The 6 Financial Ratios That Actually Matter (India): Stop Over-Analyzing Stocks

Stop analyzing 100+ ratios. These 6 essential financial ratios help Indian investors judge business quality, valuation, and safety—without confusion.

Short Answer (TL;DR)

Indian stock investors only need 6 financial ratios to make informed decisions:

ROCE – Business quality

ROE (with Debt) – Shareholder returns

Cash Flow Conversion – Profit truth check

PEG Ratio – Growth-adjusted valuation

Price-to-Book – Valuation for banks & NBFCs

Interest Coverage – Debt survival

Together, these ratios answer three questions that actually matter:

Is the business good? Is the stock reasonably priced? Will the company survive?

Everything else is noise.

Why Most Investors Get Stuck

Open any Indian stock screener—and you’ll see 100+ ratios:

Current Ratio

Quick Ratio

Asset Turnover

EV/EBITDA

Inventory Days

This leads to analysis paralysis.

As a retail investor, you don’t need 100 ratios.

You need the Vital Few—the ones that separate:

Compounders from Wealth Destroyers

In our previous guide on Cash Flow, we learned how to check if profits are real.

Now, we go one level deeper.

Part 1: Quality Ratios

Is this a good business?

Before asking “Is this stock cheap?”, ask:

“Is this business even worth owning?”

1️⃣ ROCE – Return on Capital Employed

The King of Ratios

If you track only one ratio for non-financial companies, make it ROCE.

What it asks:

For every ₹100 invested in the business (Equity + Debt), how much profit is generated?

Why it matters:

This is pure business logic.

If a company borrows at 10% but earns only 8% ROCE, it is destroying value—even if profits look fine.

Benchmarks (India):

> 20% → Excellent (moat / pricing power)

10–20% → Average

< 10% → Avoid (inefficient business)

Investor Insight:

Rising ROCE is a classic multi-bagger signal.

A move from 15% → 25% ROCE often precedes major stock rerating.

2️⃣ ROE – Return on Equity

The Shareholder’s View (with a trap)

What it asks:

For every ₹100 of shareholder money, how much profit is generated?

The Trap:

ROE can be artificially boosted using debt.

Example:

Equity: ₹10

Debt: ₹90

Profit: ₹5

ROE = 50% (looks amazing)

Reality = high bankruptcy risk

Golden Rule:

Never look at ROE alone

High ROE + Low Debt = Gold Standard

Always check Debt-to-Equity alongside ROE.

Part 2: The Truth Ratio

Are the profits real?

3️⃣ Cash Flow Conversion (CFO / EBITDA)

The Lie Detector

This is one of the most underrated ratios in Indian markets.

What it asks:

“You say you made ₹100 in profit—how much actually came into the bank?”

Why it matters (India-specific):

Sales can be booked easily

Cash collection cannot be faked easily

Benchmarks:

> 70% → Healthy, real profits

50–70% → Monitor closely

< 50% → Red flag

Hard Rule:

If EBITDA is rising but cash conversion is falling, something is wrong.

That’s how accounting problems show up before headlines.

Part 3: Valuation Ratios

Is the stock cheap or expensive?

A great business at a bad price is a bad investment.

4️⃣ PEG Ratio – Price with Growth Context

PE Ratio alone is misleading.

PE 50 isn’t expensive if growth is 40%

PE 10 isn’t cheap if profits are shrinking

PEG = PE / Earnings Growth Rate

Peter Lynch Rule:

PEG < 1 → Undervalued

PEG ≈ 1 → Fair

PEG > 2 → Expensive

Indian Reality:

In bull markets, finding PEG < 1 is rare.

For quality growth stocks, PEG < 1.5 is often reasonable.

5️⃣ Price-to-Book (P/B)

Only for Banks, NBFCs & Insurance

Important:

Do not use P/B for manufacturing or FMCG companies.

Why it works for banks:

For banks, Book Value = Cash + Loans (real assets).

Benchmarks:

P/B < 1 → Undervalued or bad asset quality

P/B 1–2.5 → Reasonable

P/B 3–4 → Premium (e.g., HDFC Bank historically)

Strategy:

When a strong bank trades near historical low P/B, it’s often an opportunity—not a risk.

Part 4: Survival Ratios

Will the company go bust?

6️⃣ Interest Coverage Ratio (ICR)

Debt Survival Check

What it asks:

How many times can the company pay interest using operating profit?

Danger Zones:

ICR < 1.5 → Critical

ICR < 1 → Borrowing to pay interest (Ponzi behaviour)

ICR > 3 → Safe

ICR > 10 → Fortress balance sheet

Rule:

Avoid companies with ICR < 1—no turnaround story is worth that risk.

Bonus: The Indian Governance Check

Promoter Share Pledging

This isn’t a ratio—but in India, it’s non-negotiable.

What it is:

Shares pledged by promoters to raise personal loans.

Rules of Thumb:

0% → Ideal

> 25% → Red flag

> 50% → Uninvestable

Risk:

If prices fall, lenders dump shares → crash

(Examples: Zee, Coffee Day)

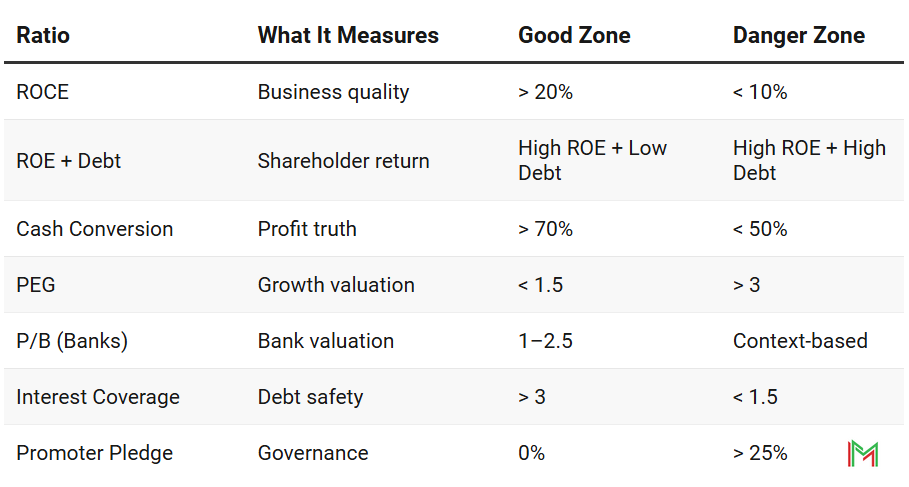

Summary Cheat Sheet

Frequently Asked Questions

Q: What is the most important financial ratio for Indian stocks?

ROCE is the most important ratio for non-financial companies because it measures true business efficiency.

Q: Is ROCE better than ROE?

Yes. ROCE includes debt and is harder to manipulate, making it a better quality indicator.

Q: Which ratio detects fake profits?

Cash Flow Conversion (CFO/EBITDA) is the best indicator of inflated profits in Indian companies.

Final Thought: Context Is King

Ratios are tools—not rules.

Power companies like NTPC will always have lower ROCE

FMCG companies like Nestlé will always trade at high PE

Use:

Cash Flow to verify truth

Ratios to judge quality, valuation, and survival

That’s how conviction is built.

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer