GE Shipping FY25 Results: Earnings Dip, But Stock Trades at 30% NAV Discount

Despite a flat FY26, GESHIP offers deep value—0.69× P/B, 18% FCF yield, and 42% of market cap in cash—providing downside protection and re-rating potential

1. Shipping Company

greatship.com | NSE: GESHIP

Business Segments

🚢 Shipping Business (Core Segment)

Fleet Composition (as of Mar 31, 2025):

Crude Tankers: 5 vessels (~0.69 Mn DWT) – Suezmax & Aframax

Product Tankers: 17 vessels (~1.05 Mn DWT) – Primarily MRs

Dry Bulk Carriers: 12 vessels (~1.12 Mn DWT) – Supramax & Capesize

LPG Carriers: 4 vessels (~0.19 Mn DWT) – All time-chartered

🛢️ Offshore Business (via 100% subsidiary Greatship India Ltd)

Asset Base:

4 Jack-up Drilling Rigs

18 Support Vessels (PSVs, AHTSVs, MPSVs, ROVSVs)

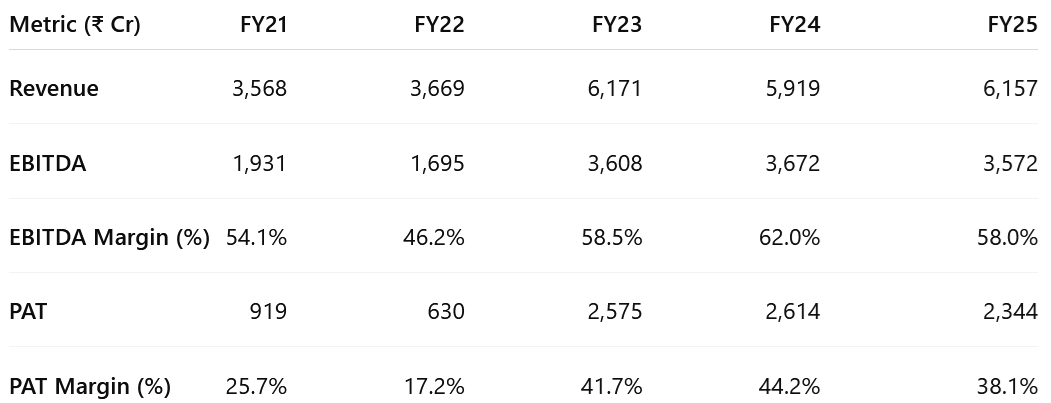

2. FY21-25: PAT CAGR 31% & Revenue CAGR 14%

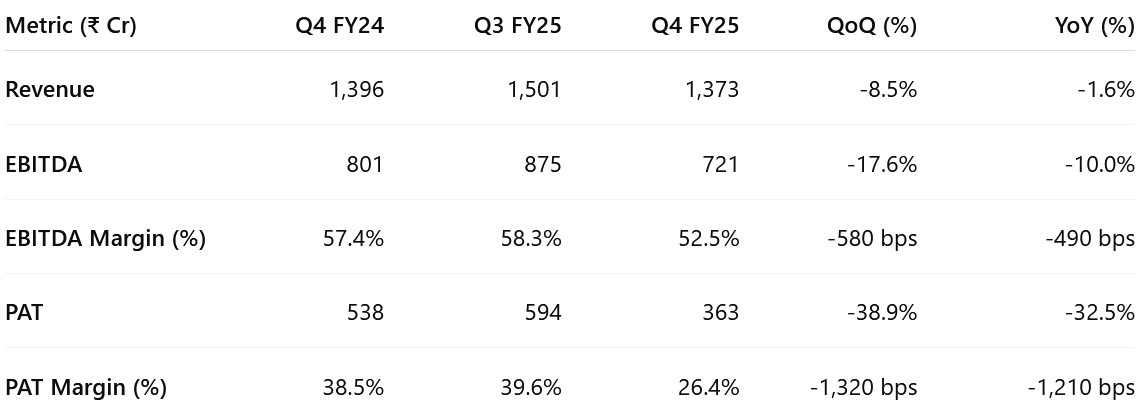

3. Q4-25: PAT down 33% & Revenue down 2% YoY

PAT down 39% QoQ & Revenue up 9% QoQ

QoQ Decline: Revenue and EBITDA softened sequentially as tanker spot rates stayed subdued; PAT fell ~39% QoQ.

YoY Drop: Earnings normalised from a strong Q4 FY24 base (Red Sea disruption peak, rerouting-driven rates).

Margins: EBITDA and PAT margins remain healthy but off peak — cost controls and LPG time charters provided some cushion.

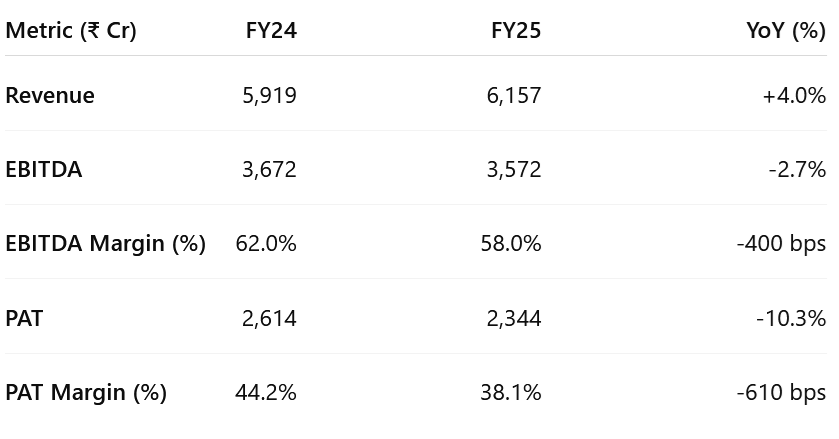

4. FY-25: PAT down 10% & Revenue up 4%

FY25 was a year of steady execution, cash preservation, and capital discipline, though earnings pulled back from FY24 highs. While the supernormal profit phase normalized, GE Shipping stayed resilient — positioning itself for counter-cyclical growth when valuations turn attractive.

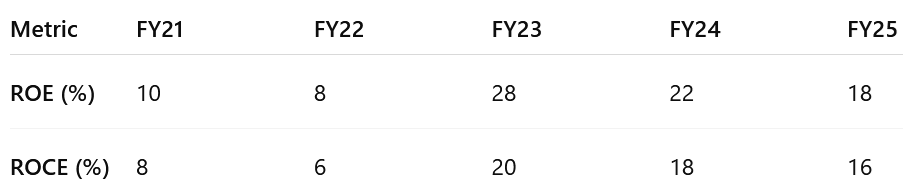

5. Business Metrics: Muted Return Ratios

Strong capital discipline and fleet optimization strategy

FY23 Upcycle Peak: High spot rates (post-Ukraine, Red Sea) and strong operating leverage from an owned fleet with minimal capex.

FY24–25 Normalization: Returns moderated but remained strong due to cost control, stable LPG charter income, and a net cash balance sheet.

6. Outlook: 60% Growth in FY26 with 50 bps margin expansion

6.1 FY-25 Expectations vs Performance — GE Shipping

✅ Hits in FY25

Resilient Revenue Growth: Revenue rose despite lower tanker rates — showing portfolio diversification (LPG, dry bulk).

Strong Cash Flows & Net Cash Position: Maintained >₹5,800 Cr net cash; conservative balance sheet enabled dividend continuity and capex flexibility.

Stable EBITDA: Despite market headwinds; margins held at 58%.

LPG Segment Support: All 4 LPG vessels on long-term charters delivered consistent, high-quality cash flows amid volatile tanker markets.

Efficient Capital Deployment: Avoided high-priced vessel purchases; took impairment hits conservatively; stayed patient on capital allocation.

Offshore Repricing Visibility: Secured 2 short-term contracts post-monsoon and 1 long-term ONGC contract — improving utilization outlook for FY26.

❌ Misses in FY25

PAT Decline: Lower spot tanker earnings and one-time asset impairments.

Earnings Normalization: End of FY23–24 supercycle peak.

Impairment on MR Tankers: ₹70 Cr write-down on 3 recently acquired product tankers due to falling asset prices.

No Major Asset Expansion: No accretive vessel additions despite healthy cash — impact of high secondhand prices and limited distress opportunities.

Tanker Rate Weakness: Crude and product tankers saw 30–40% YoY rate declines; Red Sea premium faded faster than expected.

6.2 Outlook for FY26 — GE Shipping

FY26 likely to be a consolidation year — stable operations, modest earnings visibility, and margin defense driven by LPG and offshore.

Shipping Business

Crude Tankers 🔄 Stable to Slightly Positive

Supported by long-haul Atlantic trade (US, Brazil, West Africa); volatility from Red Sea/Panama remains a tailwind.

Product Tankers 🔻 Soft

MR/LR2 segment faces pressure from orderbook and refinery self-sufficiency in Asia & Africa.

LPG 🔒 Stable

All 4 vessels on long-term charters → full revenue visibility.

Dry Bulk 🔼 Moderately Positive

Minor bulks (bauxite, alumina) and fleet supply tightness support earnings. Coal/iron ore may stay subdued.

Offshore (Greatship India)

3 rigs to operate in FY26:

2 short-term deployments post-monsoon

1 ONGC long-term contract starts Q4 FY26

1 rig remains active since FY25

Full-year contribution likely from Q3 onward, improving margins and utilization.

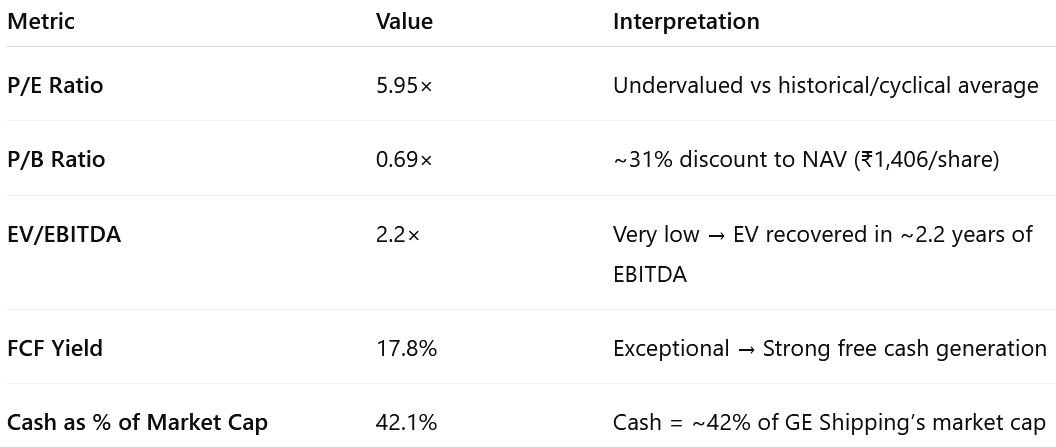

7. Valuation Analysis — GE Shipping

7.1 Valuation Snapshot

With cash equal to 42% of its market cap, EV/EBITDA at 2.2×, and FCF yield near 18%, GE Shipping offers rare value:

The stock is asset-backed, cash-rich, and earnings-capable.

Yet, it trades at levels that imply zero growth and no credit for future upside from offshore, freight volatility, or capital deployment.

7.2 What’s in the Price?

Stable Earnings Outlook:

At 6× P/E, the market prices in that FY25-level profitability is stable with limited earnings growth.No Credit for Upside Triggers:

Valuation reflects no benefit from offshore recovery, freight market spikes, or capital deployment.Asset Value Compression:

Recent MR tanker impairments (~₹70 Cr) and softening asset prices appear fully discounted.Cash Not Valued:

Despite holding ₹5,862 Cr in net cash (~42% of market cap), the stock trades at 0.69× P/B and 2.2× EV/EBITDA — implying the market expects this capital to remain idle.Steady-State Dividend Assumed:

With a 3% yield and consistent payouts, the market prices in continuation — not escalation — of returns.

7.3 What’s Not in the Price?

Capital Deployment Optionality:

₹5,800+ Cr in net cash gives GE Shipping the flexibility to buy assets, raise dividends, or repurchase shares — none of which are factored into current valuations.Offshore Monetization:

Three rigs are scheduled to be operational in FY26, including a long-term ONGC charter — yet offshore NAV remains unrecognized.Re-rating Potential:

A shift to 8× P/E or 1× P/B (in line with global peers) implies a 35–85% re-rating from current levels.Spot Rate Optionality:

Any supply-chain disruption (Red Sea, Panama, sanctions, tarriffs etc) could spike rates — GE Shipping, with high spot exposure, stands to benefit significantly.Bulk Market Support:

Structural demand in minor bulks and an aging global fleet add rate resilience not priced in.

7.4 Risks and What to Monitor

❗ Key Risks

Tanker Oversupply: New deliveries in MR/LR2 segments could weigh on rates.

Offshore Execution Delays: Deferred redeployment or renegotiated contracts would delay earnings recovery.

Asset Depreciation: Further decline in vessel values may compress NAV and trigger impairments.

Idle Cash Drag: Undeployed capital in a high inflation environment erodes shareholder value.

🔍 What to Track

Quarterly Charter Coverage (Crude, Product, Bulk)

Rig Redeployment Timelines and Day Rates

Buyback / Dividend Actions

Geopolitical Events Affecting Trade Routes

8. Implications for Investors

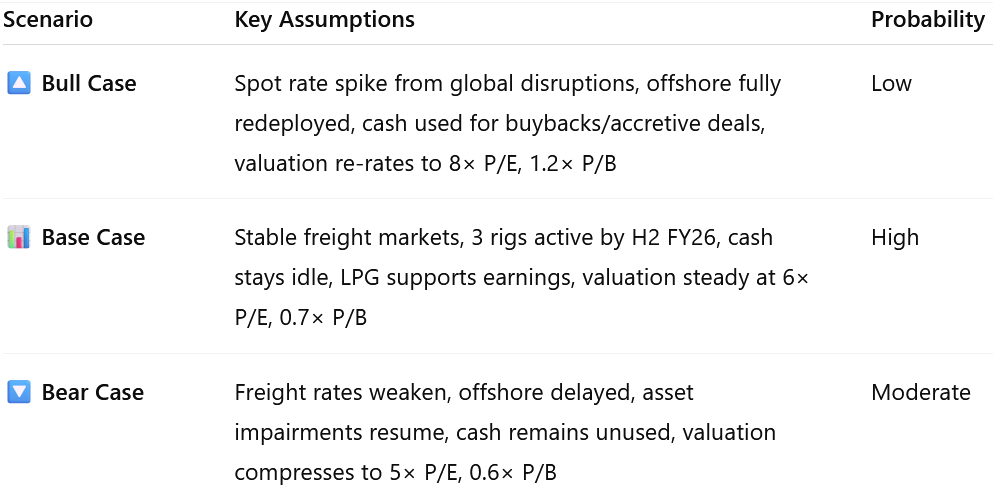

8.1 Bull, Base & Bear Scenarios — GE Shipping

8.2 Is There Any Margin of Safety?

Deep Value Metrics:

0.69× P/B, 5.95× P/E, 2.2× EV/EBITDA → all indicate underpricing of assets and earnings.Net Cash = Floor:

₹5,862 Cr in net cash (₹418/share) = 42% of market cap — a hard buffer against downside.Consistent Cash Flows:

₹2,472 Cr in FY25 FCF → 17.8% FCF yield, supporting dividend continuity and capital reinvestment.

🔐 Even in a downcycle, GE Shipping’s balance sheet strength, cash flow profile, and stable LPG income provide a durable margin of safety.

8.3 Where Is the Upside Potential?

Valuation Re-rating:

A shift to 8× P/E or 1× P/B lifts valuation by 35–85%, without needing earnings growth.Capital Levers Unused:

GE’s ₹5,800+ Cr cash pile offers optionality for buybacks, fleet additions, or higher payouts — levers the market doesn’t value today.Offshore Earnings Rebound:

3 rig deployments in FY26 will boost consolidated profitability and highlight underappreciated offshore NAV (~₹323/share).Event-Driven Upside:

Geopolitical or supply-chain shocks could reprice spot rates sharply — and GE is ideally positioned to capitalize.

📈 The upside lies in catalysts GE Shipping controls — capital, assets, execution — and external shocks it’s structurally built to benefit from.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer