Epack Durable: PAT up 169% & Revenue up 77% in H1-25 at a PE of 79

Revenue growth of 45-50% in FY25 while maintaining margins. Targeting $1 bn revenue in 5 years. Will benefit form the AC market growing 20%+ for the next 8-10 years. PLI incentives to support margins.

1. Why is EPACK interesting

epackdurable.com | NSE: EPACK

As one of the larger ODM for AC's in India, EPACK is expected to benefit from the AC market growing at around 20% for the next 8-10 years on account of increased adoption. In the short term EPACK will benefit form PLI incentives, and environment of shortfall in capacities and low inventories in the market. 2. Original Design Manufacturer (ODM) for AC’s & small domestic appliances

the second largest ODM player with a market share of ~24% in India in terms of number of indoor and outdoor units manufactured in fiscal 2023

3. FY22-24: PAT CAGR of 66% & Revenue CAGR of 25%

4. FY24: PAT up 11% & Revenue down 8%

5. Weak Q2-25: In losses (losses down 39%) & Revenue up 112% YoY

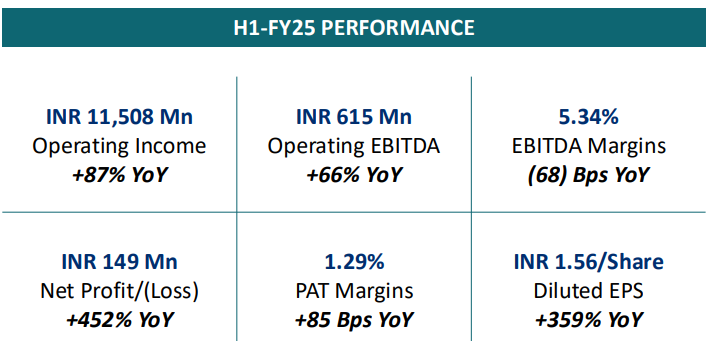

6. Strong H1-25: PAT up 452% & Revenue up 87% YoY

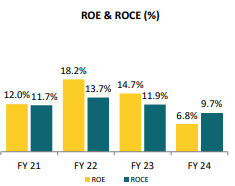

7. Return Ratios

So, first of all, the company is extremely confident and positive that we will achieve ROE, ROCE of minimum 15% in time to come, very shortly, within a span of two to three years, for sure.

8. Strong outlook: Revenue growth of 45-50%

We're talking about $1 billion revenue over the next five years.i. FY25: Revenue growth of 45-50%

the year-end number we are looking at is almost 45%-50% growth, so which means with Rs. 750 crores already achieved, we are looking at close to anywhere between Rs. 2,100 crores plus minus Rs. 50 odd crores of revenue in the entire year.

ii. FY25: Margins to be maintained

The guidance on margin remains the same. We have been maintaining that last year we achieved a margin of 8.12% the EBITDA margins and we are targeting to achieve similar kind of margins around 8% for the current year as well.

iii. Strong order book to support FY25 revenue projections

the order book is extremely healthy, and this is why we have shared the numbers for the entire year at almost 45% growth.

9. PAT growth of 452% & Revenue growth of 87% in H1-25 at a PE of 79

10. Hold?

If I hold the stock then one may continue holding on to EPACK

Following a weak FY24, Q1-25 performance was exceptional. However Q2-25 has been very weak. Overall H1-25 has been quite strong. Given the low inventories in the market the forecast for next two quarters is strong giving confidence in EPACK delivering on the guidance of 45-50% growth.

The inventories in the market are bare minimum. The forecast for next two quarters or our order book for next two quarters is also extremely healthy.

We are poised to outgrow the market growth. So, maybe this year the market is estimated to grow at least 25% plus on complete year basis, whereas the EPACK is definitely going to outgrow the market growth.

Losses in Q2-25 is a big red flag and needs to be watched carefully even though the losses are not on account of business momentum getting damaged.

the capacity utilization of Sricity plant has just been 10% in first half of this year. although our fixed overheads have already started. This has ranked down the performance in the short term

when you compare Q2 of last year to Q2 of this year, we might see some dip in the margin which is actually because of the increased contribution of sales from air conditions. So air conditions being a slightly low margin business, can support slightly low overall margins.

PLI incentive will support the bottom line of EPACK. For context, FY25 PLI incentive is expected to be Rs 37.5 cr when FY24 PAT was Rs 35 cr.

for the Financial Year 24-25, the total outlay for the expected PLI incentive is going to be Rs. 37.5 crores out of which roughly Rs. 14.5 crores is something which has been accrued in Q1 itself and the balance will be accrued in the subsequent 3 quarters.

Macro tailwinds of AC market doubling ever 4-5 years (20% CAGR) on account of increased penetration provide a long runway for growth over the next decade. Short term supply constraints of shortfall in capacity and low inventories will add to the tailwinds

At a global average of 42% penetration, we India is just at 8%, which means we have a long way to go. So, on a long term basis, we see the market is going to double every 4-5 years

Excess capacity in the market has come flat now and people see that there is a shortfall in capacity

So, we see that this the growth for AC especially will continue over next 8-10 years definitely because we are really sitting in a very low penetration level.

10. Buy?

If I am looking to enter EPACK then

EPACK has delivered PAT growth of 452% and revenue growth of 87% in H1-25 at a PE of 79 which makes the valuations fully valued in the short term.

With an outlook of 45-50% revenue growth in FY25 while maintaining margins at a PE of 79 implies that FY25 performance is already discounted in the price.

The opportunity in EPACK is a longer term opportunity on account of the macro tailwinds given the 20% CAGR in the AC markets for the next 8-10 years. Given that EPACK is fully priced in the short term, entry in the stock can be around times where the stock is showing weakness owing to market conditions

Previous coverage of EPACK

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer

Really fine analysis on Epack