GE Shipping Q3 FY26 Results: PAT up 37%, Trades at 25% Discount to NAV

Offers deep value — 1.1× P/B, 9% FCF yield, 42% of market cap in cash—providing downside protection and strong re-rating potential given a strong Q4 expectation

1. Shipping & Oilfield Services Provider

greatship.com | NSE: GESHIP

Shipping Business (Core Segment)

Diversified Shipping Fleet: Manages a fleet of 40 vessels with a mix of asset classes:

Offshore Business (via 100% subsidiary Greatship India Ltd)

Provides end-to-end support for the oil and gas industry with a fleet of 23 assets:

Drilling: 4 high-specification Jack-up Rigs.

Logistics & Support: 19 vessels including Platform Supply Vessels (PSV), Anchor Handling Tugs (AHTSV), and Multipurpose Support Vessels (MPSVV)

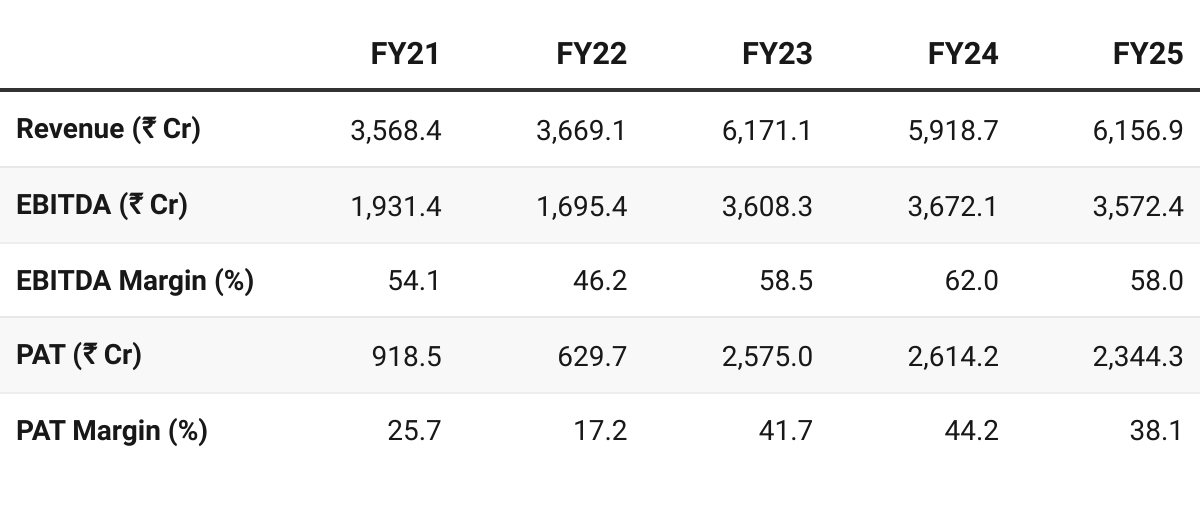

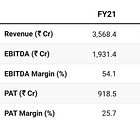

2. FY21-25: PAT CAGR 31% & Revenue CAGR 14%

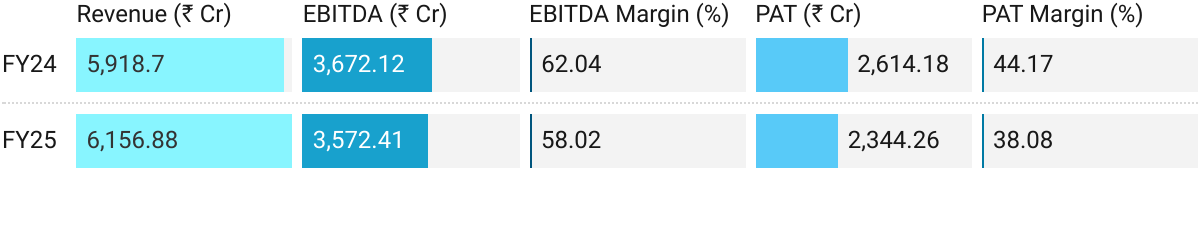

3. FY-25: PAT down 10% & Revenue up 4%

FY25 was a year of steady execution, cash preservation, and capital discipline, though earnings pulled back from FY24 highs. as the supernormal profit phase of FY24 normalized

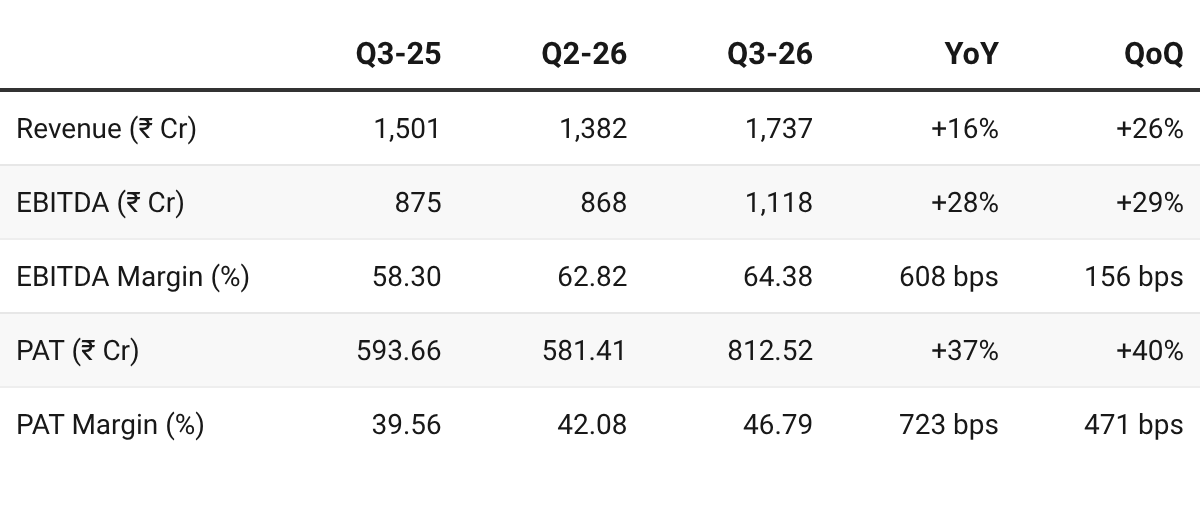

4. Q3-26: PAT up 37% & Revenue up 16% YoY

PAT up 40% & Revenue up 26% QoQ

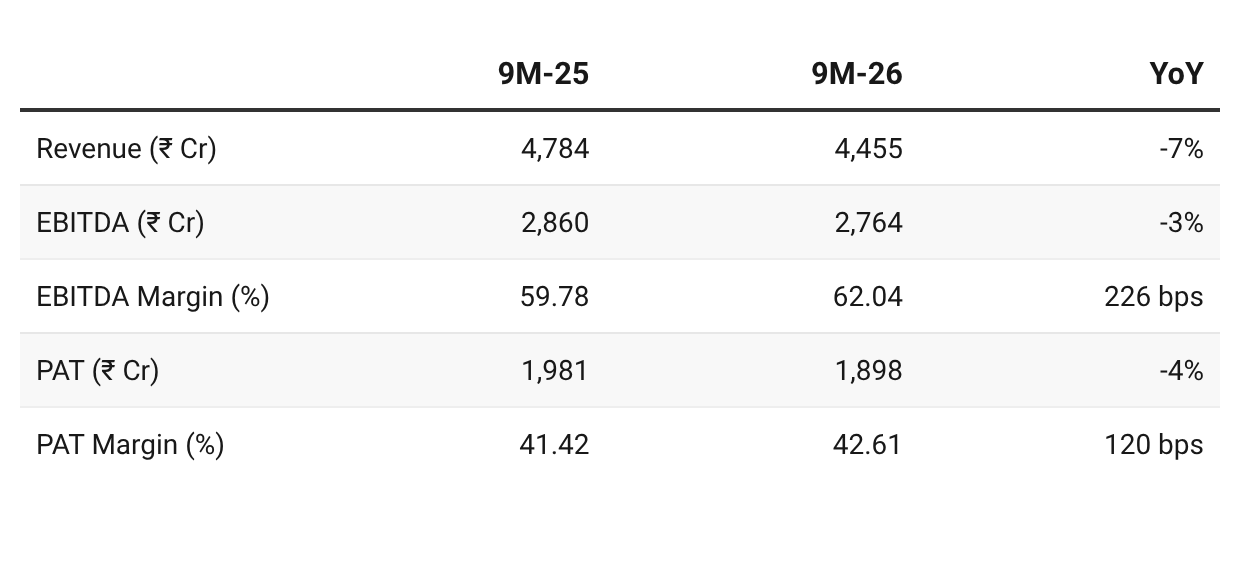

5. 9M-26: PAT down 4% & Revenue down 7% YoY

Expects strong Q3 momentum to persist into Q4 FY26, citing “unusually strong” early performance:

Shipping:

Dry Bulk: January remained strong (unusual for seasonally weak Q4), driven by China iron ore stocking and grain trade growth.

Crude: January rates rose significantly vs. Q3. Stricter Russian sanctions forced India to source from the Middle East/South America (Brazil, Guyana), increasing international fleet demand.

Product: Q4 expected to benefit as LR2s switch to Aframax crude trade, tightening supply and lifting rates.

Offshore:

Vessels: Four set for Q4 repricing (vs. one in Q3), capitalizing on steady, profitable market rates.

Financials:

NAV: Uptrend expected via operating cash profits rather than asset value changes.

Visibility: High offshore coverage; capacity fixed at profitable rates through FY27.

Outlook: Cautious on high asset prices, but the Q4 operating environment remains robust.

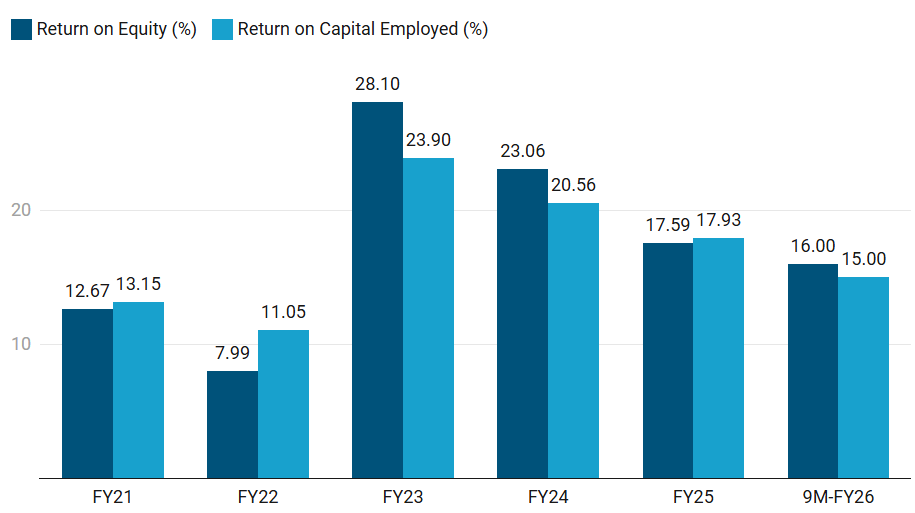

6. Business Metrics: Return Ratios Muted by Cash on Balance Sheet

Strong capital discipline and fleet optimization strategy

FY23 Upcycle Peak: High spot rates (post-Ukraine, Red Sea) and strong operating leverage from an owned fleet with minimal capex.

FY24–25 Normalization: Returns moderated but remained strong due to cost control, stable LPG charter income, and a net cash balance sheet.

7. Outlook — Great Eastern Shipping Company

7.1 FY26 Guidance

Conservative strategy of capital preservation and timing the market,

Outlook remains generally positive across most sectors due to supply constraints and geopolitical shifts.

Strategic Guidance and Investment Philosophy

Maintaining a net cash position ~₹7,000 Cr rather than aggressively expanding the fleet at today’s high asset prices.

Asset prices too high to yield attractive returns

Current yields are around 10-13% on a replacement cost basis)

Waiting for a market downturn to deploy cash more profitably.

Instead of capacity expansion — sell older vessels and purchase more modern ones to maintain fleet quality.

Future Outlook by Segment

Shipping (Tankers, Dry Bulk, and Gas)

Crude Tankers — Strong outlook

Driven by OPEC’s production schedules and significant output increases from South America, specifically Brazil.

Sanctions on Russian oil increased demand for the international trading fleet as India and other nations shift sourcing to the Middle East and South America.

Product Tankers — Recovered from previous quarters

Anticipates increased switching of vessels from product to crude trades, which should further tighten the product tanker market.

Dry Bulk — Strong, despite being in a seasonally weak quarter

Growth supported by increased iron ore imports into China for inventory stocking and a rise in grain trade.

LPG and LNG — LPG spot earnings are strong

Order book is high at 29%.

No plans to enter the LNG fleet market — extremely high asset prices and suboptimal returns compared to their traditional sectors.

Offshore Business (Greatship)

Vessel Utilization — Showing signs of recovery

healthy utilization levels around 65-66%

Supply constrained — few assets were ordered in the last decade

~500-700 ships globally are in “cold lay-up” and unlikely to return to service due to high reactivation costs.

Jackup Rigs — Green shoots” are appearing as

Saudi Aramco begins calling back rigs that were previously suspended,

Expected to tighten the market through 2026.

Revenue Visibility — 80% of offshore vessel capacity fixed for FY27 at profitable rates.

Market Risks and Constraints

Scrapping Overhang:

Scrapping has been minimal for a decade — strong markets encourage owners to keep older ships in operation.

resulted in a high proportion of “old fleet” (20+ years) across all categories.

Asset Price Volatility:

While current earnings are good, a drop in market rates could lead to a corresponding drop in the market value of the fleet, which justifies their decision to remain net cash for now.

7.2 9M FY26 Performance vs FY26 Guidance

Net Asset Value (NAV) Growth:

NAV increased consistently over the 9-month and 12-month periods.

Growth primarily driven by operating cash flows rather than fluctuations in ship values, which remained relatively stable between September and December.

Several sectors performed ahead of expectations during the 9M period:

Crude Tankers & LPG: These sectors were cited as the primary areas of out-performance. Crude tanker markets were bolstered by OPEC production schedules and increased output from South America (Brazil).

Dry Bulk: This segment remained unusually strong in the third quarter, which is typically the seasonally weakest period of the year. This strength was driven by iron ore stocking at Chinese ports and growth in the grain trade.

Product Tankers: This sector saw a recovery during the most recent quarter compared to the previous two quarters.

Offshore Visibility: In the offshore segment — secured high revenue visibility, with 80% of vessel capacity already fixed for FY27 at profitable rates.

Management acknowledged that maintaining a high cash balance (which earns approximately 3% in dollars) acts as a drag on overall return ratios when compared to the 10%+ yields possible from shipping assets.

However, they maintain that waiting for a market downturn to deploy this cash is the more prudent long-term strategy to ensure future capital appreciation.

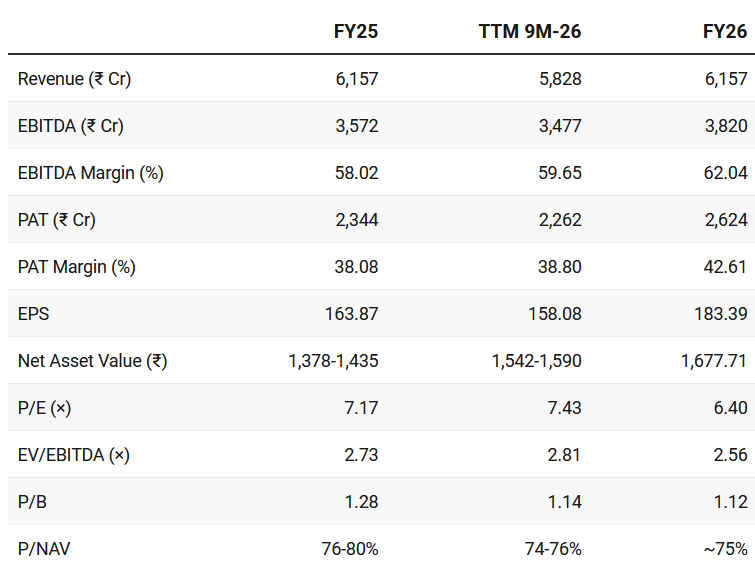

8. Valuation Analysis — GE Shipping

8.1 Valuation Snapshot

Current Market Price= ₹1,174.4; Market Cap = ₹17,040.8 Cr

The stock trades at 0.74x NAV. Historically, GE Shipping is considered “fairly valued” at 0.9x to 1.0x NAV during healthy cycles.

Represents a ~25% discount to the resale value of the fleet and cash.

With Q4 expected to be strong than Q3 TTM P/E (~7x) and EV/EBITDA (~3.8x) are cheap cheap with potential for re-rating of multiples.

Sum-of-the-Parts (SOTP) Valuation

Net Cash Surplus: ~₹7,000 Cr (approx. 42% of the share price).

“Operating Business” Value: ~₹17,000 (Market Cap) - ₹7,000 (Net Cash) = ₹10,00 Cr.

Operational Valuation: Paying only ~4.5x earnings for the actual fleet of ships and rigs.

Free Cash Flow (FCF) Yield: ~8.5% (for 9M-FY26 not annualized) makes for very attractive valuations.

8.2 Opportunity at Current Valuation

NAV Arbitrage (26% Liquidation Discount)

The most immediate opportunity is the gap between the market price and the Net Asset Value (NAV).

At current price, stock is trading at a 26% discount to the resale value of its ships and cash.

The “Optionality” of the ₹7,000 Cr Cash

Approximately 42% of the market cap is sitting in cash.

Management is intentionally “waiting on the sidelines” because they believe current ship prices are too high.

If the shipping market “cracks” and asset prices drop by 20–30%, GESHIP has the “dry powder” to double its fleet at the bottom of the cycle.

Investors are currently paying almost nothing for this growth potential; you are buying the ships, and the ₹7,000 crore “expansion fund” is essentially a bonus.

Cash Machine (Strong Free Cash Flow Yield)

When you strip out the surplus cash, the valuation of the actual business becomes remarkably cheap.

The fleet’s free cash flow yield net of cash is 19.67%.

The market is valuing the operating business at only ₹10,778 Cr. For a business that generated over ₹1,900 Cr in profit in nie months — a low multiple.

Momentum from a strong Q3 to carry over into Q4 FY26, with several sectors showing “unusually strong” performance in the early months of the quarter.

Shipping Segment Expectations

Dry Bulk: Continued to be strong in January — considered unusual because the fourth quarter is seasonally the weakest quarter of the year for this sector.

Crude Tankers: Crude market has significantly risen as of January compared to the previous quarter.

Product Tankers: LR2 tankers are moving into the Aframax crude trade, which is expected to tighten the supply and push up rates for product tankers.

Offshore Segment (Greatship)

Vessel Repricing: Four vessels scheduled for repricing in the fourth quarter. This provides an opportunity to fix these vessels at current market rates, which have held steady and remain profitable.

8.3 Risk at Current Valuation

The “Cash Drag” and ROE Risk (Strategic Risk)

GE Shipping is holding ₹7,000 Cr in cash (over 40% of its market cap).

Management is being extremely conservative, waiting for a “market crack” to buy ships. If shipping rates and asset prices stay high for the next 2–3 years, the company will continue to earn only ~7–8% on its cash in bank deposits while its competitors earn 15–20% on active vessels.

This results in a significantly lower Return on Equity (ROE). An investor might see the stock “stagnate” while the rest of the shipping sector rallies, simply because the company is under-invested.

Biggest Risk — Opportunity Loss

While the stock is “cheap” net of cash, the primary risk is time. If you buy today, you are betting that management is correct to wait for a cyclical correction in the market value of secondhand ships. If a correction doesn’t come, your capital is essentially stuck in a low-yield bank account managed by a shipping company.

Previous Coverage of GESHIP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer