Kaynes Technology Q1 FY26 Results: PAT up 47%, FY26 Guidance on Track

On-track 60% revenue growth guidance in FY26. Outperformance on margin. Growth to $1B by FY28 & $2B by FY30 fully priced in. Valuations leave no margin for error

1. Electronic System & Design Manufacturer (ESDM)

kaynestechnology.co.in | NSE: KAYNES

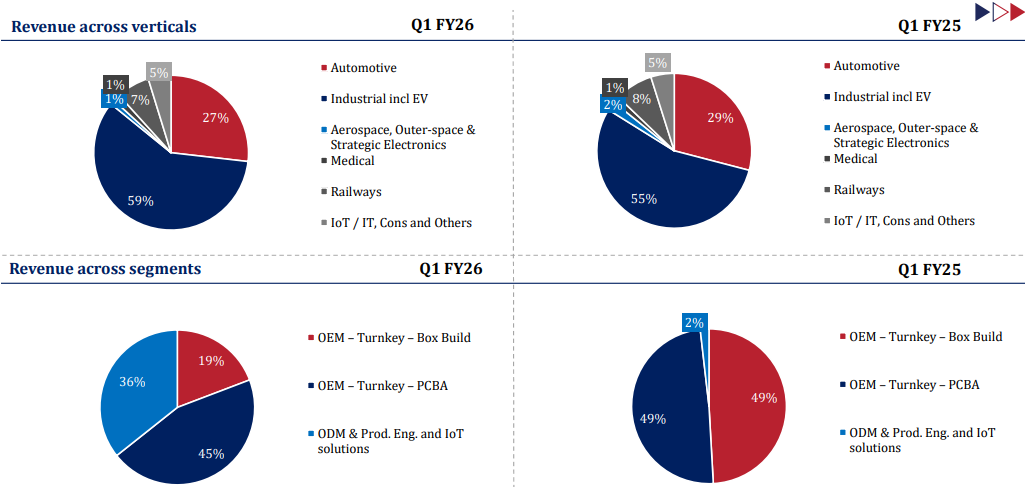

Segmental Revenue

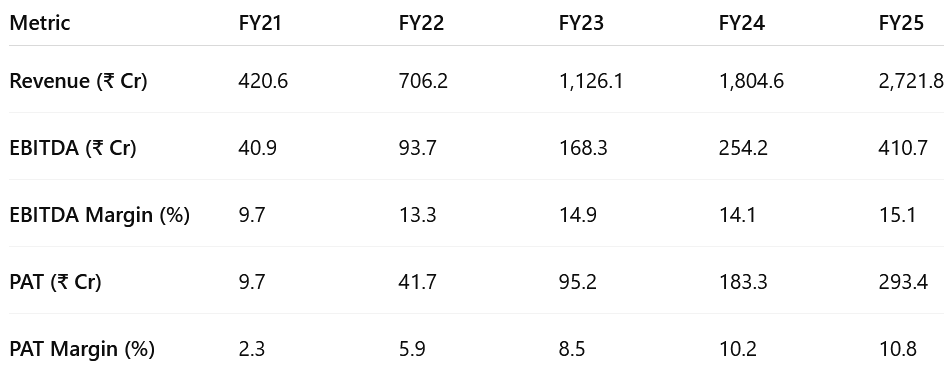

2. FY21-25: PAT CAGR 135% & Revenue CAGR 59%

Big Picture: In four years Kaynes morphed from a domestic EMS assembler into a solutions-led, globally exposed electronics platform with double-digit margins and a semiconductor runway for its next growth phase.

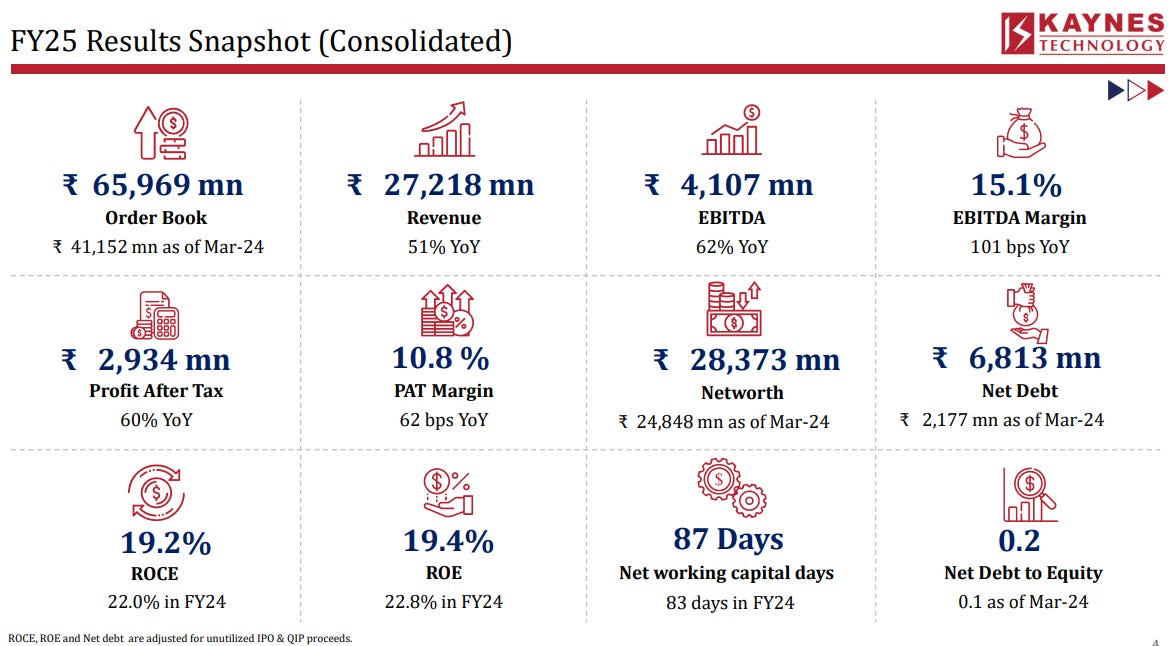

3. FY-25: PAT up 60% & Revenue up 51%

Revenue — driven by smart meters, industrial/EV orders, and deeper wallet share.

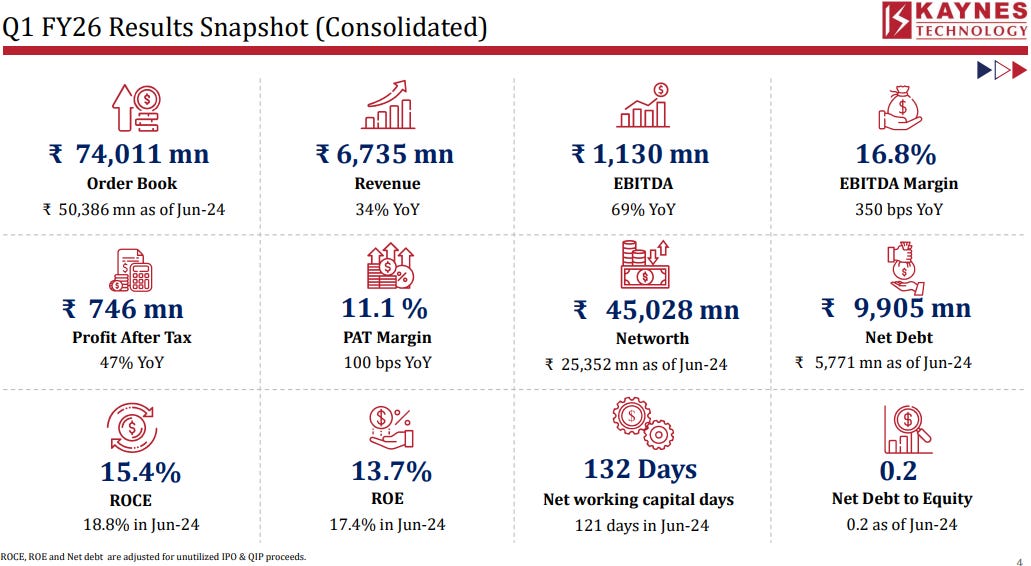

4. Q1-26: PAT up 47% & Revenue up 34%

Business Momentum & Sector Trends

Broad-Based Growth: Strong performance across automotive, industrials, EVs, railways, and aerospace.

Gross Margin Expansion: +200 bps YoY across all six verticals, driven by:

Higher share of ODM

Material cost optimization

Execution of long-term cost reduction strategies

Working Capital:

Q1 WC days at 132 due to seasonal ramp-up and acquired receivables

Target: Sub-70 days by FY26-end, post resolution of ₹350 Cr in acquisition-related receivables

Strategic Developments

Global Expansion:

Acquired August Electronics (Canada) to enter North America and tap high-margin clients

Capacity Build-Up:

OSAT (Sanand): Pilot shipments expected Q4 FY26

HDI PCB Plant (Chennai): Commercial operations by Jan 2026

Capex from QIP Funds:

₹313 Cr deployed for OSAT (out of ₹756 Cr planned)

₹114 Cr deployed for PCB plant

Stake Allotments:

Up to 20% equity offered to global tech partners (e.g., AOS, US clients) to deepen alignment and enable tech transfer

Product & Segment Highlights

EVs: Orders secured from leading 2-wheeler OEMs; 4-wheeler ramp-up in progress

Aerospace: Multiple $10 Mn+ orders signed; revenue contribution expected from Q3

Railways: Kavach in pilot phase; additional investments made in ODM partners

Smart Meters: Stable, phased execution; will remain a smaller contributor

Management Commentary

Strategic focus on transitioning from EMS to an integrated ESDM + ODM player, with deeper tech integration and vertical capabilities (PCBs, semiconductors)

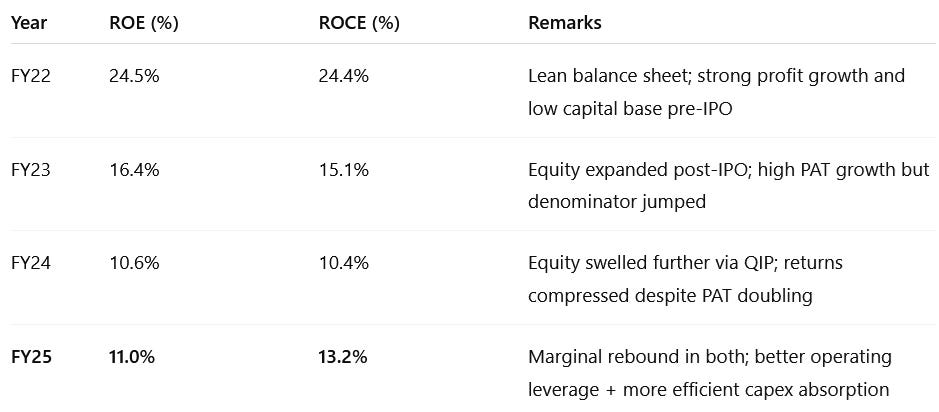

5. Business Metrics: Muted Return Ratios

Temporarily Muted by Front-Loaded Capital Infusion

After peaking above 24 %, Kaynes’ ROE/ROCE have temporarily cooled to ~19 % as it front-loads capacity for the next growth leg. With capex past its heaviest phase and richer product lines coming onstream, a rebound toward the low-20s looks achievable by FY27.

6. Outlook: 60% Growth in FY26 with 50 bps margin expansion

6.1 Management Guidance & Future Outlook (Q1 FY26)

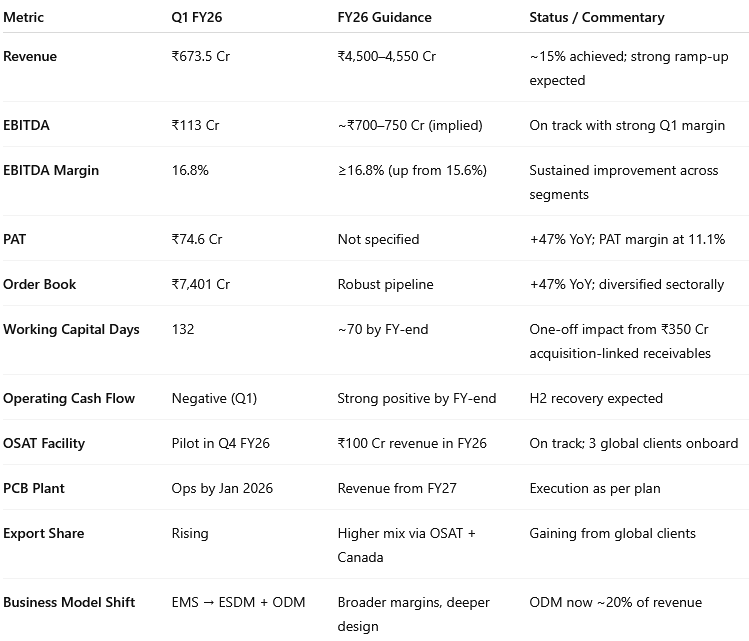

Post Q1-26: Exceeding margin guidance & meeting FY26 revenue target

FY-26: 60% growth with 50 bps margin expansion

FY-28: $1 billion revenue

FY-30: $2 billion revenue

Revenue & Growth Outlook

FY26 Revenue Guidance Reaffirmed:

Management remains confident of delivering ₹4,500+ crore in consolidated revenue:₹4,250 Cr from core EMS/ESDM operations

₹175 Cr from August Electronics (Canada)

₹100 Cr from the OSAT (Sanand) business, expected to begin commercial billing in Q4

Execution Momentum Building:

With Q2 expected to cross ₹1,000 Cr in revenue, a strong ramp-up is anticipated in H2, backed by a robust and diversified order pipeline across EVs, aerospace, railways, and industrials.

Margin & Profitability Outlook

EBITDA Margin Guidance Upgraded:

Q1 EBITDA margin of 16.8% exceeded the earlier full-year guidance of 15.6%. Management now expects margins to sustain or improve through FY26, supported by:Higher share of ODM and advanced technology products

Procurement efficiencies and cost reduction gains

Operating leverage from scale as revenue accelerates

Gross Margin Gains Broad-Based:

Margin improvements are visible across all six business verticals, reflecting structural changes in mix and execution discipline.

Working Capital & Cash Flow Management

Q1 WC Days Elevated at 132, due to seasonality and a ₹350 Cr acquisition-related receivable (not yet due)

FY26 Target: Reduce normalized working capital days to ~70 days by:

Resolving one-off receivables

Supplier-managed inventory

Improved forecasting and receivables discipline

OCF Outlook: Expecting significantly positive operating cash flow by FY26-end, with sequential improvement through better asset utilization and capital efficiency.

Capacity Expansion & Investment Plans

OSAT Facility (Sanand):

Pilot shipments to begin by Q4 FY26; multiple global clients onboard, including U.S., German, and Indian players.

~50% of ₹756 Cr planned capex to be deployed by FY27.HDI PCB Plant (Chennai):

Construction complete; operational readiness expected by Jan 2026. Key step toward backward integration and domestic innovation in PCBs.Strategic Use of Capital:

Recent QIP proceeds to fund inorganic growth:Expanding design capabilities (ODM)

Strengthening presence in North America and Europe

Building niche, high-margin verticals in embedded systems and advanced electronics

Sectoral Trends & Order Book Visibility

Order Book:

₹7,401 Cr as of Q1 FY26 (up from ₹5,038 Cr YoY), driven by wins across multiple sectors.

Management attributes QoQ fluctuations to order timing, not demand.Segment Ramp-Ups:

EVs: Strong traction in 2-wheelers; 4-wheeler ramp expected

Aerospace: Multiple $10M+ orders signed, execution starts Q3 onward

Railways: Kavach project in pilot phase; investments made in ODM partners

Smart Meters: Steady rollout; remains a stable but smaller revenue contributor

Export Outlook:

OSAT and global EMS contribute to a rising export share; long-term vision includes import substitution and global supply chain integration.

Strategic Direction

From EMS to ESDM + ODM:

Kaynes is evolving into a full-stack design + manufacturing partner, offering embedded systems, product design, and end-to-end manufacturing.Tech & IP Focus:

Investments in R&D, co-development, and niche verticals (e.g., photonics, semiconductors, advanced packaging) to strengthen differentiation and margin profile.

Management Confidence

Revenue & Margin Guidance Fully On Track

Order Book Visibility Remains Strong

Capex Execution Proceeding as Planned

Cash Flow and Capital Efficiency Set to Improve Sharply in H2

6.2 Q1 FY26 vs FY26 Guidance

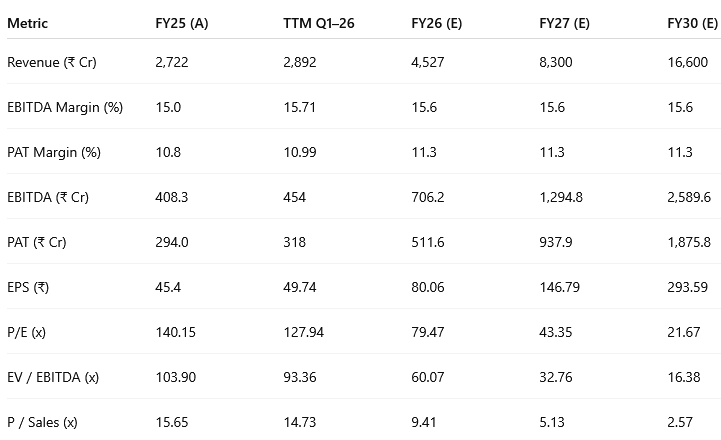

7. Valuation Analysis — Kaynes

7.1 Valuation Snapshot

Valuation Compression Ahead

P/E falls from 79.5× in FY26E to 21.7× by FY30E

EV/EBITDA compresses from 60× to 16.4×

P/S drops from 9.4× to 2.6×

Implied Market Expectation: Rapid earnings growth will drive valuation normalization without necessarily requiring a share price correction.

High Premium Today, but Strong Visibility

FY26 valuations are rich by absolute standards:

P/E of ~80× and EV/EBITDA of ~60× are well above even premium EMS peers globally.

However, valuation reflects:

Rapid earnings compounding (PAT CAGR >40% FY25–30E)

Strong structural tailwinds (Make-in-India, semiconductor shift)

High ROCE / ROE potential from FY27 onwards

Strategic moves into high-value verticals (OSAT, PCB, ODM)

PEG Ratio Consideration

Near 2× PEG — expensive but not unreasonable given visibility and growth drivers

Valuation Justification Hinges on Execution

The valuation assumes:

Timely ramp-up of OSAT & PCB capacity

Seamless integration of acquisitions (e.g., August Electronics)

Sustained margin profile (15.6% EBITDA, 11.3% PAT)

Revenue doubling every 2–3 years

Any miss on margin, WC discipline, or execution timelines could compress earnings and increase valuation risk.

Kaynes is still expensive on FY26/TTM, but forward multiples normalize rapidly

The valuation story is tied tightly to execution — especially FY26–27 delivery and global business expansion

PEG near 2× today leaves limited room for error, but if performance continues to match guidance, valuation is defendable

7.2 Opportunity at Current Valuation

Strong Growth Visibility

Q1 FY26 saw revenue up 34% YoY, with ₹6,735 Cr achieved against FY26 guidance of ₹4,500+ Cr. The ₹7,401 Cr order book (+47% YoY) provides clear multi-quarter execution visibility across industrial, EV, aerospace, and rail segments.

Margin Strength with Longevity

EBITDA margin stood at 16.8% in Q1 (above full-year guidance), driven by:

ODM mix gains

Cost efficiencies via backward integration

High-margin global orders

Margins are expected to remain elevated as scale and OSAT/PCB capacity kick in from FY27.

Positioned on Structural Tailwinds

Transition from EMS to high-value ESDM + ODM

China+1 manufacturing shift and PLI schemes

Entry into semiconductors (OSAT) and HDI PCB

Design-led wins in EVs, defense, and railways

These provide durable tailwinds for growth and margin protection.

Valuation Compression = Long-Term Upside

While FY26 valuations remain high (P/E: ~79×, EV/EBITDA: ~60×), forward multiples fall rapidly:

FY27E: P/E ~43×, EV/EBITDA ~33×

FY30E: P/E ~22×, EV/EBITDA ~16×

A >40% PAT CAGR makes earnings compounding the key return driver.

Opportunity Rating: High

Kaynes offers a rare mix of visibility, margin strength, strategic expansion, and structural tailwinds—making it a compelling long-term play despite near-term valuation richness.

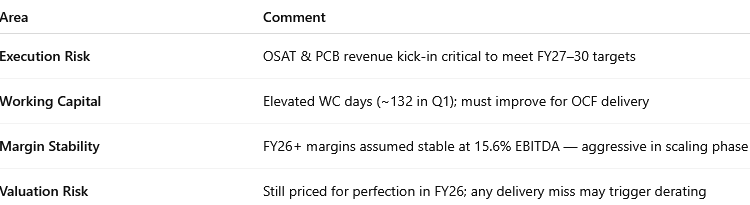

7.3 Risk at Current Valuation

Valuation Leaves Little Room for Error

At ~79× FY26 P/E and ~60× EV/EBITDA, Kaynes is priced for perfection. Any delays in revenue ramp-up, margin compression, or integration setbacks could lead to a sharp de-rating.

Execution Risk from New Verticals

OSAT and HDI PCB lines, critical to FY27–30 projections, are still under development.

Execution delays, yield issues, or client onboarding challenges may affect timelines and returns.

Working Capital Stress

Q1 FY26 net working capital days rose to 132, with receivable days jumping to 145. Elevated working capital tied to ramping global operations and acquisition-linked receivables may weigh on OCF and ROCE if not quickly normalized.

Global Expansion Complexity

Integration of August Electronics (Canada) and Sensonic (Austria) brings cross-border execution complexity.

Any friction in managing global teams, compliance, or logistics may impact profitability.

Macro & Sector Risks

Slowdowns in EV/industrial capex, delays in defense/railway orders, or semiconductor cycle shifts could affect growth.

Geopolitical and FX risks could impact export-linked revenue and margin realization.

Risk Rating: Moderate to High

Kaynes is a high-quality, high-growth franchise—but current valuations demand flawless execution. Investors must monitor WC discipline, new facility ramp-up, and global expansion closely to avoid downside risk.

Previous Coverage of Kaynes

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer