Fineotex Chemical Ltd - A high growth stock

Growth in top line and bottom line. The stock can grow in a portfolio

Company Overview

Fineotex Chemical Limited is a specialty chemical company with its headquarters in Mumbai, India. Founded in 1979 by Mr. Surendra Tibrewala, the Fineotex Group has evolved into a specialty chemicals manufacturer that caters to multiple sectors such as textile, home care, hygiene, mining, garment, water treatment, leather, construction, paint, agrochemicals and adhesives.

Fineotex Chemical Limited is a manufacturer of over 450 specialty chemicals and enzymes. Its manufacturing plants, situated in Navi Mumbai (India) and Selangor (Malaysia) are fungible across the entire product range. It has a new plant in Ambernath, Mumbai which will enhance its capacities from 1,04,000 MT per annum, and is catering to clientele across key international textile hubs.

Its subsidiary Biotex, in Malaysia spearheads its research and development initiatives. BioTex specializes in high end specialty finishing textile chemicals like water & oil repellents, antimicrobials, etc. for textiles and also has a great presence in few segments for the paint sector. Its joint venture with HealthGuard enhances geographic reach provides durable antimicrobial and anti-viral sustainable chemistries in the market.

Share Details

NSE:FCL

Closing Price = 312.45(12-Jun-23)

52 Week High = 409. Trading at 24% below 52 wk high

52 Week Low = 155.25. Trading at 101% above 52 wk low.

P/E = 40

Market Cap = 3,480 cr ( ~$ 420 million)

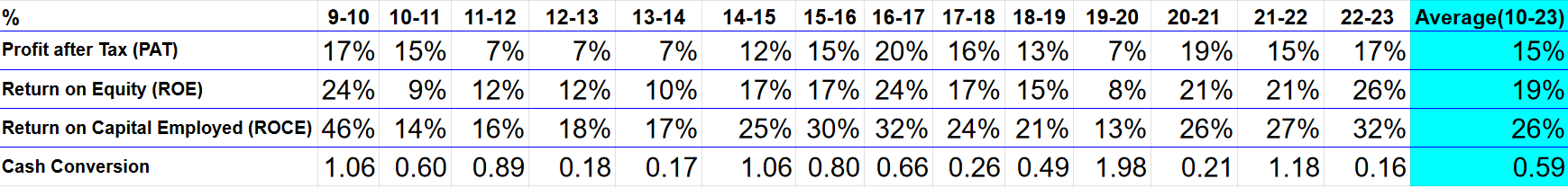

Quality: Returns on capital employed in cash

PAT margins are consistent. ROE and ROCE is good. Cash conversion is erratic to say the least. One has to be overlook certain things in a small cap. ROE in last 3 years is 20%+ but just below 20% overall so can be overlooked.

Growth

Growth overall has been good. To compound at 28% during the period FY10-23 i.e. 13 years is quite incredible. PAT has also kept in pace with a compounded annual growth rate of 23% during the FY10-23. In ability to consistently generate free cash flow is a cause of concern.

Growth momentum has been solid. It has not slowed even as the company has grown. Actually the growth momentum is increasing as the company is growing in size.

So What????

If I own the stock, I will definitely hold on for the long term till the growth story plays out completely.

If I don’t own the stock, I would like to enter it at a better price. I find it difficult to justify a 40 PE for a company where the company is not generating free cash flow consistently.

Disclaimer

It is an analysis of the company data and not a stock recommendation

My analysis can be completely wrong and can change the next minute based on changes in my understanding of the company

I look to own good companies at prices where there is a path to market beating returns over decades