Ganesh Housing FY25 Results: PAT Up 30%, FY26 PAT Growth at 20–30%; ₹10 K Cr Free Cash Flow Visibility Over 10 Years

Strong margin profile, net-debt-free growth, and SEZ leasing momentum position Ganesh Housing as a high-visibility compounder through FY26 and beyond

1. Real Estate Developer

ganeshhousing.com | NSE: GANESHHOUC

2. FY21-25: Profitable from FY22; Revenue CAGR of 55%

2.1 Business Growth: Revenue Grows 5.5x in 5 Years

Growth reflecting strong project execution and monetization of its premium land bank in Ahmedabad.

2.2 Why Are Ganesh Housing’s Margins So High?

Owns ~500 acres in Ahmedabad, mostly acquired at low historical cost

Minimal land acquisition cost results in structurally high gross margins

FY25: ~₹200 Cr revenue from land sales at nearly 100% gross margin

SEZ projects like Million Minds to generate recurring, capital-light lease income

High margins driven by legacy land bank, zero debt, and efficient capital use

Margins may moderate as revenue mix diversifies

However, margins expected to remain above industry average with SEZ leasing starting FY26

3. Q4-25: PAT up 46% & Revenue down 7% YoY

PAT up 46% YoY to ₹165 Cr, driven by a capital-light business model and strong gross margins from land monetization.

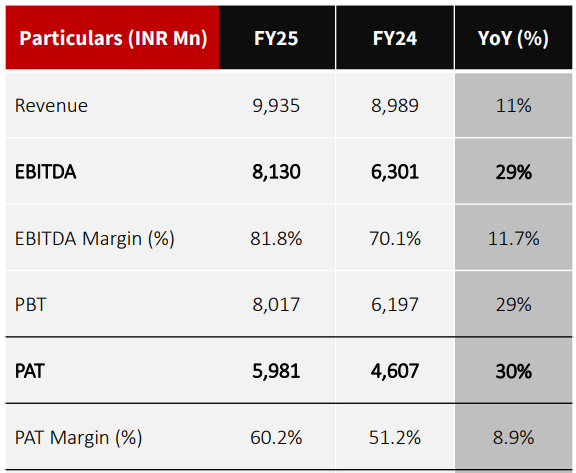

4. FY25: PAT up 25% & Revenue up 19% YoY

FY25 Guidance delivered

FY25 PAT grew 30%, just inline with 30–35% guidance given in Q3-25 earnings call

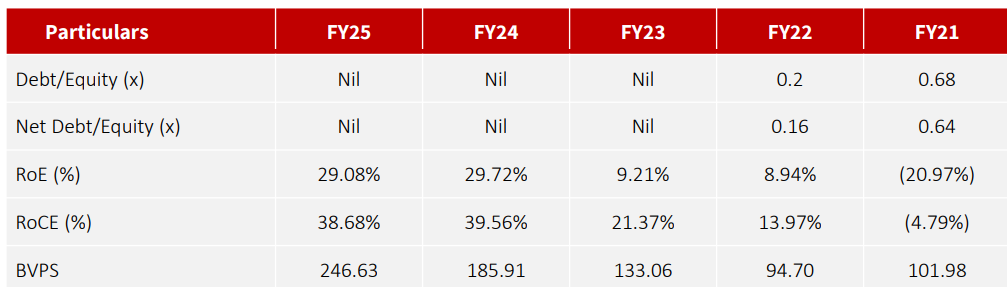

5. Business metrics: Strong return ratios

ROE rose from <10% in FY22–23 to 29.1% in FY25, driven by margin gains and efficient capital use

ROCE steady at ~39%, despite SEZ capex and land buys funded through internal accruals

Net-debt-free, asset-light model boosts returns without leverage risk

6. FY26 Outlook: 20–30% bottom-line growth

20–30% bottom-line growth and revenue to grow as SEZ leasing and Godhavi monetization kick in.

6.1 Ganesh Housing – FY25: Guidance vs. Actuals

Hits: Strong execution, sustained margins, zero leverage, and early monetization of new assets support confidence in FY26 trajectory.

Misses: No significant revenue inflection yet; leasing inflows and project launches will determine scale acceleration.

Watchlist: SEZ Phase 1 leasing conversion into actual rentals, Godhavi launch ramp-up, and timely approvals for new commercial towers

6.2 Future Outlook: FY26–FY28

A. Earnings Growth Momentum to Sustain

Management has guided for 20–30% PAT growth in FY26, after delivering 30% in FY25.

This momentum is expected to continue for the next 2–3 years, supported by:

New project launches (One Thaltej, SEZ Residential)

SEZ Phase 1 rental inflows beginning FY26 H2

Monetization of high-margin land from Godhavi and other pockets

B. Recurring Rental Income Adds a New Revenue Stream

Million Minds SEZ Phase 1: 70% of leasable area under LOIs, expected to generate ~₹72 Cr annually from FY26 H2.

SEZ Phase 2 planned for launch in FY26 adds annuity growth visibility.

Over time, Ganesh will become a hybrid developer with both sales-led and lease-driven revenue — improving earnings quality.

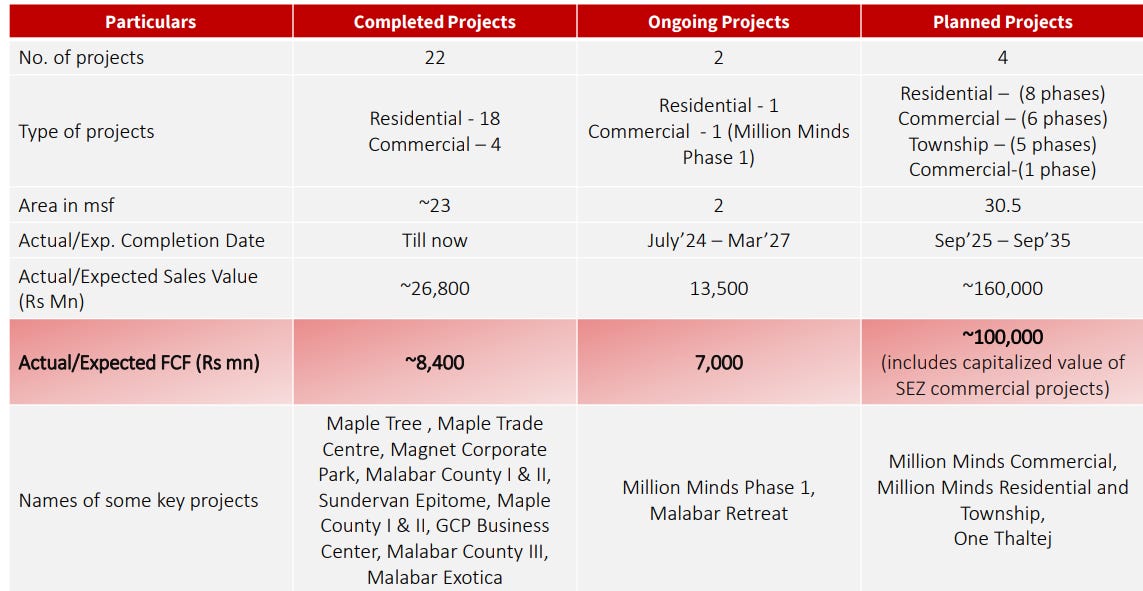

C. Project Pipeline Offers Multi-Year Visibility

Planned Projects: 30.5 msf across commercial, residential, and township formats.

Estimated Sales Value: ~₹16,000 Cr over next 8–10 years

Land Bank: ~500 acres (432 acres at Godhavi alone) ensures no dependency on external acquisition for scale.

D. Margins to Stay Structurally High

FY25 EBITDA margin was 81.8%, driven by legacy land and low execution cost.

Even with normalization, margins are expected to stay above 70%, significantly higher than sector peers.

E. Balance Sheet Strength Enables Self-Funded Growth

Net-debt-free for 11+ quarters.

₹428 Cr of FY25 capex (SEZ + land) fully funded via internal accruals.

With ₹157 Cr cash balance and high operating cash flows, future projects are likely to remain self-financed.

7. Valuation Analysis

7.1 Valuation Snapshot – Ganesh Housing (FY25 / FY26E)

Trades at modest valuation multiples despite delivering best-in-class profitability, strong return ratios, and zero leverage.

Visible free cash flow of ₹10,000 Cr over the next 10 years, and rental income beginning FY26

Stock offers meaningful re-rating potential.

7.2 What’s Priced In

A. High-Margin Business Model with Visibility

Ganesh consistently delivers EBITDA margins above 80%, driven by:

Low-cost legacy land bank

In-house execution

Capital-light expansion

While these margins are embedded in near-term valuations, the sustainability of these margins for the next decade is likely underpriced — especially as more townships and SEZ assets are monetized.

B. Free Cash Flow Durability

The company expects to generate ~₹10,000 Cr in FCF over FY25–FY35, including capitalized SEZ assets. At current market cap (~₹8,300 Cr), this implies:

~12% FCF yield annually

Deep intrinsic value support not yet reflected in pricing

This embedded value acts as downside protection but isn’t fully priced in as recurring cash flow yet.

C. ROE/ROCE Profile Signals Execution Strength

With FY25 ROE at 29.1% and ROCE at 38.7%, Ganesh demonstrates rare capital efficiency in real estate — especially without leverage. These return ratios justify premium multiples and should support long-term rerating as scale builds through leasing and high-ticket launches.

D. Balance Sheet Strength = Growth Optionality

The firm remains net-debt-free, having funded ₹428 Cr of capex in FY25 (land + SEZ) entirely from internal accruals. This:

Enhances investor confidence

Enables self-funded expansion

Reduces dilution risk — a key concern with peers

E. Execution & Pipeline Visibility

Ganesh has delivered 23 msf of completed projects and is executing another 2 msf, with 30.5 msf in the pipeline (₹1.6 lakh Cr sales value potential). Major near-term drivers like:

SEZ Phase 1 leasing (₹72 Cr rental/year)

Godhavi township monetization

One Thaltej launch

...are expected to drive revenue visibility and investor re-rating, but may not yet be fully embedded in current multiples.

7.3 What’s Not Priced In

A. SEZ Leasing Becoming an Annuity Engine

Phase 1 of Million Minds IT SEZ (0.85 msf leasable) is nearing completion, with 70% space under LOIs.

Rental realization of ₹70–75/sq.ft/month implies annual lease revenue of ₹70–₹72 Cr.

Leasing starts Q3 FY26 onward but the market is yet to treat Ganesh as a hybrid developer with stable annuity income.

Valuation doesn’t yet reflect REIT-like recurring cash flows from commercial leasing.

B. ₹16,000 Cr Sales Pipeline with ₹10,000 Cr FCF Potential

The company has visibility on 30.5 msf of planned projects to be monetized over the next decade.

Estimated FCF of ₹10,000 Cr over FY25–FY35 provides significant intrinsic value tailwind.

Current market cap (~₹8,300 Cr) implies that long-term FCF is not fully capitalized, despite full land ownership.

The market is likely valuing only 1–2 years of earnings, not the full land-backed development cycle.

C. Township Upside from Godhavi

Ganesh holds 432 acres in the Godhavi region, one of Ahmedabad’s fastest-developing zones.

Only 18 acres monetized in FY25; broader roll-out expected in FY26–FY27.

Management commentary suggests plotted + bulk developer sales to unlock value progressively.

This land alone could contribute ₹5,000 Cr+ in revenue over 7–10 years.

D. Optionality from Commercial Expansion

Upcoming launch of One Thaltej (1.8 msf commercial) in FY26, positioned as a high-end, premium-grade asset.

Could become a flagship asset in Ahmedabad's CBD and drive leasing or presale traction.

Management has indicated interest in increasing leasing-led projects with global tenants and Tishman Speyer support.

No commercial optionality is baked into valuations yet.

E. Potential for Valuation Re-Rating

Ganesh trades at 1.18x MCap-to-Sales and ~10x EV/EBITDA, well below peers with weaker balance sheets.

As annuity income scales and PAT becomes more predictable, P/E multiples could expand toward 18–20x.

Any rerating would be FCF-justified, not just sentiment-led.

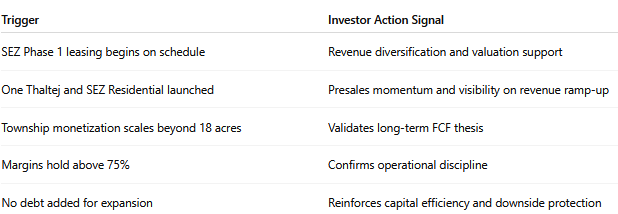

8. Implications for Investors: What to Watch

8.1 Bull, Base & Bear Case Scenarios

In the bull case, Ganesh transitions into a high-margin, annuity-plus-sales model with valuation re-rating.

The base case assumes stable growth, efficient use of land bank, and steady leasing.

The bear case reflects slower monetization, SEZ delays, or township demand weakness — which could cap upside despite margin strength.

8.2 Why Investors May Want to Stay Invested or Add to Ganesh Housing

A. Strong Earnings Visibility

FY26–FY28 growth to be driven by SEZ leasing, Godhavi township monetization, and high-margin project launches.

₹10,000 Cr FCF potential over the next decade underpins long-duration cash flows.

B. Capital-Efficient Growth

Net-debt-free, internally funded growth with FY25 ROE at 29.1% and EBITDA margin over 80%.

No dilution risk and ample capacity to scale organically.

C. Valuation Still Attractive

At ~13.9x P/E and 1.18x MCap-to-sales, valuation does not fully capture leasing annuity or ₹1.6 lakh Cr project pipeline.

Rerating likely as annuity revenues kick in and execution milestones are met.

8.3 Key Risks & What to Monitor

A. SEZ Leasing Execution Risk

70% of leasable area in Phase 1 is under LOIs, but conversion into binding leases and timely rental commencement (Q3 FY26) is critical.

Any delays in fit-outs, approvals, or tenant onboarding may defer annuity inflows.

B. Project Launch & Approval Delays

Major revenue triggers like One Thaltej and SEZ Residential are expected in FY26.

Delays in RERA approvals, municipal clearances, or market conditions could defer launch timelines and presales.

C. Township Monetization May Be Gradual

While Godhavi holds ~432 acres, actual monetization depends on market absorption, infrastructure support, and developer demand.

Early-phase bulk sales may not reflect sustained traction unless pricing and segmentation align with buyer interest.

D. Margin Normalization Risk

Current EBITDA margin (81.8%) is driven by low land cost. As the land bank is gradually monetized and replenishment begins, future margins may taper toward 65–70%.

This could impact valuation multiples if not offset by scale or leasing ramp-up.

E. Geographic Concentration

The entire project pipeline is concentrated in Ahmedabad, which, while growing, exposes the company to regional real estate cycles, regulatory shifts, or demand fluctuations.

F. Valuation Catch-Up Depends on Execution

Although the stock trades at reasonable multiples, a meaningful re-rating hinges on delivery of leasing, launches, and FCF realization.

Any delays in these execution drivers could flatten return expectations despite high ROE/ROCE.

8.3 What to Watch (FY26–FY27)

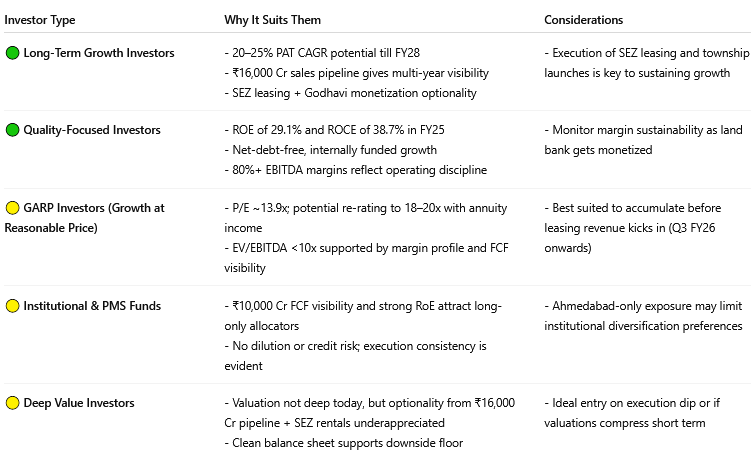

8.4 Investor Segmentation Outlook – Ganesh Housing

Ganesh is transitioning from pure land monetization to a high-margin, capital-efficient, annuity-backed developer

Could deliver 25–30% EPS CAGR over the next 3 years if execution and leasing stay on track

₹10,000 Cr in expected free cash flow is not yet fully priced into the stock

SEZ rentals add a stable income stream, diversifying revenue beyond sales

Market may re-rate as SEZ leasing starts and presales ramp up in FY26–FY27

Previous coverage of GANESHHOUC

Got Feedback on This Analysis? Let Us Know at hi@moneymuscle.in

Read the Full Disclaimer (Important)