Frontier Springs Q1 FY26 Results: PAT Up 111%, Revenue to 2X by FY27 on FY25 Base

Revenue CAGR of 47% as it targets ₹500 Cr revenue by FY27 with stable margins. Valuations leaves modest upside unless non-railways revenues scale up meaningfully

1. Supplying springs and forgings for Indian Railways

frontiersprings.co.in | BOM: 522195

The company primarily produces Hot Coiled Compression Springs and forging items, catering especially to the needs of Wagon, Locomotives, and Carriage sectors. Registered with RDSO since 1990, Frontier Springs is a trusted supplier to the Indian Railways

Indian Railways – Our Primary Customer

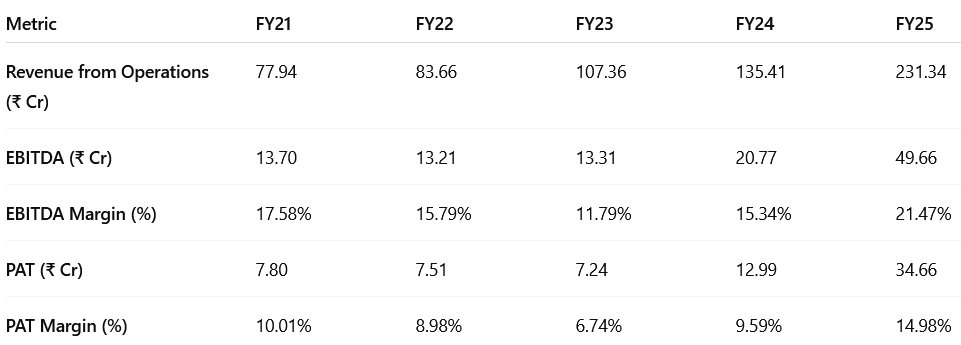

2. FY21–25: PAT CAGR 45% & Revenue CAGR 31%

2.1 What Changed Between FY21–25

3× Revenue Growth: Scale-up across all business segments.

Product Diversification: Transitioned from primarily Coil Springs to include Forgings and Air Springs—now a 3-engine business model.

Capacity Expansion: Forging division scaled with a new 6-tonne hammer; Coil & Air Springs capacity augmented to serve LHB coach demand.

Air Springs Scale-Up: From trial stage to commercial volumes; ~₹15–20 Cr revenue in FY25 with ₹120 Cr potential by FY27.

Margin Expansion: Aided by value-added product mix and better pricing.

Defense & Export Entry: Forging business preparing to enter Defence; export talks on with Alstom, Siemens, Bombardier (metro OEMs).

Capex-Backed Growth: ₹13.6 Cr invested in FY25; further ₹15 Cr internal accrual-based capex planned for FY26 expansion.

Business Model Evolution: Moving from a pure spring supplier to a multi-product rail infra and suspension system platform with OEM co-development potential.

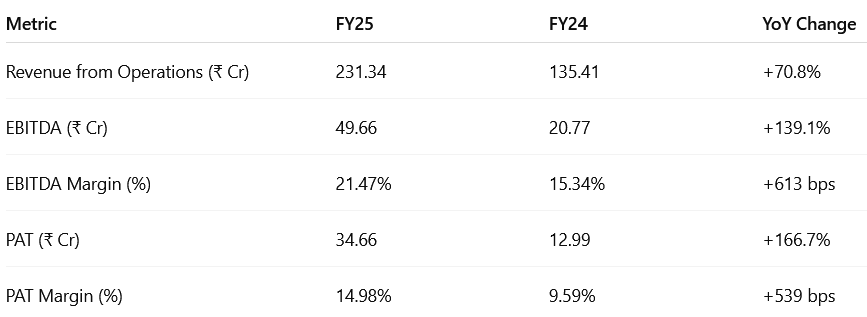

3. FY25: PAT up 167% & Revenue up 71% YoY

Broad-Based Growth: Strong execution across Coil Springs, Forgings, and Air Springs, with healthy Railway order inflow.

Margin Expansion: Shift toward higher-value products.

Air Springs Scaled: Transitioned from pilot to full-scale production; strong traction from LHB coach demand supports FY26 growth visibility.

4. Q1-26: PAT up 111% & Revenue up 48% YoY

PAT up 26% & Revenue up 8% QoQ

Growth driven by robust demand across our key product categories of Coil Springs, Air Springs, and Forgings.

Favourable demand environment, together with softer raw material prices, has supported our margins and helped sustain profitability.

5. Business Metrics: Return Ratios Rebounded with Scale and Margin Gains

6. Strong Outlook: Growth of 60%+ in FY26

6.1 FY26 Guidance — Frontier Springs

60%+ revenue growth with stable margins in FY26

Order-book of ₹250-300 Cr provides visibility to FY26 target of ₹375 Cr

Targets of ₹375 Cr revenue in FY26 (+62% YoY) and ₹500 Cr in FY27.

Segment mix for FY26: ₹150–170 Cr coil springs, ₹125 Cr air springs, and the balance from forgings.

Margins guided at 21–23% EBITDA, with management confident of sustaining or improving to 22–23%+ via higher-value air springs and forgings.

Capex of ₹15 Cr on schedule; sufficient to support growth to ₹500 Cr without major additional spend.

Ramp-up of 6-tonne hammer facility is progressing well.

Started receiving orders from Indian Railways for forgings

Actively engaging with customers in other industries to broaden presence in this vertical.

Order book stood at ₹150 Cr in April 2025, rising to ₹200–250 Cr by May, providing visibility to FY26 delivery.

Overall

Robust order book

Expanding capacities with a clear focus on value-added products,

Well-positioned to capitalize on the railway modernization initiative

6.2 Q1 FY26 Performance vs FY26 Guidance

Revenue lag: Q1 revenue at ₹75 Cr implies Frontier must deliver ~₹100 Cr/quarter in Q2–Q4 to hit guidance. Execution is therefore the key variable.

Order visibility: ~₹250 Cr of orders already secured by May, with tenders in pipeline, supports the target but makes growth back-ended.

Margins ahead of plan: Q1 EBITDA margin of 27.1% is well above guidance, creating potential for PAT to exceed estimates even if revenue falls slightly short.

Assessment

FY26 guidance remains achievable, but revenue execution risk is material.

Margins provide a cushion, making PAT targets more attainable than the top-line goal.

The story beyond FY26 depends on visibility into FY28 and beyond, where diversification and sustained order flow will matter.

FY26 Targets → Achievable if order execution remains smooth; potential upside to PAT vs guidance, but revenue will be the stretch metric.

7. Valuation Analysis – Frontier Springs

7.1 Valuation Snapshot — Frontier Springs

CMP ₹5299.9; Mcap ₹2,087.37 Cr

EBITDA Margin at the middle of 21-23% guidance range.

Growth Already Priced In: The market is effectively discounting Frontier’s FY26–27 growth story today. At ~26× FY27E earnings, upside looks capped unless the company delivers ahead of guidance.

Asymmetric Risk: With 90%+ revenue tied to Indian Railways, the risk-reward skews negative.

Downside if order flow slows or execution slips.

Upside only if guidance is beaten and margins hold above the 21–23% band.

What Could Unlock Headroom?

Revenue scaling faster than guidance (≥₹525–550 Cr by FY27).

Margins sustaining at 25–27% rather than 21–23%.

Without these, the stock likely just tracks earnings growth with little scope for multiple expansion.

Valuation Trajectory:

Current multiples remain rich, reflecting Frontier’s breakout FY25 and bullish FY26 guidance.

If management delivers on the guided ₹500 Cr revenue / ~15% PAT margin by FY27, the stock naturally derates to ~26× earnings — expensive compared to high-quality forging peers.

Street expectations already embed this compression: P/E moving from ~41× to ~26× as PAT rises from ₹35 Cr (FY25) to ~₹78 Cr (FY27E).

Bottom Line: Frontier offers strong earnings growth but limited scope for re-rating. Unless execution meaningfully outpaces guidance, investors should expect valuation compression alongside earnings growth, not multiple expansion.

7.2 Opportunity at Current Valuation

Margin Outperformance: Q1 FY26 EBITDA margin of 27% is already above the guided 21–23% range. If sustained, EBITDA/PAT could exceed guidance by ~15–20%.

Structural Tailwinds:

Premium valuations require business momentum to sustain through FY28 and beyond for upside

Railway modernisation (LHB coaches, Vande Bharat, wagon orders, metro expansion) underpins multi-year demand visibility.

Long term bet requiring high conviction: Railway modernisation initiative playing exactly out as planned — Frontier executing without a single miss.

At current valuations, the opportunity for fresh entry appears limited. Frontier Springs is better suited for existing investors, who can continue to ride the ongoing momentum and reassess around FY26-end, when visibility into FY28 could emerge.

7.3 Risk at Current Valuation

Valuations Already Reflect FY27: At ~35× FY26E and ~26× FY27E P/E, the stock is discounting management’s guidance upfront, leaving limited room for re-rating unless earnings exceed estimates.

Single-Customer Dependency: >90% of revenues come from Indian Railways; any slowdown in tendering, delays in wagon/coach production, or policy shifts could sharply hit revenue.

Execution Risk: To meet FY26 revenue guidance, Frontier must scale to ~₹100 Cr/quarter in Q2–Q4 (vs ₹75 Cr in Q1). Any slippage in order conversion could drag full-year delivery below target.

Raw Material Volatility: Margins benefited from softer steel prices in Q1. A reversal could compress EBITDA back toward ~20–21%.

Concentration of Growth Plans: FY26–27 capex of ₹15 Cr is entirely tied to railways; lack of diversification means growth is captive to one sector cycle.

Valuation Downside: If FY27 guidance is missed, multiples could compress toward sector averages (18–22× P/E, 12–15× EV/EBITDA), implying meaningful downside.

Previous coverage of Frontier Springs

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer