HG Infra Engineering Ltd - Attractively priced

Strong order book position, revenue visibility and superior return ratios

Company Overview

HG Infra Engineering Ltd (HGINFRA) is a Jaipur (Rajasthan) based infrastructure construction, development and management company with focus on road projects, including highways, bridges and flyovers. Its main business operations include providing engineering, procurement and construction (“EPC”) services and undertaking civil construction and related infrastructure projects primarily in the roads and highway sector.

Share Details

NSE: HGINFRA( hginfra.com)

Quality: Returns on capital employed in cash

Return ratios have improved over the last four financial years. HGINFRA has delivered on its strategy to ‘Maintain Fiscal Discipline‘, though cash conversion is an area of concern.

Growth

Top-line growth CAGR is good at 27% but it is lumpy with FY19 and FY22 pulling up the overall CAGR growth. On the other hand improvement in profit margin is yielding a more consistent bottom-line growth.

Growth Momentum

The past growth momentum has been high.

Outlook

The comments around the margin during the earning calls inspires confidence where the company management is guiding for a strong order book, top-line growth visibility and consistent EBIDTA margin.

The company in its Q4-23 earnings call has guided for

top-line growth of 23% for FY24

top-line growth of 20%+ in FY25.

EBIDTA margin of 16%.

The revenue has been guided upon where majority of execution is going to be where the appointed date is being declared as of now.

The top-line growth guidance is disappointing given that is lower than the historic CAGR delivered by HGINFRA

The company anticipates securing orders worth INR8,000 to INR9,000 crores in FY ‘24 to maintain the book-to-bill ratio of more than 2.5x.

We aim to have 20% to 25% of our order book comprising non-road projects within next two years, three years

For FY24E, targeted growth rate is 23% Ganga expressway project will drive growth and contribute ~1/3rd of total FY24E revenue. One needs to keep listening for any commentary on this project.

So What????

If I currently hold the stock, I may continue holding it based on my past returns, expectations for future returns, and the availability of alternative stock ideas. If I intend to hold it then one needs to look out for the 20%+ top-line growth trajectory of the company for FY24 and FY25 along with EBIDTA margin of around 16%.

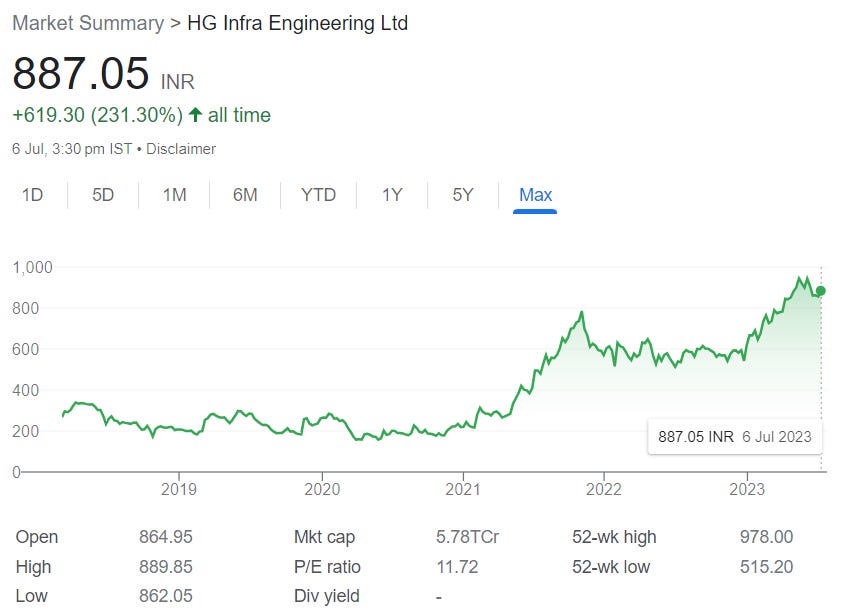

If I don't currently own the stock, I might consider entering it given that it has a strong order book, revenue and margin visibility for FY24 and FY25. HGINFRA is available at a PE of around 12 with a growth visibility of 20%+ for the next two years along with a book-to-bill ratio of more than 2.5x.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades