Frontier Springs FY25: PAT Up 167%, Revenue to Double by FY27

PAT CAGR of 47% as it Targets ₹500 Cr revenue by FY27 with stable margins; priced at 20× FY27 P/E leaves modest upside unless exports or defence scale up meaningfully

1. Supplying springs and forgings for Indian Railways

frontiersprings.co.in | BOM: 522195

The company primarily produces Hot Coiled Compression Springs and forging items, catering especially to the needs of Wagon, Locomotives, and Carriage sectors. Registered with RDSO since 1990, Frontier Springs is a trusted supplier to the Indian Railways

Indian Railways – Our Primary Customer

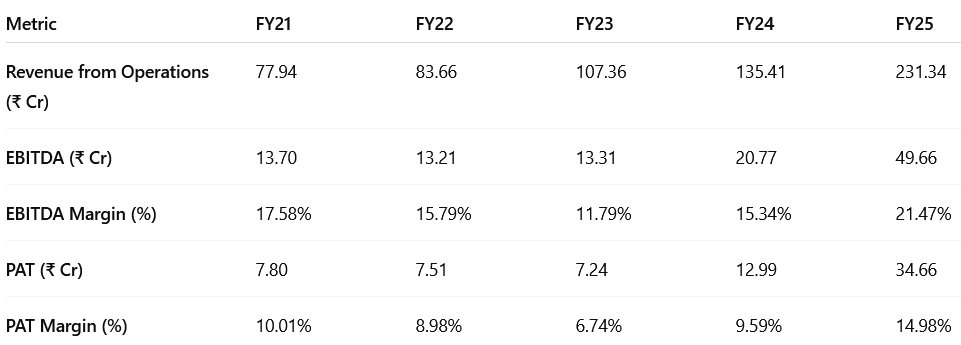

2. FY21–25: PAT CAGR 45% | Revenue CAGR 31%

2.1 What Changed Between FY21–25

3× Revenue Growth: Scale-up across all business segments.

Product Diversification: Transitioned from primarily Coil Springs to include Forgings and Air Springs—now a 3-engine business model.

Capacity Expansion: Forging division scaled with a new 6-tonne hammer; Coil & Air Springs capacity augmented to serve LHB coach demand.

Air Springs Scale-Up: From trial stage to commercial volumes; ~₹15–20 Cr revenue in FY25 with ₹120 Cr potential by FY27.

Margin Expansion: Aided by value-added product mix and better pricing.

Defense & Export Entry: Forging business preparing to enter Defence; export talks on with Alstom, Siemens, Bombardier (metro OEMs).

Capex-Backed Growth: ₹13.6 Cr invested in FY25; further ₹15 Cr internal accrual-based capex planned for FY26 expansion.

Business Model Evolution: Moving from a pure spring supplier to a multi-product rail infra and suspension system platform with OEM co-development potential.

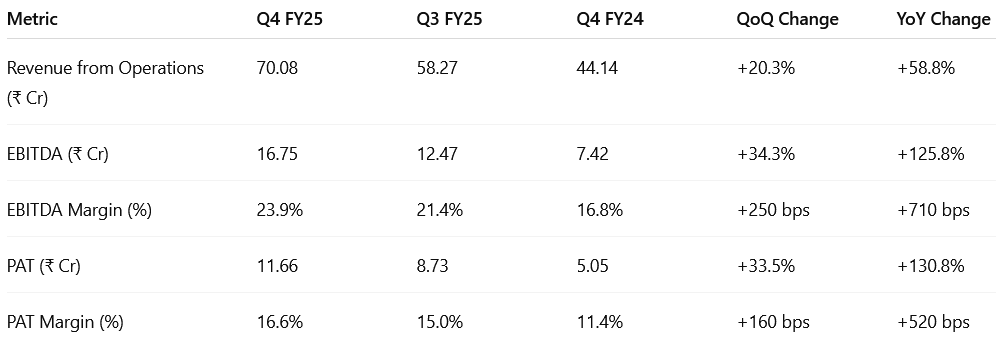

3. Q4 FY25: PAT up 131% & Revenue up 59% YoY

PAT up 34% and Revenue up 20% QoQ

Operational Peak: Q4 delivered record revenue and PAT, driven by strong execution and demand across segments.

Sequential Momentum: Reflects improving throughput and supply chain efficiency.

Margin Expansion: EBITDA margin aided by better cost absorption and operating leverage.

Visibility Strengthening: Exit momentum backed by Railway orders and metro OEM evaluations (Siemens, Alstom, Bombardier) for air spring exports.

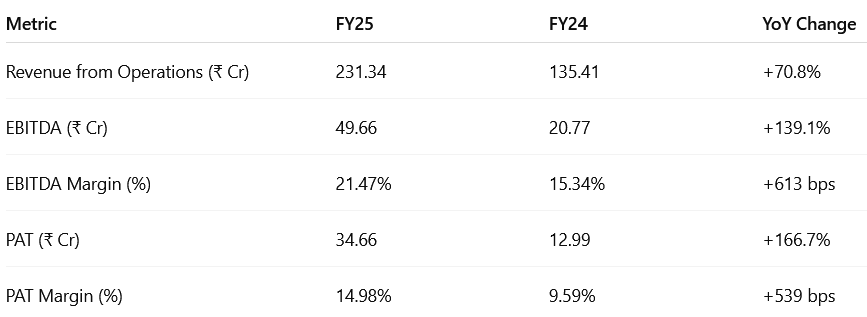

4. FY25: PAT up 167% & Revenue up 71% YoY

Broad-Based Growth: Revenue rose 71% YoY to ₹231 Cr, led by strong execution across Coil Springs, Forgings, and Air Springs, with healthy Railway order inflow.

Margin Expansion: EBITDA margin improved 613 bps YoY to 21.5%, driven by pricing power, operating leverage, and a shift toward higher-value products.

Air Springs Scaled: Transitioned from pilot to full-scale production; strong traction from LHB coach demand supports FY26 growth visibility.

Capex via Internal Accruals: ₹13.6 Cr invested in FY25 to expand capacity—fully funded through profits, underscoring capital discipline.

5. Business Metrics: Return Ratios Rebounded with Scale and Margin Gains

ROCE doubled in FY25 to 41% as operating leverage kicked in from higher capacity utilization, rising margins, and asset turns.

ROE also rose sharply to 24.7%, reflecting stronger profitability on the back of disciplined capital allocation and internal accrual–funded expansion.

The rebound marks a decisive shift from the FY22–23 trough, driven by margin tailwinds, better working capital control, and a maturing asset base.

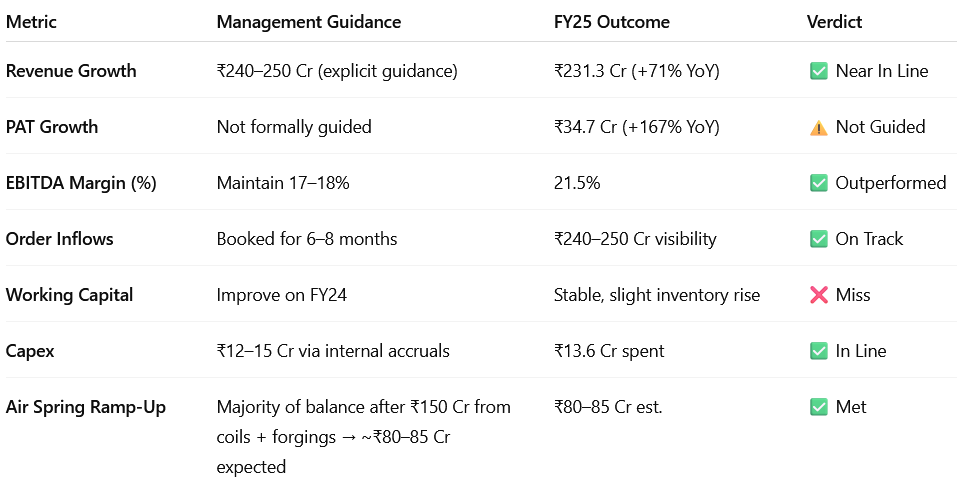

6. Strong Outlook: Revenue growth of 60%+ in FY25

6.1 FY25 Expectations vs. Performance

HITS (Exceeded or Met Guidance)

Topline Acceleration: FY25 revenue of ₹231 Cr just about meets expectations on strong demand for coil and air springs, plus new forging volumes.

PAT Surprise: Net profit more than doubled guidance due to higher margins and lower-than-expected depreciation/finance costs.

Margin Expansion: EBITDA margin of 21.5% vs guidance of 17–18%, driven by mix shift and cost control.

Execution Discipline: Selective bidding and capacity-led fulfillment helped maintain delivery pace and pricing strength.

Capex Discipline: ₹13.6 Cr capex fully funded from profits; FY26 expansion to continue at similar pace.

Air Spring Ramp-up: Commercial execution in line with LHB coach integration plans; export readiness improving.

MISSES

Forging Capacity Expansion Delayed: Commissioning of the 6T hammer, expected in FY25, was deferred. Commercial production is now slated to begin in FY26, with potential to unlock higher-value railway forgings and diversify into Defence and metro segments.

Working Capital Efficiency: No major improvement in WC cycle; receivables and inventory saw modest build-up in Q4 due to higher scale.

Export Contribution: While metro OEM talks (Siemens, Bombardier) progressed, FY25 saw minimal export revenue.

6.2 FY26 Guidance – Frontier Springs

60%+ revenue growth with stable margins in FY26

Order-book of ₹250-300 Cr provides visibility to FY26 target of ₹375 Cr

Outlook: The positive momentum witnessed in FY’25 has continued into the start of FY'26 with exceptionally strong demand visibility across all three of our core segments.

Revenue: We have set ambitious target of achieving Rs. 375 crore in gross revenue for FY'26 and Rs. 500 crore for FY'27.

Around 90 to 100 every quarter we are trying this year so that's why we are able to achieve 375 crores

Segmental Revenue: FY'26 will be around 150- crores-170 crore of coil spring, 125 crore of air spring and the balance will be the forging division.

Margins: Sustainable with potential of expansion

Focus will remain on ramping up high margin value added products, especially in the air springs and forging segments and on sustaining our leadership in the coil spring business.

Will definitely maintain 21% but we are trying to get more value added items and more value added this thing for forging also and for some other product and we are trying to go up from 21% to 22%-23%.

Capex: We plan to invest additional 15 crore in plant and machinery over the coming year

After doing this Rs. 15 crore CAPEX ….. not much is required till we reach a revenue of Rs. 500 crores

Order Book: On 1st of April, our order book was around Rs. 150 crore and after 2 months of this financial year, today my order position is around 200 crores to 250 crore.

I am 100% sure in another one month in June we will got Rs. 50 crore order also

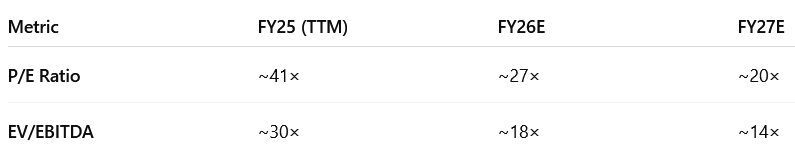

7. Valuation Analysis – Frontier Springs

7.1 Valuation Snapshot

Trailing valuations appear rich, reflecting Frontier’s breakout FY25 performance and strong FY26 guidance.

If the company delivers ₹500 Cr revenue and ~15% PAT margin by FY27 (as guided), the stock naturally derates to ~20× earnings — bringing it in line with high-quality forging peers.

This implies little valuation expansion room unless growth surprises on the upside or margins improve.

Valuation compression is built in: Street expectations already model P/E derating from 41× → 20× as PAT scales from ₹35 Cr → ₹75 Cr.

7.2 What’s Priced In vs. What’s Not

✅ Already Priced In:

FY26 & FY27 Revenue Targets: ₹375 Cr (FY26) and ₹500 Cr (FY27), with EBITDA margins of 21–22%.

PAT CAGR of ~20% with FY27 PAT estimated at ₹75 Cr+.

Full Air Spring Ramp-Up: 300 coach sets/month from the Kanpur facility, contributing ₹60–70 Cr.

Partial Forging Scale-Up: Hammer assumed to contribute via railway forgings, but not fully booked for defence/metro.

Railway Order Flow: Continued LHB + wagon tenders considered “default” in consensus models.

Net-Cash Balance Sheet: Debt-free operations and low capex needs support premium over leveraged peers.

🔓 Not Fully Priced In (Optional Upside Triggers):

Defence & Metro Orders: Hammer utilisation beyond 60% and approval for heavier forged components can unlock ₹80–100 Cr in high-margin revenue.

Export Scale-Up: Metro/OEM trials with Siemens, Alstom, or Southeast Asia clients could lift visibility and diversify client base.

Working Capital Release: FY25 inventory build (₹39.7 Cr) limits FCF. A 20-day reduction could double FCF and add 300 bps to ROCE.

Margin Expansion to 23–24%: From a richer product mix (air springs, forgings), not yet factored into base models.

Tender Upside: Orders in hand (~₹250–300 Cr) already cover FY26 revenue — any additional wins (e.g. Vande Bharat sleeper tenders) add optionality.

7.3 What Would Justify a Re-Rating?

For Frontier to trade at 25× forward earnings again, the market likely needs evidence of:

Diversification beyond Indian Railways (>10% revenue from exports or defence)

Sustained ROCE >25% with margin expansion toward 23–24%

Stronger FCF Conversion via inventory control and pricing power

Full Hammer Utilisation for non-rail orders without capex slippage

Without these, valuation may settle near 18–20× P/E, aligning with other niche component players with high capital efficiency but concentrated customer bases.

8. Implications for Investors – Frontier Springs

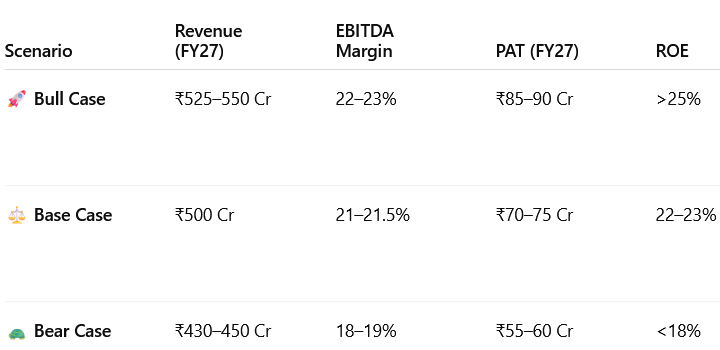

8.1 Bull, Base & Bear Case Scenarios

Bull Case: Hammer >80% utilised, air springs scale to 325+ sets/month, defence + metro orders land, exports begin, working capital improves

Base Case: FY27 revenue target achieved, air spring scale to 300 sets/month, hammer at 60%+ utilisation, no exports, margins stable

Bear Case: Air spring ramp delayed, hammer underutilised (railway-only), exports/metro orders don’t convert, WC strains FCF

Investor Takeaway:

At today’s price (~41× P/E), the market reflects the base case.

Bull-case outcomes (exports + margin expansion) offer upside, while the bear case introduces re-rating risk if execution falters or working capital worsens.

8.2 Key Risks & What to Monitor

A. Execution Risk – Forging Ramp-Up & Air Spring Scale

Growth depends on ramping the 6T hammer and hitting full air spring capacity.

Watch for:

Hammer utilisation >60% by Q4 FY26

Defence/metro approvals (e.g. BEML, Siemens)

Monthly dispatches of ≥300 coach sets

B. Margin Risk – Pricing & Product Mix

Margins could compress from input costs or lower-value tender wins.

Watch for:

Product mix shift to high-value forgings and air springs

Domestic vs. export realisations

Trends in railway tender pricing

C. Working Capital Risk – Inventory Buildup

Inventory stood at ₹39.7 Cr in FY25, straining FCF.

Watch for:

Reduction in inventory days toward 75–80

Railways payment cycle

Free cash flow conversion vs. earnings

D. Customer Concentration Risk – >90% Railways

Heavy dependence on Indian Railways limits pricing power and increases volatility.

Watch for:

Share of revenue from metro/defence/export clients

Progress on client diversification

L1/L2 tender share in key SKUs

E. Valuation Sensitivity – High Expectations

Trading at ~41× P/E and ~30× EV/EBITDA, Frontier assumes near-flawless execution.

Watch for:

FY27 PAT delivery of ₹75–85 Cr

Margin stability ≥21%

Capex & WC within planned limits

9. Valuation Outlook & Margin of Safety – Frontier Springs

9.1 Where the Valuation Stands Today

At ~41× FY25 P/E and ~30× EV/EBITDA, Frontier Springs is valued as a high-quality niche engineering play—but with little margin for error. These multiples already price in:

Revenue of ₹375 Cr in FY26 and ₹500 Cr in FY27, as guided

Stable EBITDA margins of 21–22%

PAT compounding to ₹70–75 Cr by FY27

Full ramp-up of air springs (300+ coach sets/month)

Partial contribution from the 6-ton hammer via railway forgings

A net-cash balance sheet and ₹15 Cr capex fully funded from internal accruals

9.2 Where the Market Isn’t Looking Yet

Valuation doesn’t yet account for several high-impact upside levers:

These triggers could lift FY27 PAT toward ₹85–90 Cr and support a forward P/E re-rating to 25–27×, vs 20× base case.

9.3 Margin of Safety: Moderate

Despite strong fundamentals, Frontier’s valuation leaves little room for execution missteps. The stock trades at a premium to most rail-engineering peers due to its superior ROCE and clean balance sheet—but that premium is justified only if:

The hammer ramps to 60%+ utilisation

Export or defence orders begin to contribute by FY27

Working capital intensity improves and FCF yield rises

Supporting Buffers:

Net cash balance sheet (₹5.2 Cr cash vs ₹5.9 Cr debt)

Strong ROCE (41%) and 15% PAT margin

Low capex requirement (~₹15 Cr over FY25–26)

No equity dilution risk; fully internally funded growth

Execution Risks:

90%+ dependence on Indian Railways

FCF yield <1% in FY25 due to inventory build-up

Export/metro traction remains unproven

Bottom Line: Frontier offers a moderate margin of safety, supported by strong earnings quality and growth visibility.

Upside from export wins, margin expansion, or WC efficiency could improve return profile—but downside protection depends on strict execution of the FY26–27 roadmap.

Previous coverage of Frontier Springs

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer