Hariom Pipe Industries: PAT growth of 38% & Revenue growth of 110% in 9M-24 at a PE of 28

Even after a weak Q3-24, HARIOMPIPE is on track to deliver a strong FY24. HARIOMPIPE is looking to double in FY24 over FY23. HARIOMPIPE is guiding for 57% revenue CAGR for FY23-26

1. Integrated manufacturer of steel pipes and tubes

hariompipes.com | NSE : HARIOMPIPE

2. FY20-23: PAT CAGR of 53% & Revenue CAGR of 41%

3. Strong FY23: PAT up 45% & Revenue up 55% YoY

4. Strong H1-24: PAT up 61% & Revenue up 102% YoY

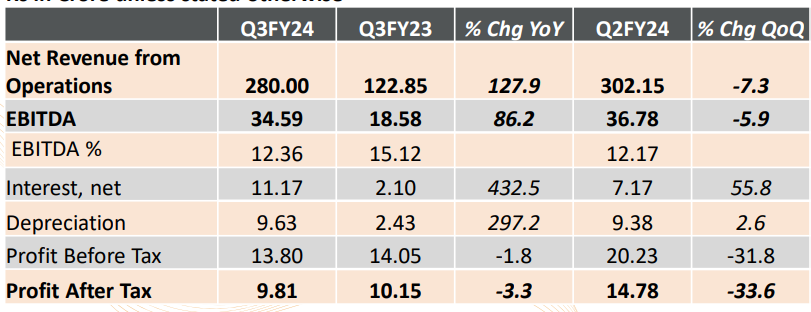

5. Weak Q3-24: PAT down 3% & Revenue up 128% YoY

PAT down 34% and Revenue down 7% QoQ

6. Strong 9M-24: PAT up 38% & Revenue up 110% YoY

7. Business metrics: Strong return ratios

EPS, RoCE and RoE in FY23 impacted by higher equity base from preferential allotment done in March 2023

8. Outlook: Revenue CAGR of 57% for FY23-26

i. Revenue CAGR of 57% for FY23-26

Revenue growing from Rs 644.46 cr in FY23 to Rs 2,500 cr in FY26 implies a revenue CAGR of 57%

To reach Rs 2,500 crore in Revenue by FY26 without compromising on our profitability

On track to achieve our FY26 goal

9. PAT growth of 38% & Revenue growth of 110% in 9M-24 at a PE of 28

10. So Wait and Watch

If I hold the stock then one may continue holding on to HARIOMPIPE

Based on 9M-24 performance, HARIOMPIPE looks on track to deliver the strongest yearly performance in terms of revenue and PAT in its history

HARIOMPIPE has delivered a weak Q3-24 and should watch out for weak quarters going forward. Despite a weak Q3-24, FY24 is expected to be strong.

FY24 target is around 1200 Cr Revenue & around 12-13% EBITDA Margin

HARIOMPIPE has a strong outlook till FY26 which provides a reason to continue till FY26

11. Or, join the ride

If I am looking to enter HARIOMPIPE then

HARIOMPIPE has delivered PAT growth of 38% & Revenue growth of 110% in 9M-24 at a PE of 28 which makes valuations quite reasonable in the short-term.

HARIOMPIPE is guiding for 57% revenue CAGR for FY23-26 at a PE of 28 which makes valuations quite attractive from a long term perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer