H.G. Infra Engineering: 21-22% revenue growth in FY24 with long term revenue CAGR of 17-18% at a PE of 10

Industry tailwinds driving a strong order book position leading to strong revenue visibility. Order book being executed efficiently delivering growth with margin expansion strong return ratios

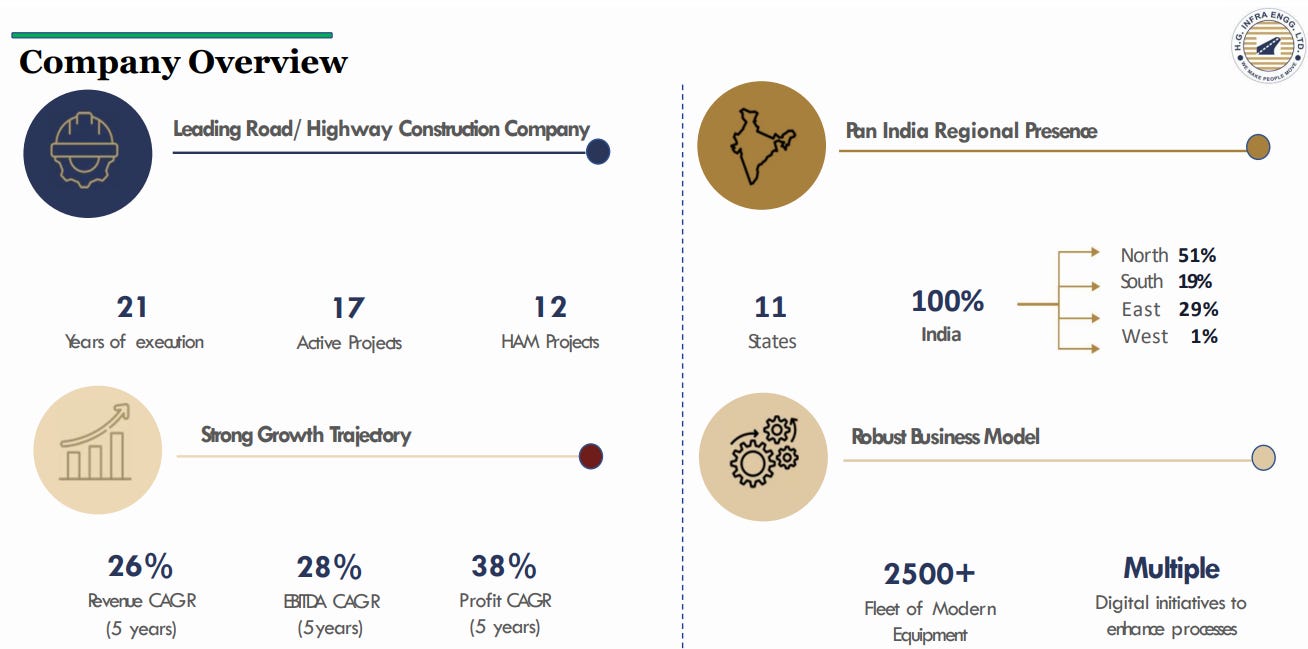

1. Leading Road/ Highway Construction Company

hginfra.com | NSE: HGINFRA

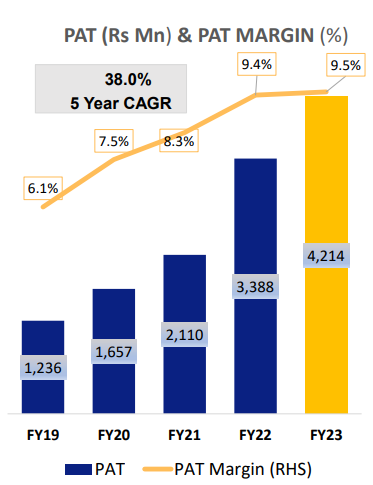

2. FY19-23: PAT CAGR of 38% & Revenue CAGR of 26%

3. FY23: PAT up 30% & Revenue up 23% YoY

4. Q1-24: PAT up 21% & Revenue up 19% YoY

5. Q2-24: PAT up 20% & Revenue up 21% YoY

Revenues surged to Rs. 954.5 crores, marking a 20% yoy growth

PAT margin for Q2 FY24 consolidated stood at 10.1% resulting in PAT of Rs. 96.1 crores compared to 81.8 crores in core Q2-FY23. This represents a significant growth of 17.3% in PAT on a year-on-year basis.

6. H1-24: PAT up 29% & Revenue up 21% YoY

Revenue of H1 FY24 surged to Rs. 2305.7 crores, an increase of 21.2%

PAT in H1 FY24 was Rs. 246.5 crores with 10.7% profit margin as compared to 191.4 crores at 10.1% margin in H1 FY23.

7. Business metrics: Strong return ratios

8. Outlook: 21-22% revenue growth in FY24

i. On track to deliver 21-22% revenue growth in FY24

One thing is that for this year we were looking at about 5400 crores and this is roughly 21%-22%

ii. 11-15% revenue growth in FY25

FY25 revenue expected to grow to Rs 6,000-6,200 cr up 11-15% from Rs 5,400 cr expected in FY24. The slow down in FY25 growth coming on account of concerns are slow down in tendering.

So, roughly, we are keeping our number about say 6,000 to 6,200.

As we all know, the NHAI tendering has been in the slow lane till September ‘23. The major reason behind lagging in numbers is because of the prolonged and uncertain monsoon across the country that is for the execution as well. It has now recently picked up due to certain changes in the bidding process and internal conditioning of the department. The next 4-5 months will be vital for the sector due to upcoming Center and State elections as known to each one of us. We are working on our strategy for priorities to overcome these challenges and we are optimistic that bidding will definitely accelerate in coming months.

iii. Guidance for 17-18% revenue CAGR till FY27

In the annual report, we would talk about that by say next five years, we were looking to take this revenue to 10,000 to be very specific and roughly 17% to 18% let me be clear on that.

iv. Strong revenue visibility: Order book 2.3X FY23 revenue

For Quarter ended September 2023, our order books stand at Rs. 10,678 crores which has established our presence across 11 states with the EPC segment comprising 51% of our entire project and HAM segment constituting the remaining 49%.

9. 21-22% revenue growth in FY24 with long term revenue CAGR of 17-18% at a PE of 10

10. So Wait and Watch

If I hold the stock then one may continue holding on to HGINFRA

Coverage of HGINFRA was initiated after Q4-23 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24. HGINFRA has delivered in H1-24 in line with the guidance 21-22% revenue growth for FY24

Outlook for Q3-24 looks strong with expectation of 20-21% growth

So, with that Quarter 3 and Quarter 4, we expect that we will be touching upon the same number from 20% to 21%.

One should be ready a slowdown in momentum as FY25 growth is expected to be 11-15% as compared to 20%+ growth in FY24 and long term growth guidance of 17-18% CAGR till FY27

11. Or, join the ride

If I am looking to enter HGINFRA then

PAT up 29% & 17% revenue growth delivered in H1-24 with an outlook for 21-22% revenue growth in FY24 and a guidance to grow by 11-15% in FY25 at a PE of 10 makes HGINFRA quite reasonable.

Long term growth outlook of 17-18% revenue CAGR till FY27 at PE of 10 makes HGINFRA quite reasonable.

Previous coverage of HGINFRA

Don’t like what you are reading? Will do better.` Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades