GE Shipping Q2 FY26 Results: Muted Earnings But Stock Trades at 26% Discount NAV

Despite a flat FY26, GESHIP offers deep value—0.69× P/B, 18% FCF yield, and 42% of market cap in cash—providing downside protection and re-rating potential

1. Shipping Company

greatship.com | NSE: GESHIP

GESHIP operates as a diversified maritime giant with two primary segments: Shipping (Standalone) and Offshore Oilfield Services (through its 100% subsidiary, Greatship (India) Limited).

Business Segments

🚢 Shipping Business (Core Segment)

Diversified Shipping Fleet: Manages a fleet of 38 vessels (3.04 million DWT) with a strategic mix of asset classes:

Tankers: 5 Crude Carriers and 17 Product Carriers (the largest segment by vessel count).

Dry Bulk: 12 Carriers ranging from Capesize to Supramax.

Gas: 4 LPG (VLGC) Carriers.

Strategic Market Positioning: Operates primarily in the spot market for tankers and dry bulk to capture rate volatility, while using time charters for LPG and rigs to provide a baseline of predictable cash flow.

🛢️ Offshore Business (via 100% subsidiary Greatship India Ltd)

Through Greatship, the company provides end-to-end support for the oil and gas industry with a specialized fleet of 22 assets:

Drilling: 4 high-specification Jack-up Rigs.

Logistics & Support: 18 vessels including Platform Supply Vessels (PSV), Anchor Handling Tugs (AHTSV), and Multipurpose Support Vessels (MPSVV)

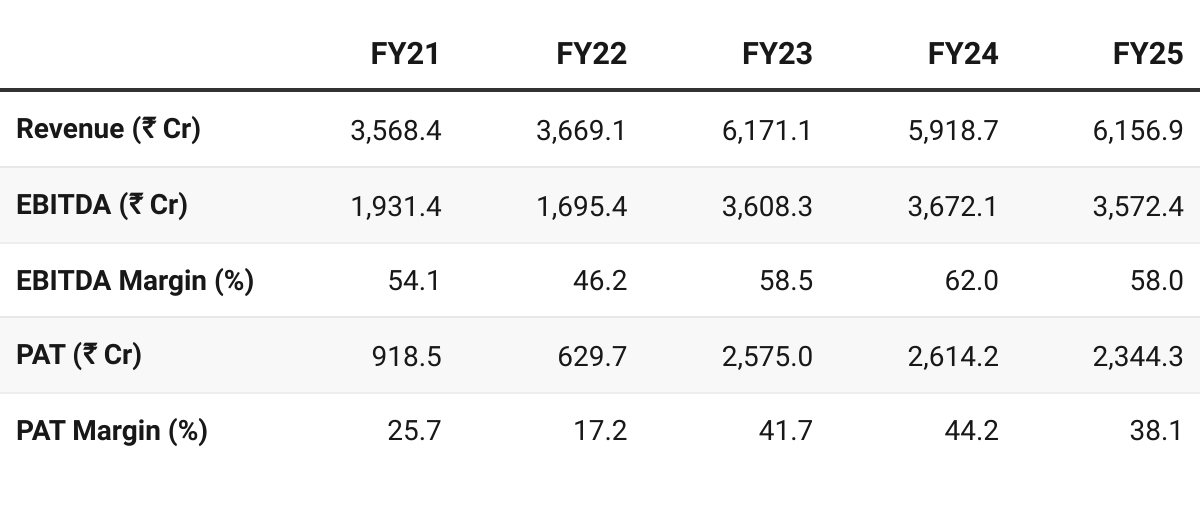

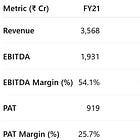

2. FY21-25: PAT CAGR 31% & Revenue CAGR 14%

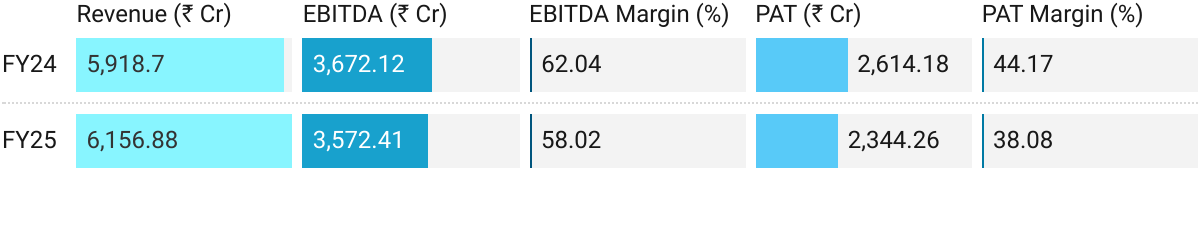

3. FY-25: PAT down 10% & Revenue up 4%

FY25 was a year of steady execution, cash preservation, and capital discipline, though earnings pulled back from FY24 highs. While the supernormal profit phase normalized, GE Shipping stayed resilient — positioning itself for counter-cyclical growth when valuations turn attractive.

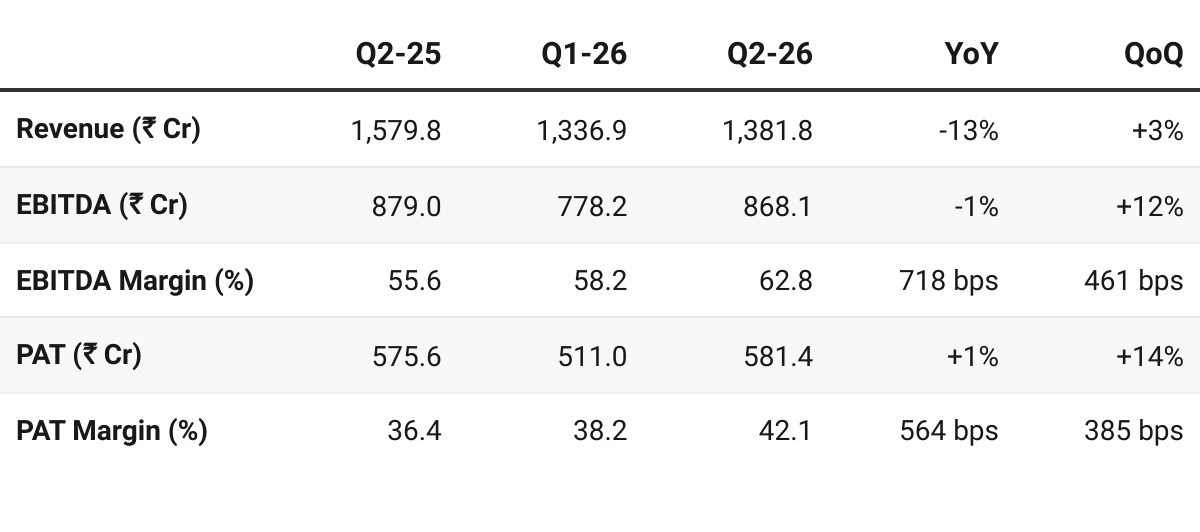

4. Q2-26: PAT up 1% & Revenue down 13% YoY

PAT up 14% & Revenue up 3% QoQ

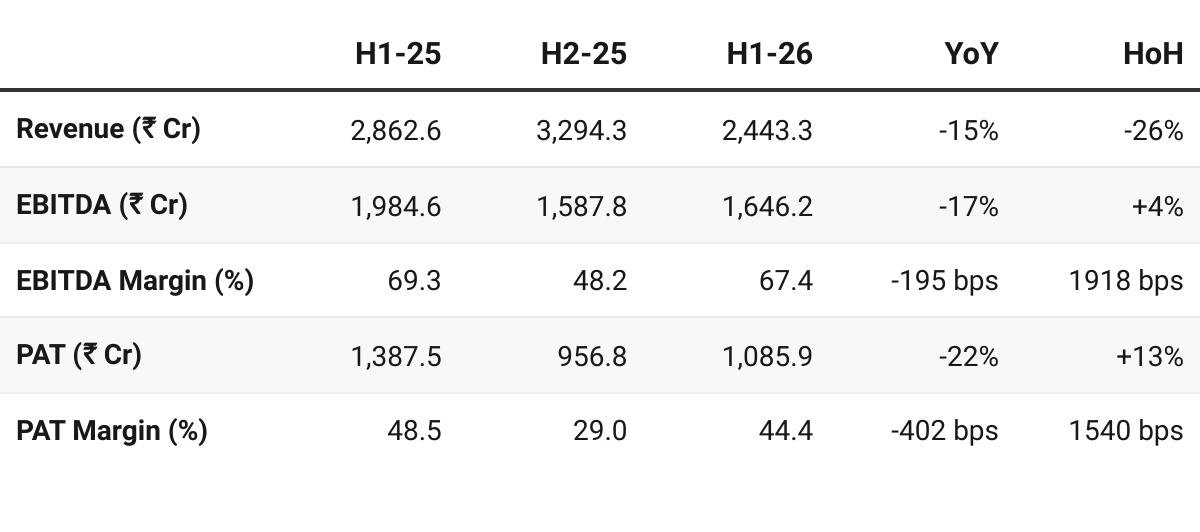

5. H1-26: PAT down 22% & Revenue down 15% YoY

PAT up 13% & Revenue down 26% HoH

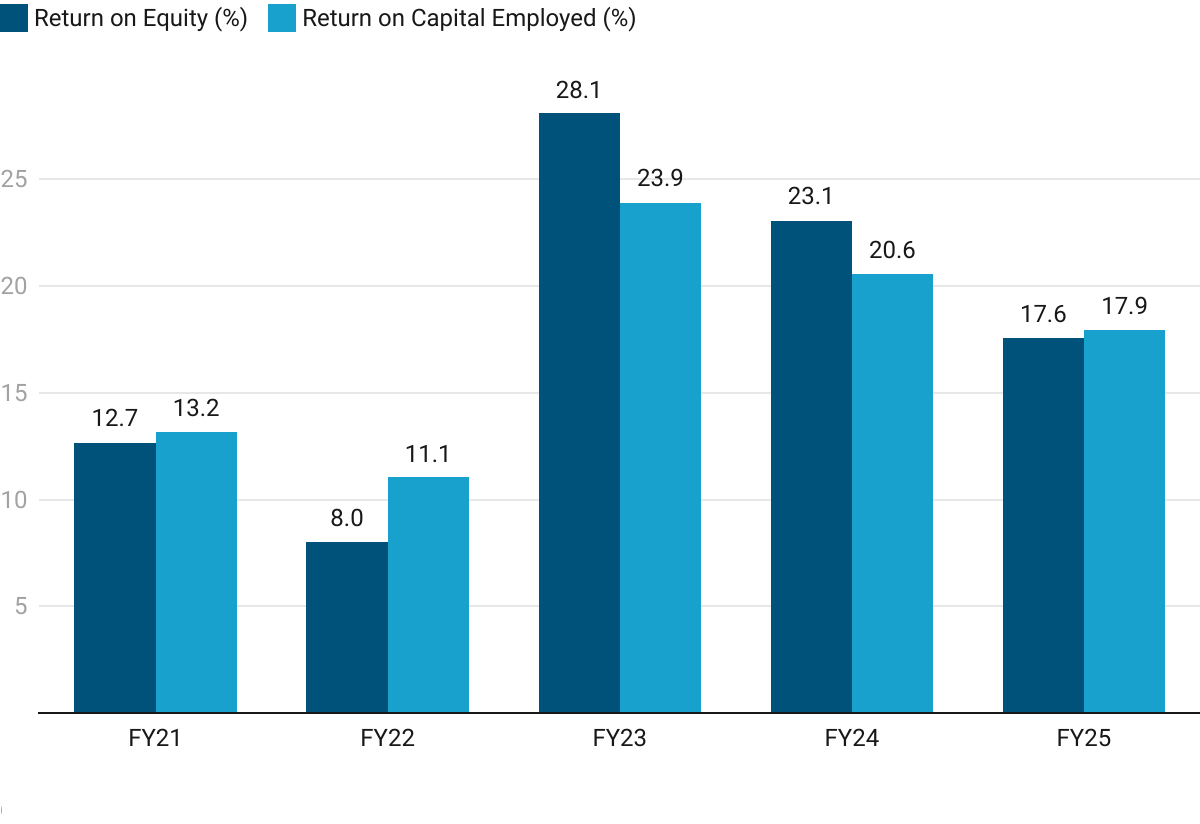

6. Business Metrics: Return Ratios Muted by Cash on Balance Sheet

Strong capital discipline and fleet optimization strategy

FY23 Upcycle Peak: High spot rates (post-Ukraine, Red Sea) and strong operating leverage from an owned fleet with minimal capex.

FY24–25 Normalization: Returns moderated but remained strong due to cost control, stable LPG charter income, and a net cash balance sheet.

7. Outlook:

7.1 FY26 Guidance — GE Shipping

Capital Allocation & Investment Strategy

The “Wait and Watch” Approach:

Cautious stance on large-scale fleet expansion due to high asset prices.

Currently “waiting on the sidelines” for more favorable prices.

IRR Benchmarks:

Targeting a minimum 10% IRR in U.S. Dollar terms for any new ship acquisitions.

Previously aimed for 15% — acknowledge that 10% is a more realistic “bare minimum” in the current high-price environment

Cash Accumulation: ~Rs. 7,000 crores in net cash

Prepared to “act quick” and potentially double their fleet size if the market “cracks” and prices drop significantly.

Fleet Management: The “Switch Strategy”

Modernization over Expansion:

Not increasing the total number of ships,

Focusing on “switch strategy”—selling older vessels (20+ years) and replacing them with modern, secondhand ships (5–10 years old)

To maintain capacity and improve the age profile.

New Segments: Closely watching the container ship segment but has not yet invested, citing the need for a correction in freight rates and asset values before entering.

Shipping Market Outlook (Segment-Wise)

Crude Tankers (Positive):

Sees a significant demand increase driven by the unwinding of OPEC production cuts and new supply from Brazil and Guyana.

Expect market to tighten further — particularly for Suezmax and VLCC

Product Tankers (Cautious):

Earnings have been significantly lower compared to the “exceptional” highs of early 2024 (Red Sea disruption).

While prices have strengthened slightly, management is wary of the high order book (18%) and potential demand-supply imbalances.

Dry Bulk (Mixed):

Positives: Strong demand for bauxite (from West Africa to China) and front-ended grain trade due to tariff fears.

Negatives: Weakness in the coal trade as China and India increase domestic production, and concerns over China’s real estate market impacting iron ore.

LPG (Stable but High Supply): Rates remain high in a historical context, but management noted a very elevated order book (29%), which could create future pressure.

Offshore Business Outlook

Profitability:

Segment has returned to profitability

80% of vessel capacity for FY26 is already locked in at profitable rates.

Rig Contracts:

Three of four rigs are currently working.

Fourth rig began a seven-month contract in November 2025.

Financial Impact:

Management warned of “lumpy expenditure” in Q3 and Q4 FY26 due to costs associated with preparing rigs for new contracts.

Significant repricing of rigs is not expected until H1 and H2 of FY27.

Shareholder Returns & Debt

Consistent Dividends: Shifted to a higher dividend payout ratio (roughly 27% of standalone earnings)

De-leveraging: Actively prepaying loans where possible to avoid “negative carry” (holding debt while sitting on large cash reserves)

7.2 H1 FY26 Performance vs FY26 Guidance

Crude Tankers (Actuals exceeding early Guidance)

Guidance: In early 2025, management was cautious, noting that the “winter recovery” never happened and rates were plateauing.

H1 Performance: The segment performed better than expected due to “significant tightening” in the Suezmax/VLCC sectors.

Outlook for H2: Management has turned decidedly bullish, citing OPEC production cuts unwinding and new sanctions on Russian exporters (Rosneft/Lukoil) as massive demand drivers for their spot-heavy fleet.

Dry Bulk (Actuals matching Guidance)

Guidance: Management predicted a “slightly weaker” year but identified Bauxite as a “bright spot.” They also anticipated geopolitical shifts in trade routes.

H1 Performance: Matches the “geopolitical volatility” thesis. A “front-ended grain trade” (China stocking up on soybeans to avoid potential US tariffs) provided an unexpected boost to Panamax/Kamsarmax rates.

Outlook for H2: Stability expected, with China’s infrastructure appetite remaining the key variable.

Offshore/Greatship (Actuals matching “Warning” Guidance)

Guidance: Management guided for a return to profitability but issued a specific “red flag” regarding high mobilization costs.

H1 Performance: Returned to profit (₹218 Cr). Three of four rigs are working.

Outlook for H2: Management reiterated a warning in November: expect “lumpy mobilization expenses” in Q3 and Q4. While the rigs are employed, the upfront costs of moving them will suppress net margins for the remainder of the year.

Strategic Guidance: The “Sideline” Strategy

Guidance: Management stated they would not buy ships at “historically high” prices and would instead hoard cash.

H1 Performance: Total liquid assets reached ₹8,121 Crore. The company successfully avoided buying expensive assets, opting instead for a “switch strategy”

Triangulation: Management is staying 100% disciplined to their guidance. They are sacrificing higher H1 ROE (by holding low-yield cash) to maintain a “Net Cash” surplus of $550 million for a future market correction.

Summary Outlook for the Remainder of FY26

Positives:

NAV Growth: Driven by ₹500 Cr quarterly cash accruals and Rupee depreciation. Year-end NAV is expected to be ~₹1,600.Dividend Security: The ₹7.20 quarterly dividend is backed by an 11% Free Cash Flow yield.

Crude Tailwinds: The tightening tanker market is the primary “alpha” for the H2 bottom line.

Headwinds:

Offshore Margin Compression: Q3/Q4 results will likely be “noisy” due to the mobilization expenses management warned about.

Product Tanker Oversupply: This segment remains the “red light” in the portfolio due to a high global order book.

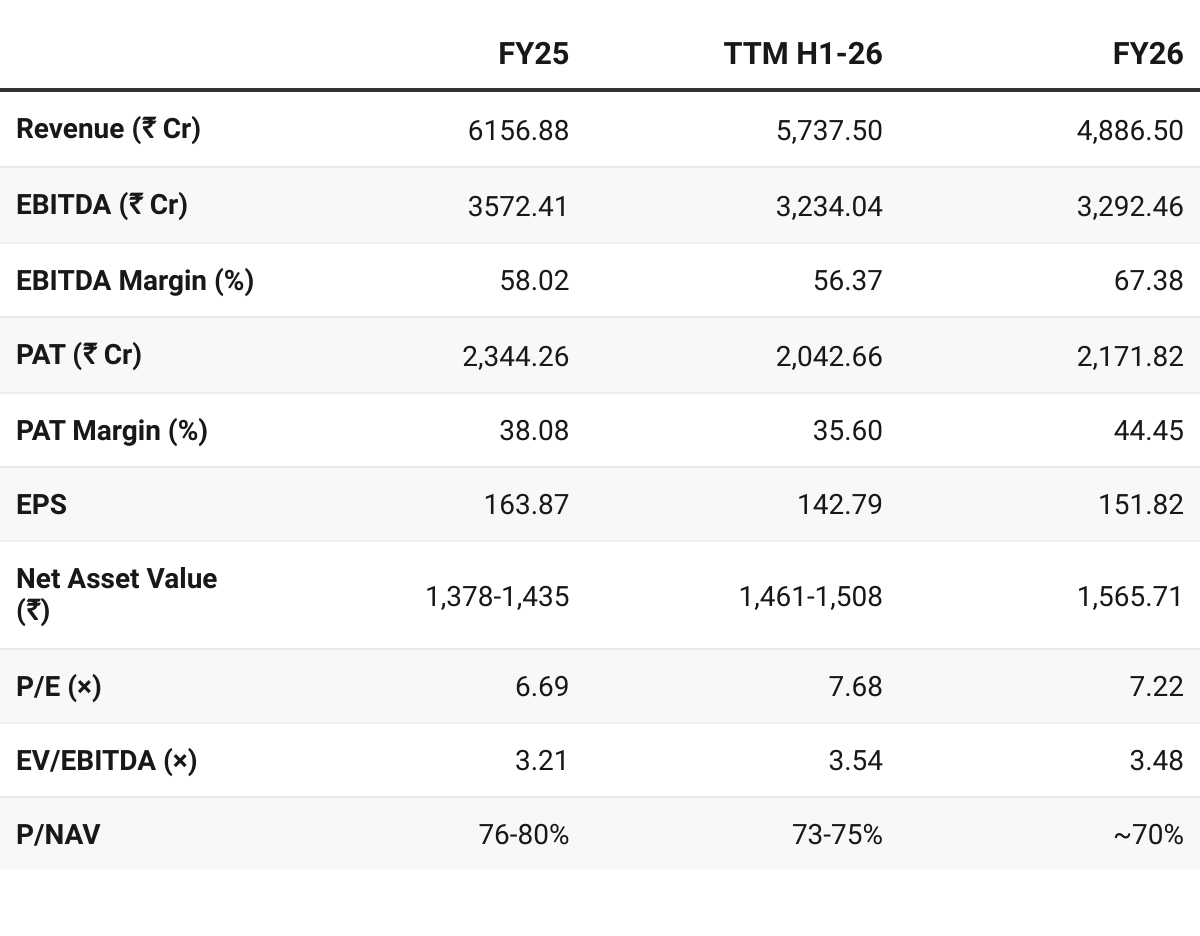

8. Valuation Analysis — GE Shipping

8.1 Valuation Snapshot

Current Market Price= ₹1,096; Market Cap = ₹15,647.3 Cr

Asset-Based Valuation (Industry Standard)

In shipping, the most critical metric is Price-to-NAV (P/NAV) because ships are liquid assets with a global market price.

Current NAV (as of Nov 2025): ₹1,484

Projected FY26 NAV (Year-end): ₹1,565 – ₹1,610 (driven by retained earnings and Rupee depreciation).

Current Market Price: ₹1,096

Valuation Insight: The stock trades at 0.74x NAV. Historically, GE Shipping is considered “fairly valued” at 0.9x to 1.0x NAV during healthy cycles.

The Opportunity: Buying at ₹1,096 represents a 26% immediate discount to the resale value of the fleet and cash.

Profitability Multiples (Earnings Power)

P/E (~7x): While low for a mid-cap, it doesn’t tell the full story.

EV/EBITDA (~3.5x): This is the “screamingly cheap” indicator. For a company with 58% EBITDA margins suggests the market expects a catastrophic collapse in shipping rates that hasn’t happened.

Sum-of-the-Parts (SOTP) Valuation

Net Cash Surplus: ₹6,872 Crore (Gross Cash of ₹8,121 Cr minus Debt).

“Cash Value” per share: ₹481 (approx. 44% of the share price).

“Operating Business” Value: ₹15,650 (Market Cap) - ₹6,872 (Net Cash) = ₹8,778 Crore.

Operational Valuation: You are paying only ~4x earnings for the actual fleet of 38 ships and 4 rigs.

Yield & Income Analysis

Dividend Yield: 2.63% (~₹28.80 per share annually).

Free Cash Flow (FCF) Yield: 11.03% on the full market cap.

Operating FCF Yield (Net of Cash): 19.67%.

8.2 Opportunity at Current Valuation

The NAV Arbitrage (26% Liquidation Discount)

The most immediate opportunity is the gap between the market price and the Net Asset Value (NAV).

At current price, stock is trading at a 26% discount to the resale value of its ships and cash.

Historically, shipping companies trade closer to their NAV during healthy markets. A simple re-rating to 0.9x NAV would imply a ~22% upside from current levels purely on valuation correction.

The “Optionality” of the ₹8,000 Crore War Chest

Approximately 52% of the market cap is sitting in cash and liquid investments.

Management is intentionally “waiting on the sidelines” because they believe current ship prices are too high.

If the shipping market “cracks” and asset prices drop by 20–30%, GESHIP has the “dry powder” to double its fleet at the bottom of the cycle.

Investors are currently paying almost nothing for this growth potential; you are buying the ships, and the ₹8,000 crore “expansion fund” is essentially a bonus.

The “Pure Operating” Cash Machine (20% FCF Yield)

When you strip out the surplus cash, the valuation of the actual business becomes remarkably cheap.

The fleet’s free cash flow yield net of cash is 19.67%.

The market is valuing the operating business at only ₹8,778 Cr. For a business that generated over ₹1,000 Cr in profit in just six months — a low multiple.

An investor is buying GEHIP at roughly 4x operating earnings.

4. Specific Sector Catalysts (Crude Tanker Tightening)

Guidance in Nov 2025 turned significantly more bullish on the crude segment.

The unwinding of OPEC production cuts and new sanctions on major Russian exporters (Rosneft/Lukoil) are creating a “scramble for cargoes.”

Since 100% of GE Shipping’s crude tankers are in the spot market, they are perfectly positioned to capture any sudden spikes in Suezmax and VLCC rates in H2 FY26. This provides an earnings “kicker” that isn’t yet priced into the stock.

The USD Upside

Stock provides a natural hedge against a weakening Rupee and global volatility.

GE Shipping is a “Net Dollar Long” company. Every time the Rupee falls, the value of the company’s ships and its USD cash balance increases in INR terms, automatically pushing the NAV higher

GESHIP is an opportunity for a patient, value-oriented investor.

You are being paid a 2.6% dividend to wait for the market to either (A) recognize the true value of the ships or (B) provide a crash that allows management to deploy their massive cash pile to buy assets at a discount.

8.3 Risk at Current Valuation

While the stock has a high “margin of safety” due to its cash, these five risks could negatively impact the share price or long-term returns:

The “Cash Drag” and ROE Risk (Strategic Risk)

GE Shipping is holding ₹8,121 Crore in liquid assets (over 50% of its market cap).

Management is being extremely conservative, waiting for a “market crack” to buy ships. If shipping rates and asset prices stay high for the next 2–3 years, the company will continue to earn only ~7–8% on its cash in bank deposits while its competitors earn 15–20% on active vessels.

This results in a significantly lower Return on Equity (ROE). An investor might see the stock “stagnate” while the rest of the shipping sector rallies, simply because the company is under-invested.

Extreme Spot Market Volatility (Operational Risk)

100% of its crude tankers and 80-90% of its dry bulk fleet exposed to the spot market.

Unlike companies with long-term fixed contracts, GE Shipping’s revenue is reset every few weeks based on global demand. If OPEC+ production cuts are extended or global oil demand drops due to a recession, the company’s earnings could fall off a cliff within a single quarter.

In May 2025, management admitted they were expecting a “winter recovery” in tankers that never happened, showing how even experts can be caught off guard by spot market weakness.

The “Unwinding of Inefficiencies” (Geopolitical Risk)

Current shipping rates are artificially high due to global disruptions (Red Sea rerouting, Russian sanctions).

If the Russia-Ukraine conflict ends or the Red Sea becomes safe for transit again, ships will return to shorter, more efficient routes. This “unwinding” would effectively increase the global supply of ships without a single new vessel being built.

A sudden resolution of the Red Sea crisis would likely cause a sharp, double-digit correction in global shipping rates, hitting GESHIP’s spot-heavy portfolio the hardest.

Fleet Aging and Regulatory Pressure (Asset Risk)

The company’s fleet is aging, with an average age of ~15 years.

Older, less fuel-efficient ships may soon face port penalties, higher taxes, or be outright banned by top-tier charterers.

While the company is using a “switch strategy,” they are replacing 20-year-old ships with 10-year-old secondhand ones. They are not investing in newbuild “eco-ships,” which may leave them at a technological disadvantage if the industry shifts rapidly toward green fuels.

“Lumpy” Offshore Expenses (Short-term Earnings Risk)

In the November 2025 call, management issued a specific warning about the Offshore (Greatship) segment.

They anticipate “lumpy mobilization expenses” in Q3 and Q4 FY26. These are the high upfront costs of preparing rigs and vessels for new contracts.

Even if the shipping side performs well, these “lumpy” costs could lead to disappointing quarterly net profit numbers in the short term, which might trigger a sell-off by traders who do not understand the long-term nature of offshore contract cycles.

Asset Price Overvaluation (Impairment Risk)

Management already took a ₹70 Crore write-down (impairment) on three product tankers in May 2025.

Management noted that asset prices for tankers are currently at “historically high” levels. If the company finally decides to deploy its ₹8,000 Crore cash pile to buy ships and the market corrects shortly after, the company will be forced to take massive non-cash impairment hits on the P&L, destroying book value.

Biggest Risk — Opportunity Loss

While the stock is “cheap” net of cash, the primary risk is time. If you buy today, you are betting that management is correct to wait for a cyclical correction in the market value of secondhand ships. If a correction doesn’t come, your capital is essentially stuck in a low-yield bank account managed by a shipping company.

Previous Coverage of GESHIP

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer