Hariom Pipe Industries: PAT growth of 22% & Revenue growth of 80% in FY24 at a PE of 31

Guidance for 57% revenue CAGR for FY24-26 by HARIOMPIPE as it targets a revenue of Rs 2500 cr by FY26 while maintaining margins.

1. Integrated manufacturer of steel pipes and tubes

hariompipes.com | NSE : HARIOMPIPE

2. FY20-24: PAT CAGR of 47% & Revenue CAGR of 48%

3. Strong FY23: PAT up 45% & Revenue up 55% YoY

4. 9M-24: PAT up 38% & Revenue up 110% YoY

5. Weak Q4-24: PAT down 2% & Revenue up 32% YoY

PAT up 71% and Revenue up 18% QoQ

6. FY24: PAT up 22% & Revenue up 80% YoY

7. Business metrics: Improving return ratios

EPS, RoCE and RoE in FY23 impacted by higher equity base from preferential allotment done in March 2023

Asset sweating for higher RoCE

Continue to remain OCF positive and generate FCF by FY25

8. Outlook: Revenue CAGR of 47% for FY24-26

i. Revenue CAGR of 47% for FY24-26

Revenue growing from Rs 1,158.38 cr in FY23 to Rs 2,500 cr in FY26 implies a revenue CAGR of 47%

On track to achieve our FY26 goal

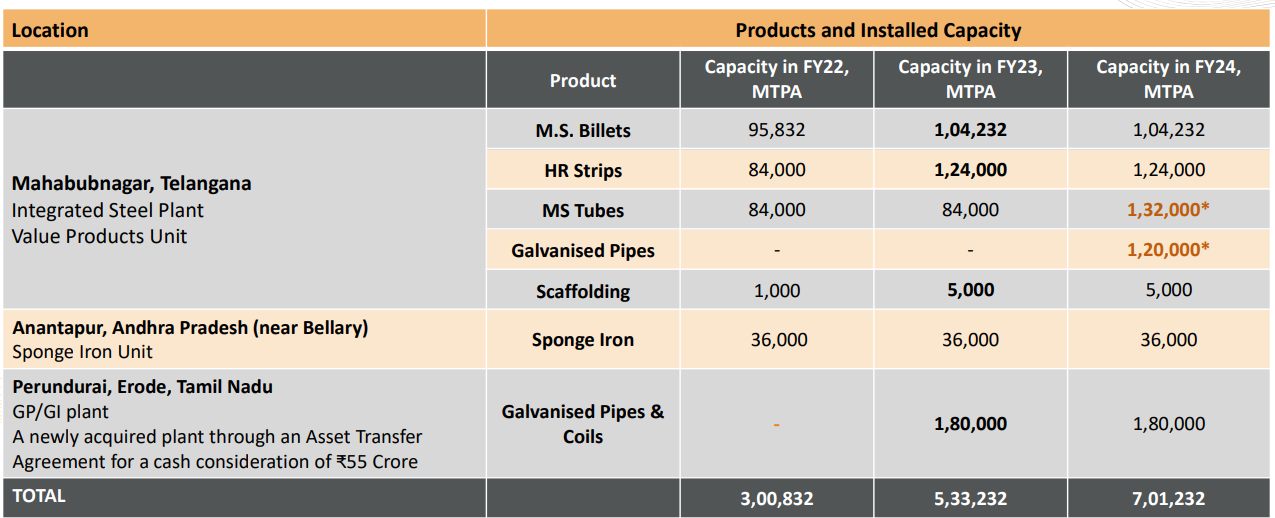

ii. Capacity in place to support FY26 revenue targets

9. PAT growth of 22% & Revenue growth of 80% in FY24 at a PE of 31

10. So Wait and Watch

If I hold the stock then one may continue holding on to HARIOMPIPE

Coverage of HARIOMPIPE was initiated after Q3-24 results. The investment thesis has not changed after a FY24 delivered in-line with the guidance given for FY24. The delivery of a strong FY24 has increased confidence in the management to deliver a FY25 as per the guidance

FY24 target is around 1200 Cr Revenue & around 12-13% EBITDA Margin

HARIOMPIPE has delivered weaker PAT margins in FY24 and should be a big red flag if the margin trend continues to deteriorate in Q1-25 and beyond.

HARIOMPIPE has a strong outlook till FY26 which provides a reason to continue till FY26

11. Or, join the ride

If I am looking to enter HARIOMPIPE then

HARIOMPIPE has delivered PAT growth of 22% & Revenue growth of 80% in FY24 at a PE of 31 which makes valuations fully priced in the short-term.

HARIOMPIPE is guiding for 47% revenue CAGR for FY24-26 while maintaining margins at a PE of 32 which which creates an opportunity from a long term perspective.

Previous coverage of HARIOMPIPE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer