Interglobe Aviation: 21% growth in H1 in line FY24 guidance of 16% growth at PE of 18 and 10+% FCF yield

Strong demand, yet, headwinds on account of aircraft groundings due to engine issues. INDIGO confident of meeting FY24 capacity guidance of 16%+ growth & long-term capacity guidance to double by 2030

1. 7th largest airline in the world

goindigo.in | NSE: INDIGO

Nearly 2/3rd of domestic market share in Aug-23

In August, IndiGo continued to have the largest market share at 63.3 percent

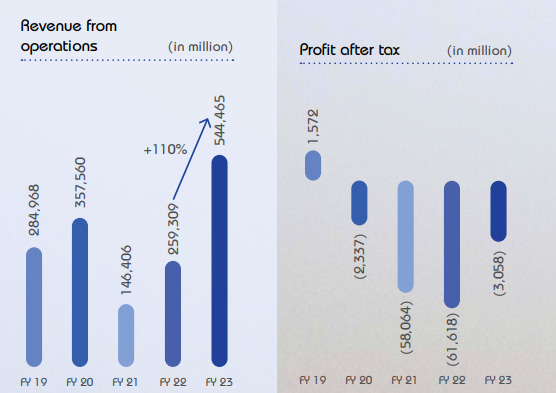

2. FY19-23: Making losses since the last 4 years

Expected to make a profit in FY24 after 4 years

3. FY23: Strong recovery since Q3-23, operational & financial

A year of recovery and growth as the demand remained robust, and we continued to serve the lion-share of this demand. Our revenues for the financial year 2023 more than doubled as compared to last year and we also reported the highest ever annual revenues of 558.8 billion rupees.

4. Q1-24: Back to profits and revenue up 32% YoY

5. Seasonally weak Q2-24: Back to profits and revenue up 21% YoY

Weak Q2-24 on QoQ basis:

PAT margin contraction to 1.3% in Q2-24 from 18.5% in Q1-24

6. H1-24: Back to profits and revenue up 25% YoY

we have completed a full cycle and remained profitable for the last four quarters.

7. Business metrics: Generating free cash flow

Sustainability of the business not in question even after 4 years of losses as its cash reserves at the end of FY23 were 42% of FY23 revenue.

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). The more free cash flow a company has, the more it can allocate to dividends, paying down debt, and growth opportunities.

6. Outlook: Profitable in FY24 after 3 years

i. 16%+ revenue growth in FY24

We will broadly grow at north of mid-teens in the financial year 2024 as compared to financial year 2023.

Looking ahead, demand remains robust, however, we have headwinds in the form of aircraft groundings due to engine issues pertaining to the Pratt & Whitney supply chain challenges. There is a mitigation plan under execution, and we are confident of meeting our financial year 2024 capacity guidance of the north of mid-teens addition and our long-term capacity guidance to double in size by 2030

ii. Strong outlook for Q3

Moving on to the third quarter, while we are still awaiting the service bulletin from Pratt & Whitney, which will give us further clarity on our capacity, we are currently estimating around 25 percent capacity addition in the third quarter on a year-over-year basis. Further, as compared to the third quarter of the last financial year, we are expecting similar trends in yields and load factors.

iii. Adverse impact on operating fleet from Q4 onwards

Higher number of groundings could impact Q4-24 and the outlook for FY25

We have recently received further communication from our OEM, Pratt & Whitney, with respect to the powder metal issues.

Will adversely impact our operating fleet from Q4 onwards, which is post January 1st 2024, and would lead to higher number of groundings.

To deliver on our planned capacity and to cater to the robust demand, we are executing a range of mitigation measures

With these mitigation initiatives, we reiterate our financial year 2024 capacity growth guidance of north of mid-teens, and we also remain confident in meeting our long-term capacity guidance.

iv. 12% CAGR, 2X by FY30

So, we’re looking to double ourselves in the next 7 years, and that's where the cash is going to be prioritized towards.

v. 30% international market share by FY25

30% International ASK’s (Available Seat Kilometer) in next 2 years up from 26% as of Q2-FY23 end

our share of available seat kilometers has increased to 26 percent, and we aspire to reach 30 percent of international ASKs in the coming years.

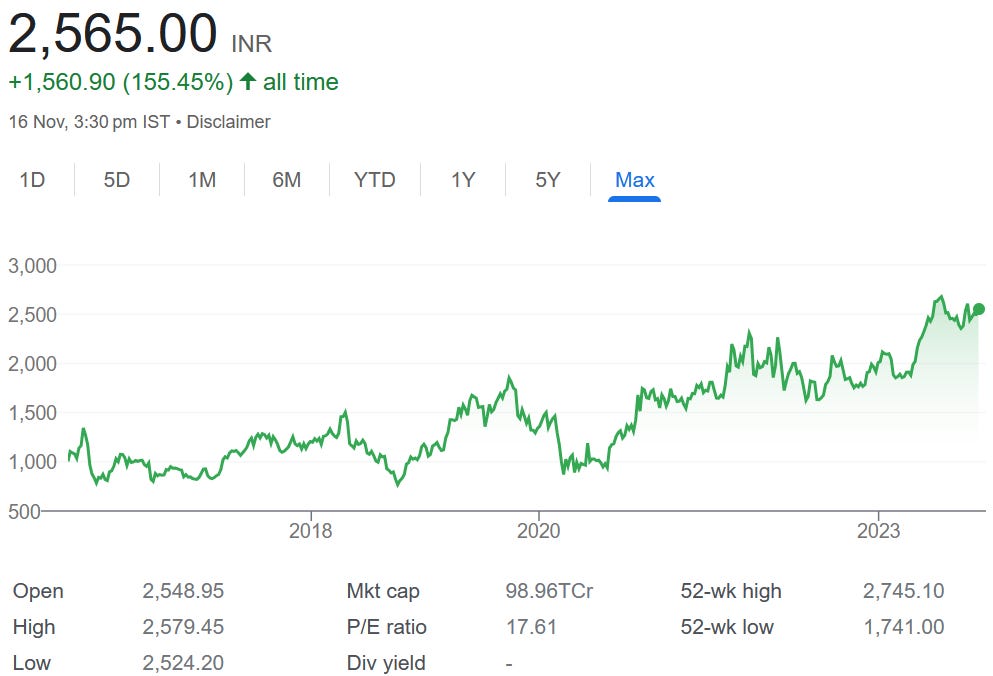

7. Revenue up 25% in H1-24 & 16%+ growth in FY24 at a PE of 18

8. So Wait and Watch

If I hold the stock then one may continue holding on to INDIGO

Coverage of INDIGO was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24. INDIGO has delivered in H1-24 in line with the guidance for FY24

we have been able to meet our guidance as we added around 28 percent capacity as compared to September quarter last year.

While H1-24 was strong, the margin contraction seen in Q2-24 vs Q1-24 needs to be watched for in Q3-24.

Outlook for Q3-24 looks strong given the guidance for 25% YoY capacity addition

The risk of adverse impact on operating fleet from Q4 onwards needs to be be watched at on account of the engine issues. Q4-24 may impact achievement against the FY24 guidance. Even if INDIGO manages the Q4 impact in FY24, the risk to the outlook for FY25 exists.

9. Or, join the ride

If I am looking to enter INDIGO then

21% revenue growth delivered in H1-24 with an outlook for 16%+ revenue growth in FY24 and a guidance to grow at 12% CAGR and double by FY30 at a PE of 18 makes INDIGO quite reasonable.

However, it gets really interesting when one looks at the free cash flow

For FY23. INDIGO generated Rs 12,158 cr of free cash flow and is available for a market cap of Rs 99,174. Its free cash flow yield of 12% makes the valuations look very attractive.

For H1-24. INDIGO generated Rs 10,069 cr of free cash flow and is available for a free cash flow yield of 10% (not annualized) makes the valuations look very attractive.

One needs to enter keeping in mind the risk of the engine issues creating volatility in the short term and impacting the outlook for FY25.

Previous coverage of INDIGO

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades