Jyoti Resins and Adhesives: PAT growth of 45% & revenue down by 2% for FY24 at 26 PE

Jyoti Resins guiding for 20-25% volume CAGR for FY24-27. Will continue to maintain 30-40% ROE and 40%+ ROCE. May face challenges in the short term as margins of FY24 will not sustain.

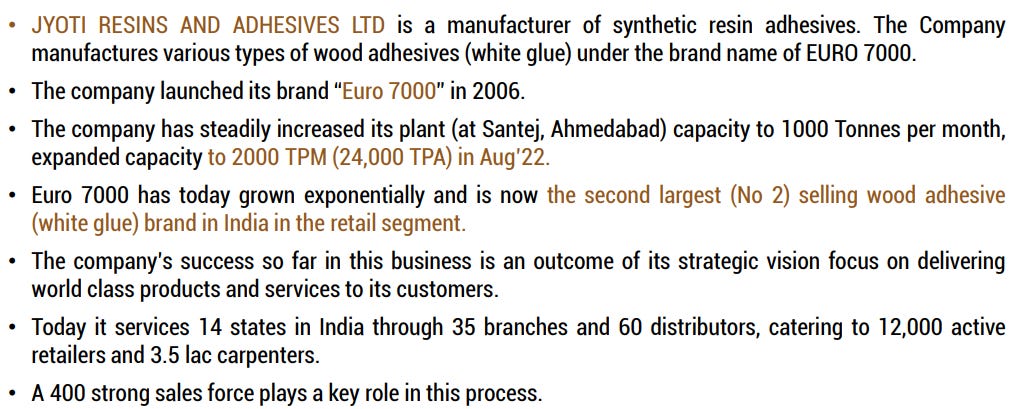

1. Manufacturer of synthetic resin adhesives

euro7000.com | BOM: 514448

The company launched its brand “Euro 7000” in 2006, and is now the second largest (No 2) selling wood adhesive (white glue) brand in India in the retail segment

2. FY20-24: PAT CAGR of 53% & Revenue CAGR of 26%

3. FY23: PAT up 135% & Revenue up 43%

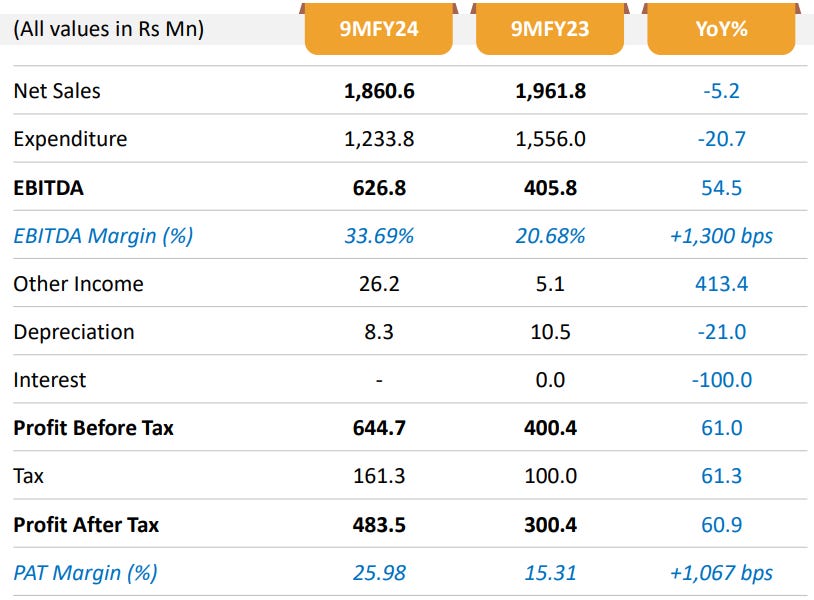

4. Strong 9M-24: PAT up 61% & Revenue down 5% YoY

5. Q4-24: PAT up 14% & Revenue down up 10% YoY

PAT up 14% & Revenue up 15% QoQ

6. Strong FY24: PAT up 45% & Revenue down 2% YoY

7. Business metrics: Strong return ratios

8. Strong outlook: Volume CAGR of 20-25%

i. FY24-27: Volume CAGR of 20-25%

We are targeting 20-25% Volume CAGR over the next 3 years (Base Year: FY2024) owing to softer FY24

ii. FY25: EBITDA margin of 22-25%

EBITDA Margin of 32% in FY24 is not sustainable and EBIDTA margins will revert to a range seen in FY23.

As we said in all the previous calls, we are comfortable with EBITDA margin of 22% to 25%.

iii. 30-40% ROE and 40%+ ROCE

Continue to maintain +30-40% ROE and +40% ROCE.

Stay debt free and generate positive operating cash flows and free cash flows.

9. PAT growth of 45% & revenue down by 2% in FY24 at a PE of 26

10. So Wait and Watch

If I hold the stock then one may continue holding on to Jyoti Resins with caution

The guidance for FY24-27 of 20-25% volume CAGR provides a reason to continue with Jyoti Resins for the longer term.

FY25 could be a challenging from a bottom line perspective. With a best case scenario of 25% top-line growth and EBITDA Margin of 32% in FY24 reverting to a 22-25% could seriously challenge bottom-line growth in FY25.

One needs to watch Jyoti Resins on a quarter by quarter basis and look for an exit if FY25 does not go as per guidance. However the outlook for 20-25% growth over the longer term provides a reason to continue with Jyoti Resins

11. Join the ride

If I am looking to enter Jyoti Resins then

Jyoti Resins has delivered PAT growth of 45% with revenue down by 2% in FY24 at a PE of 26 which makes the valuations fully priced in the short term.

The guidance of Jyoti Resins to deliver revenue CAGR of 20-25% for FY24-27 at a PE of 26 which makes the valuations quite acceptable over the longer term

One needs to be cautious and needs to be tracked quarterly that Jyoti Resin delivers as per guidance, or else there is no reason to enter a company which has deliver revenue de-growth in FY24.

Previous Coverage of Jyoti Resins and Adhesives Ltd

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer