Jai Balaji Industries: PAT growth of 23% & revenue growth of 16% in Q1-25 at a PE of 17

Revenue growth of 25-30% in FY25. EBITDA margin expansion to 17-18% provides strong outlook for FY25. JAIBALAJI undergoing capex till FY26 providing a roadmap for longer term growth

1. Manufacturers of DI Pipes & Specialized Ferro Alloys

jaibalajigroup.com | NSE: JAIBALAJI

Jai Balaji Industries is an integrated steel products company specialising in value-added products like ductile iron pipes and specialised ferroalloys.

Currently we have around 9% to 10% of the DI pipe market share of India and our aim is to reach 18% to 20% of the market share post our capacity expansion plans.

One of the largest producers of Specialized Ferro Alloys in India

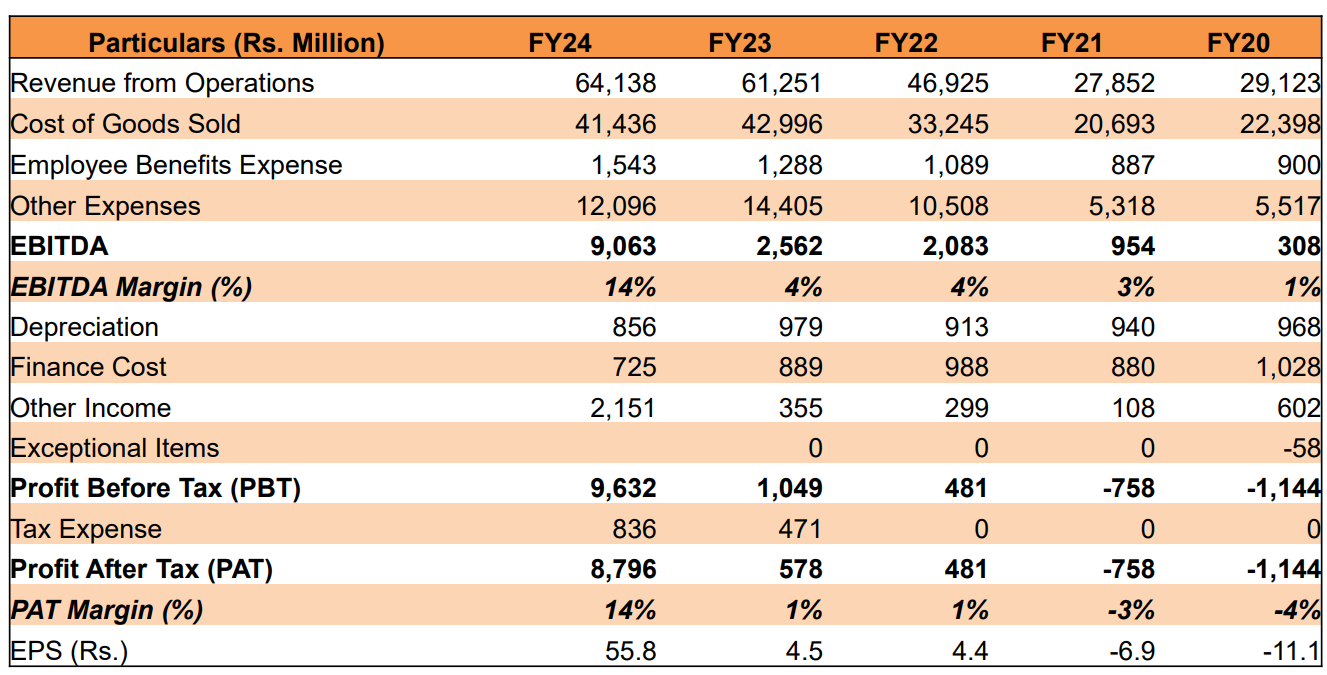

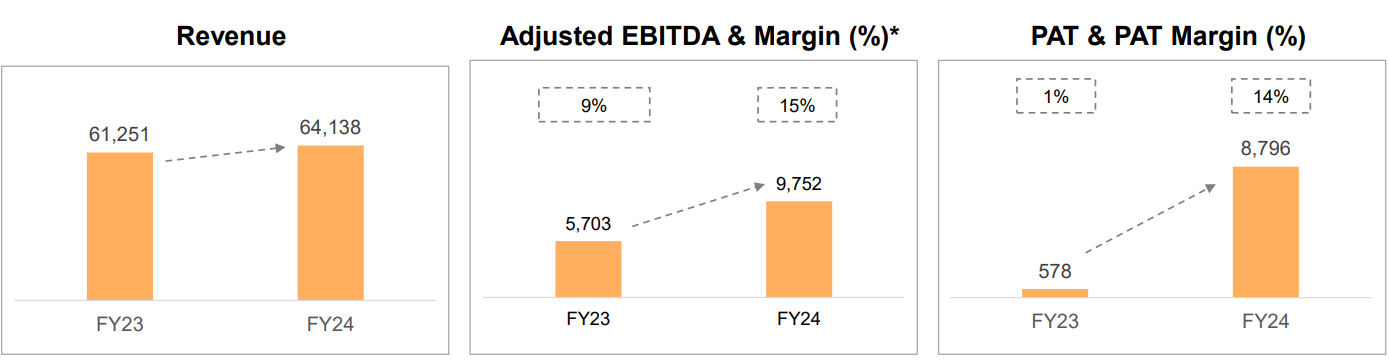

2. FY20-24: EBIDTA CAGR of 133% & Revenue CAGR of 22%

3. Strong FY24: PAT 1422% & Revenue up 5% YoY

4. Q1-25: PAT up 23% & Revenue up 16% YoY

5. Business metrics: Strong & Improving return ratios

Becoming net debt free company in next 12-15 Months and strengthening the Balance Sheet

6. Outlook: 25-30% revenue growth in FY25

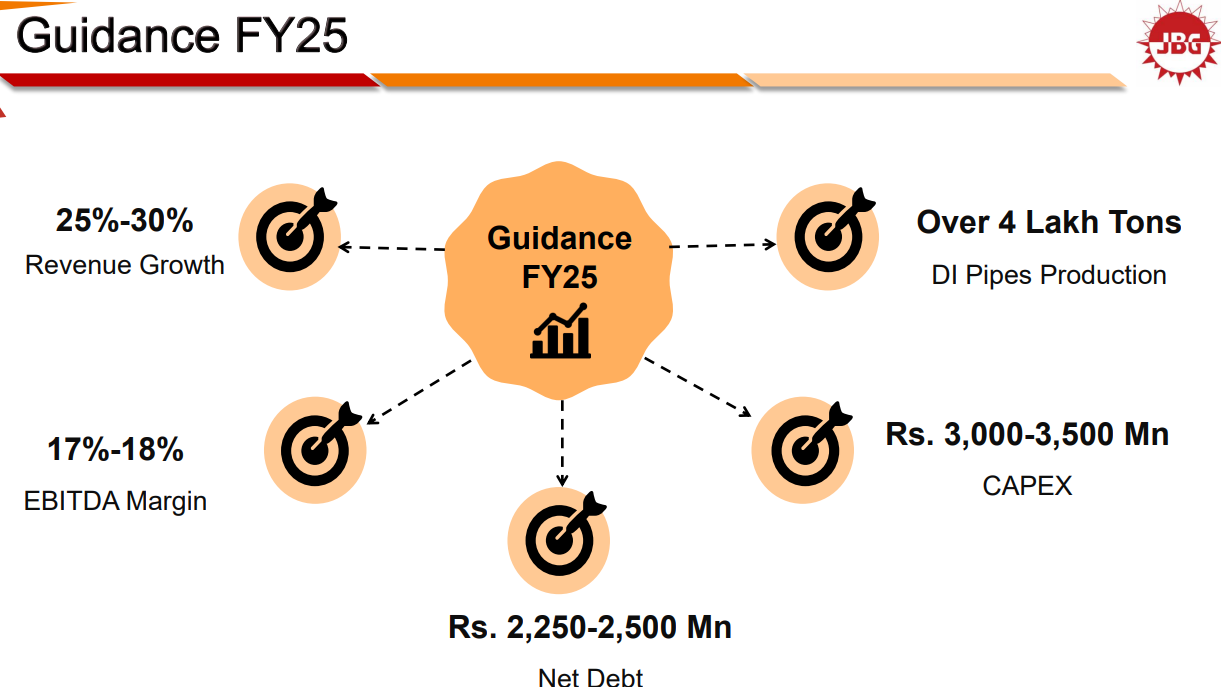

i. FY25: 25-30% revenue growth

For FY '25, we anticipate revenue growth in the region of 25% to 30%, EBITDA margins of around 17% to 18% and the net debt to be reduced to a range of around INR225 to INR250 crores.

The capital expenditure is also expected to be in the range of INR300 to INR250 crores and we expect the ductile iron pipe production to exceed INR4 lakh tons.

With a focus on increasing the contribution of value-added products for margin expansion, we expect DI to contribute 45% to 50% and Ferroalloys to contribute around 35% of our total volumes by FY '25 '26.q

ii. FY24-26: Revenue CAGR of 22-25%

FY24 revenue of Rs 6413.8 cr growing to Rs 9,500-10,000 cr by FY26 implies a revenue CAGR of 22-25% for FY26

We are expecting a full year revenue in FY26 to around 9,500 to 10,000 crores on current prices basis

7. PAT growth of 23% & Revenue growth of 16% in Q1-25 at a PE of 17

8. So Wait and Watch

If I hold the stock then one may continue holding on to JAIBALAJI.

JAIBALAJI has delivered a strong turnaround in FY24 after a lackluster FY21-23. It has been followed up with a good Q1-25. While the management is confident, however catch up is required in the rest of the year to achieve the 25-30% revenue growth guidance given the 16% growth in Q1-25

Q1-25: We are positive about maintaining this momentum and continuing to provide exceptional results in the future.

The bottom line is expected to grow faster than top-line given that EBITDA margin is expected to expand from 14% in FY24 to 17-18% in FY25. Q1-25 EBITDA of 18.4% is pointing towards the ability of JAIBALAJI management in delivering on the EBITDA guidance in FY25

Capacity Expansion Plans are in place to support growth till FY26. Volume CAGR of 48% for DI pipes for FY24-26. Volume growth of 14% for Ferro Alloys for FY24-25.

The outlook for JAIBALAJI looks very strong based on the industry tailwinds in place

The company is well-positioned for growth, supported by strong industry tailwinds in the ductile iron pipe industry and the specialized ferro alloys and also robust capacity expansion plans

The proposed debt reduction will not only strengthen the balance sheet but will also improve margins given the reduction in interest costs.

we are optimistic that within the next 12 months we will achieve our goal of becoming a net debt free company.

9. Or, join the ride

If I am looking to enter JAIBALAJI then

JAIBALAJI has delivered PAT growth of 23% & Revenue growth of 16% in Q1-25 at a PE of 17 which makes valuations quite reasonable.

FY25 guidance for 25-30% revenue growth with EBITDA margin expansion to 17-18% implies EBITDA growth of 40-54% at a PE of 17 makes valuations look attractive from medium term.

FY26 revenue guidance of Rs 9500-10,000 cr implies 22-25% revenue CAGR for FY24-26 at a PE of 17 makes valuations look attractive from a longer term.

JAIBALAJI generated free cash flow of Rs 459 cr on a market cap Rs 16,664 cr, implies that its available at a free cash flow yield of 2.8% which is positive that its generating free cash flow at the time of an ongoing capacity expansion.

Previous coverage of JAIBALAJI

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Also invested into Motilal (it's a steal at 15x), and RBL. Find the low P/B too enticing but perplexing too. What are your thoughts on Medplus?

Thanks. Find your thread to be a good starting point. Liked the analysis of Fineotex and Frontier Springs. Waiting for a good entry point. Was already invested in SG Mart and Action Construction. Would be great if we could pick our minds on some ideas that I have.