ITD Cementation: PAT growth of 91% & Revenue growth of 30% in Q1-25 at a PE of 30

Revenue growth of 20% in FY25. EBITDA Margin expansion to 11% in FY25. Order book at 2X of FY25 expected revenue. Available at reasonable free cash flow yield of 3.8%.

1. EPC player undertaking Heavy Civil & Infrastructure projects

itdcem.co.in | NSE : ITDCEM

ITD Cementation India Limited is one of the leading Engineering and Construction Companies undertaking Heavy Civil, Infrastructure and EPC business and operating in India for nine decades with an established presence and expertise in Maritime Structures, Mass Rapid Transit Systems, Airports, Hydro-Electric Power, Tunnels, Dams & Irrigation, Highways, Bridges & Flyovers, Industrial Structures and Buildings, Foundation & Specialist Engineering

2. FY20-24: PAT CAGR of 58% & Revenue CAGR of 28%

3. Strong FY23: PAT up 80% & Revenue up 34%

4. Strong FY24: PAT up 120% & Revenue up 52%

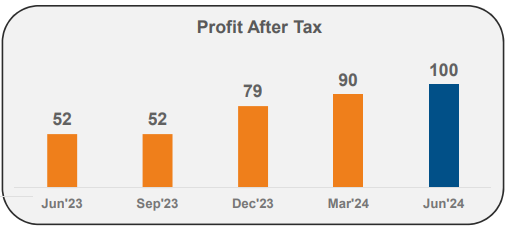

5. Strong Q1-25: PAT up 91% & Revenue up 30%

6. Business metrics: Improving return ratios

8. Outlook: 20%revenue growth in FY25

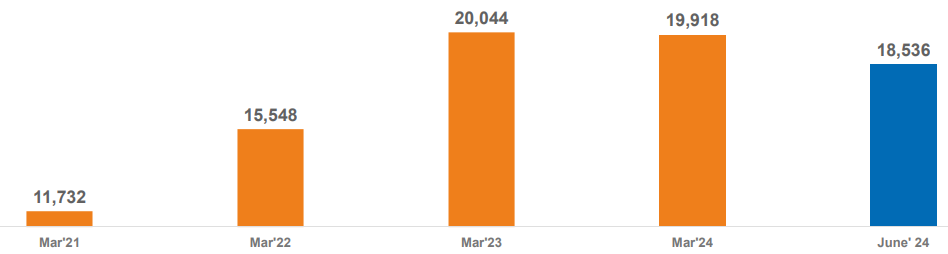

i. 20% top-line growth in FY25

One can expect Rs 9,260 cr revenue in FY25, given the 20% growth expectation.

ii. EBITDA Margin expansion

EBITDA Margin expansion from 10.5% in FY 24 to closer to 11% in FY25

iii. Strong order-book: 2X+ FY25 expected revenue

Order book is nearly double the Rs 9,260 cr revenue expected in FY25. However, the reducing order book is a big red flag and this trend needs to be watched very closely. The implications of a falling order book would be seen in the business results of FY-26

9. PAT growth of 91% & Revenue growth of 30% in Q1-25 at a PE of 30

10. So Wait and Watch

If I hold the stock then one may continue holding on to ITDCEM

Coverage of ITDCEM was initiated after Q1-24 results. The investment thesis based on a strong order book and strong execution has not changed after a strong FY24

Q1-25: Highest ever quarterly revenue of Rs 2,381 crore

Q1-25: Highest ever quarterly PAT of Rs 100 crore

ITDEM is increasing its PAT sequentially, QoQ, starting from Q2-22. One can hold on as ITDCEM is in the middle of a good run.

Reduction in order book is a red flag and needs to be watched for. If order book does not start growing it would have implications on FY26. One can watch it on a quarter by quarter basis for another 1-2 quarters before taking any decision.

The impending stake sale by its promoter is an overhang on ITDEM. Those uncomfortable with the promoter looking for an exit can also exit. Others can watch who is the next promoter is and the valuations at which the stake sale takes place.

11. Or else join the ride

If I am looking to enter ITDCEM then

ITDCEM has delivered PAT growth of 91% & Revenue growth of 30% in Q1-25 at a PE of 30 which makes the valuations look reasonable from the short term .

Revenue growth of 20% in FY25 with expanding margins at a PE of 30 which makes the valuations look fairly priced in the medium term.

ITDCEM generated Rs 369 cr of free cash flow in FY24 on a market cap of Rs 9552 cr which translates into a free cash flow yield of 3.86% which makes valuations acceptable

Execution against the FY25 guidance would drive ITDCEM in the medium term. Over the long term order intake and build up of the order book would create opportunity in ITDCEM and hence the order inflow in FY25 would be critical.

Targeting an order inflow of around Rs 9,000-10,000 cr in FY25

Previous coverage on ITDCEM

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer