Kaynes Technology: PAT up 95% & Revenue up 64% in H1-25 at a PE of 147

Guidance for 66% revenue & 77% EBITDA growth in FY25. Order book 1.8X FY25 revenue. $1 billion revenue target by FY28. Tripling business by FY29. Longer term growth of 40-50%

1. Electronic System & Design Manufacturer (ESDM)

kaynestechnology.co.in | NSE: KAYNES

2. FY21-24: PAT CAGR of 166% & Revenue CAGR of 62%

3. Strong FY24: PAT up 93% & Revenue up 60%

4. Strong Q2-25: PAT up 86% & Revenue up 59%

5. Strong H1-25: PAT up 95% & Revenue up 64%

6. Business metrics: Strong return ratios

7. Outlook: 77% EBITDA growth & 66% revenue growth in FY25

i. FY25: Revenue growth of 66%

revenue will cross Rs 3,000 crore in FY25

For the year 2025, we expect to clock a similar rate of growth in revenue greater than 60% and an improvement in operational EBITDA margin of more than 100 basis points.

ii. FY25: EBITDA growth of 77%

FY24 EBITDA margin of 14.1% expanding to 15% in FY25 on revenue growth of 66%, implies an EBITDA growth of 71%

With the trend in EBITDA margin improvement, we believe we will cross the operational EBITDA of 15% this year.

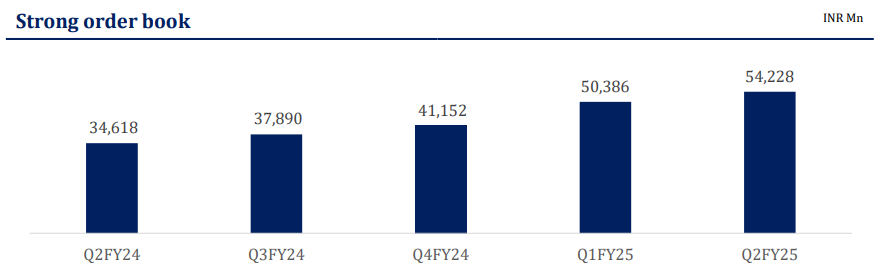

iii. Strong revenue visibility: Order book 1.8X revenue expected for FY25

Order book of Rs 5,422.8 cr is 1.8X FY25 expected revenue of Rs 3,000 cr.

iv. FY24-29: Strong growth outlook

Long-Term Ambitions: They reiterated their commitment to reaching USD 1 billion in revenue by FY28, a target initially announced during their IPO.

3X Business: Furthermore, they aim to achieve a tripling of their current business size by FY29.

Confidence in Sustained Growth: Management believes they are well-positioned to maintain high growth rates (40-50%) for at least the next decade.

8. PAT growth of 95% & Revenue growth of 64% in H1-25 at a PE of 147

9. Hold?

If I hold the stock then one may continue holding on to KAYNES

KAYNES has delivered a strong multi-year performance. On the back of this strong performance it is also guiding for a strong FY25, followed by a strong outlook for F24-29. One can continue riding the strong business uptrend which KAYNES is delivering.

In the short term KAYNES has the order book to support FY25 top-line projections.

The business momentum is strong and should ride it as long as it sustains.

10. Buy?

If I am looking to enter KAYNES then

KAYNES has delivered PAT growth of 95% & Revenue growth of 64% in H1-25 at a PE of 147 which makes the valuations quite expensive in the short term.

With a FY25 guidance of 66% revenue growth and 77% EBITDA growth at PE of 147, the valuations look expensive from a FY25 perspective.

The opportunity will emerge over the longer term if the outlook of reaching $1 billion by FY28 and tripling business by FY29 is achieved.

Opportunity will emerge over the longer term if KAYNES is able to deliver on high growth rates (40-50%) for at least the next decade.

KAYNES management is quite confident on delivering on the FY24-29 outlook but 5 years is a long time and there may be volatility along the way given there is no margin of safety with KAYNES at a PE of 147

Previous coverage of KAYNES

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer