Interglobe Aviation: 27% revenue growth in 9M-24 and back to profits at PE of 17

INDIGO has delivered a strong 9M-24 beating its capacity growth guidance for FY24. 20% growth expected in FY24. It is available at an attractive free cash flow yield.

1. 7th largest airline in the world

goindigo.in | NSE: INDIGO

Nearly 2/3rd of domestic market share in Aug-23

In August, IndiGo continued to have the largest market share at 63.3 percent

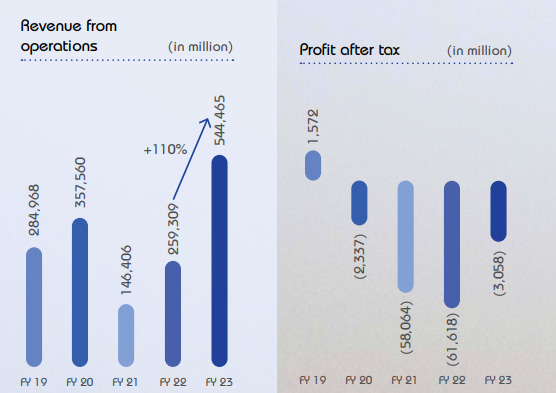

2. FY19-23: Making losses since the last 4 years

Expected to make a profit in FY24 after 4 years

3. FY23: Strong recovery since Q3-23, operational & financial

A year of recovery and growth as the demand remained robust, and we continued to serve the lion-share of this demand. Our revenues for the financial year 2023 more than doubled as compared to last year and we also reported the highest ever annual revenues of 558.8 billion rupees.

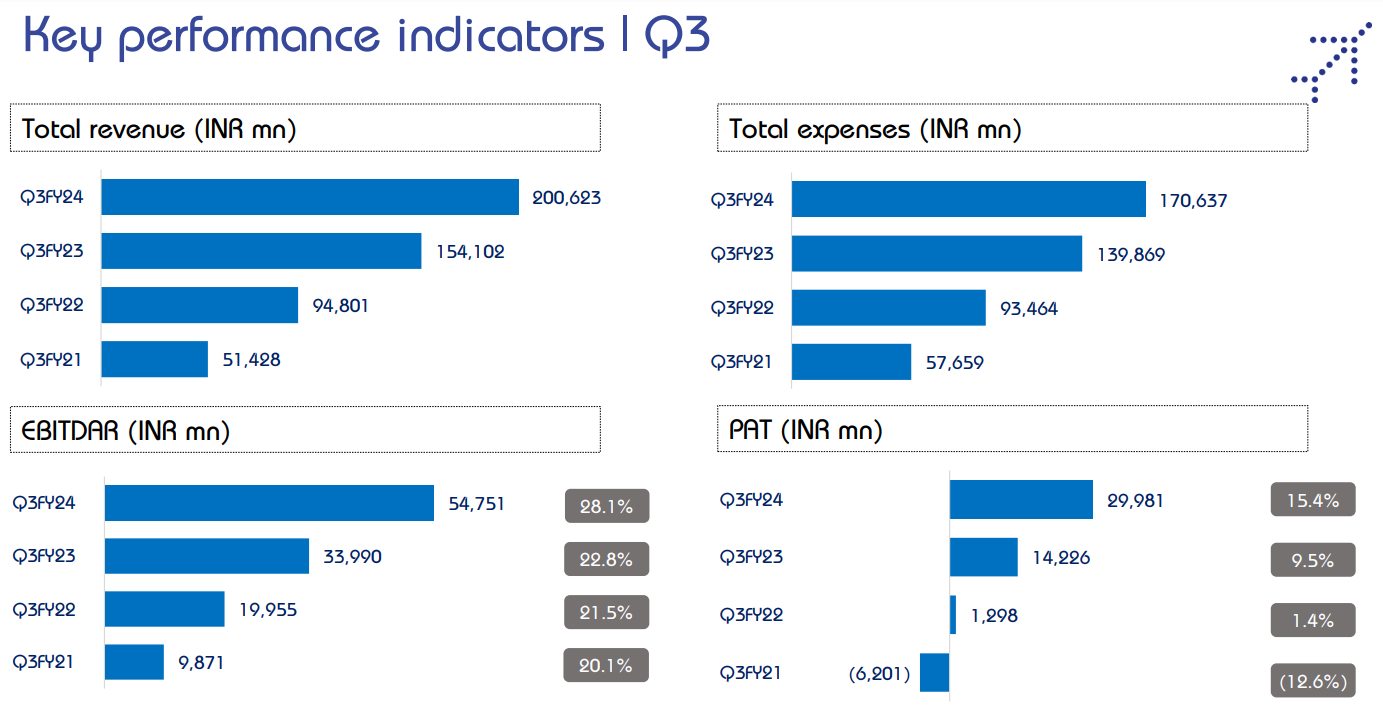

4. H1-24: Back to profits and revenue up 25% YoY

we have completed a full cycle and remained profitable for the last four quarters.

5. Strong Q3-24: PAT up 111% and revenue up 30% YoY

PAT up 1487% and revenue up 29% QoQ

6. Strong 9M-24: Back to profits and revenue up 27% YoY

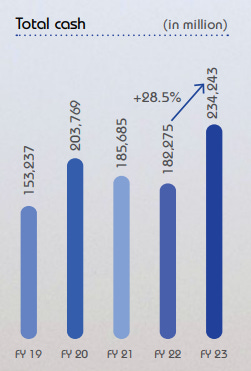

7. Business metrics: Generating free cash flow

As of 31st December 2023: IndiGo had a total cash balance of INR 324,280 million comprising INR 191,996 million of free cash and INR 132,285 million of restricted cash.

Sustainability of the business not in question even after 4 years of losses as its cash reserves at the end of FY23 were 42% of FY23 revenue.

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). The more free cash flow a company has, the more it can allocate to dividends, paying down debt, and growth opportunities.

6. Outlook: Beating FY24 guidance

Moving on to the fourth quarter, based on our current estimates and with the numerous mitigation measures in place, we are expecting around 12 percent capacity growth in the fourth quarter on a year-over-year basis.

With this, we will be exceeding our original guidance for the fiscal year 2024 which was north of mid-teens capacity growth and will deliver a growth of more than 20% as compared to fiscal year 2023.

7. Revenue up 27% in 9M-24 and back into profits at a PE of 17

8. So Wait and Watch

If I hold the stock then one may continue holding on to INDIGO

Coverage of INDIGO was initiated after Q1-24 results. The investment thesis has not changed after a strong Q3-24. The only changes are the delivery of a strong 9M-24 and the increased confidence in the management to deliver a stronger FY24. INDIGO has delivered in 9M-24 in line with the guidance for FY24

Outlook for Q4-24 looks strong given the guidance for 12% YoY capacity addition

On can wait for the outlook for FY25 given the performance in 9M-23

For the next fiscal year 2025, we are currently assessing our growth targets and will communicate the capacity guidance at a later stage.

9. Or, join the ride

If I am looking to enter INDIGO then

27% revenue growth and back into profits in 9M-24 at a PE of 17 makes valuations look quite reasonable.

For H1-24. INDIGO generated Rs 10,069 cr of free cash flow and is available for a market cap of Rs 120,699 cr. Its free cash flow yield of 8.3% (not annualized) makes the valuations look very attractive.

Of the Rs 120,699 cr market cap of INDIGO, Rs 19,199.6 cr is in free cash. This implies that 16% of the market cap is in cash which provides a margin of safety to the valuations.

Our liquidity continues to remain robust as we ended the December quarter with free cash of 192 billion rupees, a net increase of 11.2 billion rupees as compared to the September quarter end.

Previous coverage of INDIGO

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action.