KPI Green Energy Q1 FY26 Results: PAT up 68%, Guides for 60-70% Growth Till FY30

Guidance of 60-70% revenue in FY26 with stable margins. Strong execution and IPP growth create potential of valuation reset and possibility to upside if guidance is met.

1. Renewable power generating company in Gujarat

kpigreenenergy.com | NSE: KPIGREEN

2. FY21–25: PAT CAGR of 111% & Total Income CAGR of 67%

3. FY25: PAT up 101% & Total Income up 70% YoY

Guidance Outperformance: Management had guided for ~60% YoY growth, but actual income growth came in higher at 70%, indicating strong execution against a high base.

Sustainable Profitability: EBITDA margins remained stable at ~33%, reaffirming disciplined execution even as the company scaled up rapidly.

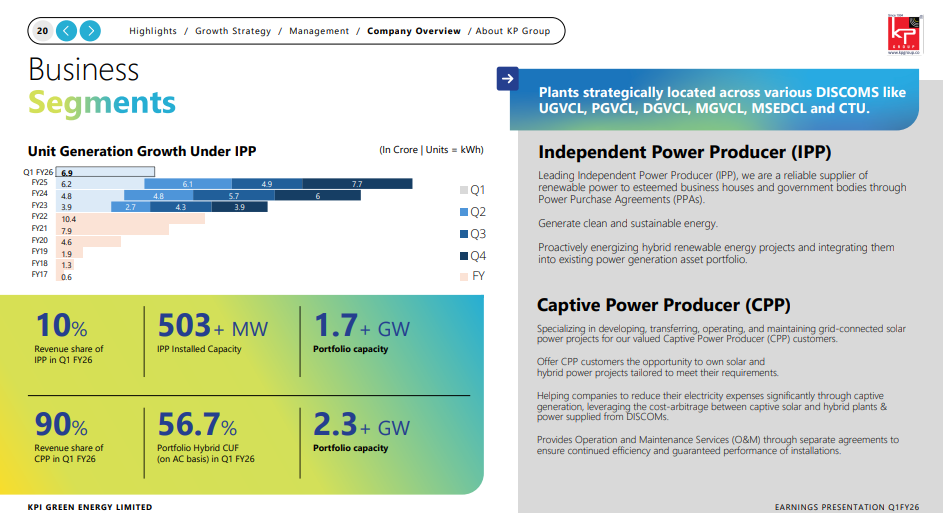

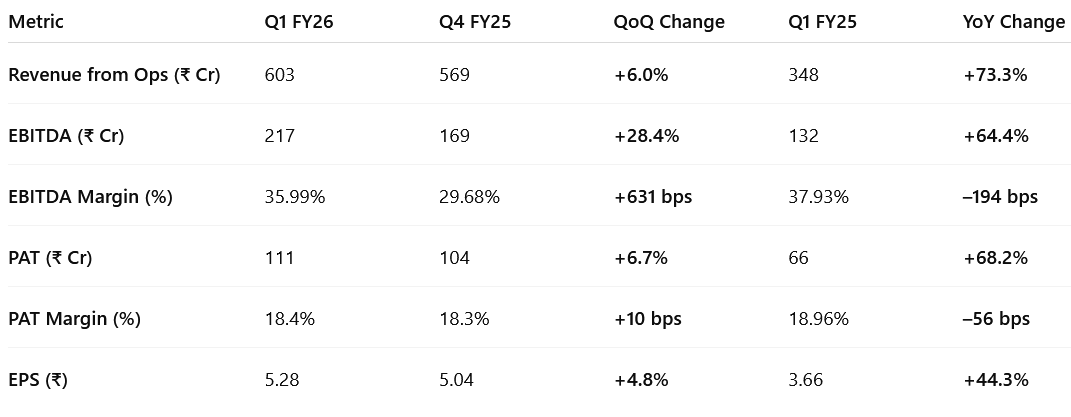

4. Q1-26: PAT up 68% & Revenue up 73% YoY

PAT up 19% & Revenue up 6% QoQ

Strong Start to FY26

Driven by higher EPC execution in CPP segment and growing IPP revenues

The margin saw a slight contraction, which the management attributes to their strategic focus on aggressive growth.

Reflects strong operating leverage despite minor cost inflation in EPC contracts

Segmental Highlights

Captive Power Producer (CPP)

EPC execution momentum remains robust

Multiple industrial clients onboarding across Gujarat and Maharashtra

Strong traction in booking new capacity and scaling execution

Independent Power Producer (IPP)

Growing annuity revenue from long-term PPAs

Operating IPP portfolio contributed ~25–30% of Q1 revenue

Hybrid projects (solar + wind) beginning to gain commercial traction

Order Book & Pipeline

Order Book: ₹1,000+ Cr (EPC + IPP under execution)

Execution visibility for next 4–6 quarters

New states and hybrid projects expanding geographic and customer diversification

Balance Sheet & Liquidity

Net Debt remains elevated (~₹2,500 Cr), but:

IPP cash flows improving

Strong treasury inflow from EPC business

Management reiterated no urgent equity dilution, thanks to internal accruals

The broad-based execution across CPP and IPP, backed by a deep order book and robust client demand, reflects a well-managed scale-up — with growing confidence in full-year guidance.

Significant Strategic Developments:

Order Book: The company's orders in hand have exceeded 3 gigawatts (GW).

Partnership with Delta Electronics: Three Memorandums of Understanding (MoUs) were signed to collaborate on Battery Energy Storage Systems (BESS), green hydrogen, and EV infrastructure.

Project Development: The company received a Letter of Intent (LoI) from GUVNL for the development of a 150 MW wind power project.

Capacity Expansion: KPI Green has 1.7 GW of installed and upcoming Independent Power Producer (IPP) capacity

Green Hydrogen Pilot: A 1 MW pilot project for green hydrogen is underway and is expected to be energized by October.

5. Business metrics: Steady return ratios

Multi-Year Improvement: ROE and ROCE climbed steadily from FY21 to FY24, driven by operational efficiency and strong execution.

FY25 Return Compression: Returns moderated in FY25 due to higher capital employed, with equity tripling YoY as the company scaled.

Healthy Profitability Maintained: Even with equity dilution, KPI delivered high-teen ROE and double-digit ROCE, reflecting efficient asset monetization.

7. Outlook: Revenue CAGR of up to 60-70%

Growth Target: The company after Q1-26 results has reiterated a 60-70% YoY growth target until the fiscal year 2030.

Focus on Growth: Management stated they are prioritizing sustainable growth, which is reflected in their strong order pipeline and strategic collaborations.

Continuation of Guidance set in Q4-25 earnings call

Revenue Growth

We are committed to at least 60% to 70% growth year-on-year. We are very positive that we will improve the same in the next year also.

EBITDA Margin:

Combined EBITDA margin would be around 32% to 33%.

PAT Margin

We will be able to maintain our margin of 17% to 19% margin at a PAT level.

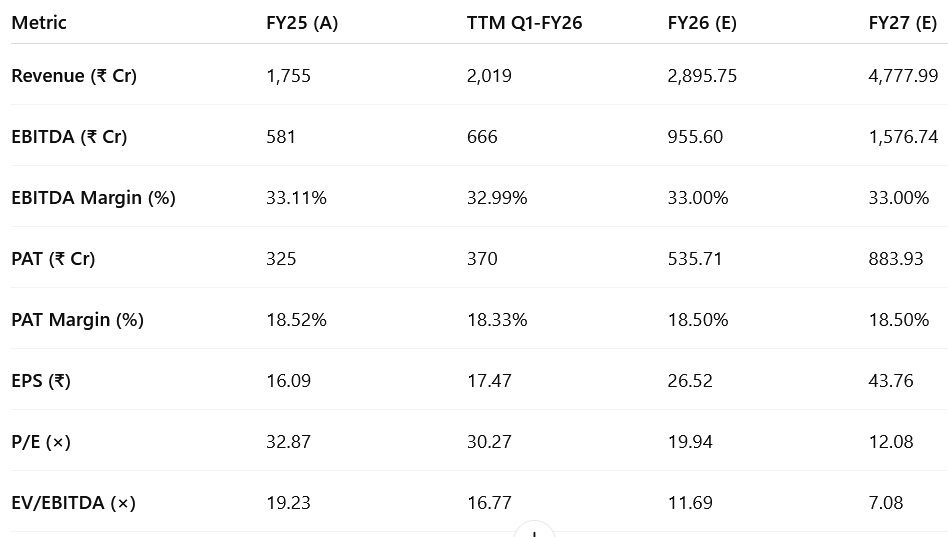

7. Valuation Analysis

7.1 Valuation Snapshot – KPI Green Energy Ltd.

Forward looking analysis is restricted to FY27 as one needs to watch execution play out.

Assumptions Used

FY26 and FY27 Revenue, EBITDA, and PAT are based on management commentary and extrapolated growth trends.

Assumes 65%+ YoY revenue growth in FY26, and ~65% growth again in FY27.

EBITDA margins are assumed to remain stable at ~33%, in line with historical and TTM figures.

PAT margins are assumed to be steady at ~18.5%, in line with FY25 and TTM results.

Valuation Compression Offers Upside

P/E drops sharply from ~33× in FY25 to ~20× in FY26 and ~12× in FY27, despite conservative earnings estimates.

EV/EBITDA follows similar compression, from ~19.2× in FY25 to ~7× in FY27, indicating improving profitability and scale without the market repricing the stock aggressively yet.

These ratios price in only 1–2 years of earnings growth, suggesting possible rerating if execution remains strong.

What the Valuation Says:

At FY26E P/E of ~20x, KPI Green is trading below the typical range for high-growth renewable IPPs (often 25–35×), despite delivering >30% PAT CAGR.

FY27E P/E of ~12x is particularly compelling — implies that the market is not yet fully baking in continued scale-up or margin expansion.

EV/EBITDA below 8× in FY27:

Utility-scale and solar IPPs globally often trade at 10–14× EV/EBITDA when margins are stable and debt is predictable.

KPI's EV/EBITDA of 7× on FY27 EBITDA suggests valuation discount or room for rerating, particularly if cost of capital falls or long-term offtake improves visibility.

Watchouts

High debt levels (~₹2,500 Cr net) remain a levered risk, particularly if working capital cycles extend or receivables build up.

KPI Green is moving into a valuation sweet spot — combining robust earnings visibility with steep valuation compression. If execution on growth, margins, and capital discipline continues, the stock appears well-positioned for a rerating over the next 12–18 months.

7.2 Opportunity at Current Valuation

Revenue visibility: ₹2,900 Cr FY26 revenue and ₹535 Cr PAT guided; current run-rate supports guidance.

Profit growth: PAT up 49% YoY in Q1; margins steady (EBITDA ~33%, PAT ~18.5%) on strong execution.

Valuation cooling: P/E down to ~20×, EV/EBITDA ~11.7× for FY26 — significantly lower than historical levels.

IPP optionality: Annuitized cash flows growing; hybrid solar-wind and captive projects to improve mix.

Capital discipline: Healthy PAT-to-OCF, low leverage, no equity dilution expected.

Execution strength: High uptime, on-time delivery, and cost controls driving return on capital.

Group advantage: Backward integration and in-house project control enable lean and fast rollouts.

Opportunity Rating: HIGH

Strong execution + valuation reset + IPP growth = upside potential if guidance is met.

7.3 Risk at Current Valuation

Execution-heavy: Lumpy EPC revenue; project delays (permits, monsoon, logistics) can disrupt growth.

IPP still scaling: Cash flows growing but still small vs EPC; full annuity benefits yet to kick in.

Margin sensitivity: Cost inflation (modules, BOS, freight) may compress EPC margins.

Sector risks: Policy changes (ALMM, grid, BCD) and state-level delays could impact timelines.

Valuation sensitivity: At 20× P/E, delivery must be consistent; misses may trigger de-rating.

Risk Rating: MODERATE

Well-positioned, but dependent on timely execution and stable input costs to sustain current valuation.

Previous coverage of KPIGREEN

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer