Ganesh Housing Corporation: PAT growth of 25% & Revenue growth of 19% in 9M-25 at a PE of 24

30-35% PAT growth guidance in FY25 with high margins. GANESHHOUC owns the land bank purchased at low prices. Rs 10,800 cr free cash flows expected in the next 10 years.

1. Why is GANESHHOUC interesting?

ganeshhousing.com | NSE: GANESHHOUC

The company is capitalizing on strong market conditions, leveraging its extensive land bank, and achieving impressive financial results driven primarily by land sales, with project sales and rental income slated to become more significant in the coming years. They are focused on the mid-to-premium housing segment and commercial spaces, primarily within Ahmedabad, and are experiencing high demand for their developments.2. Real Estate Developer

3. FY20-24: Back in profit from FY22 with Revenue CAGR of 34%

4. FY24: PAT up 351% & Revenue up 45% YoY

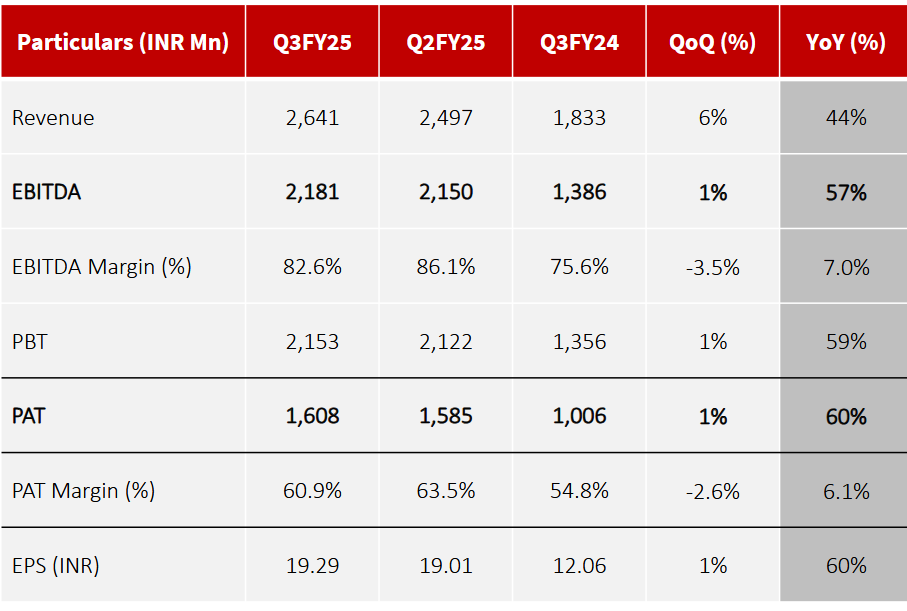

5. Q3-25: PAT up 60% & Revenue 44% YoY

Land sales in Q3: approximately 25-26 acres were sold, resulting in a revenue of 90% of the total.

6. 9M-25: PAT up 25% & Revenue up 19% YoY

7. Business metrics: Strong & improving return ratios

8. Outlook: Strong guidance for free cash flow (FCF)

Rs 10,860 cr of free cash flow expected in the next 10 years on a current market cap of Rs 11,614 cr

i. PAT growth of 30-35% in FY25

This robust performance positions us well to exceed our projected 30 to 35% PAT growth for FY25

ii. EBITDA Margins are sustainable

The exceptionally high margins are a factor of historically low land acquisition costs which are now being sold at current high market rates. It is able to achieve higher margins than competitors as it typically develops projects on land it has historically acquired at lower cost.

"We would have competitive edge over other developers because generally we we tend to develop projects only on the land which we historically own."

iii Solid land bank

Ganesh Housing has a substantial land bank of 535 acres, fully paid for, forming a cornerstone of its strategy.

"total land bank we have in Ganesh housing and subsidiary and which are fully paid around 535 acres of land and this land is fully paid for and fully account for"

They are actively seeking new land acquisitions in high-potential areas. The company engages in both land sales and development, with a flexible approach based on market conditions and the potential for profitability.

"We actually look at saying that whether it makes better sense to develop that piece of land or it makes sense to sell it off. We are getting a good price and sometimes the latter wins over development. That's where we sell."

iv. Transition from land sales to more project-based revenue streams

Ganesh Housing Corporation Limited is exhibiting strong performance and significant growth within the Ahmedabad real estate market. The company is well-positioned to capitalise on current trends and looks to transition to more project-based revenue streams over the coming years. The extensive land bank and debt-free position provide a robust foundation for sustainable growth and shareholder value creation. The company is focussed on the Ahmedabad area, and has a strong grip on the residential, commercial and SEZ spaces in the city.

9. PAT growth of 25% & Revenue growth of 19% in 9M-25 at a PE of 24

10. Hold?

If I hold the stock then one may continue holding on to GANESHHOUC

Based on 9M-25 performance GANESHHOUC looks on track to deliver as per the management guidance of 30-35% PAT growth and deliver a strong FY25.

The outlook for revenue in FY26 is strong. GANESHHOUC is expecting revenue and rental income from the million minds commercial project, with lease rentals expected to reach approximately ₹70 crores in FY26.

we may be able to get a majority of the lease rentals in the next FY26 itself. So almost like what we said about 70 crores is the lease rentals we'll be earning on that year on year

GANESHHOUC is riding the tailwinds in Ahmedabad's real estate market

Ahmedabad's real estate market achieved a 10-year high in residential unit sales, growing 15% year-on-year. There has been a spike in office transactions in the city.

A roadmap for the next 5 years includes expansion in Ahmedabad's growth corridors.

11. Buy?

If I am looking to enter GANESHHOUC then

GANESHHOUC has delivered PAT growth of 25% and Revenue growth of 19% in H1-25 at a PE of 24 which makes the valuations quite reasonable in the short term.

GANESHHOUC is guiding for PAT growth, 30-35% in FY-25 at a PE of 24 which makes the valuations attractive from a FY25 perspective.

GANESHHOUC is guiding to deliver Rs 10,860 cr of free cash flow expected in the next 10 years on a current market cap of Rs 11,614 cr which makes it quite attractive on a free cash flow yield perspective.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Hey! Can you please confirm whether Ganesh Housing Ltd are only developers or whether they are both developers and builders?