Frontier Springs: PAT growth of 190% & Revenue growth of 77% in 9M-25 at a PE of 27

FY25 revenue growth of 67%. Revenue growth of 40% in FY26. Order book in place to support FY26 growth. 40% growth in FY27. Revenue CAGR of 49% for FY24-27. EBITDA margins to sustained.

1. Supplying springs and forgings for Indian Railways

frontiersprings.co.in | BOM: 522195

The company primarily produces Hot Coiled Compression Springs and forging items, catering especially to the needs of Wagon, Locomotives, and Carriage sectors. Registered with RDSO since 1990, Frontier Springs is a trusted supplier to the Indian Railways

Indian Railways – Our Primary Customer

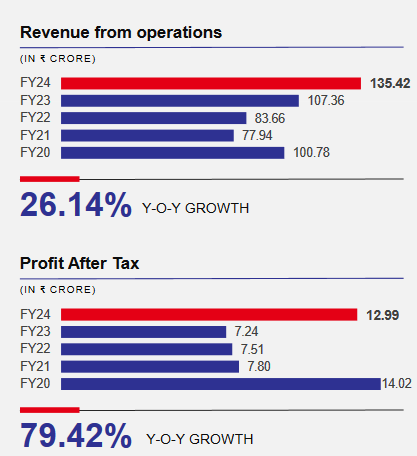

2. Recovery in PAT in FY24 after a weak FY20-23

3. Strong FY24: PAT up 79% and Revenue up 26% YoY

4. Strong Q2-25: PAT up 171% and Revenue up 77% YoY

PAT up 20% and Revenue up 12% QoQ

5. Strong 9M-25: PAT up 190% and Revenue up 77% YoY

6. Return ratios: Strong improvement in FY24

6. Strong Outlook: Revenue growth of 67% in FY25

i. FY25: Revenue growth of 67%

FY24 Revenue of about Rs 135 cr to grow to Rs 225 cr in FY25 i.e. 67% growth

We remain firmly on track to achieve our stated guidance of ₹240-250 crores in gross revenues for the current financial year

ii. FY26: 40% revenue growth

With Rs 250 cr revenue for FY25 (including GST) growing to Rs 350 cr implies a growth of 40%. Growth projection is backed by a strong order book.

this year we are targeting 250 next year will be around 350.

Our healthy order book continues to grow, giving us confidence in sustaining these growth rates into FY26

ii. FY27: 40%+ revenue growth

With Rs 350 cr planned revenue for FY26 (including GST) growing to Rs 500 cr implies a growth of 40%+

in last concall I have already told that by 26-27 we will be targeting 500 crores business which is gross

iv. Order book 3.4X FY25 expected revenue

With Rs 250 cr revenue for FY25 (including GST) the order book of Rs 850 crore is 3.4X FY25 expected revenue.

As far as orders are concerned, we have a good order book almost Rs.850 crore orders are in hand includes forging, air springs and coil springs

7. PAT growth of 190% and Revenue up 77% in 9M-25 at a PE of 27

8. Buy?

If I hold the stock then one may continue holding on to Frontier Springs

The performance for 9M-25 has been strong and is in line to achieve the guidance of Rs 240-250 cr revenue in FY25. Management is indicating for a strong FY26 on the back of a strong order book.

Our results are in line with the guidance we set at the beginning of the financial year, and we remain on track to achieve our target gross revenue of ₹240-250 crores for FY25. The strong performance this quarter was driven by robust contributions from all three of our business verticals: Coil Springs, Forging, and Air Springs.

Frontier Springs is in the middle of a strong run and has sequentially grown its Revenue and PAT on a QoQ basis for the last 6 quarters from Q2-24.

While the past track record of Frontier Springs is not exceptional, one can expect a strong future given the underlying orders in place to support the business growth. However, outlook is strong for FY-25

The demand for our products remains robust, and we have a strong order book with excellent visibility of future demand. We remain confident in achieving our stated guidance and look forward to a future full of growth and prosperity

Outlook is very positive given guidance of revenue CAGR of 49% for FY24-27

New product (Air Springs) to significantly contribute to the topline growth

New (Air Springs) to help improve the margin profile of the business

Strong Industry Tailwinds and growth visibility

9. Buy?

If I am looking to enter Frontier Springs then

Frontier Springs has delivered PAT growth of 190% and revenue growth of 77% in 9M-25 at a PE of 27 which makes the valuations acceptable.

Outlook for 67% revenue growth in FY25 with bottom-line growing in line with top-line growth the top-line on account of EBITDA margin expansion at a PE of 27 makes the valuations reasonable from a FY25 perspective.

Outlook for 40% revenue growth in FY26 at a PE of 27 makes the valuations reasonable from a FY26 perspective.

Outlook for 49% revenue CAGR for FY24-27 at a PE of 27 creates opportunity in Frontier Springs.

Frontier Springs is completely dependent on its order book. Even though order book is strong to support FY26 growth, any weakness in order book is a red flag

The risk of investing in a small company with Rs 240-250 cr of revenue expected for FY25 needs to be kept in mind.

Frontier Springs did not conduct an earnings call for Q3-25. Absence of latest management commentary adds to the risk in taking a call on the stock.

Previous coverage of Frontier Springs

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer