Innova Captab: PAT up 39% & Revenue up 17% in Q1-25 at a PE of 41

Guidance of doubling revenue and PAT in the next 3 years by INNOVACAP. New plant coming up this year to support the growth guidance. Track record of doubling turnover in 3-4 years in the past decade.

1. Why is INNOVACAP interesting

innovacaptab.com | NSE: INNOVACAP

INNOVACAP is coming up with a greenfield expansion of setting up a plant in Jammu which would help it double its revenue and PAT in the next 3 years. The doubling of PAT at current valuations would create an opportunity in INNOVACAP over the next 3 years. 2. Pharmaceutical Company

3. FY21-24: PAT CAGR of 39% & Revenue CAGR of 38%

4. Strong FY24: PAT up 39% & Revenue up 17%

5. Strong Q1-25: PAT up 68% & Revenue up 27% YoY

PAT up 2.6% & Revenue up 11% QoQ

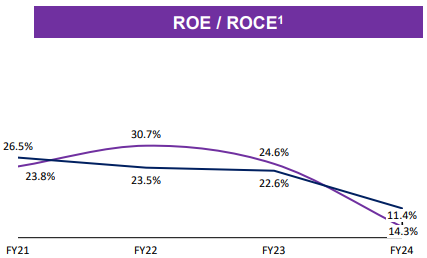

6. Return Ratios

ROCE/ROE is lower due to additional investment in Jammu plant and higher capital base due to IPO in Dec’237. Strong outlook: Revenue & PAT to double in 3 years

INNOVACAP guiding to double revenue and bottom-line in the next 3 years

With the help of Jammu plant, we are feeling that again we will double our revenue and bottom-line numbers to double in the next 3 years

Over the past 3-4 years, our revenue has grown at a robust growth rate of 35% CAGR. With the addition of our new Jammu facility, we are optimistic about maintaining this strong growth rate over the next 3-4 years.

Last 10-12 years, we have always doubled our turnover in the 3-4 years. Sometimes it is like let's say 3 years, sometimes it was 4 years. So, even in the near past if you see, the same growth rate we have maintained.

8. PAT growth of 68% & Revenue growth of 27% in Q1-25 at a PE of 41

9. Do I stay?

If I hold the stock then one may continue holding on to INNOVACAP

Following a strong FY24, Q1-25 performance has been strong and INNOVACAP looks to be on track to deliver a strong FY25

The outlook of doubling revenue and PAT in 3 years is a strong reason to continue with INNOVACAP.

INNOVACAP has sufficient capacity to meet current demand and support future growth as the proposed Jammu plant is expected to add Rs 800-900 cr in 3-4 years time

So, that figure come around at Rs 800 crores, Rs 900 crores in a period of 3-4 years

10. Do I enter?

If I am looking to enter INNOVACAP then

INNOVACAP has delivered PAT growth of 68% and revenue growth of 27% in Q1-25 at a PE of 41 which makes the valuations fully priced in the short term.

With an outlook of doubling both revenue and PAT in the next 3 years at a PE of 41 the valuations of INNOVACAP look acceptable from a longer term perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer