Karur Vysya Bank: PAT growth of 50% & Total Income growth of 20% in 9M-24 at a PE of 9.5

KARURVYSYA PAT growth driven by lower provisions in FY24. Impact of provisions will moderate PAT growth in FY25. Reducing provisions will improve quality of book and provide potential for P/B rerating

1. A private sector bank

kvb.co.in | NSE: KARURVYSYA

2. FY20-23: PAT CAGR of 68% & Total Income CAGR of 9%

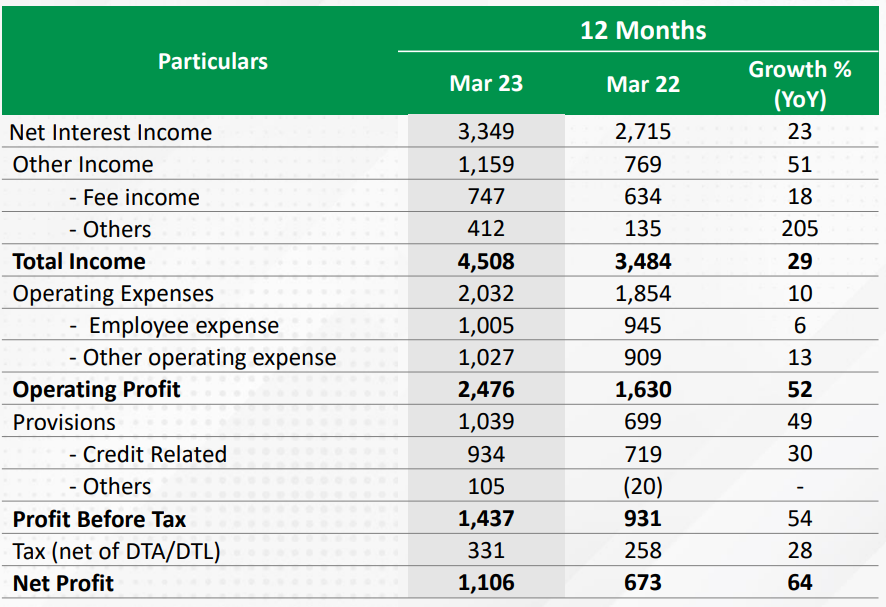

Income growth picked up in FY23

3. Strong FY23: PAT up 64% & Total Income up 29%

4. H1-24: PAT up 54% & Total Income up 24% YoY

Profit growth supported by lower provisions.

5. Strong Q3-24: PAT up 43% & Total Income up 13% YoY

6. Strong 9M-24: PAT up 50% & Total Income up 20% YoY

Profit growth supported by lower provisions.

Operating profit growth grew by 13% in 9M-24. This is an indicator of the PAT growth for FY25 when the impact of lower provisioning would have played out within FY24.

7. Business metrics: Strong & improving return ratios

8. Outlook: FY25 PAT growth to be in the mid-teens

Operating profit growth grew by 13% in 9M-24. This is an indicator of the PAT growth for FY25 when the impact of lower provisioning would have played out within FY24.

We are estimating a PAT growth of around 15% for FY25. We are assuming that the status quo of FY24 will be maintained in FY25. Additional improvements over the FY24 performance will take place in FY25.

9. PAT growth of 50% & Total Income growth of 20% in 9M-24 at a PE of 9.5

10. So Wait and Watch

If I hold the stock then one may continue holding on to KARURVYSYA

Based on 9M-24 performance, KARURVYSYA looks on track to deliver the strongest PAT & total income in FY24

KARURVYSYA is in the middle of a strong run and has delivered sequential QoQ growth in top-line & bottom line in all the three quarters of FY24

11. Join the ride

If I am looking to enter KARURVYSYA then

KARURVYSYA has delivered PAT growth of 50% and revenue growth of 20% in 9M-24 at a PE of 9.5 which makes the valuations quite reasonable.

At a Q3-24 end net-worth of Rs 9,542.60 cr and a market cap of Rs 14,059 cr implies that KARURVYSYA is trading a price to book of 1.47 which makes the valuations quite attractive.

FY25 PAT growth estimate of around 15% at PE of 9.5 is nothing exciting but we are looking at a re-rating based on the price to book multiple as the provisions reduce and the quality of the book improves.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer