HDFC Asset Management Company: PAT up 29% & Revenue up 37% in H1-25 at a PE of 44

Strong growth on the back of Industry growth & increasing market share. HDFCAMC asset mix containing a higher proportion of equity compared to Industry benefiting from the uptrend in equities

1. Amongst India’s largest mutual fund managers

hdfcfund.com | NSE: HDFCAMC

Amongst India’s largest mutual fund managers with QAAUM market share of 11.5% for the quarter ended September 30,2024.

Amongst India’s largest Actively Managed Equity Mutual Fund managers with QAAUM market share of 12.9% for the quarter ended September 30,2024.

One of the most preferred choices of individual investors, with a market share of 13.2% of the individual monthly average AUM for September 2024.

2. FY19-24: PAT CAGR of 11% & Revenue CAGR of 7%

3. Strong FY-24: PAT up 37% & Revenue up 19% YoY

4. Q2-25: PAT up 32% & Revenue up 38% YoY

5. Strong H1-25: PAT up 29% & Revenue up 37% YoY

6. Strong return ratios

7. Strong Outlook

Strong Industry and Company Growth: The Indian mutual fund industry continues its impressive growth trajectory. HDFC AMC surpassed Rs 7,500 cr in AUM, driven by strong equity market performance and robust SIP inflows.

Shift Towards Equity: HDFCAMC's asset mix is tilting further towards equity, now at 67.7% on a closing basis. This reflects both market gains and the popularity of equity-oriented SIPs.

Navigating Margin Pressure: While absolute revenue is growing, revenue yields are facing pressure due to regulatory pricing formulas and strong AUM growth. HDFC AMC is exploring options to manage this.

8. PAT growth of 29% & revenue growth of 37% in H1-25 for a PE of 44

9. Hold?

If I hold the stock then one may continue holding on to HDFCAMC

HDFCAMC has delivered a strong H1-25 which is pointing towards a strong FY25. One can ride the business momentum and industry tailwinds till they last.

From an underlying business perspective HDFCAMC is increasing market share to 11.5% and delivering strong AUM growth on QoQ and YoY basis which is a big positive for the business

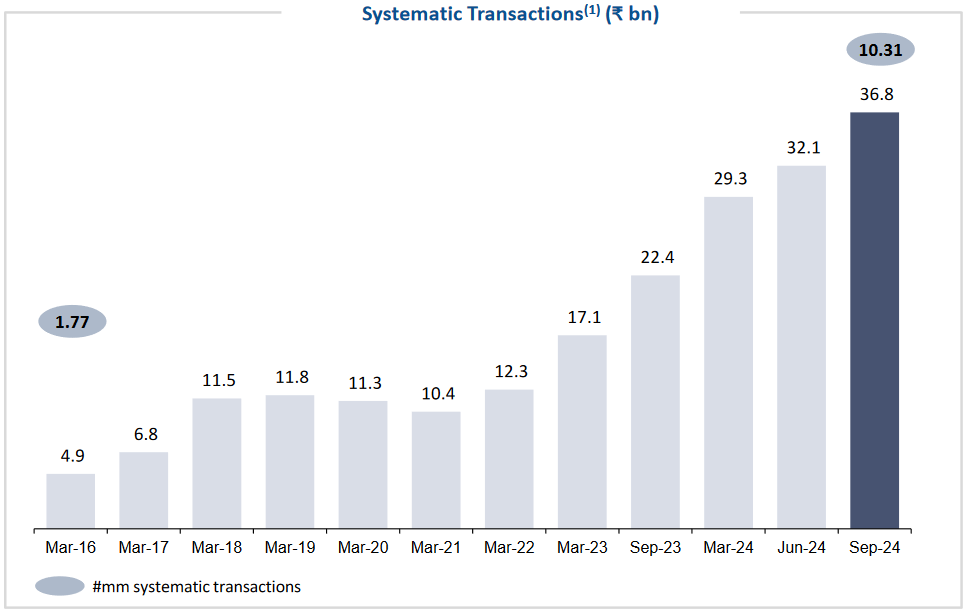

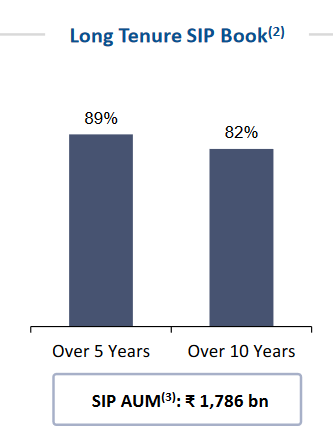

Strong and stable “Order Book” provides predictable flows providing confidence that business performance is sustainable.

10. Buy?

If I am looking to enter HDFCAMC then

HDFCAMC has delivered 29% in PAT and 37% growth in revenue in Q1-25 at a PE of 44 which makes the valuations fully valued in the short term.

The industry AUM has grown by 7 times in the last 10 years. 24% of Mutual fund investors in India are HDFCAMC customers. Hence HDFCAMC is expected to benefit from industry tailwinds. At a PE of 44, the opportunity in the stock will emerge over the medium to longer term.

The industry continued its upward journey and closed the quarter with AUM of over INR61 trillion, signifying sevenfold increase over the last 10 years

Unique customers stands at 11.8 million as on September 30,2024 compared to 50.1 million for the industry, a penetration of 24%.

At a PE of 44 the margin of safety is limited and the current valuations will not support a weak quarter

Previous Coverage of HDFCAMC

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer