid, BCD) and state-level delays could impact timelines.

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer