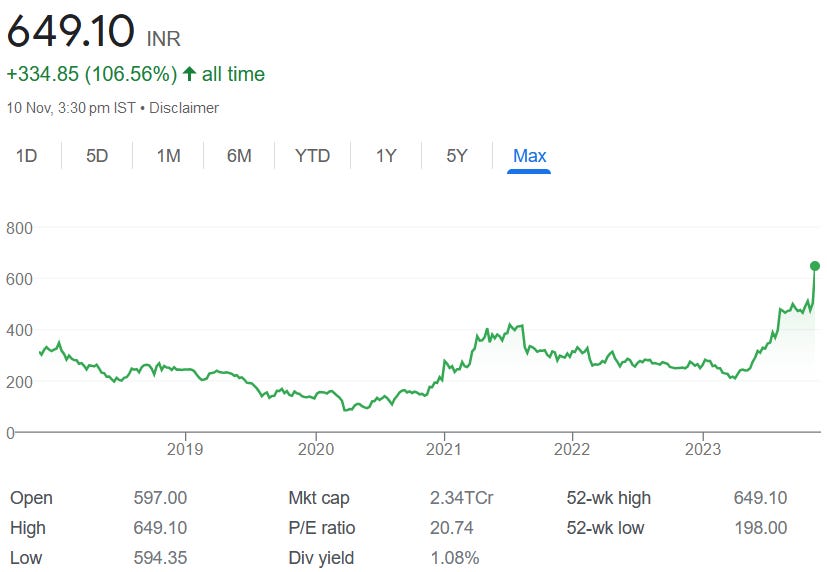

IFGL Refractories: PAT up 99% & Revenue up 26% in H1-24, on track to meet FY24 targets & 19-26% growth outlook till FY27, at a 21 PE

Challenges encountered in Q2-24 in the overseas markets yet IFGLEXPOR delivered a strong quarter on account of growth in Indian markets. IFGLEXPOR is investing in Indian capacities to capture growth

1. Refractory solutions for iron & steel manufacturing

ifglgroup.com | NSE : IFGLEXPOR

IFGL Refractories Ltd offers a wide range of specialised refractory products & operating systems. Expertise in the Iron Making, Steelmaking and Continuous Casting areas with particular emphasis in Slide Gate Systems, Purging Systems, Ladle Lining & Ladle Refractories, Tundish Furnitures & Tundish Refractories, and others.

2. FY20-23: PAT CAGR of 26% & Revenue CAGR of 15%

3. A weak FY23: PAT up 2% and Revenue up 10% YoY

4. Q1-24 stronger than FY23: PAT up 104% and Revenue up 19% YoY

Q1-24 improvement in margin YoY. Q1-24 margin higher than FY23 margin

5. Strong Q2-24: PAT up 95% and Revenue up 33% YoY

Highest-ever quarterly revenue of Rs 459.5 crores in Q2FY24, representing a remarkable 33% Y-o-Y growth.

PAT up 28% and Revenue up 8% QoQ

Q2-24 improvement in margin YoY. Q2-24 margin expansion QoQ

6. Strong H1-24: PAT up 99% and Revenue up 26% YoY

7. Return Ratios: Improving on account of margin expansion

8. Outlook: 25% revenue growth and 12%+ EBITDA in FY24

i. 25% revenue growth and 12%+ EBITDA in FY24

Based on H1-24 looks on track to deliver 25% revenue growth and 12%+ EBITDA in FY24. The asking rate for YoY top-line growth in H2-24 is 24% which is similar to H1-24.

We are talking of a consolidated turnover of 1,750 plus.

Consolidated, my guidance is about 12% plus EBITDA margins.

ii. To 2X revenue in FY27 or FY28, 19-26% CAGR growth outlook

IFGL Refractories Aims To Double Revenue In 4-5 Years | CNBC TV18

iii. Will 2X revenue on FY21 base in FY25 ahead of plan of FY26

Target of Rs 2085 cr revenue by FY26, double of FY21 revenue. Guidance to reach Rs 1750 cr by FY24. One could expect the Rs 2000+ cr turnover target to be achieved in FY25 itself.

I will maintain the same, that we are talking of doubling our turnover in five years' time from 2021 to 2026.

iv. Growth in FY25 to supported by capex in existing facilities

In both Odisha and Vizag, we have spent approximately 50% of the planned CAPEX so far, and in Kandla we have completed almost, we have spent about 90% of that. The remaining CAPEX is expected to be completed by March 24.

Research Center at Kalunga is almost ready and likely to be operationalized in Q3FY24.

With these enhanced capacities and new production capabilities, we expect to improve the scale of business which will lead to scaled benefits and operating leverage playing out of the long-term offer for the benefits for the company.

v. Growth in FY26 to supported by new manufacturing facility

9. 25% growth in FY24 and 19-26% growth till FY27 at a PE of 21

10. So Wait and Watch

If I hold the stock then one may continue holding on to IFGLEXPOR.

Coverage of IFGLEXPOR was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24

25% revenue growth guidance for FY24 and a capex driven roadmap for growth delivering 19-26% growth till FY27 provide opportunities to stay invested and keep watching its execution.

One needs to keep a watch on the steel cycle. Management has confirmed in Q2-24 call that environment outside India was very tough. One can safely assume that growth was driven by India. The outlook for IFGLEXPOR will change if the steel cycle in India changes. One and needs to actively watch out for the steel cycle in India and in rest of the world.

9. Or, join the ride

If I am looking to enter the IFGLEXPOR then

PAT growth of 99% & revenue growth of 26% in H1-24 is available for a PE of 21 which makes valuations reasonable for FY24.

IFGLEXPOR is on track to deliver 25% revenue growth and 12%+ EBITDA in FY24. Most likely it will deliver a an EBITDA margin higher than 12%. Assuming H1-24 PAT margin of 7.6% for FY24 and the 25% growth in revenue, will lead to Rs 132 cr of PAT in FY24. This a 68% growth in FY24 PAT. It implies that IFGLEXPOR is available for a FY24 forward PE of 17 which makes valuation quite reasonable in the short-term.

A 19-26% growth till FY27 at a PE of 21 looks reasonable over the long-term.

The challenge in IFGLEXPOR will be if the steel cycle which is looking weak in the rest of the world starts impacting growth in FY25.

Previous coverage of IFGLEXPOR

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades