IndusInd Bank: PAT growth of 23% & Total Income growth of 17% in 9M-24 at a PE of 13 & price to book less than 2

INDUSINDBK delivered loan growth of 20% as of Q3-24 with outlook of 18-23% CAGR in loan growth till FY26. It looks on track to meet its overall FY26 guidance with 4 quarters of consecutive EPS growth

1. 5th Largest Private Bank

indusind.com | NSE: INDUSINDBK

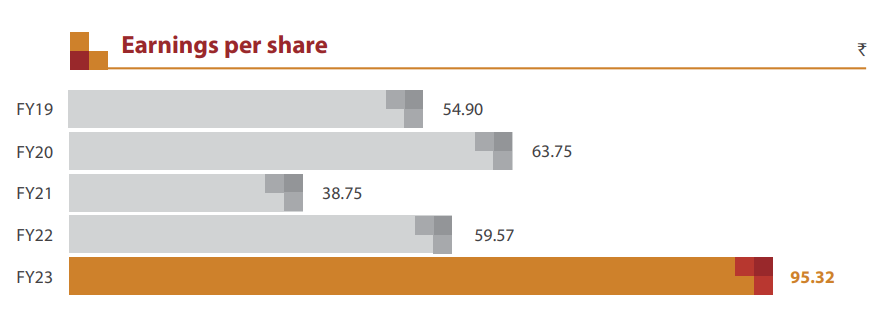

2. FY19-23: 14% CAGR for Earnings per share

Growth delivered in FY23 only

3. Strong H1-24 : PAT up 26% & Total Income up 17% YoY

Total Income of ₹14,436 crores as compared to ₹12,370 crores for the corresponding previous half year

Net Profit was ₹4,326 crores as compared to ₹3,436 crores during corresponding previous half year increased by 26% YoY.

4. Strong Q3-24 : PAT up 17% & Revenue up 17% YoY

5. Strong 9M-24 : PAT up 23% & Total Income up 17% YoY

6. Strong & consistent return ratios

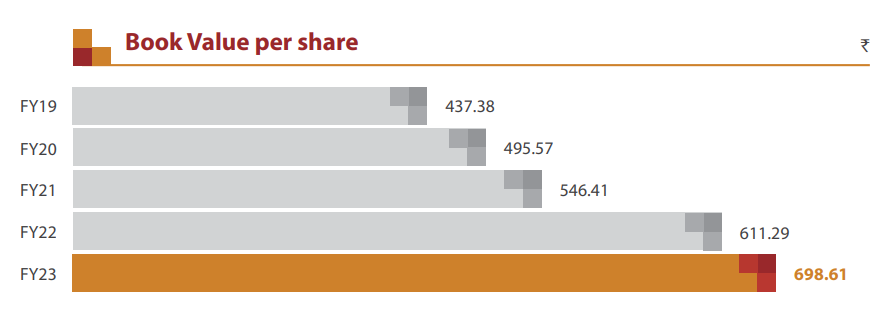

INDUSINDBK has grown its book sequentially year on year

7. Outlook: 18-23% loan growth CAGR for FY23-26

9M-24 performance on track to deliver as per targets.

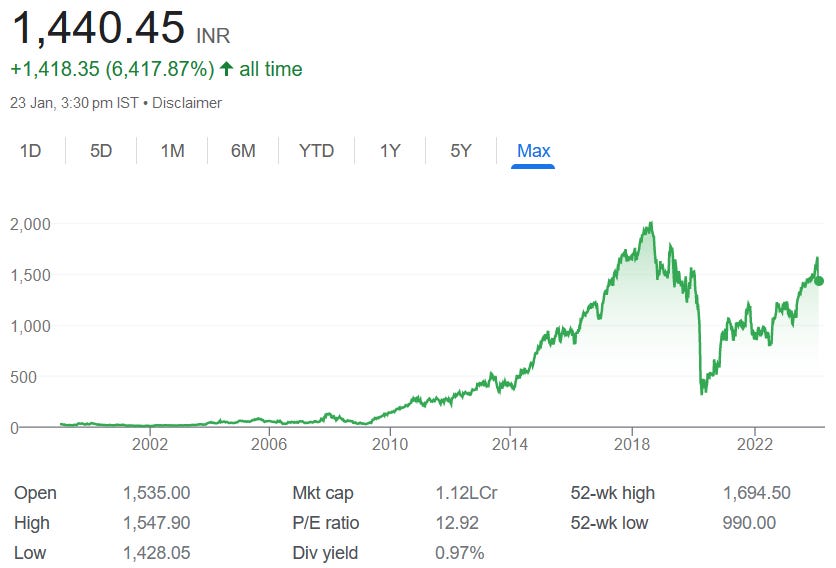

8. PAT growth of 23% & Total Income growth of 17% in 9M-24 at a PE of 13

9. So Wait and Watch

If I hold the stock then one may continue holding on to INDUSINDBK

Coverage of INDUSINDBK was initiated after Q2-24 results. The investment thesis has not changed after a strong 9M-24. There is confidence that INDUSINDBK is on track to deliver a strong PAT in FY24.

INDUSINDBK has delivered a sequential EPS growth in the last 4 quarters

There is an outlook for strong loan growth till FY26 where INDUSINDBK is targeting 18-23% loan growth

10. Or, join the ride

If I am looking to enter INDUSINDBK then

INDUSINDBK has delivered a strong 9M-24 with PAT growth of 23% & revenue growth of 17% at a PE of 13 which makes the valuations reasonable in the short term.

From a longer term perspective the outlook for loan growth of 18-23% till FY26 at a PE of 13 makes the valuations reasonable.

From a price to book perspective, INDUSINDBK has a net-worth of Rs 58,841 cr on a market cap of Rs 112,221 cr implying its available at P/B of less than 2 which looks reasonable.

Previous coverage of INDUSINDBK

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

Perspectives may change based on evolving understanding of the company.

Focus is on identifying potential stock ideas for long-term market-beating returns.

Content does not constitute explicit stock recommendations.

Investors should conduct thorough stock research and seek professional advice.

Information is for educational purposes and not financial advice or a call to action