ITD Cementation: PAT growth of 63% & Revenue growth of 27% in H1-25 at a PE of 25

Revenue growth of 20% in FY25 & FY26. FY27 revenue growth of 15%. EBITDA margin expansion. Order book ~2X of FY25 expected revenue. Acquisition by Adani Group to be a positive for the business

1. EPC player undertaking Heavy Civil & Infrastructure projects

itdcem.co.in | NSE : ITDCEM

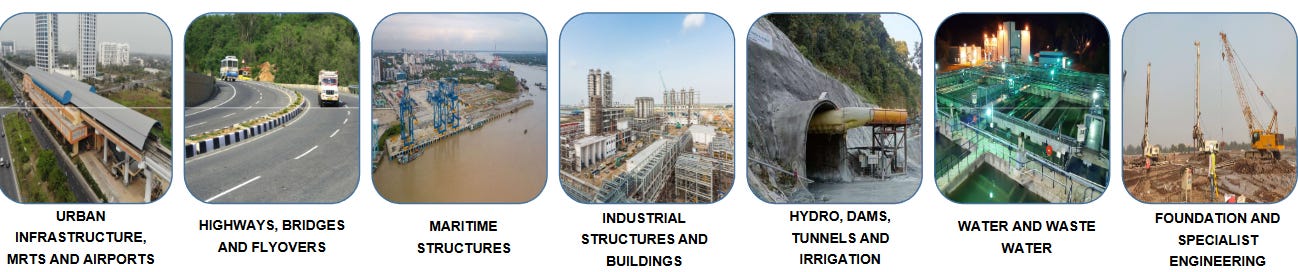

One of the leading Engineering and Construction Companies undertaking Heavy Civil, Infrastructure and EPC business

Expertise in Maritime Structures, Mass Rapid Transit Systems, Airports, Hydro-Electric Power, Tunnels, Dams & Irrigation, Highways, Bridges & Flyovers, Industrial Structures and Buildings, Foundation & Specialist Engineering

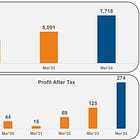

2. FY20-24: PAT CAGR of 58% & Revenue CAGR of 28%

3. Strong FY24: PAT up 120% & Revenue up 52%

4. Strong Q2-25: PAT up 72% & Revenue up 24%

5. Strong H1-25: PAT up 63% & Revenue up 27%

6. Business metrics: Improving return ratios

8. Outlook: 20%revenue growth in FY25

i. 20% top-line growth in FY25

One can expect Rs 9,260 cr revenue in FY25, given the 20% growth expectation.

FY25 & FY26: '25, '26 you can find, as I have mentioned before also, around 20% plus-minus we should be.

FY27: It will slightly taper down. Once it becomes big, so 20% next year, maybe 15% in that range.

ii. EBITDA Margin expansion

EBITDA Margin expansion from 10.5% in FY 24 to closer to 11% in FY25

On EBITDA Margin: Yes. I mean that for convenience purpose if we could reduce this and that, otherwise 10% plus.

iii. Strong order-book: 2X+ FY25 expected revenue

Order book is nearly double the Rs 9,260 cr revenue expected in FY25. However, the reducing order book is a big red flag and this trend needs to be watched very closely. The implications of a falling order book would be seen in the business results of FY-26

9. PAT growth of 63% & Revenue growth of 27% in H1-25 at a PE of 26

10. Hold?

If I hold the stock then one may continue holding on to ITDCEM

The investment thesis based on a strong order book and strong execution has not changed after a strong FY24 and H1-25.

Business execution is strong as exhibited from Q2-25 performance despite challenges.

This quarter, revenue is a little bit affected due to monsoon.

At the same time, in general, Bangladesh, we are working for one transmission line. And because of the political scenario, we could not do much during last quarters.

Reduction in order book is a red flag and needs to be watched for. If order book does not start growing it would have implications on FY26. One can watch it on a quarter by quarter basis for another 1-2 quarters before taking any decision.

Acquisition by the Adani group will be a positive for ITDCEM

In terms of Adani, I mean we have to do much more work than what we have been doing so far, including whatever work we are doing, apart from Adani, that will remain, that will grow. And maybe we'll be getting some more jobs from Adani. So that is a positive side. We have to enhance our capability. That much I can say at this moment.

11. Buy?

If I am looking to enter ITDCEM then

ITDCEM has delivered PAT growth of 63% & Revenue growth of 26% in H1-25 at a PE of 26 which makes the valuations look reasonable from the short term .

Revenue growth of 20% in FY25 & FY26 with expanding margins at a PE of 26 makes the valuations look fairly priced in the medium term.

Revenue growth of about 15% in FY27 with expanding margins at a PE of 26 makes the valuations look fairly priced in the longer term

One can expect strong free cash flow generation as ITDCEM does not foresee any major capital expenditure requirements in the near future.

And regarding your other capex issue, so far, our capex is around INR67 crores this quarter. Going forward, next year, we had said that the capex will be under control because whatever we have invested, just we have done the last 2 years, we don't see that much investment coming.

Execution against the FY25 guidance would drive ITDCEM in the medium term. Over the long term order intake and build up of the order book would create opportunity in ITDCEM and hence the order inflow in FY25 would be critical.

On Order intake:

But as I said that end of the year, total job I think INR10,000 crores will be secured in this year. That we are confident about that.

Secured orders worth ~Rs 3,850 crore in FY25 till date

Previous coverage on ITDCEM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer