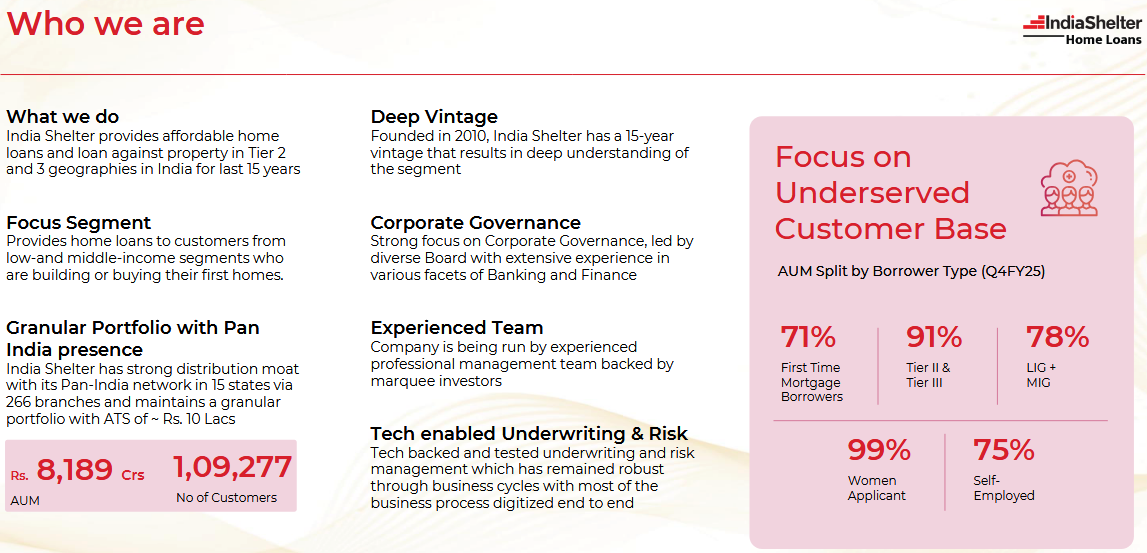

India Shelter Finance Q1 FY26 Results: PAT up 44%, Maintain Guidance for FY26

AUM growth of 30-35% in FY26. Issues on asset quality need to be watched. Fully valued on FY26 multiples. Opportunity if growth & asset quality sustain into FY27

1. Home Loans and Loan Against Property

indiashelter.in | NSE: INDIASHLTR

2. FY21-25: PAT CAGR of 45% & Net Total Income CAGR of 39% & AUM CAGR of 45%

3. FY25: PAT up 53% & Net Total Income up 43% YoY

Execution aligned with strategy — deeper rural penetration, 43 new branches, 30%+ AUM growth.

Strong unit economics — improving branch productivity, rising AUM per employee.

Best-in-class asset quality — Net Stage 3 at 0.8%, credit cost at 41 bps.

India Shelter exits FY25 with clear validation of its high-margin, low-risk growth engine

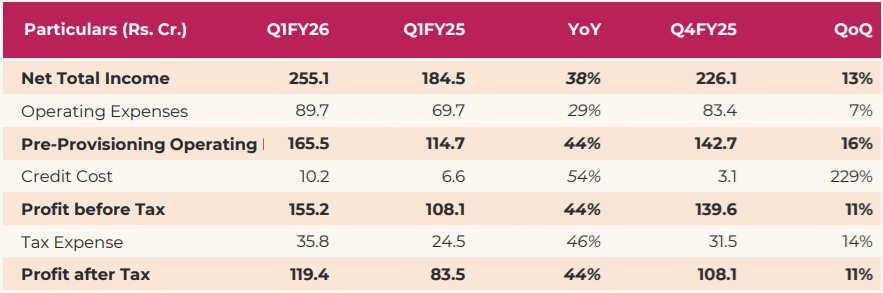

3. Q4-25: PAT up 44% & Net Total Income up 38% YoY

PAT up 11% & Net Total Income up 13% QoQ

AUM growth of 34% year-on-year, reaching an AUM of Rs. 8,712 crores. In Q1FY26, we disbursed Rs. 887, registering a growth of 24% year-on-year. In Q1FY26, we added 24 new branches as per the branch expansion strategy, geographic presence stood at 290 branches as of 30th June 2025.

Profitability Drivers:

Spread expansion to 6.4% (+20 bps QoQ, +30 bps YoY).

Cost of funds declined to 8.6% (–10 bps QoQ, –30 bps YoY).

Operating leverage: Opex/AUM improved to 4.2% (vs. 4.4% YoY).

Asset Quality

Management acknowledged early-bucket stress but reiterated full-year credit cost guidance at 40–50 bps.

Gross Stage 3: 1.2% (flat YoY, +10 bps QoQ) | Net Stage 3: 0.9% (stable)

30+ DPD: 4.5% (vs. 3.1% in Q4FY25; seasonal uptick + macro stress in states like MP, Karnataka)

Credit Cost: 0.5% (in line with guidance of 40–50 bps).

Q1FY26 was strong on growth and profitability, demonstrating scalability. Asset quality is the main monitorable for FY26.

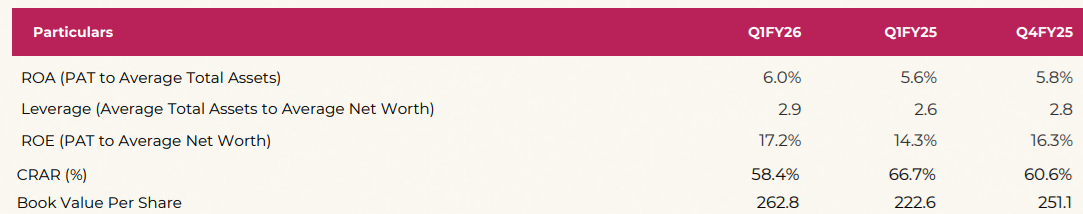

5. Business metrics: Return Ratios Strengthened

6. Outlook: AUM CAGR of 30-35% for FY25-30

6.1 FY26 Guidance

We continue to maintain our guidance of:

Branch addition of around 40 to 45 for the year,

Maintain spreads of more than 6% in the medium term

Credit cost of around 40 to 50 bps

Loan growth of around 30%, 35%

So, in terms of our ROE guidance, by like FY28 down the line three years from here, we will start touching a leverage of about 4x. At that point of time, ROA will be about 4.5% that briefly results into ROE of about 18%. So that is guidance for medium-term, and we continue to maintain that.

6.2 Q1 FY26 Performance vs. FY26 Guidance

Growth — On Track:

AUM grew 34% YoY in line with the 30–35% full-year growth guidance.

Disbursements grew +24% YoY support momentum, though QoQ dip (–5%) reflects seasonality.

Margins — Ahead of Guidance:

Spread expanded to 6.4% vs. guidance of >6%

Supported by 20 bps QoQ CoF reduction (to 8.6%).

Margins appear sustainable for FY26.

Credit Cost — Within Guidance:

Q1 credit cost at 0.5%, matching guided 40–50 bps range for the full year.

Branch Expansion — Front-Loaded:

24 branches opened in Q1 (already 50–60% of the 40–45 full-year target).

Profitability — Stronger than Expected

PAT grew +43% YoY with ROE of 17.2%

ROA at 6.0% remains comfortably above medium-term aspiration.

Asset Quality — Monitorable:

Gross Stage 3 stable at 1.2%, but 30+ DPD rose to 4.5% vs. ~3% in recent quarters, reflecting seasonal and macro pressures.

Management reiterated confidence in maintaining annual credit cost guidance.

India Shelter delivered a strong Q1FY26, broadly on or ahead of guidance in growth, margins, credit cost, and profitability. The only watchpoint is the early-bucket delinquency (30+ DPD spike), which management expects to stabilize in Q2 and improve from H2FY26. Branch expansion and technology-led sourcing give confidence in sustaining guided 30–35% AUM growth with ROE >17%.

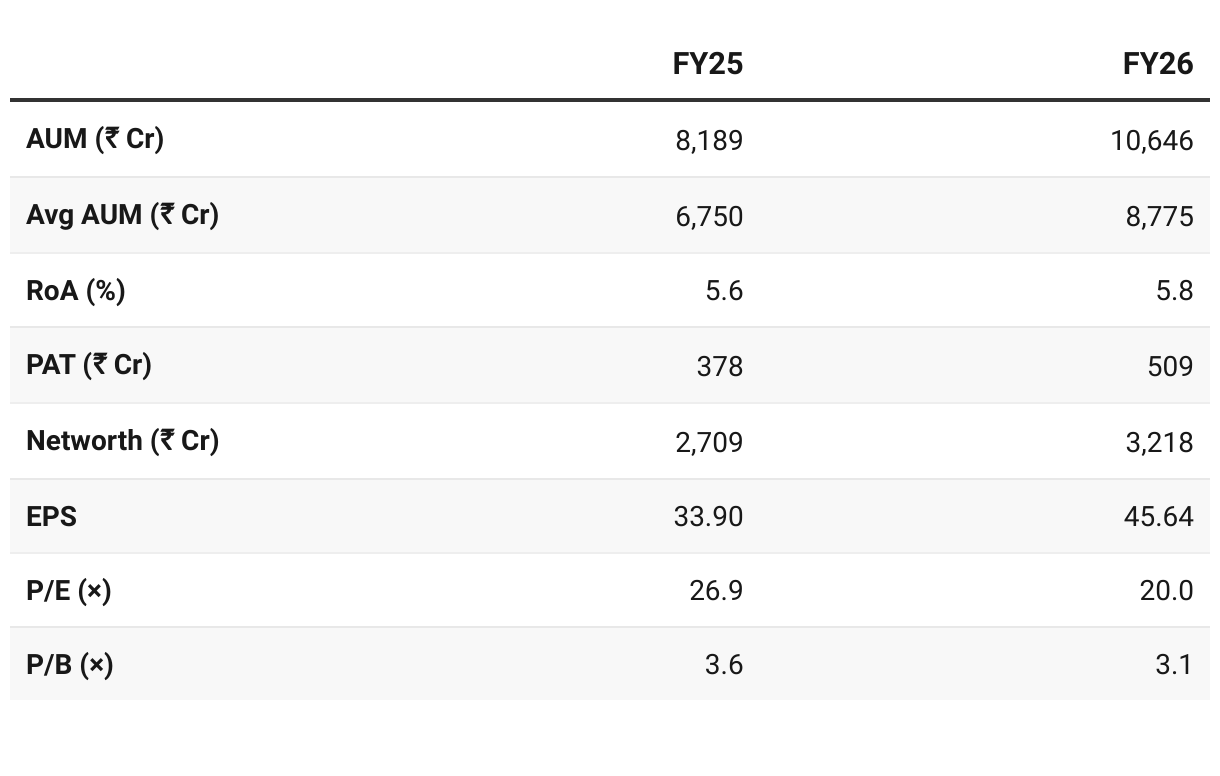

7. Valuation Analysis

7.1 Valuation Snapshot — India Shelter Finance

CMP ₹911; Mcap ₹9,840.5 Cr;

India Shelter is a high-growth play in affordable housing finance. At 20× FY26E P/E / 3.1× P/BV, the stock looks fully valued from a FY26 perspective. Opportunity exists if growth and asset quality guided for FY26 sustain into FY27 with potential

7.2 Opportunity at Current Valuation

Sustained Growth Visibility: AUM growth of 30–35% CAGR guided for FY26 can support a similar PAT trajectory if spreads (>6%) and credit costs (40–50 bps) are maintained.

Improving Profitability: ROE has crossed 17% in Q1FY26 for the first time since listing; management aspires to reach ~18% ROE by FY28 as leverage rises to ~4×. With steady-state ROA of ~5.5–6%, India Shelter is among the more profitable affordable housing financiers.

Structural Tailwinds: Affordable housing finance demand, government programs (PMAY/CLSS), and Tier II/III penetration provide a long runway for growth without intense large-bank competition.

7.3 Risks at Current Valuation

Asset Quality Monitorables: 30+ DPD spiked to 4.5% in Q1FY26; while management expects normalization, any sustained slippage could push credit costs above the 40–50 bps guidance.

Geographic Concentration: Higher stress in Madhya Pradesh and Karnataka poses state-specific risks; expansion into new markets may also carry early delinquency volatility.

Execution & Scaling Risks: Aggressive branch addition (24 in Q1 vs 40–45 guided for FY26) could strain employee productivity and collections in near term.

Valuation Sensitivity: At ~20× FY26E P/E, the stock looks fully valued on near-term numbers; upside requires growth and asset quality trends to remain intact into FY27.

Previous Coverage of INDIASHLTR

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer