Interglobe Aviation: Two-thirds of Indian market,16% growth in FY24 & 2X by FY30 at PE of 24 and 13% FCF yield

Indigo owns two thirds of India, the third largest & fastest growing domestic market, with target of one third of international market & working to double itself by FY30

1. 7th largest airline in the world

goindigo.in | NSE: INDIGO

Nearly 2/3rd of domestic market share in Aug-23

In August, IndiGo continued to have the largest market share at 63.3 percent

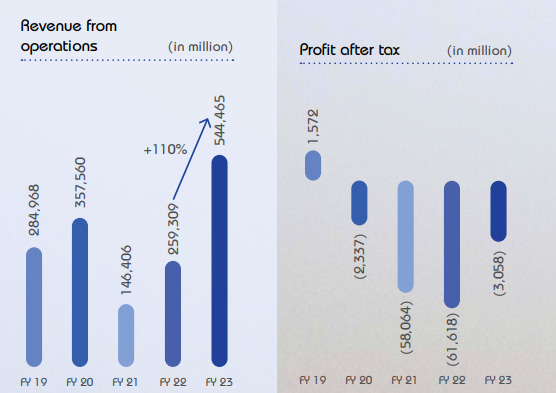

2. FY19-23: Making losses since the last 4 years

Expected to make a profit in FY24 after 4 years

3. FY23: Strong recovery since Q3-23, operational & financial

A year of recovery and growth as the demand remained robust, and we continued to serve the lion-share of this demand. Our revenues for the financial year 2023 more than doubled as compared to last year and we also reported the highest ever annual revenues of 558.8 billion rupees.

4. Q1-24: Back to profits and revenue up 32% YoY

5. Business metrics: Generating free cash flow

Sustainability of the business not in question even after 4 years of losses as its cash reserves at the end of FY23 were 42% of FY23 revenue.

Free cash flow (FCF) is the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). The more free cash flow a company has, the more it can allocate to dividends, paying down debt, and growth opportunities.

6. Outlook: Profitable in FY24 after 3 years

i. 16%+ revenue growth in FY24

We will broadly grow at north of mid-teens in the financial year 2024 as compared to financial year 2023.

ii. 12% CAGR, 2X by FY30

So, we’re looking to double ourselves in the next 7 years, and that's where the cash is going to be prioritized towards.

iii. 30% international market share by FY25

30% International ASK’s (Available Seat Kilometer) in next 2 years up from 16% in 9M FY23

iv. India is underpenetrated with huge potential for growth

7. 16%+ revenue growth in FY24 at a PE of 24

8. So Wait and Watch

If I hold the stock then one may continue holding on to INDIGO. INDIGO gives the opportunity to own

two-thirds of India the 3rd largest (after China & USA) and the fastest growing domestic market in the world

nearly a third of international ASK’s (Available Seat Kilometer) in next 2 years

doubling the 7th largest airline of the world by FY30

Owning INDIGO will not be easy. It has generated losses for the last 4 years. One needs to look at the free cash flow to understand the value of the business. Without the free cash flow the sustainability of the business can be in question given its poor track record of generating PAT.

9. Or, join the ride

If I am looking to enter the stock then

16%+ revenue growth in FY24 with a guidance to grow at 12% CAGR and double by FY30 at a PE of 24 makes it quite reasonable.

However, it gets really interesting when on looks at the free cash flow for FY23. INDIGO generated Rs 12,158 cr of free cash flow and is available for a market cap of Rs 91,551. Its free cash flow yield of 13% makes the valuations look very attractive.

Don’t like what you are reading?

Let us know at hi@moneymuscle.in

Will make it better.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades