HDFC Asset Management Company: PAT up 37% & Revenue up 19% in FY24 at a PE of 40

Top performing fund in the 1 & 3 year bucket driving market share gains & delivering strong business growth in FY24.

1. Mutual fund manager

hdfcfund.com | NSE: HDFCAMC

HDFC AMC is the #3 player in market share behind SBI AMC who is the the leader, with ICICI Prudential AMC, the #2 player

AUM by Segment: Higher focus on Equity compared to Industry

2. FY19-24: PAT CAGR of 11% & Revenue CAGR of 7%

3. 9M-24: PAT up 26% & Revenue up 33% YoY

4. Q3-24: PAT up 44% & Revenue up 29% YoY

PAT up 11% & Revenue up 4% QoQ

5. Strong FY-24: PAT up 37% & Revenue up 19% YoY

6. Strong return ratios

7. PAT growth of 37% & revenue growth of 19% in FY-24 for a PE of 40

8. So Wait and Watch

If I hold the stock then one may continue holding on to HDFCAMC

HDFCAMC has delivered the strongest yearly performance in terms of revenue and PAT in FY24

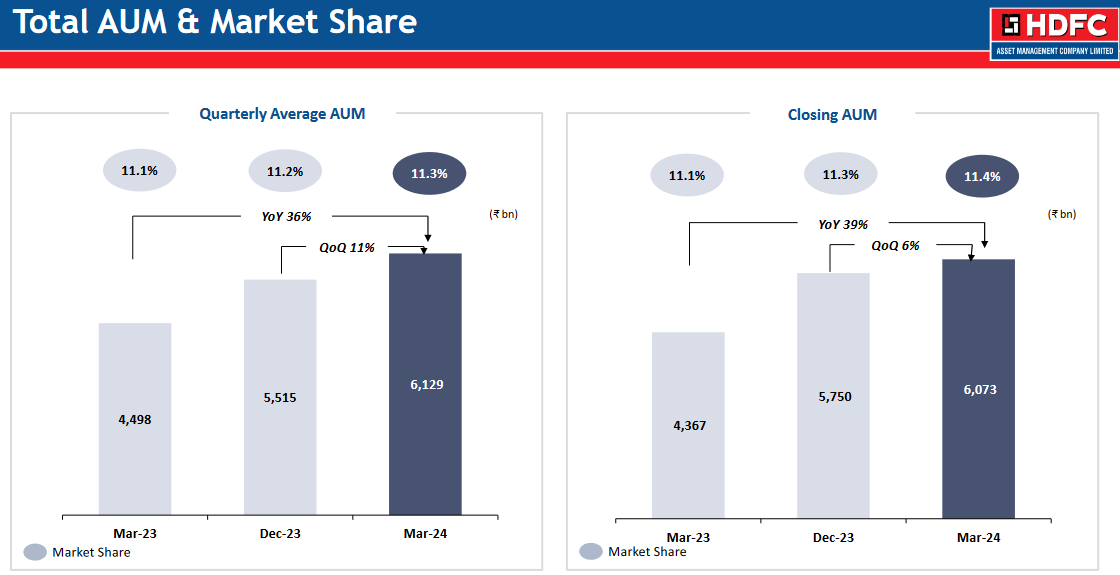

From an underlying business perspective HDFCAMC is increasing market share to 11.4% from 11.1% over FY24 based on closing AUM which is a big positive for the business

9. Or, join the ride

If I am looking to enter HDFCAMC then

HDFCAMC has delivered 37% in PAT and 19% growth in top-line in FY24 at a PE of 40 which makes the valuations fair from a short term perspective and does not provide opportunities in the short term.

The performance of HDFCAMC as the top performing fund in the 1 year and 3 year time horizon should drive market share gains and sustain the growth momentum in the business and provide opportunity in the stock over the longer term.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer