Jyoti Resins and Adhesives: PAT growth of 61% & revenue down by 5% for 9M-24 at 26 PE

Jyoti Resins is guiding for revenue CAGR for 20-25% for FY24-27 even after a soft top-line growth for FY24. Guiding to continue to maintain 30-40% ROE and 40%+ ROCE.

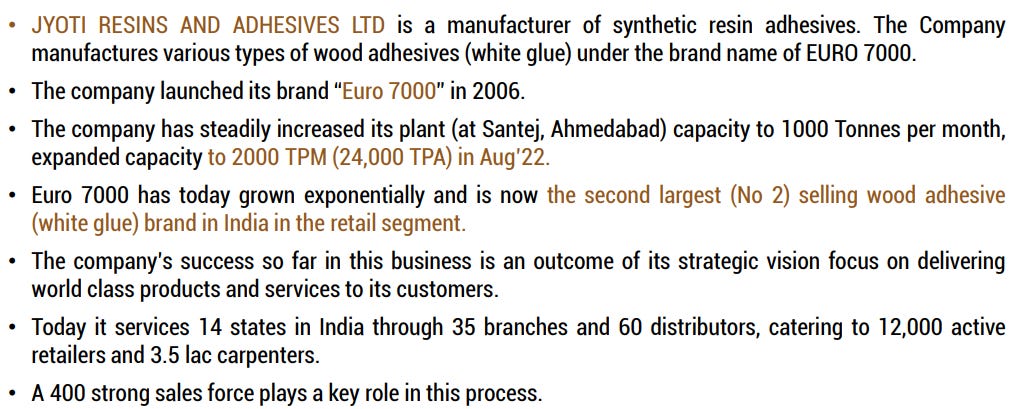

1. Manufacturer of synthetic resin adhesives

euro7000.com | BOM: 514448

The company launched its brand “Euro 7000” in 2006, and is now the second largest (No 2) selling wood adhesive (white glue) brand in India in the retail segment

2. FY18-23: PAT CAGR of 113% & Revenue CAGR of 38%

3. FY23: PAT up 135% & Revenue up 43%

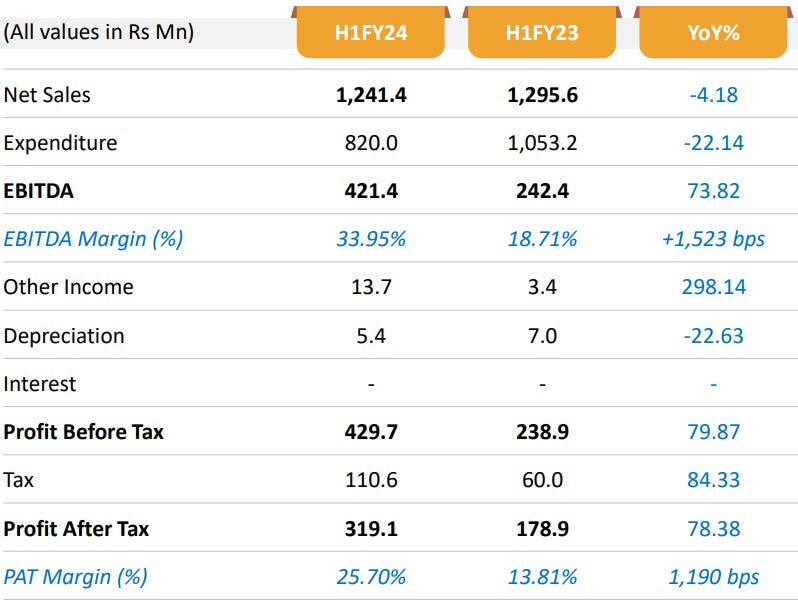

4. H1-24: PAT up 78% & Revenue down 4% YoY

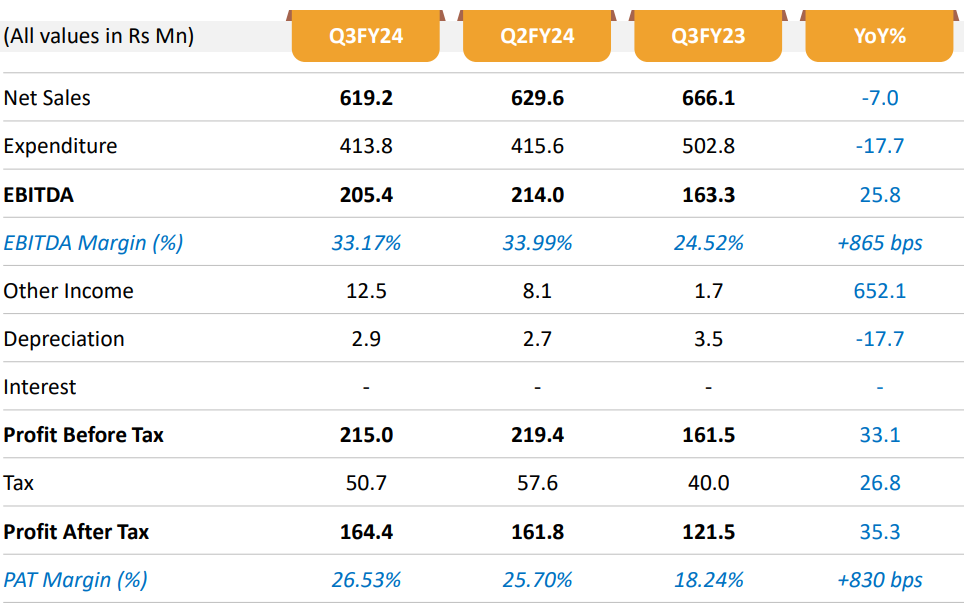

5. Q3-24: PAT up 35% & Revenue down up 7% YoY

PAT up 2% & Revenue down 2% QoQ

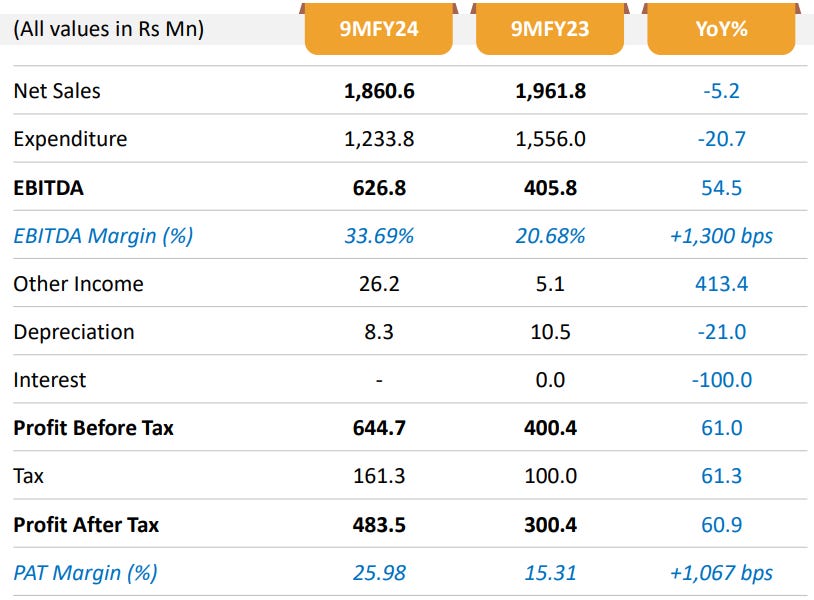

6. Strong 9M-24: PAT up 61% & Revenue down 5% YoY

7. Business metrics: Strong & improving return ratios

8. Strong outlook: Revenue CAGR of 20-25%

i. FY24-27: Revenue CAGR of 20-25%

Over the last 5 years, we have grown at CAGR of 38%, 103%, 113% on Revenue, EBIDTA, PAT.

We are targeting 20-25% CAGR over the next 3 years (Base Year: FY2024)

ii. 30-40% ROE and +40% ROCE

Continue to maintain +30-40% ROE and +40% ROCE.

Stay debt free and generate positive operating cash flows and free cash flows.

9. PAT growth of 61% & revenue down by 5% in 9M-24 at a PE of 26

10. So Wait and Watch

If I hold the stock then one may continue holding on to Jyoti Resins

Based on 9M-24 performance, Jyoti Resins looks on track to deliver the strongest PAT in FY24

The guidance till FY27 of 20-25% revenue CAGR provides a reason to continue with Jyoti Resins

11. Join the ride

If I am looking to enter Jyoti Resins then

Jyoti Resins has delivered PAT growth of 61% with revenue down by 5% in 9M-24 at a PE of 26 which makes the valuations quite acceptable over the short term.

The guidance of Jyoti Resins to deliver revenue CAGR of 20-25% for FY24-27 at a PE of 26 which makes the valuations quite acceptable over the short term

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer