Garware Hi Tech Films: PAT growth of 74% & revenue growth of 27% in 9M-25 at a PE of 29

Revenue CAGR of 22% guidance for FY24-27. Margins to be stable at 25% (+/- 3%). Margins to expand by 1.5-2% from FY27. GRWRHITECH expecting strong cash flows from the growth till FY27

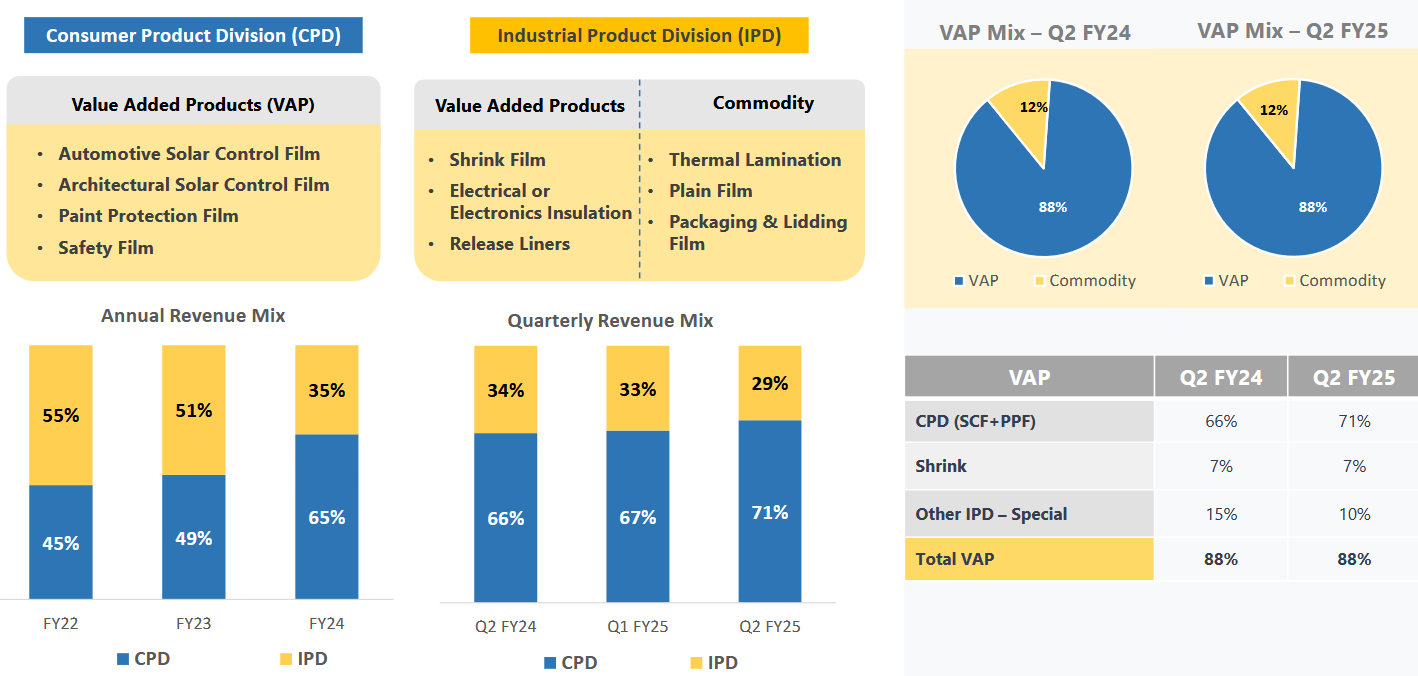

1. Polyester + specialty film manufacturer

garwarehitechfilms.com | NSE: GRWRHITECH

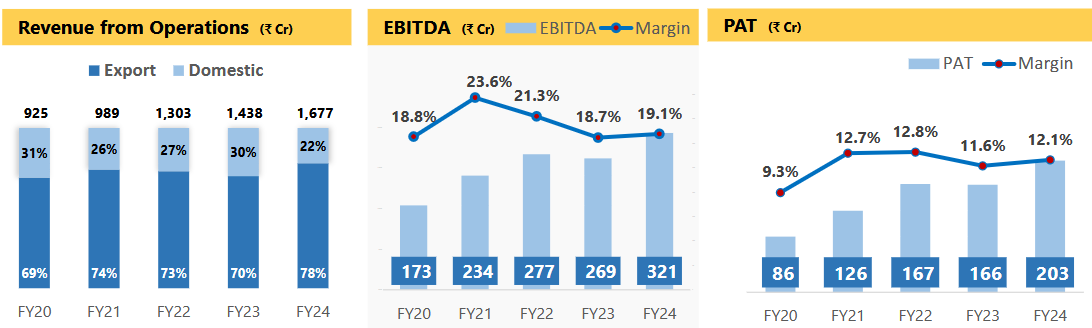

2. FY20-24: PAT CAGR of 34% & Revenue CAGR of 21%

3. FY24: PAT up 22% & Revenue up 17% YoY

4. Q3-25: PAT up 9% & Revenue up 3% YoY

5. 9M-25: PAT up 74% & Revenue up 27% YoY

6. Business metrics: Improving return ratios

7. Outlook: 22% Revenue CAGR for FY25-27

i. Revenue CAGR of FY24-27 of 20%+

The guidance translates into 20%+ yoy growth in FY25,FY26 and FY27

FY25: And into -- if you see the 9-month results, we are on course to cross like I won't mention the number, but the INR2,000 crore plus guidance was more or less given

FY26: So the guidance given for FY '26 was INR2,500 crores. That -- we maintain the same guidance. I mean, we definitely meet that.

FY27: We expect a top line growth of 20% to 25% on top line

ii. EBIDTA margin of 25% (+/- 3%) with expansion in FY27

TPU Extrusion Line which will provide backward integration for PPF (Paint Protection Films), supports new R&D and new product lines with expected completion in October 2026 would drive margin expansion in FY27

Target EBITDA Margin: The company aims to maintain an EBITDA margin of 25% (+/- 3%).

FY25: But if you see 9-month numbers, we are still at 24%, which is a very healthy sign as compared to the past. And Q4, we expect to maintain these kind of numbers. So we are really well on course

FY27: We expect around 1.5% to 2% improvement in the gross margin -- operating margins.

8. PAT growth of 74% & Revenue growth of 27% in 9M-25 at a PE of 29

9. Hold?

If I hold the stock then one may continue holding on to GRWRHITECH.

Based on 9M-25 performance one can look forward to a strong FY25 providing a reason to continue with GRWRHITECH.

Our strategic initiatives and diversified product offerings have allowed us to navigate these seasonal factors effectively, ensuring that our financial outlook and the guidance remains unchanged.

GRWRHITECH management is indicating that it it will end FY25 strongly with a strong Q4-25

Q4-25: On quarter-on-quarter basis, will be a very strong growth. And there will be a strong growth as Y-o-Y basis also

GRWRHITECH is guiding for a 20%+ growth till FY27 with stable margins. One can continue as long as the business is executing on 20%+ growth trajectory.

10. Buy?

If I am looking to enter GRWRHITECH then

GRWRHITECH has delivered PAT growth of 74% & Revenue growth of 27% in 9M-25 at a PE of 29 which makes valuations reasonable in the short term.

GRWRHITECH has a given a guidance for 20%+ revenue CAGR for FY24-27 at a PE of 29 makes valuations look reasonable from a longer term perspective.

GRWRHITECH delivered Rs 191.96 cr of free cash flow against a market cap of Rs 9,083.87 cr. It is available on a free cash flow yield of 2.1% (not annualized) which makes the valuations reasonable.

GRWRHITECH the ability to deliver strong cash flows and with a cash surplus of Rs 572 cr which is 6% of its market cap adds a safety cushion to the valuations.

Our financial position remains strong and we are pleased to report that we have a cash surplus of INR572 crores as of 31st December, 2024.

Given our strong cash flows, we will fund expansions through internal accruals.

At a PE of 29, the margin of safety is dependent on the execution against the guidance of delivering 20%+ revenue CAGR till FY27 and the stock may react if execution is not in line.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Sir what is the impact of Trump tarrif on the company (Garware Hi Tech films)

Negative for their US business. Negative for the overall business as US contributes 50% of overall business.

However if you read the management commentary in the Q3 earnings call they are claiming that in the worst case scenario they will be able to handle it. Let's see if the management can deliver on what they have said in the Q3 earnings call