Fineotex Chemical: PAT growth of 41% & long term PAT growth of 25%+ CAGR at PE of 34

FCL is not a turnover based company, looking for volumes and top-line with no EBITDA margins. In the last 12 or 13 years of being listed, FCL has a PAT & EBITDA CAGR of 25%+

1. Specialty chemicals producer with a focus on textiles chemical

fineotex.com | NSE: FCL

Successful expansion into the cleaning and hygiene segment

Non-textile segments will drive volume and value growth going forward

Segmental Split

So, let me say that the volumes in textiles is 44% broadly, and the revenues is like 59%. And the remaining you can, take it as for the like 56% volumes is on the FMCG and almost 40%- 41% is the revenue mix for the FMCG.

2. FY19-23: Growth picked up from FY22

And in our last 12 or 13 years of being listed, our average CAGR growth of PAT and EBITDA has been more than 25%. And our EBITDA percentage in, also, you can always check, it has been minimum 16 to 18%. Till where we are today is 27%, broadly.

3. FY23: PAT up 57% and revenue up 40% YoY

4. Q1-24: PAT up 29% and revenue down 3% YoY

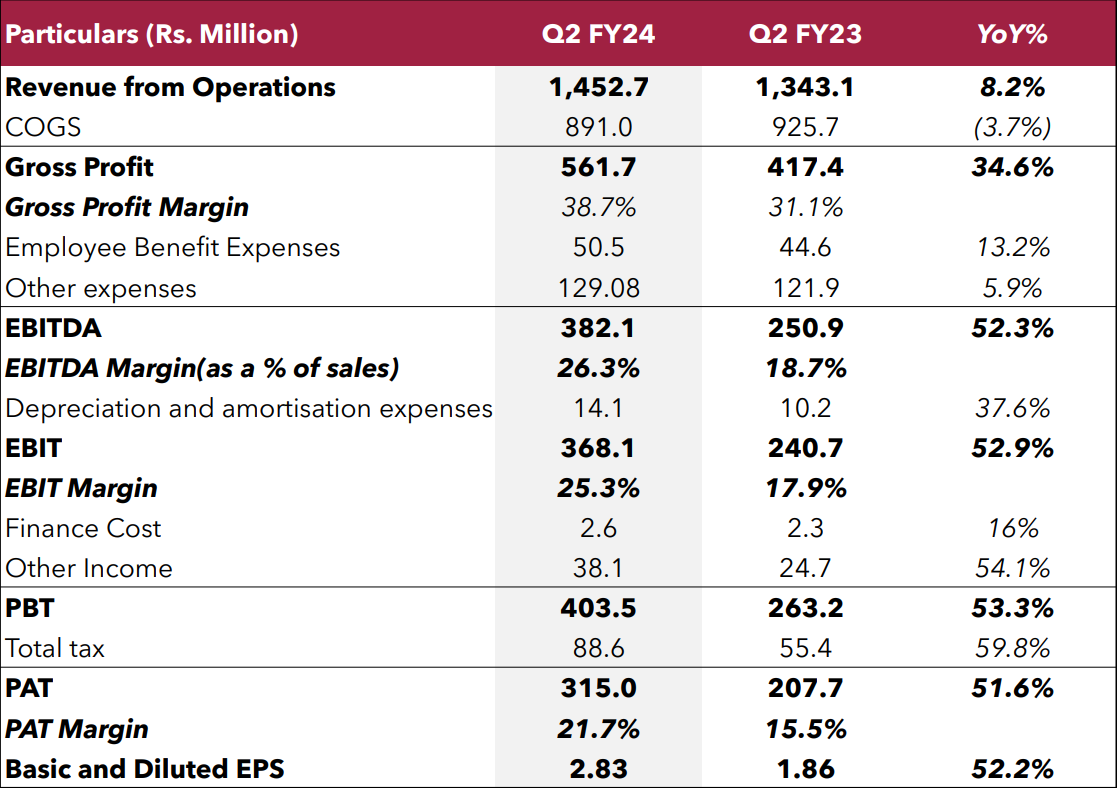

5. Q2-24: PAT up 52% and revenue up 8% YoY

there has been an increase of 43% in the volumes year-on-year basis,

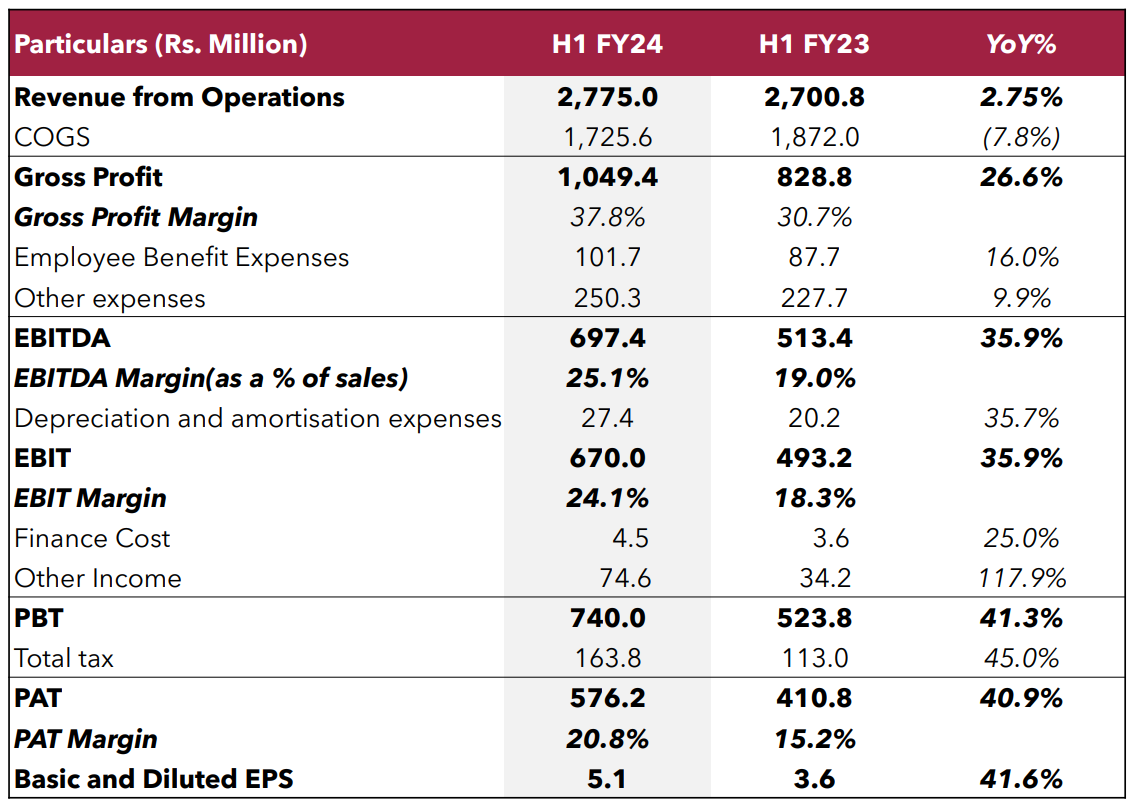

6. H1-24: PAT up 41% and revenue up 3% YoY

7. Business metrics: Strong return ratios & cash generation

Cash flow from Operation (CFO) to EBITDA for HI-FY24 is 80.72%.

Return on Capital Employed (ROCE) for HI-FY24 is 36.38%,.

Return on Equity (ROE) HI-FY24 is 30.31 %.

We are a very cash disciplined company. As you can see in the last so many years, we have always been cash rich company as such and debt free. We would like to remain as such a debt free company more or less.

6. Outlook: Bottom was made in Q1-24

i. Bottom line growth with limited top-line

H1-24 PAT growth of 41% on a revenue growth of 3% YoY even after a volume growth of 43% in Q2-24 on account of changing product mix with higher contribution of non-textiles

in the last three, four quarters, there has been a change in our product mix. And also, the more we focus on hygiene and FMCG areas, the average realisation prices are comparatively lesser. So, although the volume growth has been 40%, or 43%, if we talk about the incremental business sales, that has not gone more than, let's say, 30% or in terms of volumes, yes, sorry, I mean, in terms of 10%, it has gone up from the, in the revenue mix, because of the product mix has changed as such.

ii. Headwinds stopped: Downfall of pricing & destocking over in Q1-24

So, actually, in our last con call also, I had somewhere mentioned that the bottom's already behind us. And that was, if I'm not wrong, it was the month of August or something. And that is what we can expect in the future. I am quite of the opinion that the bottom demand or let's say the downfall of the pricing and the destocking activity all have been completed in the quarter one for most of the commodity chemical companies.

iii. Maintaining 24% to 26% EBITDA

The H1 EBITDA is already 25.13% as I see now. So, that is something, we are very confident to keep delivering on that line.

iv. H2-24 to be better than H1-24

we are confident of delivering the EBITDA numbers, percentages, what we have been doing in the past. And always there will be some growth. Let me also mention generally for the business where we are, the H2s are generally better than H1s, generally.

7. PAT growth of 41% in H1-24 at a PE of 34

8. So Wait and Watch

If I hold the stock then one may continue holding on to FCL

Coverage of FCL was initiated after Q1-24 results. The investment thesis has not changed after a strong H1-24. The only changes are the delivery of a strong H1-24 and the increased confidence in the management to deliver a stronger FY24. FCL has delivered in H1-24 in line with the guidance for FY24

we are focused on solution driven product lines, rather than ‘me too’ kind of businesses, which always is fluctuating in terms of EBITDA and profitability and things. The way the last two, three years have been encouraging for us, I am -- our team is, I think, we are the most confident right now that we will be able to, you know, again, deliver much better performance in the future. That's all I can tell you from the forward-looking point of view.

The volume growth of 41% inspires confidence in business.

FCL pointing to the bottom being made in Q1, maintaining EBITDA margins and H2-24 being better than H1-24 inspiring confidence to stay in the stock.

9. Or, join the ride

If I am looking to enter FCL then

41% PAT growth delivered in H1-24 at a PE of 34 makes FCL fairly valued in the long term

Over the long-term FCL has a track record of delivering 25%+ growth which makes the stock interesting from a long term perspective.

And in our last 12 or 13 years of being listed, our average CAGR growth of PAT and EBITDA has been more than 25%. And our EBITDA percentage in, also, you can always check, it has been minimum 16 to 18%. Till where we are today is 27%, broadly.

Positions need to be built over time over bad days when the stock is not doing well.

Previous coverage of FCL

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades