Karur Vysya Bank: PAT growth of 45% & Total Income growth of 21% in FY24 at a PE of 9.8

P/B of 1.6 creates re-rating opportunities in P/B multiple. Strong outlook based on loan growth of 14%+, stable NIMs and ROA of 1-6-1.65% in FY25 for KARURVYSYA.

1. A private sector bank

kvb.co.in | NSE: KARURVYSYA

2. FY20-24: PAT CAGR of 62% & Total Income CAGR of 12%

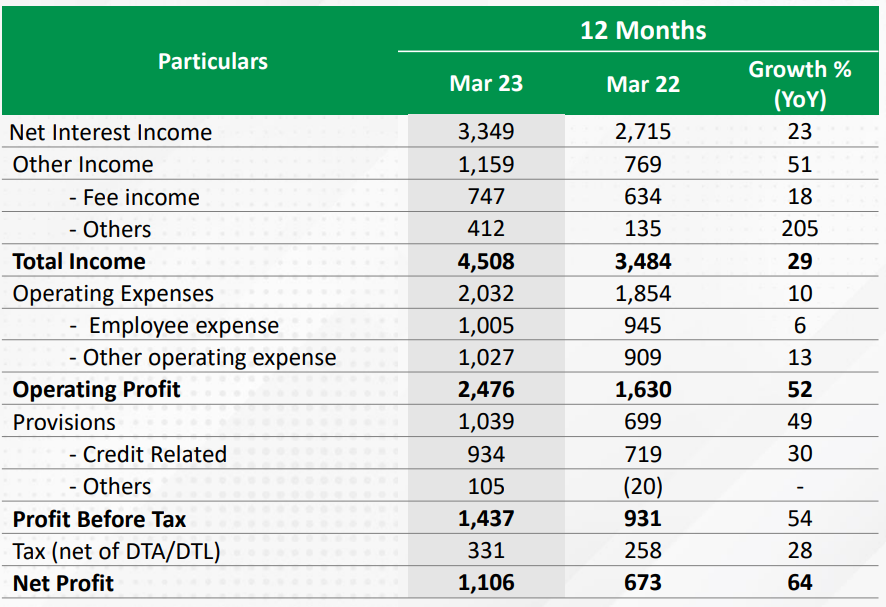

Income growth picked up from FY23

3. Strong FY23: PAT up 64% & Total Income up 29%

4. Strong 9M-24: PAT up 50% & Total Income up 20% YoY

Profit growth supported by lower provisions.

5. Strong Q4-24: PAT up 35% & Total Income up 26% YoY

6. Strong FY24: PAT up 45% & Total Income up 21% YoY

Operating profit growth grew by 14% in FY24. This is an indicator of the PAT growth for FY25 when the impact of lower provisioning would have played out within FY24.

7. Business metrics: Strong & improving return ratios

We have achieved ROA of 1.76% in this quarter. It could be noticed that our ROA has consistently improved from 0.19% in December '20, and grown sequentially in the last 13 quarters

8. Outlook: Loan growth to be at 14%+

i. FY25: Loan growth at 14%+

Loan Growth: Overall loan growth to be at 14% plus

Net Interest Margins (NIMs): With respect to the margins, we expect that to be at and around 4% levels till first half of the current year

Gross NPA: down to 1.4%, and we expect that we will continue to maintain at below 2% levels.

Net NPA: down to 0.4%, and we would continue to maintain net NPA at less than 1% of our loan book.

ROA: We have achieved ROA of 1.63% in financial year '24. Our effort would be to ensure that our ROA is above 1.6% or 1.65% levels at all times

9. PAT growth of 45% & Total Income growth of 21% in FY24 at a PE of less than 10

10. So Wait and Watch

If I hold the stock then one may continue holding on to KARURVYSYA

Based on FY24 performance, KARURVYSYA looks on track to deliver the on the FY25 guidance of 14% loan growth.

The advances of the bank grew by 16% for the year, and it could be noticed that the bank has achieved this growth after a gap of 11 years.

KARURVYSYA is in the middle of a strong run and has delivered sequential QoQ growth in top-line & bottom line in all the quarters of FY24

The momentum of FY24 is expected to continue into FY25 on the basis of a strong guidance for FY25.

11. Join the ride

If I am looking to enter KARURVYSYA then

KARURVYSYA has delivered PAT growth of 45% and total income growth of 21% in FY24 at a PE of 9.8 which makes the valuations quite reasonable.

At a Q4-24 end net-worth of Rs 9,802.82 cr on a current market cap of Rs 15,704 cr implies that KARURVYSYA is trading a price to book of 1.6 which makes the valuations quite reasonable.

FY25 loan growth estimate of around 14% at PE of 9.8 is nothing exciting but we are looking at a re-rating based on the price to book multiple as the provisions reduce and the quality of the book improves. There will be an opportunity in the stock till a price to book of closer to 2 based on outlook for FY25.

Previous coverage of KARURVYSYA

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer