Jupiter Wagons: PAT growth of 165% & Revenue growth of 77% in FY24 at 72 PE

Revenue growth of 50% expected in FY25. Order book at 1.5X FY25 expected revenue in place to support FY25 growth. JWL looking to grow from Rs 3600+ cr in FY24 to Rs 10,000 cr by FY27 or FY28

1. One of the largest player in India’s Railway sector

jupiterwagons.com | NSE: JWL

2. FY21-24: PAT CAGR of 84% & Revenue CAGR of 54%

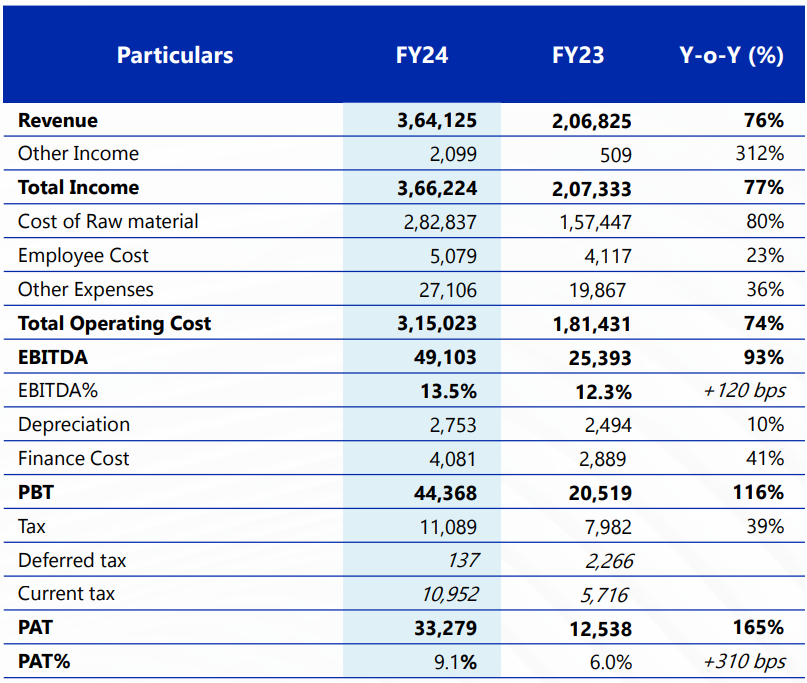

3. Strong FY23: PAT up 151% & Revenue up 76%

4. Strong 9M-24: PAT up 170% & Revenue up 87%

5. Strong Q-24: PAT up 156% & Revenue up 57% YoY

PAT up 25% & Revenue up 24% QoQ

6. Strong FY24: PAT up 165% & Revenue up 77%

7. Business Metrics: Strong & improving return ratios

8. Outlook: Revenue growth of 50%+ in FY25

i. FY25: Revenue growth of 50%

Revenue expectation of Rs 5,500-5,600 cr in FY25 implies a 50% growth in FY25

ii. FY25: Strong revenue visibility. Order book 1.5X FY25 revenue

Assuming about Rs 5,500 cr in FY24 implies order book in place to support 1.5X FY25 expected revenue. 75% of existing order book to be executed in 18 months and the remaining 25% to be executed within FY25

Order backlog of INR 7,10,166 lakh our highest ever

About 75% would be wagon, and I think these order books have to be executed over the next 18 months.

Entire remaining almost about INR 1,700 crores, INR 1,800 crores of CV business would be executed in the current year.

iii. Rs 10,000 cr revenue by FY27 or FY28 - Revenue CAGR of 29-40%

9. PAT growth of 165% & Revenue growth of 77% in FY24 at a PE of 72

10. So Wait and Watch

If I hold the stock then one may continue holding on to JWL.

Coverage of JWL was initiated after Q1-24 results. The investment thesis has not changed after a strong FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a stronger FY25

The EBITDA margin was 13.3% in Q4 FY '24, highlighting our focused execution strategy as we continue to report industry-leading margins.

We are proud to have achieved the significant milestone of surpassing INR 1,10,000 of revenue in a single quarter for the first time ever.

JWL management is quite confident about its prospects in FY25 with expectations of 50%+ top-line growth

We anticipate a significant increase in execution and performance throughout fiscal year 2025 and remain confident in the growth trajectory of these businesses.

JWL management indicating that the journey to Rs 10,000 cr of revenue will be completed in the next 3-4 years is a reason to continue with the stock.

11. Join the ride

If I am looking to enter JWL then

JWL has delivered PAT growth of 165% & Revenue growth of 77% in FY24 at a PE of 72 which makes valuations fairly priced in the short term.

JWL is guiding for 50% revenue growth on the back of a strong order book in FY25 at at a PE of 72 which makes valuations fairly priced in the short term

Over the longer term JWL is guiding for revenue CAGR of 29-40% till FY27/FY28 at PE of 72 valuations reasonably priced in the short term

There is opportunity in JWL if execution goes as per plan. On the flip side the margin for error is small. One bad quarter and the asking rate to sustain a PE of 72 will become quite high. At a PE of 72, the stock can become expensive quite quickly if execution falters by a little.

Positions need to be built over time over bad days or periods when the stock is not doing well.

Previous coverage of JWL

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer