Kaynes Technology: PAT up 74% & Revenue up 49% in 9M-25 at a PE of 124

Guidance for 55% revenue & 66-71% EBITDA growth in FY25. Order book 2X FY25 revenue. $1 billion revenue target by FY28. 3X business by FY29. Longer term growth of 40-50%

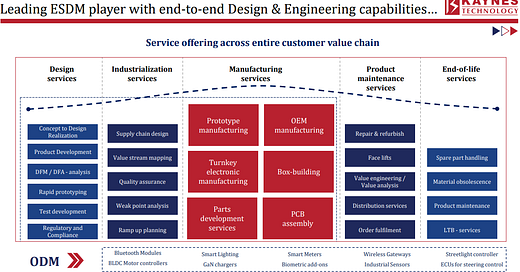

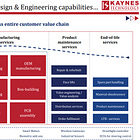

1. Electronic System & Design Manufacturer (ESDM)

kaynestechnology.co.in | NSE: KAYNES

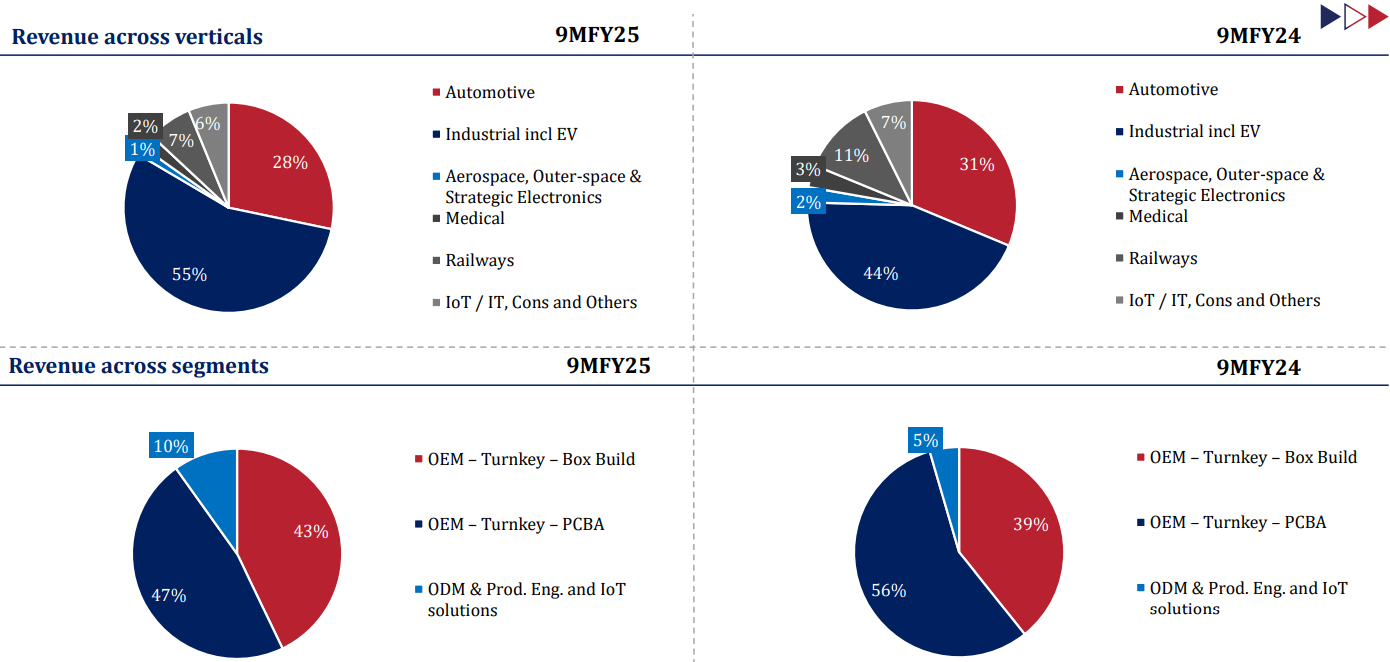

2. FY21-24: PAT CAGR of 166% & Revenue CAGR of 62%

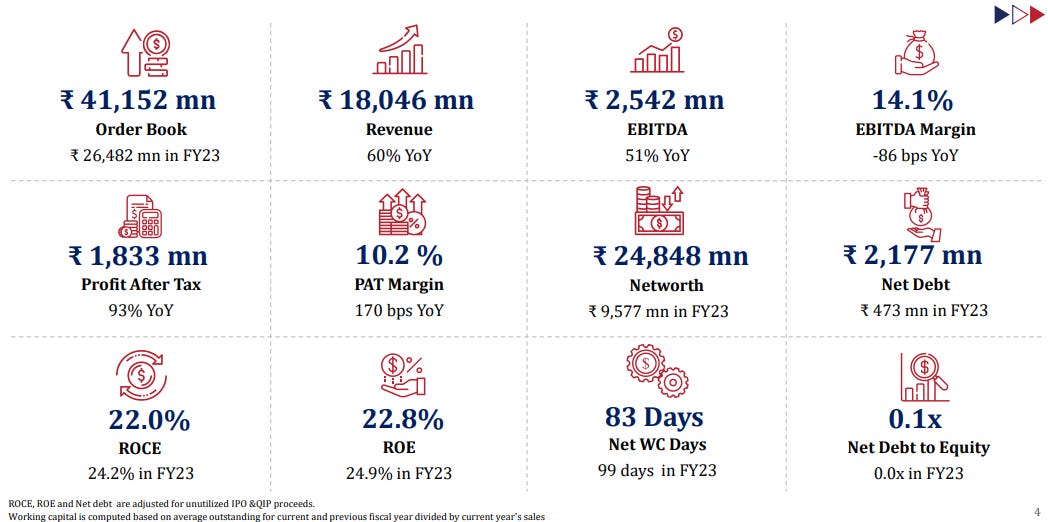

3. Strong FY24: PAT up 93% & Revenue up 60%

4. Weak Q3-25: PAT up 47% & Revenue up 30%

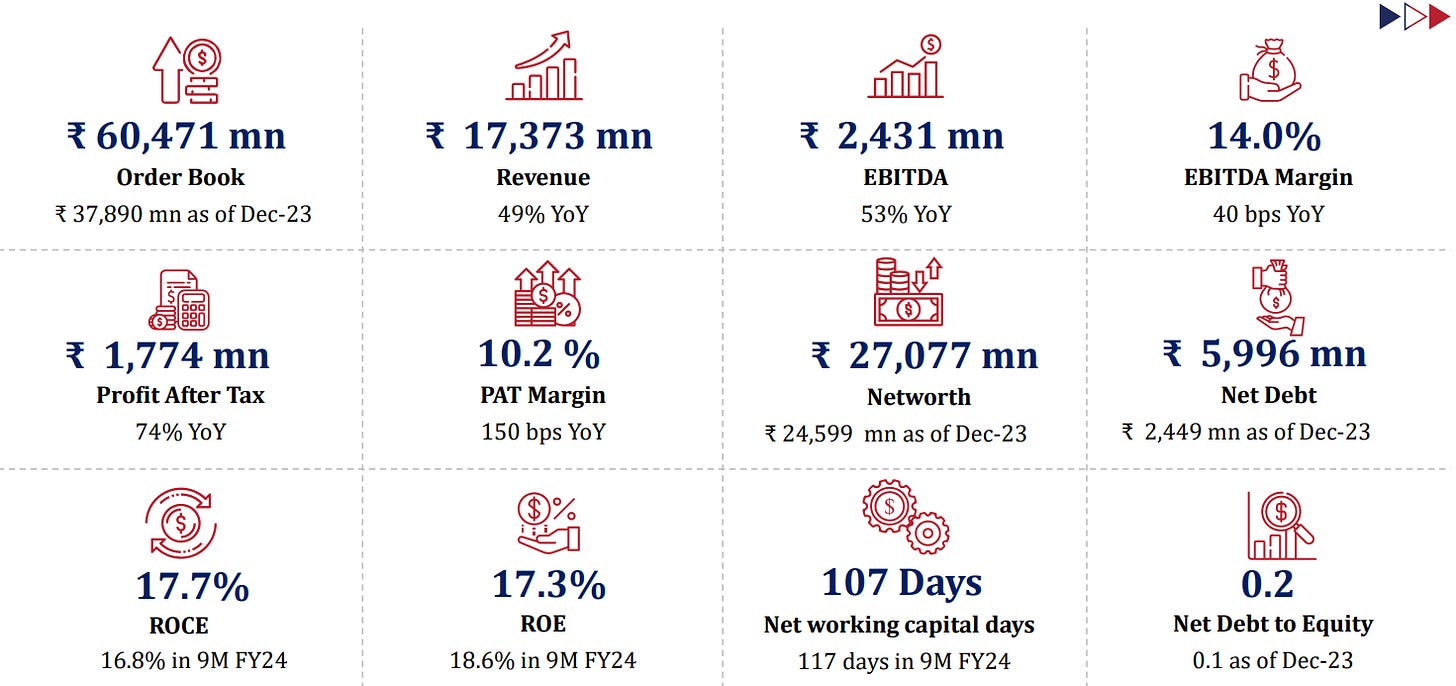

5. Strong 9M-25: PAT up 74% & Revenue up 49%

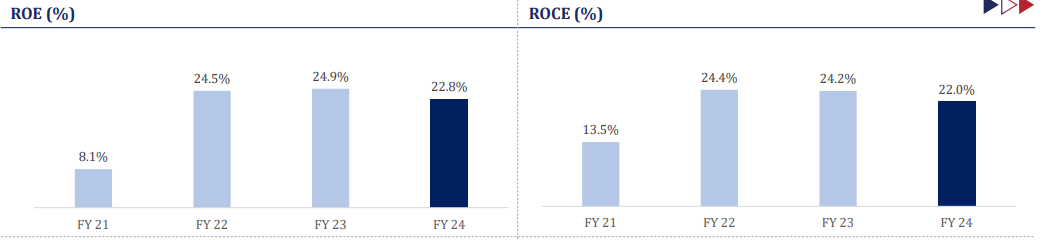

6. Business metrics: Strong return ratios

7. Outlook: 66-71% EBITDA growth & 55% revenue growth in FY25

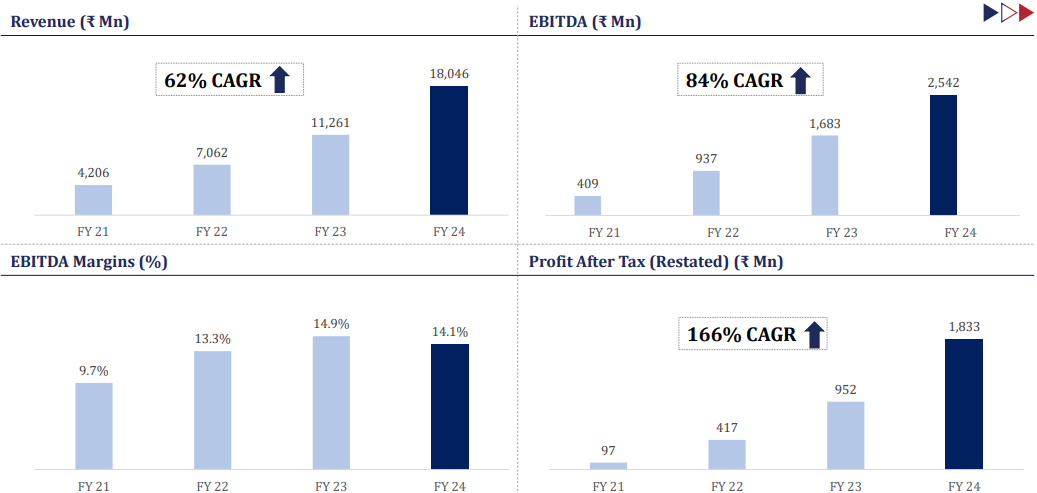

Aerospace is expected to see significantly higher numbers in FY26.

Rail business is expected to see a resurgence in FY26, with the government expected to increase spending in the sector.

Medical sector has seen a large client acquisition and is expecting successive orders.

Smart meter orders have expanded beyond PGCIL to three more states and AMIS orders, and the company expects to execute approximately 1,000 crores in the next 12 months in smart meters alone.

EV business has expanded to include two-wheelers, three-wheelers, infrastructure and components.

The company plans to acquire companies with good profitability in similar businesses to their own.

Aims to acquire companies with a ticket size of between Rs 2.5-5 cr a piece.

i. FY25: Revenue growth of 55%

Revenue guidance has been trimmed down from Rs 3,000 cr + to Rs 2,800-2,900 cr

As of Q3-25: Revenue guidance for the full year is between 2,800 and 2,900 crore.

The company expects revenue growth to exceed 55% yoy for FY25.

The company anticipates a 67-70% revenue growth in Q4.

As of Q2-25: revenue will cross Rs 3,000 crore in FY25

ii. FY25: EBITDA growth of 65-71%

The FY25 EBITDA, expected to be 15% of the projected revenue of Rs 2,800-2,900 crore, would be between Rs 420-435 crore. This represents an EBITDA growth of 65-71% compared to the FY24 EBITDA of Rs 254.2 crore.

Confident of achieving a 15% or higher EBITDA margin for the year.

The company expects that the gross margin will be upward of 30%.

For FY26, the company has a target of 15-16% operating margin.

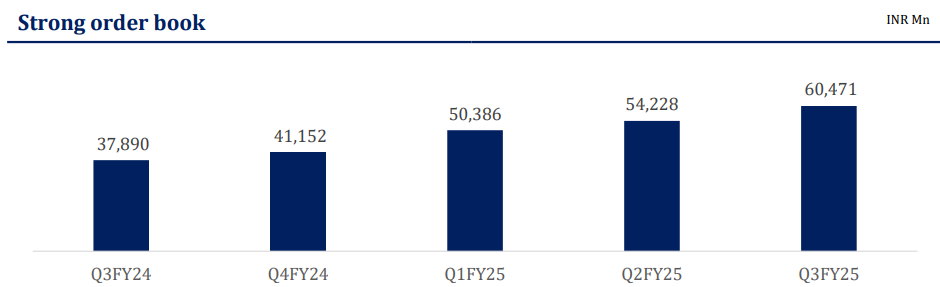

iii. Strong revenue visibility: Order book 2X+ revenue expected for FY25

Order book stands at Rs 6,047.1 cr, more than double the expected FY25 revenue of Rs 2,800-2,900 crore. This provides strong visibility into the company’s revenue for FY26.

iv. FY24-29: Strong growth outlook

Long-Term Ambitions: They reiterated their commitment to reaching USD 1 billion in revenue by FY28, a target initially announced during their IPO.

3X Business: Furthermore, they aim to achieve a tripling of their current business size by FY29.

Confidence in Sustained Growth: Management believes they are well-positioned to maintain high growth rates (40-50%) for at least the next decade.

8. PAT growth of 74% & Revenue growth of 49% in 9M-25 at a PE of 124

9. Hold?

If I hold the stock then one may continue holding on to KAYNES

The revenue guidance cut is disappointing, but the redeeming factor is that it’s due to KAYNES' ability to execute orders within FY25, not because of changes in demand. The demand environment remains strong.

Delays in earlier ordering and projects during election time impacted the rail segment in the last quarter.

There were some delays in smart meter shipments due to the new factory start-up, which the company expects to catch up on in the coming quarters.

The company's guidance cut was primarily due to the time required to execute orders in the railway and outdoor sectors, not from a lack of orders.

KAYNES has the order book to support FY25 & FY26 growth projections.

The business momentum is strong. One should ride it as long as it sustains. KAYNES is experiencing strong growth and is implementing strategic initiatives to further expand its business. While there have been some challenges, management is confident in its ability to meet its targets and achieve long-term growth.

KAYNES is confident that the macro environment is in their favor and the tailwinds will continue.

The company believes that the government will increase investments in electronic infrastructure, including railway safety, power infrastructure, and telecom.

The company believes that the government will preference Indian companies in design and manufacturing.

The company doesn't foresee budget cuts to key projects.

10. Buy?

If I am looking to enter KAYNES then

KAYNES has delivered PAT growth of 74% & Revenue growth of 49% in 9M-25 at a PE of 124 which makes the valuations quite expensive in the short term.

With a FY25 guidance of 55% revenue growth and 66-71% EBITDA growth at PE of 124, the valuations look expensive from a FY25 perspective.

The opportunity will emerge over the longer term if the outlook of reaching $1 billion by FY28 and tripling business by FY29 is achieved.

Opportunity will emerge over the longer term if KAYNES is able to deliver on high growth rates (40-50%) for at least the next decade.

KAYNES management is quite confident on delivering on the FY24-29 outlook but 5 years is a long time and there may be volatility along the way given there is no margin of safety with KAYNES at a PE of 124

Q3-25 was an example of the volatility one should be ready for as the guidance was cut due inability to execute orders on time.

Previous coverage of KAYNES

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer