Garware Hi-Tech FY25 Results: PAT Up 63%, FY26 Revenue Growth at ~20% with Stable Margins

Strong export mix and high-margin VAP portfolio support earnings momentum. FY27 outlook hinges on TPU margin gains, ₹3,000 Cr revenue path, and U.S. tariff impact.

1. Value Added Specialty Films manufacturer

garwarehitechfilms.com | NSE: GRWRHITECH

2. FY21–25: PAT CAGR of 27% & Revenue CAGR of 20%

Strong Revenue and Profit Growth: Driven by a strategic shift to high-margin specialty films.

Operating Leverage in Action: FY25 PAT margin jumped to 15.7%—the highest in five years—while EBITDA margin recovered to 23.5% on the back of better product mix and scale.

Value-Added Products (VAP): Now 87% of total revenue, VAP drove margin expansion and improved working capital efficiency.

Global Focus: 77% of revenues in FY25 came from exports, with strong positioning in premium PPF and SCF segments.

3. Q4 FY25: PAT up 35% & Revenue up 23% YoY

PAT up 28% & Revenue up 17% QoQ

Robust Revenue Growth: Strong volume growth in both domestic and international markets

EBITDA Performance: Aided by better fixed cost absorption and richer product mix in SunControl and PPF films.

Margin Accretion: Impact of higher value-added product (VAP) share and strong pricing power.

Segment Insights:

SunControl Films: Continued strength in architectural films and export momentum.

PPF: Healthy demand in both premium OEM and retail D2C channels; new variants seeing traction.

Domestic Push: Strong performance in Tier 2/3 cities via the expanding GAS network and e-commerce sales.

4. FY25: PAT up 63% & Revenue up 26% YoY

Revenue exceeded the FY25 guidance of Rs 2,000 cr, showing robust delivery

Margin Expansion driven by a higher VAP mix (87%) and operating leverage in SCF & PPF.

PAT Outperformance: PAT grew faster than revenue and EBITDA, signaling improving working capital discipline and cost controls.

Stable Global Demand: Export share remains strong at 77% of FY25 revenue, with North America, Europe, and Middle East driving volumes.

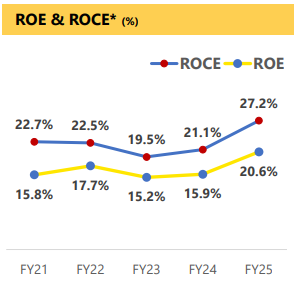

5. Business Metrics: Capital-Efficient Growth with Rising Return Ratios

Stable ROE >20%: Despite ₹650 Cr in cash, ROE remained strong on sustained profitability.

Zero Net Debt: ₹650 Cr cash surplus gives flexibility for future growth.

FY25 ROCE Drivers:

Improved asset turns via better SCF & PPF utilization

VAP share at 87%, boosting margins and returns

Tight working capital: 7-day collections, 2.9x NWC turnover

Outlook:: ROCE to remain strong in FY26–27, with ROE improving as internal cash funds new capacity.

6. Outlook: 22% Revenue CAGR for FY25-27

6.1 Garware Hi-Tech Films – FY25: Guidance vs Actuals

Hits: Delivered across key metrics — revenue, margins, PAT, global sales, and capital efficiency — with strong execution and product diversification.

Misses: None significant in FY25. FY26 delivery hinges on timely ramp-up of new PPF capacity and managing geopolitical/export headwinds.

Watchlist: Continued monitoring of U.S. tariff changes, cost of TPU feedstock, and performance in India architectural market rollout.

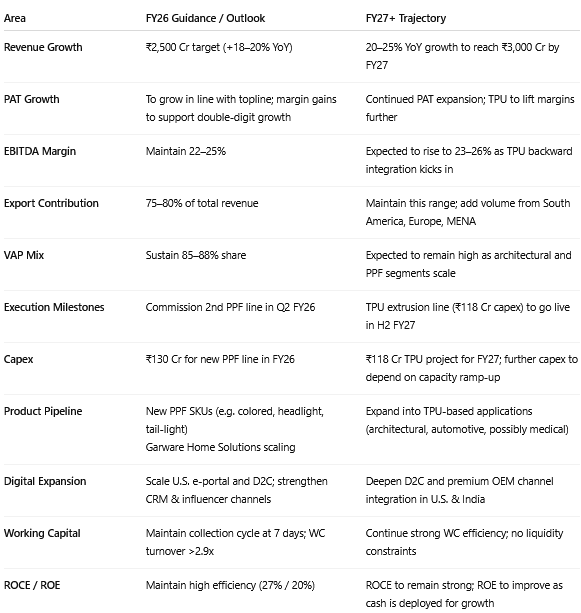

6.2 Garware Hi-Tech Films – FY26–FY27+ Management Guidance

FY26 Execution Focus:

Achieve ₹2,500 Cr revenue via full-year contribution from new PPF line

Sustain 23%+ margins and zero-debt status

Scale domestic architectural presence via GAS and Home Solutions

FY27 Growth Drivers:

₹3,000 Cr revenue goal built on 20–25% CAGR

TPU capacity (from Oct FY27) to reduce raw material dependence and boost margins by 150–200 bps

Strategic R&D to push Garware into new high-margin verticals using TPU

Geographic diversification to cushion U.S. exposure

7. Valuation Analysis

7.1 Valuation Snapshot

7.2 What’s Priced In

Garware’s current valuation — P/E ~29.5x, P/B ~3.8x, EV/EBITDA ~18.1x — reflects investor confidence in the following:

20–25% Growth Visibility: FY26 revenue guidance of ₹2,500 Cr appears embedded in the price, especially after FY25 execution beat.

Premium Margin Profile: Sustained EBITDA margin of 22–25% from a high-VAP portfolio is assumed to continue.

Strong ROCE / ROE: ROCE at 27.2% and ROE at 20.6% support premium multiples and suggest efficient capital use is priced in.

Debt-Free Balance Sheet: ₹650 Cr in cash and zero net debt give the company financial flexibility — a feature embedded in market confidence.

Execution Track Record: Consistent growth across PPF and SCF, with expansion into D2C and architectural segments, signals credibility in delivery.

Defensive Moat: Dominance in niche, premium product categories (PPF, architectural SCF) with proprietary tech and global brand presence (Global, Garware) supports valuation.

7.3 What’s Not Priced In

Despite rich valuation, the market may not have fully priced in the following upside drivers:

TPU Margin Tailwinds (FY27 Onward): TPU line (₹118 Cr capex) could lift consolidated EBITDA margin by 150–200 bps, starting H2 FY27 — this benefit is not reflected in current multiples.

₹3,000 Cr Revenue Potential: Street has likely priced in FY26 (₹2,500 Cr), but not full scaling of new capacities to ₹3,000 Cr in FY27. If realized with margin hold, re-rating is possible.

Garware Home Solutions: Entry into B2C architectural film applications for residential use opens a new vertical — early-stage but underappreciated.

D2C/E-Commerce Leverage: U.S. e-portal launch is gaining traction; if volumes grow meaningfully, it may expand margins via better unit economics.

Geographic Expansion: Growing distributor network in Middle East, Africa, and Europe could diversify risks and accelerate export-led topline.

Premium OEM Penetration: Strategic tie-ups with premium car brands or white-labeled OEM business can structurally boost PPF volumes.

Re-rating on Consistency: If Garware continues to deliver clean execution, zero-debt growth, and 20%+ ROE with expanding TAM, current valuation may look conservative.

8. Implications for Investors: What to Watch

8.1 Bull, Base & Bear Case Scenarios

Tariff Impact Summary:

Bull Case assumes Garware offsets tariffs via D2C in U.S., European volume growth, and pricing power.

Base Case factors in partial margin compression but no revenue loss.

Bear Case assumes U.S. share declines materially or pricing is hit, delaying path to ₹3,000 Cr topline and impacting earnings growth.

8.2 Why Investors May Want to Stay Invested or Add to Garware Hi-Tech Films

A. Robust Growth Visibility

Management has guided for ₹2,500 Cr revenue in FY26, with visibility into ₹3,000 Cr by FY27.

Capacity-led growth from the second PPF line (Q2 FY26) and TPU integration (FY27) supports margin and topline expansion.

Strong export mix (77%) and VAP contribution (87%) underpin durable volume and pricing power.

B. Earnings-Led Valuation Comfort

Trading at ~29.5x TTM P/E and ~18.1x EV/EBITDA — premium justified by 25% EPS CAGR, zero net debt, and 20%+ ROE.

If earnings compound as guided, P/E could compress to 18–20x by FY27, offering re-rating potential.

C. High Capital Efficiency

FY25 ROCE at 27.2% and ROE at 20.6% highlight effective capital deployment.

₹650 Cr cash reserves and no debt provide flexibility for reinvestment or shareholder payouts.

D. Execution Track Record

Garware has consistently delivered on both topline and margin guidance — beating FY25 targets across revenue, PAT, and margin.

Successful scale-up of SCF, PPF, and emerging D2C/U.S. channels reinforces investor confidence.

E. Optionality from New Verticals

New ventures like Garware Home Solutions and TPU-based product lines could open high-margin verticals (e.g. architectural, automotive interiors, possibly medical films).

These initiatives are not fully priced into current valuations but could contribute meaningfully by FY27.

F. Strategic Flexibility in Global Markets

D2C presence in the U.S., growing distributor base in MENA, EU, and East Africa offer geographic de-risking.

Backward integration via TPU reduces raw material dependency and enhances margin resilience.

8.3 Risks Not Fully Discounted

While the outlook remains bullish, several risks are underappreciated in current valuations:

U.S. Tariff Overhang: Although management downplayed the impact of the recent 10% tariff increase, uncertainty persists beyond the July review. The U.S. forms ~48% of revenue, and any escalation could disrupt volumes or pricing.

Management View: Garware believes its fully backward-integrated model, high quality, and diversified global reach provide insulation. It is also pursuing alternate distribution models (D2C, white labeling, Europe/MENA ramp-up) to mitigate risks.

Conversion Uncertainty: Scaling from guidance to ₹3,000 Cr by FY27 assumes strong uptake of new PPF capacity and architectural rollout, which may take time to ramp.

Execution Dependency: Any delay in commissioning the second PPF line or the TPU line (H2 FY27) could defer margin and volume gains.

Overseas D2C Scalability: Success of Garware’s U.S. e-commerce channel is early-stage and lacks long-term proof of traction.

New Segment Risk: Entry into Garware Home Solutions and future TPU-based categories (e.g., medical films) lack historical benchmarks and may face scale/execution challenges.

Competitive Intensity: Korean and domestic players may enter aggressively in SCF/PPF, putting pressure on pricing or channel strength.

Macro & Currency Exposure: As a major exporter, Garware remains sensitive to geopolitical instability, rupee appreciation, or regulatory shifts in key markets.

8.4 Investor Segmentation Outlook – Garware Hi-Tech Films

Previous Coverage of GRWRHITECH

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer