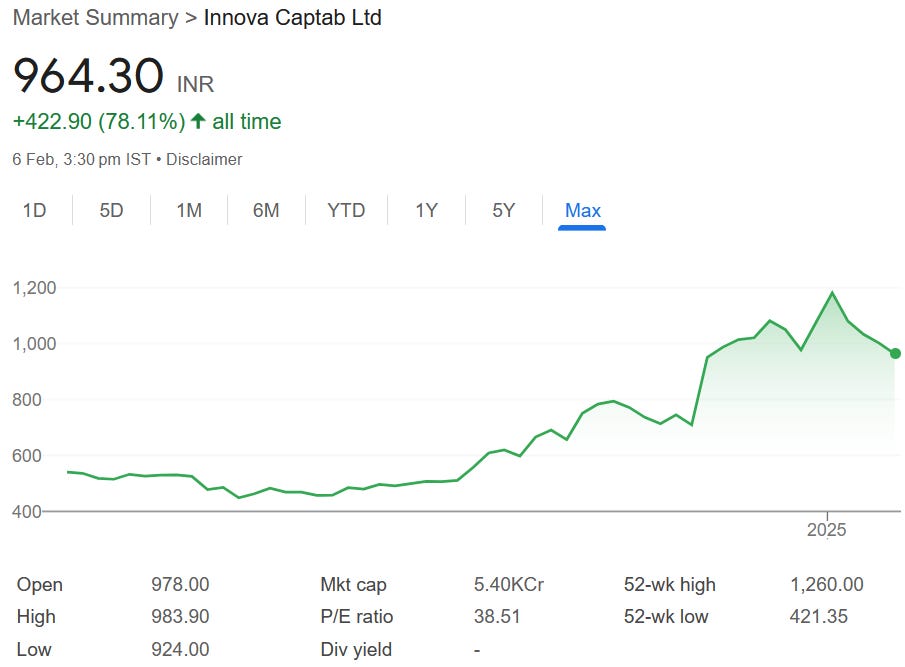

Innova Captab: PAT up 51% & Revenue up 14% in 9M-25 at a PE of 39

Revenue growth of 30%+ expected for FY26. Guidance of doubling revenue and PAT in the next 3 years by INNOVACAP. New plant operationalized to support the growth guidance.

1. Why is INNOVACAP interesting

innovacaptab.com | NSE: INNOVACAP

INNOVACAP is coming up with a greenfield expansion of setting up a plant in Jammu which would help it double its revenue and PAT in the next 3 years. The doubling of PAT at current valuations would create an opportunity in INNOVACAP over the next 3 years. 2. Pharmaceutical Company

3. FY21-24: PAT CAGR of 39% & Revenue CAGR of 38%

4. Strong FY24: PAT up 39% & Revenue up 17%

5. Weak Q3-25: PAT up 36% & Revenue up 5% YoY

6. 9M-25: PAT up 51% & Revenue up 14% YoY

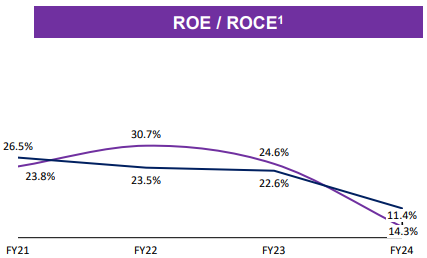

7. Return Ratios

ROCE/ROE is lower due to additional investment in Jammu plant and higher capital base due to IPO in Dec’238. Strong outlook: Revenue & PAT to double in 3 years

i. Guiding to 2X revenue & PAT in 3 years at CAGR of 26%

ii. 30%+ growth in FY25 with Rs 400-500 cr revenue from Jammu plant

Key highlight of the quarter was the successful launch of operations at our new Kathua, Jammu facility, where we commenced commercial production on January 14, 2025

So, with the help of Jammu and existing business growing at a healthy rate, we see that the revenue could be doubled from here to 2,500 crores in next three year time.

Future expectations for the Jammu facility:

Anticipates revenues of ₹400-500 crores next year from the Jammu facility

Overall margin should improve in FY27 or FY28.

Peak utilisation is estimated to be 70%, with a potential to reach ₹2,000 crores, with a 1,500-1,600 crores revenue in the demo facility

Management expects EBITDA margins to expand to 17-19% in the long term. This will be driven by the ramp-up of the Jammu facility and the company's focus on operational efficiency

Benefit from government incentives that will strengthen their financial position. Specifically, the company is eligible for:

SGST-linked incentive of 300% of the investment made in the eligible plant and machinery, available for up to 10 years from the start of commercial production.

Capital interest convention on non-investment in eligible plant and industry, reducing interest costs by approximately 600 basis points.

The company plans to deploy surplus cash towards acquisitions or greenfield projects. Potential acquisition targets could include companies in the hormone or liquid injectable space

Management believes that the implementation of revised Schedule M will benefit the company. The stricter guidelines are expected to consolidate the industry and drive business towards larger players

9. PAT growth of 51% & Revenue growth of 14% in 9M-25 at a PE of 39

10. Hold?

If I hold the stock then one may continue holding on to INNOVACAP

Following a strong FY24, 9M-25 performance has been strong and INNOVACAP looks to be on track to deliver a strong FY25 and on track to deliver on its guidance of Rs 2,500 cr in the next 3 years.

30%+ growth in FY26 from the Jammu plant is a strong reason to continue with INNOVACAP

The outlook of doubling revenue and PAT in 3 years is a strong reason to continue with INNOVACAP.

INNOVACAP has sufficient capacity to meet current demand and support future growth as the proposed Jammu plant is expected to add Rs 800-900 cr in 3-4 years time

So, that figure come around at Rs 800 crores, Rs 900 crores in a period of 3-4 years

11. Buy?

If I am looking to enter INNOVACAP then

INNOVACAP has delivered PAT growth of 59% and revenue growth of 19% in H1-25 at a PE of 39 which makes the valuations fully priced in the short term.

Addition of Rs 400-500 cr from the Jammu plan in FY26 implies a 30%+ growth in FY26 with a higher PAT growth given the 600 basis point reduction in interest costs which at PE of PE of 39 which makes the valuations reasonable from a FY26 perspective.

Jammu: the revenue and the plant will be stabilized in Q4. And from the Q1 to next year, the full four quarters will be available to us and we expect a 400 crores -500 crores revenue next year

With an outlook of doubling both revenue and PAT and delivering a CAGR of 26%, in the next 3 years at a PE of 39 the valuations of INNOVACAP look acceptable from a longer term perspective.

The outlook of doubling revenue is based on the Jammu plant delivering growth. Any delays in ramp up of production will impact the doubling of revenue to Rs 2,500 cr.

Previous coverage of INNOVACAP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer