ITD Cementation Q4 FY25 Results: PAT up 36%, FY26 Guidance for 25% Growth & Margin Expansion

Robust order pipeline, stable margins, strong execution, and group synergies position ITD for sustained growth despite premium valuation & concerns on slowing order intake

1. EPC player undertaking Heavy Civil & Infrastructure projects

itdcem.co.in | NSE : ITDCEM

One of the leading Engineering and Construction Companies undertaking Heavy Civil, Infrastructure and EPC business

Expertise in Maritime Structures, Mass Rapid Transit Systems, Airports, Hydro-Electric Power, Tunnels, Dams & Irrigation, Highways, Bridges & Flyovers, Industrial Structures and Buildings, Foundation & Specialist Engineering

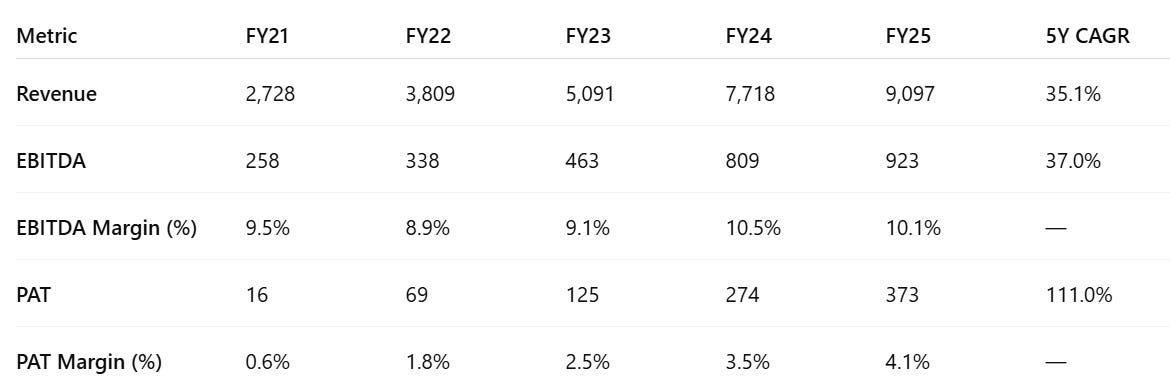

2. FY21-25: PAT CAGR of 111% & Revenue CAGR of 35%

Revenue and EBITDA growth, reflecting strong project execution and scale benefits.

PAT surged led by operating leverage and improved margin profile.

Steady EBITDA margin expansion and rising PAT margin highlight disciplined cost control and better project mix.

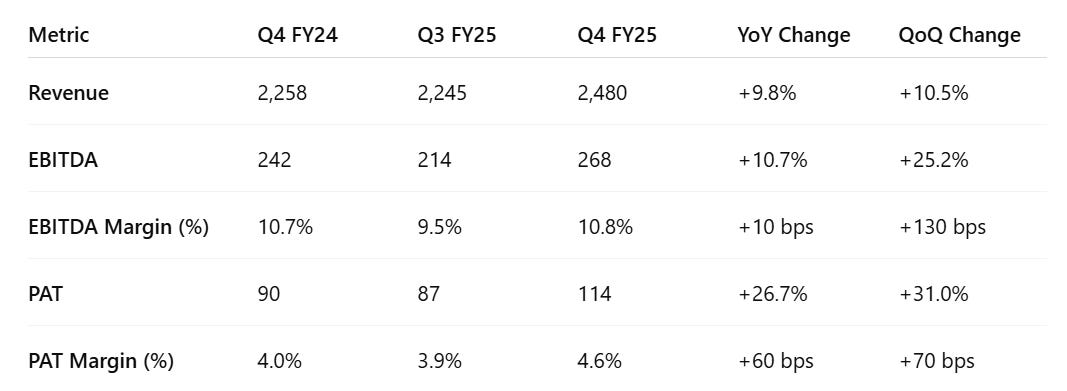

3. Q4-25: PAT up 27% & Revenue up 10% YoY

PAT up 31% & Revenue up 11% QoQ

Strong topline growth with revenue up 10.5% QoQ and 9.8% YoY, driven by execution ramp-up across segments.

EBITDA rose 25% QoQ, with margin expanding to 10.8% — reflecting better cost efficiency and project mix.

PAT surged 31% QoQ to ₹114 Cr, with PAT margin improving 70 bps to 4.6%, indicating stronger profitability momentum.

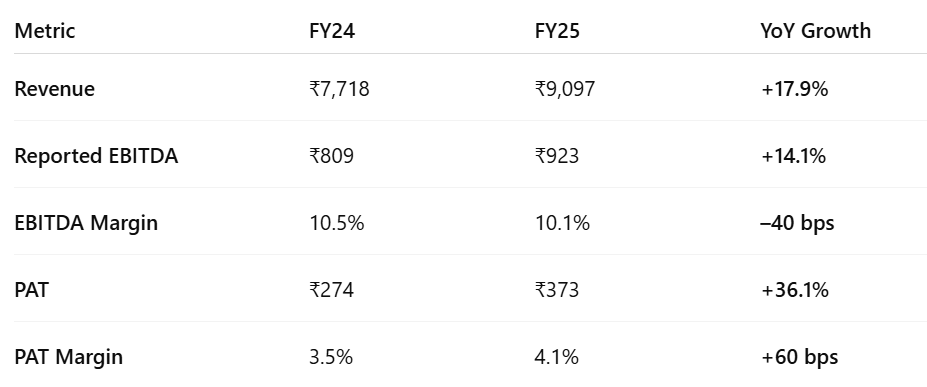

4. FY-25: PAT up 36% & Revenue up 18%

Execution matches management tone: Revenue growth was just shy of 18%, well within the ±20% guidance band — reflecting realistic forecasting and effective execution.

Management comment on FY25 & FY26 growth during Q3-25 call: '25, '26 you can find, as I have mentioned before also, around 20% plus-minus we should be.

Margins held firm: Despite input cost pressures across the sector, EBITDA margin was steady at 10.1%, aligning with the guided stability.

Bottom-line outperformance: PAT grew faster than revenue and EBITDA, indicating improving efficiency, lower finance or tax cost, or better working capital management.

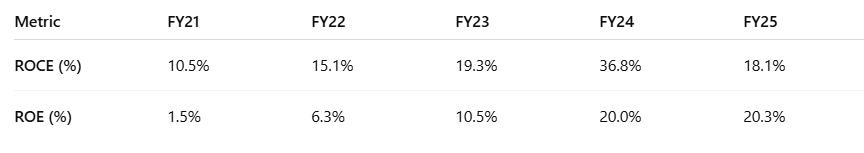

5. Business metrics: Steady return ratios

Steady Expansion: ROE improved significantly from a low base, reflecting rising net profitability and more efficient use of shareholder capital. FY25 ROE remained strong despite a dip in order inflow, indicating sustained profitability even as growth normalizes.

FY25 Dip of ROCE to 18.1%:

Reflects higher capital employed (debt + equity both rose)

Revenue and EBITDA growth moderated relative to capital growth

6. Outlook: 20%revenue growth in FY26

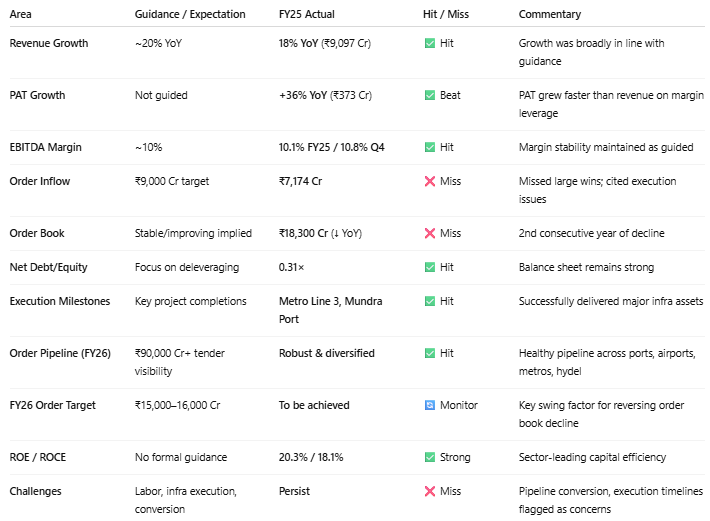

6.1 ITD Cementation – FY25: Guidance vs. Actuals

Hits: Strong execution, financial discipline, project milestones, and high RoE/ROCE justify premium valuation multiples.

Misses: Order inflow and backlog contraction are key pressure points — FY26 performance will hinge on converting ₹90k Cr+ pipeline into tangible wins.

Watchlist: Labor capacity, segment expansion (e.g. data centers, large airports), and any overlap with group EPC entities.

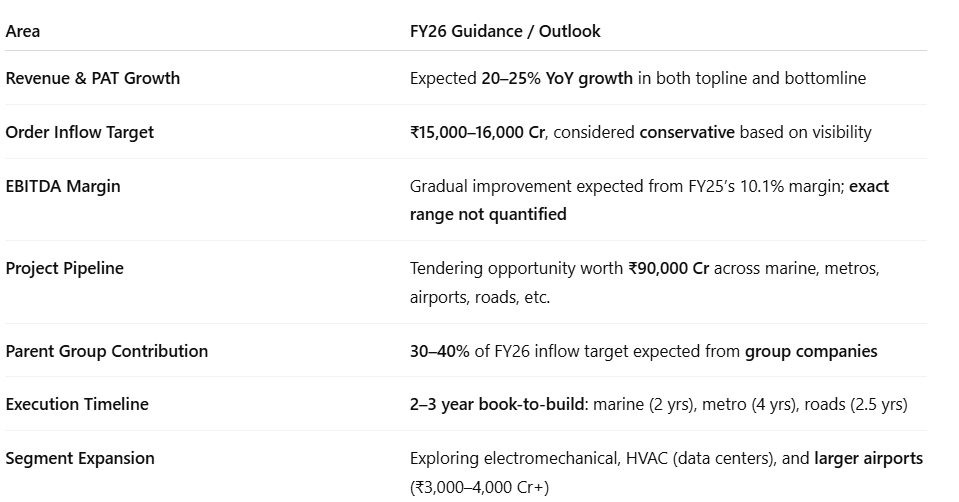

6.2 ITD Cementation – FY26 Management Guidance

Topline Growth

Expecting ~25% YoY growth in revenue (vs. ₹9,097 Cr in FY25)

Bottomline Growth

PAT expected to grow in line with revenue, maintaining 25% growth momentum

EBITDA Margins

FY25 margin: 10.1%

Expecting gradual improvement in FY26

No specific margin target quantified

Order Inflow Target

₹15,000–16,000 Cr of new orders targeted

Described as conservative, backed by robust pipeline

Parent Group Contribution

30–40% of inflow expected from Adani group companies

Pipeline includes hydel and airport EPC jobs

Project Pipeline Visibility

₹90,000 Cr+ tendering pipeline across:

Marine, airports, underground metros

Tunnels, bridges, buildings, industrial structures

Specific Tender Opportunities

Vadhavan Port: ₹1,500 Cr (dredging + breakwater)

Airports: ₹15,000–20,000 Cr potential; Navi Mumbai Airport Phase 2 (₹4,000–6,000 Cr)

New Geographies

Exploring Middle East market (e.g., Abu Dhabi branch opened)

New Segment Expansion

Plans to enter electromechanical, HVAC for data centers

Enhancing capability for larger airport EPC projects (₹3,000–4,000+ Cr)

Execution Timelines (Book-to-Build)

Marine: ~2 years

Underground Metro: ~4 years

Roads: ~2–2.5 years

Overall: 2–4 year execution cycle

Order Backlog

₹18,300 Cr as of March 2025

No slow-moving orders reported

CapEx

FY25 CapEx: ₹250 Cr

FY26 CapEx plan not detailed; implied to remain stable

7. Valuation Analysis

7.1 Valuation Snapshot

ITD Cementation trades at ~29× P/E and 5.85× P/B — rich but justified by 20%+ RoE and strong earnings momentum. EV/EBITDA at 11.9× reflects quality execution. A 2.01× book-to-sales ratio offers decent revenue visibility, though down from FY24. Net debt is low, and ROCE remains strong at 18.1%, despite a dip from last year.

Valuations remain elevated but are backed by 20%+ RoE, robust execution, and improving margins. With ₹90,000 Cr of pipeline and ₹15–16k Cr inflow target, FY26 will be crucial for sustaining premium multiples and driving valuation rerating.

7.2 What’s Priced In

The current valuation of ITD Cementation — with P/E at ~28.8×, P/B at ~5.85×, and EV/EBITDA at ~11.9× — reflects investor confidence in the following:

20–25% growth continuity: Management’s topline and bottomline guidance for FY26 appears largely priced in, especially given consistent historical performance and robust execution.

Stable double-digit margins: The company delivered a 10.1% EBITDA margin in FY25, and guidance to maintain or marginally improve this in FY26 is embedded in valuations.

Strong RoE and RoCE profile: Sustained RoE of 20%+ and RoCE above 18% signal operational excellence — these capital efficiency metrics support premium multiples.

Solid balance sheet: A net debt-to-equity ratio of just 0.31× indicates ample financial headroom, which the market rewards with valuation comfort.

Execution track record: Completion of large-scale projects like Mumbai Metro Line 3 and Mundra Port reinforce belief in management’s ability to deliver on high-value infrastructure.

7.3 What’s Not Priced In

Despite its strong performance and high multiple, the market has not fully factored in the following potential upsides:

₹15,000–16,000 Cr order inflow in FY26: While this is management’s conservative target, conversion from the ₹90,000 Cr pipeline — particularly big-ticket jobs from Vadhavan Port, Navi Mumbai Airport Phase 2, and parent group opportunities — could surprise positively.

Entry into new verticals: Expansion into high-value segments like electromechanical, HVAC for data centers, and enhanced capability in large airports (₹3,000–4,000+ Cr) could add materially to revenue and margin expansion in FY27 and beyond.

International foray: Initial moves into the Middle East (e.g., Abu Dhabi) are yet to reflect in valuation — successful execution or order wins here could open a new growth vector.

Potential margin expansion: Any meaningful improvement above the 10–10.5% EBITDA range (which management hopes for, but hasn’t quantified) would likely lead to rerating.

Longer-term strategic clarity with new promoter: Future plans (e.g., BOT projects, segment diversification, capital allocation strategy) under the group’s influence could unlock valuation re-rating.

8. Implications for Investors: What to Watch

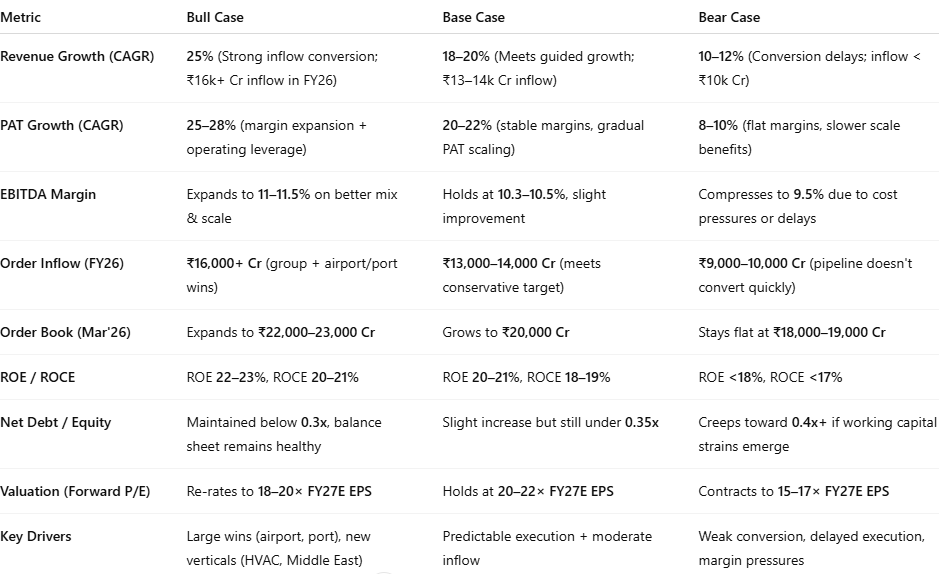

8.1 Bull, Base & Bear Case Scenarios

8.2 Why Investors May Want to Stay Invested or Add to ITD Cementation

Robust Growth Visibility

Management has guided for 25% topline and bottomline growth in FY26, supported by a ₹90,000 Cr+ project pipeline and a ₹15,000–16,000 Cr inflow target.

Book-to-sales ratio of 2.01× ensures 2+ years of revenue visibility, even before factoring FY26 wins.

Earnings-Led Valuation Comfort

Trading at ~28.8× TTM P/E and ~11.9× EV/EBITDA, valuations are rich but earnings-backed.

As PAT compounds at 20–25% CAGR, forward P/E could compress to 18–20×, offering rerating potential.

Strong Capital Efficiency

ROE of 20.3% and ROCE of 18.1% in FY25 — both expected to improve with higher utilization and order inflow recovery.

Net debt/equity of just 0.31× reflects strong financial discipline and low risk of dilution.

Execution Track Record & Strategic Leverage

Delivered high-impact projects like Mumbai Metro Line 3 and Mundra Port.

Anticipates 30–40% of FY26 order inflows from group companies, ensuring anchor client visibility with competitive edge.

Optionality from New Verticals

Exploring electromechanical and HVAC for data centers, larger airport EPC, and international markets (e.g. Abu Dhabi) — offering potential upside optionality not yet priced in.

No Slow-Moving Orders

Clean order book with no stalled or legacy projects, ensuring healthy cash flows and timely execution.

8.3 Risks Not Fully Discounted

While the outlook is bullish, several risks remain — and may not be fully reflected in current valuations:

Conversion uncertainty: Though the ₹90,000 Cr project pipeline is large, conversion to orders is not assured, especially in competitive spaces like airports and metros.

Execution dependency on labor: Labor resource constraints have been flagged as a challenge. Inability to scale effectively could impact execution timelines and margins.

Missed order inflows: FY25 order inflows (₹7,174 Cr) fell short of the ~₹9,000 Cr target — a repeat in FY26 would weaken visibility and derail the 20–25% growth narrative.

Elevated competitive intensity: EPC segments remain competitive with pricing pressure, especially in NHAI and urban infra.

Elevated metro delays: Management acknowledged uncertainty in elevated metro timelines, and currently has no projects in that sub-segment.

Expansion risk: Moving into data centers, HVAC, and large airport EPC without a proven track record carries execution and capability risks.

Internal group competition: While management downplays risks from another listed EPC entity within the group, potential overlap and dilution of bidding advantage cannot be fully ruled out.

External shocks: Political or macro events (e.g., Bangladesh project delays) highlight execution vulnerability in cross-border or state-sensitive zones.

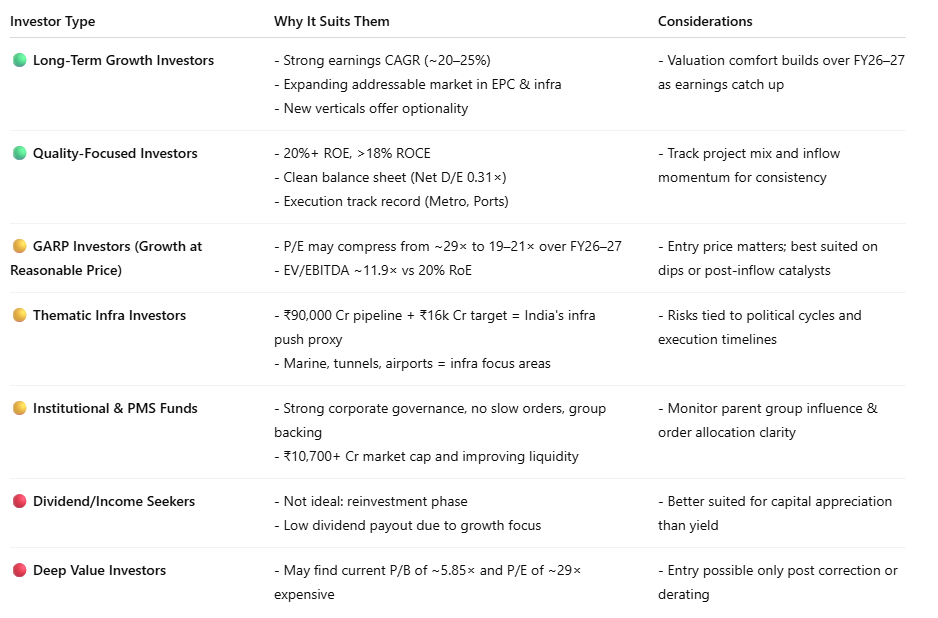

8.4 Investor Segmentation Outlook – ITD Cementation

Previous coverage on ITDCEM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer