HDFC Asset Management Company: PAT up 30% & Revenue up 37% in 9M-25 at a PE of 37

Strong growth in an environment of cyclicality. Macro trend of Industry growth & increasing market share continues in a challenging quarter. Encountering headwinds

1. Amongst India’s largest mutual fund managers

hdfcfund.com | NSE: HDFCAMC

2. FY19-24: PAT CAGR of 11% & Revenue CAGR of 7%

3. Strong FY-24: PAT up 37% & Revenue up 19% YoY

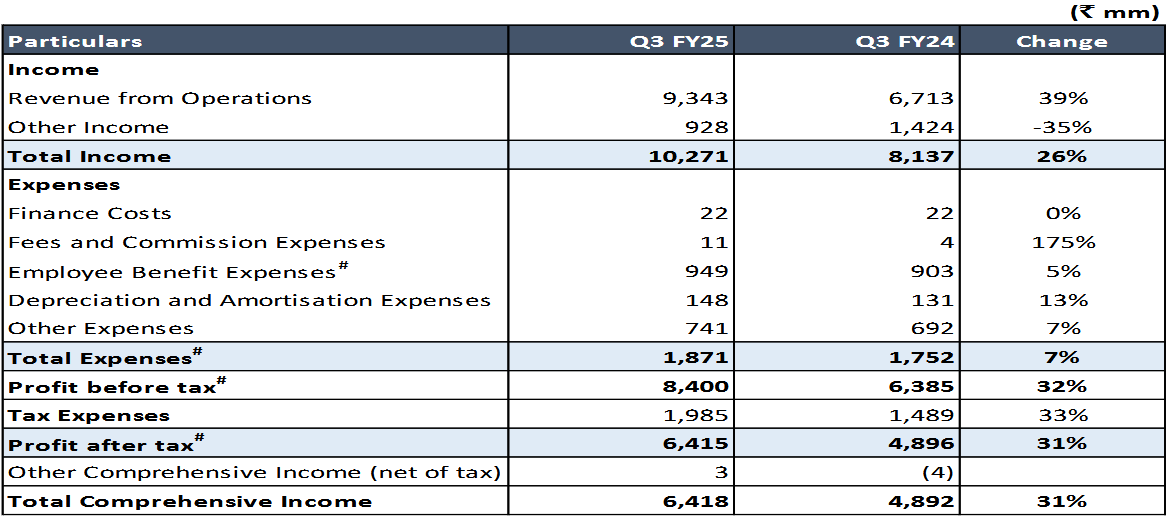

4. Q3-25: PAT up 31% & Revenue up 39% YoY

5. Strong 9M-25: PAT up 30% & Revenue up 37% YoY

6. Strong return ratios

7. Strong Outlook

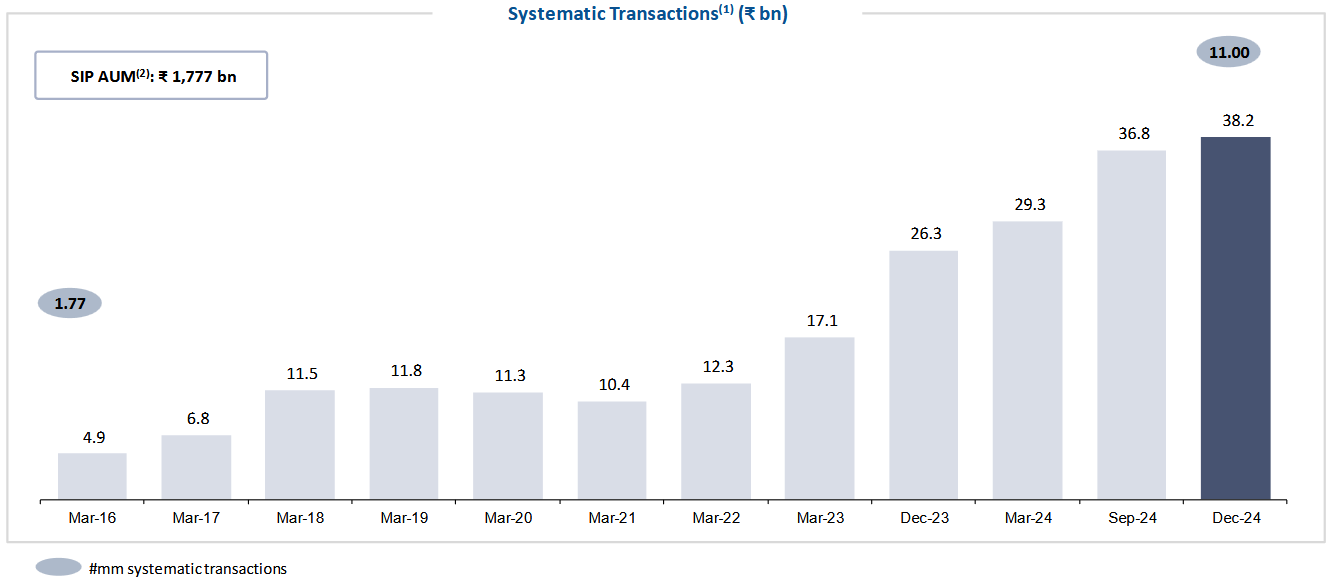

Strong Industry and Company Growth: The Indian mutual fund industry continues its impressive growth trajectory. HDFC AMC at 7,608 cr in AUM, driven by strong equity market performance and robust SIP inflows.

Shift Towards Equity: HDFCAMC's asset mix is titled towards equity, now at 66% (down from Q2-25) vs 58.7% for the overall industry on a closing basis. This reflects both market gains and the popularity of equity-oriented SIPs.

8. PAT growth of 30% & revenue growth of 37% in 9M-25 for a PE of 37

9. Hold?

If I hold the stock then one may continue holding on to HDFCAMC

HDFCAMC has delivered a strong 9M-25 which is pointing towards a strong FY25. One can ride the business momentum and industry tailwinds till they last.

From an underlying business perspective HDFCAMC is increasing market share to 11.6% and delivering strong AUM growth on QoQ and YoY basis which is a big positive for the business

One needs to keep a watch on the following developing issues and its impact on the business performance of HDFCAMC in the near future

Market Volatility: Fluctuations in the equity markets can impact HDFC AMC's "skin in the game" investments, which in turn affects their other income. This is because the company is required to invest a portion of its own capital into its own funds.

Impact of Market Downturn on AUM and Flows: An extended bear market could impact both the Assets Under Management (AUM) and the flow of new investments into HDFC's funds. While the company believes a good portion of their growth is structural, a prolonged market downturn may affect overall investor sentiment and their willingness to invest.

Cyclical Nature of Growth: The mutual fund industry, while experiencing strong growth, can be subject to cyclical patterns.

SIP Discontinuations: While gross SIP flows are a key metric, investors should be aware of the potential impact of SIP discontinuations. The net SIP number can be affected by redemptions or switches between funds. While this is more of a concern for the industry overall, it is something to be aware of.

Regulatory Changes: Investors should keep an eye on new regulations from SEBI. HDFC AMC is awaiting final regulations for new categories and will adapt its product offerings accordingly. This also means investors will need to watch for how the new regulations impact existing schemes as well as the new product offerings.

Potential for Reduced Yields: While HDFC's yields have improved, it's worth noting that a sharp increase in AUM can lead to a decline in yields due to telescopic pricing. So investors should be aware of the potential for fluctuations in yields.

Expense Management: Although the company is focused on controlling costs, expenses are expected to grow at a rate of 12-15% annually.

Impact of Direct Channel Growth: The direct channel, led by FinTechs, has been growing rapidly and now accounts for 27% of business. This may indicate changing investor behaviour, but there may also be other factors, such as MFDs moving to platforms. The growth of this channel may impact other distribution channels.

10. Buy?

If I am looking to enter HDFCAMC then

HDFCAMC has delivered 30% in PAT and 37% growth in revenue in 9M-25 at a PE of 37 which makes the valuations fully valued in the short term.

HDFCAMC is expected to benefit from industry growth and its strong position in the industry. At a PE of 35, the opportunity in the stock will emerge over the medium to longer term.

Strong Market Position: HDFC AMC is the second-largest player in the B30 markets with a 12% market share and is a preferred choice for individual investors

Growth Potential: The company has a significant number of live individual accounts, which grew by 49% year-on-year, and a unique investor count that grew by 45% year-on-year HDFCAMC is actively expanding its investor base.

At a PE of 37 the margin of safety is limited and the current valuations will not support a weak quarter

Previous Coverage of HDFCAMC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer