Innova Captab: PAT up 59% & Revenue up 19% in H1-25 at a PE of 46

Guidance of doubling revenue and PAT in the next 3 years by INNOVACAP. New plant coming up this year to support the growth guidance. Track record of doubling turnover in 3-4 years in the past decade.

1. Why is INNOVACAP interesting

innovacaptab.com | NSE: INNOVACAP

INNOVACAP is coming up with a greenfield expansion of setting up a plant in Jammu which would help it double its revenue and PAT in the next 3 years. The doubling of PAT at current valuations would create an opportunity in INNOVACAP over the next 3 years. 2. Pharmaceutical Company

3. FY21-24: PAT CAGR of 39% & Revenue CAGR of 38%

4. Strong FY24: PAT up 39% & Revenue up 17%

5. Strong Q2-25: PAT up 53% & Revenue up 13% YoY

PAT up 19% & Revenue up 8% QoQ

6. Strong H1-25: PAT up 59% & Revenue up 19% YoY

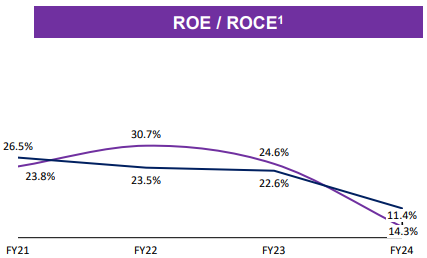

7. Return Ratios

ROCE/ROE is lower due to additional investment in Jammu plant and higher capital base due to IPO in Dec’238. Strong outlook: Revenue & PAT to double in 3 years

INNOVACAP guiding to double revenue and bottom-line in the next 3 years

The company has received a drug manufacturing license for its greenfield plant in Jammu and Kashmir. Commercialization of the facility is expected within Q3 FY25.

Management is confident in the company's growth potential. The company is focused on tapping into the immense opportunities in the Indian pharmaceutical market.

The Jammu facility is expected to generate significant revenue. The facility has a revenue potential of INR 1,200-1,300 crore in the next five years. The company expects to generate INR 400-500 crore in revenue from the facility next year.

The company is targeting a consolidated revenue of INR 2,500 crore in the next three years. This represents a CAGR of 25-35%

Management expects EBITDA margins to expand to 17-19% in the long term. This will be driven by the ramp-up of the Jammu facility and the company's focus on operational efficiency

The company plans to deploy surplus cash towards acquisitions or greenfield projects. Potential acquisition targets could include companies in the hormone or liquid injectable space

Management believes that the implementation of revised Schedule M will benefit the company. The stricter guidelines are expected to consolidate the industry and drive business towards larger players

9. PAT growth of 59% & Revenue growth of 19% in H1-25 at a PE of 46

10. Hold?

If I hold the stock then one may continue holding on to INNOVACAP

Following a strong FY24, H1-25 performance has been strong and INNOVACAP looks to be on track to deliver a strong FY25 and on track to deliver on its guidance of Rs 2,500 cr in the next 3 years.

INNOVACAP is in the middle of a strong run. It has increased PAT sequentially, QoQ for the last seven quarters starting Q4-23. One can ride the business momentum as long as it lasts.

The outlook of doubling revenue and PAT in 3 years is a strong reason to continue with INNOVACAP.

INNOVACAP has sufficient capacity to meet current demand and support future growth as the proposed Jammu plant is expected to add Rs 800-900 cr in 3-4 years time

So, that figure come around at Rs 800 crores, Rs 900 crores in a period of 3-4 years

11. Buy?

If I am looking to enter INNOVACAP then

INNOVACAP has delivered PAT growth of 59% and revenue growth of 19% in H1-25 at a PE of 46 which makes the valuations fully priced in the short term.

With an outlook of doubling both revenue and PAT in the next 3 years at a PE of 46 the valuations of INNOVACAP look acceptable from a longer term perspective.

The outlook of doubling revenue is based on timely execution and coming online of the Jammu plant. Any delays will impact the doubling of revenue to Rs 2,500 cr. At a PE of 46 the margin of safety in the stock is limited and cannot sustain weakness in execution for even a single quarter.

Previous coverage of INNOVACAP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer