Jai Balaji Industries: PAT down by 3% & revenue growth of 18% in H1-25 at a PE of 18

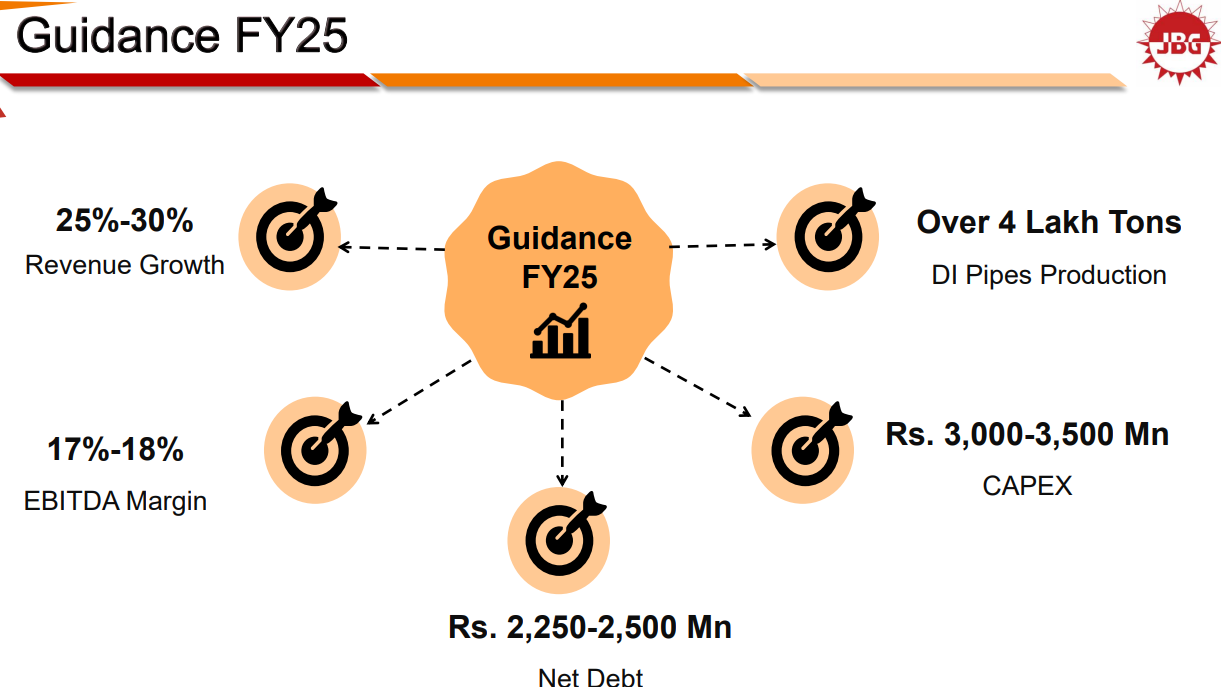

Revenue growth of 25-30% in FY25. EBITDA margin expansion to 17-18% provides strong outlook for FY25. FY24-26 revenue CAGR of 22-25%. JAIBALAJI undergoing capex till FY26 to support growth

Money Muscle is away. Limited coverage till 3-Jan-25. HAPPY NEW YEAR

1. Manufacturers of DI Pipes & Specialized Ferro Alloys

jaibalajigroup.com | NSE: JAIBALAJI

Jai Balaji Industries is an integrated steel products company specialising in value-added products like ductile iron pipes and specialised ferroalloys.

Currently we have around 9% to 10% of the DI pipe market share of India and our aim is to reach 18% to 20% of the market share post our capacity expansion plans.

One of the largest producers of Specialized Ferro Alloys in India

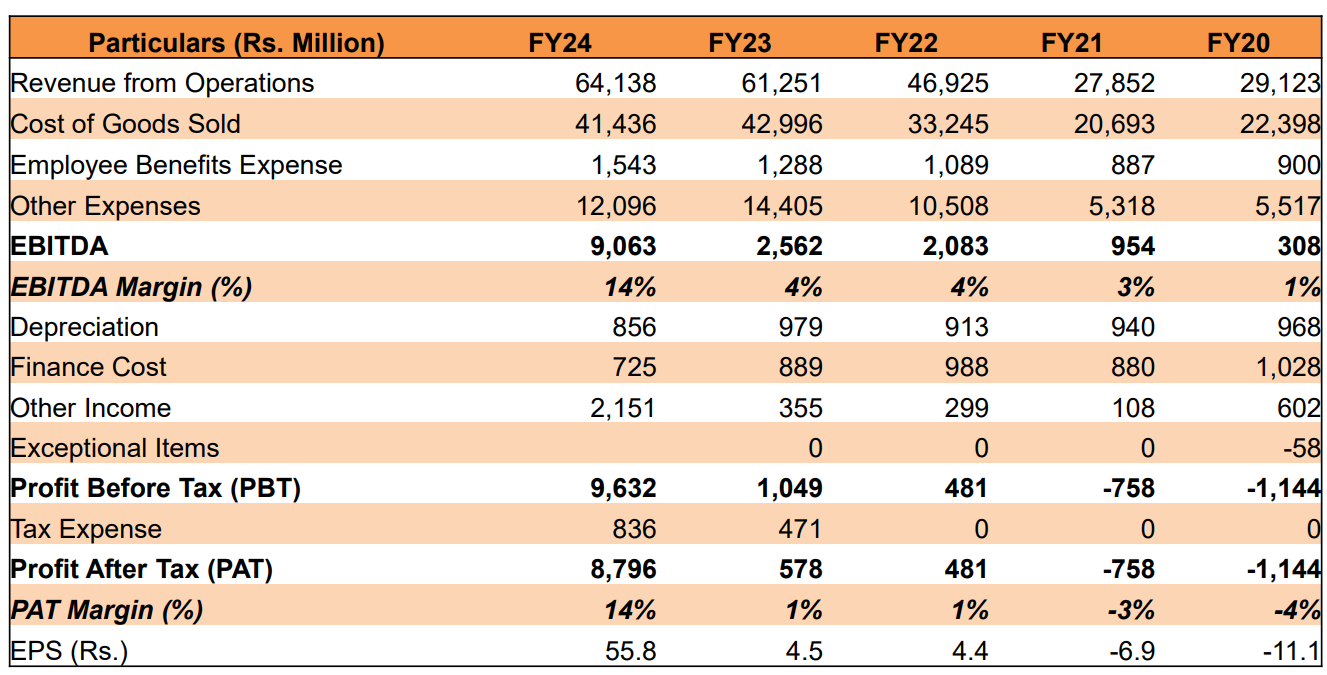

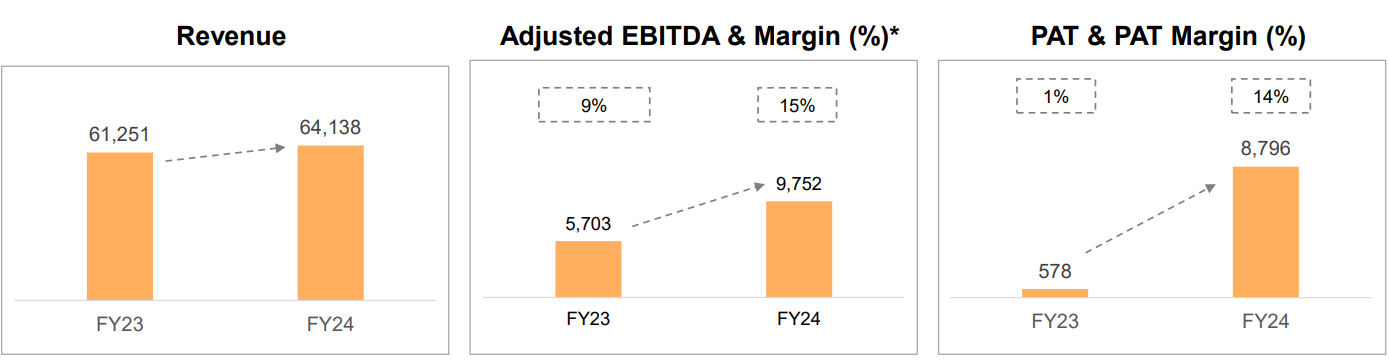

2. FY20-24: EBIDTA CAGR of 133% & Revenue CAGR of 22%

3. Strong FY24: PAT 1422% & Revenue up 5% YoY

4. Q2-25: PAT down 24% & Revenue up 1% YoY

5. H1-25: PAT down 3% & Revenue up 8% YoY

6. Business metrics: Strong & Improving return ratios

Becoming net debt free company in next 12-15 Months and strengthening the Balance Sheet

6. Outlook: 25-30% revenue growth in FY25

i. FY25: 25-30% revenue growth

Revenue Growth: Expected to be supported by an increase in the volume of ductile iron pipes, which are major contributors to the company's topline and bottom line. The company expects the share of value-added products to increase with each quarter.

EBITDA Margin: Target EBITDA margin of 17%-18%.

Debt Reduction: Become a net term debt-free company within the next 12 months. FY25 guidance to reduce term debt to ₹225-₹250 crores.

Ductile Iron Pipes: Volume of ductile iron pipes to increase incrementally each quarter.

Targeting 4 lakh tons this year.

Expect the realization for ductile iron pipes to be at similar levels, with a possible fluctuation of plus or minus 2%-3%.

Revenue contribution from DI pipes will reach 65% by the end of the current financial year and then rise to 75-80% after further capacity expansion.

Ferro Alloys: Volume expected to remain the same for H2-25, with a capacity expansion expected in Q1 of FY26. The company expects the realization in the specialized ferro alloy division to remain at similar levels, with a possible fluctuation of plus or minus 2% due to global market conditions.

Production Volume: Aiming for a production volume of 40,000 tons per month for ductile iron pipes to reach their annual goal.

Carry Forward Tax Losses: The company had ₹1000 crores of carry forward tax losses at the beginning of the year, and after Q2, the remaining losses to be consumed are ₹500 crores plus or minus 5. The company has also consumed all of its deferred tax assets in the last three quarters.

ii. FY24-26: Revenue CAGR of 22-25%

FY24 revenue of Rs 6413.8 cr growing to Rs 9,500-10,000 cr by FY26 implies a revenue CAGR of 22-25% for FY26

We are expecting a full year revenue in FY26 to around 9,500 to 10,000 crores on current prices basis

iii. Future Outlook

JAIBALAJI is strategically focused on value-added & specialised products like ductile iron (DI) pipes and specialised ferro alloys.

Capacity Expansion

JAIBALAJI expanding its DI pipes capacity from 3 lakh metric tons to 6.6 lakh metric tons. Expansion planned in two phases with 1.4 lakh metric tons expected to be commissioned in FY25 and another 2.2 lakh metric tons in FY26.

Ferro alloy capacity will increase from 1.6 lakh metric tons to 1.9 lakh metric tons by Q1-26.

Increasing blast furnace capacity from 6.3 lakh metric tons to 7.5 lakh metric tons, with the second revamp expected to be completed by Q1 of FY26.

Sinter capacity raised to 9 lakh tons in FY24. Additional 3 lakh tons expected to be commissioned in Q1-26, bringing total to approximately 12 lakh metric tons per annum.

Operational Expectations

Anticipating a very robust inquiry and tendering process starting in Q3-25.

Exploring export opportunities for DI pipes as its production capacity increases. It is targeting around 5% of its production for exports.

Potential Challenges

Slight pressure on the realization of DI pipes, due to reduction in raw material prices.

The company acknowledges that the release of funds from the government has been slower in the current quarter, but expects robust spending over the next 4-5 months.

Potential pressure of 4-5% on the realization of DI pipes over the long term due to decreasing raw material prices.

7. PAT de-growth of 3% & Revenue growth of 8% in H1-25 at a PE of 18

8. Hold?

If I hold the stock then one may continue holding on to JAIBALAJI.

JAIBALAJI has delivered a very average H1-25. While the management is confident, however a very strong catch up is required in the rest of the year to achieve the 25-30% revenue growth guidance given the 8% growth in H2-25

H1-25: We are sticking to our guidance because we are expecting increase in the volumes of ductile iron pipes which are the major contributors to our topline and the bottomline. And as we have already said earlier also that we are expecting the share of value added products to go substantially with every sequential quarter.

JAIBALAJI management in-line on delivering on the EBITDA guidance in FY25. In H1-25, EBITDA margin was 16.7% compared to the target of 17-18% in FY25.

Capacity Expansion Plans are in place to support growth till FY26. Volume CAGR of 48% for DI pipes for FY24-26. Volume growth of 14% for Ferro Alloys for FY24-25.

The outlook for JAIBALAJI looks very strong based on the industry tailwinds in place

Demand for DI pipes is expected to remain robust due to government initiatives such as the Jal Jeevan Mission (JIM) and AMRUT 2.0, as well as other irrigation schemes.

The company also anticipates a steady growth for its specialized ferro alloys.

The proposed debt reduction will not only strengthen the balance sheet but will also improve margins given the reduction in interest costs.

we are optimistic that within the next 12 months we will achieve our goal of becoming a net debt free company.

9. Buy?

If I am looking to enter JAIBALAJI then

JAIBALAJI has delivered PAT de-growth of 3% & Revenue growth of only 8% in H1-25 at a PE of 18 which makes valuations fully priced in the short term.

FY25 guidance for 25-30% revenue growth with EBITDA margin expansion to 17-18% implies EBITDA growth of 40-54% at a PE of 18 makes valuations look attractive from medium term.

FY26 revenue guidance of Rs 9500-10,000 cr implies 22-25% revenue CAGR for FY24-26 at a PE of 18 makes valuations look attractive from a longer term.

Given the tepid performance in H1-25 the growth has to come through in Q3-25 or else the guidance will not be met in FY25 and is a risk.

Previous coverage of JAIBALAJI

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer