Enviro Infra Engineers Q2 FY26 Results: PAT up 36%, On-track FY26 Guidance

Guidance of 35-40% CAGR for FY25-30 with stable margins and strong order-book. Even after muted H1 FY26 results, EIEL looks attractive on froward valuations

1. EPC Specializing in Water and Wastewater

www.eiel.in | NSE: EIEL

Other Offerings

Hybrid Annuity Model (HAM) Projects

Renewable Energy (New Diversification)

Business Model & Revenue Mix

EPC (Engineering, Procurement & Construction): 75–80% of revenues.

HAM Projects: 10–15% of revenues, with long-term annuity visibility.

O&M Services: 3–5% currently, expected to rise sharply as more projects enter operations.

Renewables: New line, currently small, but positioned for long-term growth.

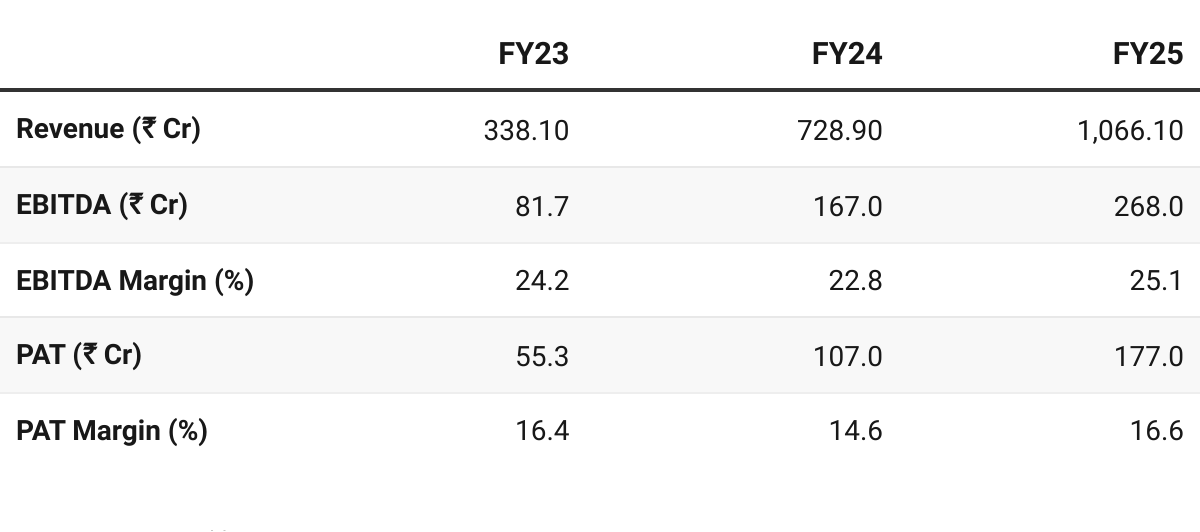

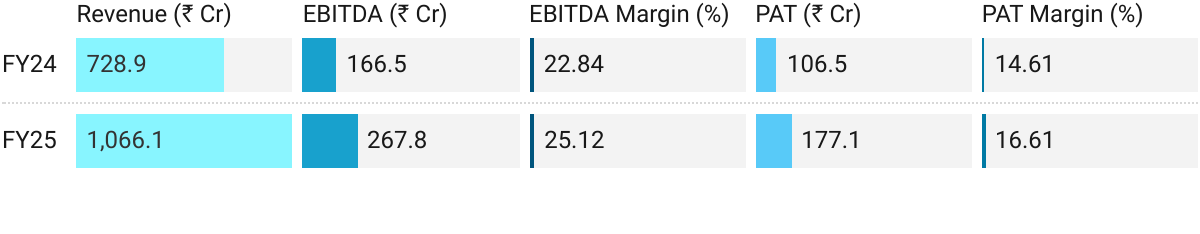

2. FY23–25: PAT CAGR of 79% & Revenue CAGR of 78%

3. FY25: PAT up 66% & Revenue up 46% YoY

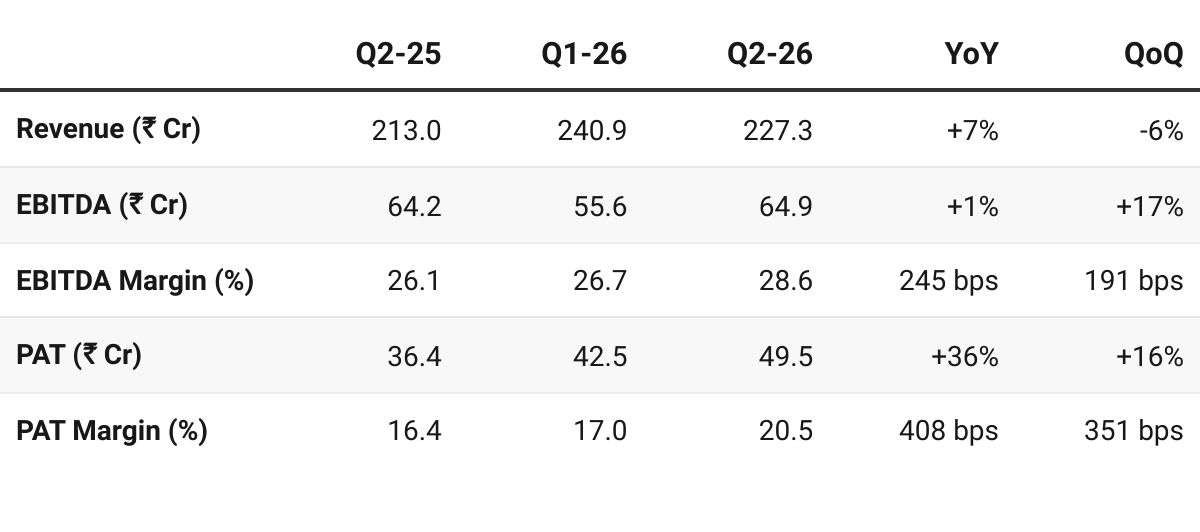

4. Q2 FY26: PAT up 36%, Revenue up 7% YoY

PAT up16% & Revenue down 6% QoQ

Top-line growth was weak due to monsoon, which typically slows down construction billing — “lean” season for EIEL

Margins expanded despite slower revenue growth.

Attributed to a “better product mix,”

Shift toward higher-margin wastewater treatment projects (>70% of revenue)

Strong in-house execution capabilities.

Profit growth aided by “Other Income”

One-off gain from the acquisition of the 40 MW solar asset at a favorable price (reverse auction) from PTC.

Execution slower due to monsoons — buildup of “unbilled revenue”

Maintained operational momentum in design and procurement.

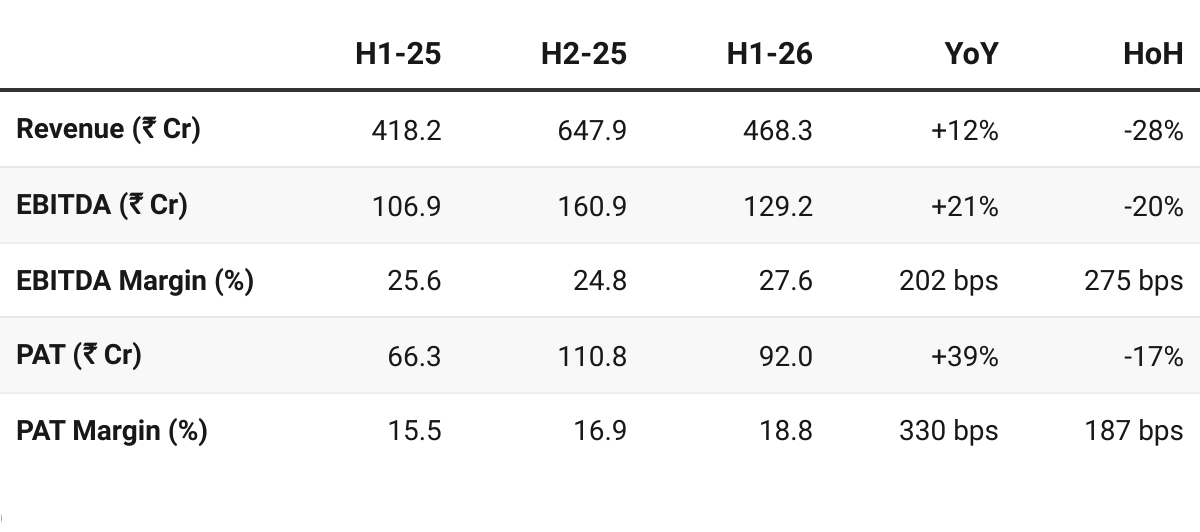

5. H1 FY26: PAT up 39%, Revenue up 12% YoY

PAT down 16% & Revenue down 6% QoQ

Operating Cash Flow (OCF): Negative ~INR 100 Crores.

Driven by an increase in Unbilled Revenue (work done but not yet billed due to milestones/monsoon).

Management expects this to reverse in Q3/Q4 as projects hit billing milestones.

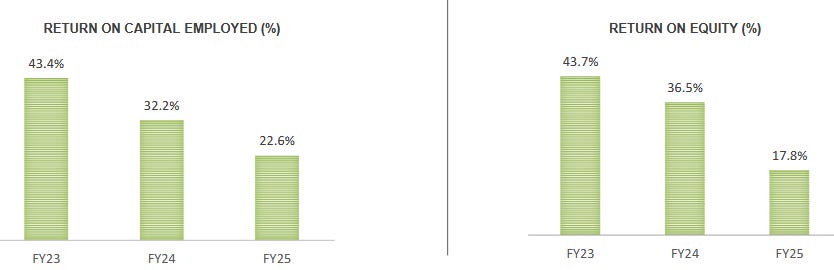

6. Business Metrics: Strong Returns

6. Outlook: 35-40% Revenue CAGR till FY30

6.1 Guidance

Growth rate which we expected on the top line, which is somewhere in the range of 35 to 40 odd percentage, which we expect.

So we maintain our guidance of the similar top line to achieve in the current financial year as well.

As far as the margin guidance is concerned, we have always confirmed our EBITDA margins to be in the range of 22% to 24%.

Maintained revenue growth guidance of 35% to 40%

Renewable Energy Revenue: ₹200 Cr in revenue FY26.

Above the core water segment guidance.

₹500 Cr by FY27

Growth of 40% to 50% over the next 4-5 years.

Margins estimated to be 18-20%, lower than the water segment

Management noted that H2 historically constitutes ~60% of revenue

Confident in meeting guidance despite a seasonally weak Q2

EBITDA margin guidance in the range of 22-24%

Order Book and Pipeline

Order Inflow: Will exceed guidance of ₹2,500 Cr (₹1,450 Cr achieved)

Cash Flow and Working Capital

OCF Target: To turn Operating Cash Flow (OCF) positive (post-tax) for FY26.

Receivables: Significant reduction in unbilled revenue

Improved cash flow realization by March 2026 as projects move from the design phase to the construction/commissioning phase.

Long-term debt expected to increase slightly due to the execution of solar Independent Power Producer (IPP) projects.

Segment Focus:

Not bidding for new Jal Jeevan Mission (JJM) projects.

Focusing on Zero Liquid Discharge (ZLD), tertiary treatment segments, and industrial sectors.

Project Execution: Timelines for current renewable projects provided:

Odisha (40 MW Solar): Completion expected by April 2026.

Maharashtra (29 MW Solar): Completion expected by June 2026.

6.2 H1 FY26 vs FY26 Guidance

Lagging revenue growth

Revenue Growth — Lagging:

Growth of 12% in H1, below the 35-40% annual target.

To hit the target, 50% growth needed in H2

EBITDA Margins — Strong

H1 margins (27.6%) are well above the guidance (22-24%).

Order Inflow — Strong

Have secured ~₹1,450 Cr against a target of ₹2,500 Cr.

Have submitted bids for ~₹8,000 Cr. To meet the target, they need a win rate of only ~13%.

Management explicitly stated they expect to “outdo” this guidance.

Cash Flow (OCF) — Weak

Cash flow is negative ₹100 Cr in H1 due to a buildup of “unbilled revenue”

Management expects unbilled revenue to convert to billing in Q3, reversing the negative flow.

Investor Watchlist for Q3:

Confident that EIEL will meet or beat its margin and order book targets.

Confidence in meeting the 35-40% revenue growth and positive cash flow is conditional on execution speed. The company has no room for slippage in Q3.

The Q3 results will be the decisive factor. If revenue growth in Q3 does not jump to at least 40-50% YoY, the full-year revenue guidance will likely be missed.

7. Valuation Analysis

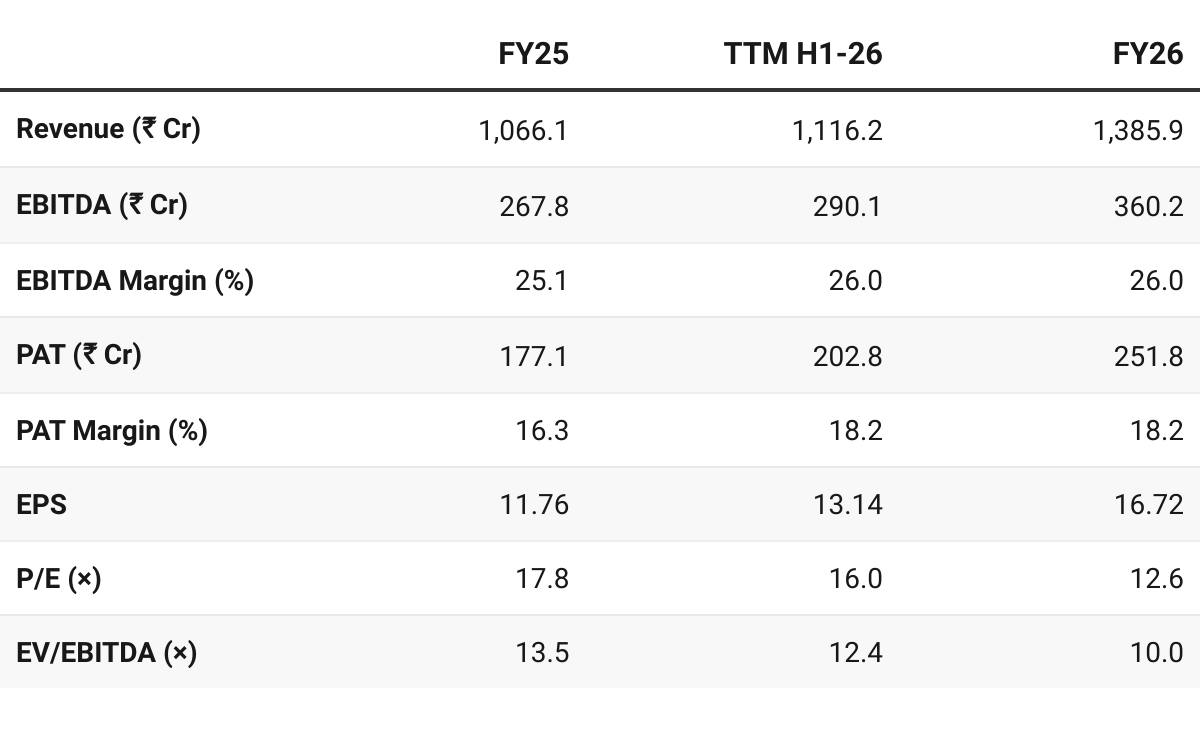

7.1 Valuation Snapshot — Enviro Infra Engineers

CMP ₹209.81; Mcap ₹3,682.8 Cr;

Revenue growth assumed at 30% given the required run-rate of 50% to achieve 35% growthfor FY26

Margins assumed to be stable

Attractive Forward Valuation:

At 13× FY26E P/E and 10× EV/EBITDA, EIEL appears reasonably valued in the near term

Opportunity will emerge as growth momentum continues into FY27

7.2 Opportunity at Current Valuation

Significant Valuation “Margin of Safety”:

With management providing an outlook for strong growth beyond FY26, valuations are very attractive for company promising 35-40% growth with stable margins

At 13× FY26E P/E and 10× EV/EBITDA the margin of safety in the stock if growth lags for a quarter of two

We look forward to having this 35%, 40% CAGR growth for at least next five years. So, we understand till 2030, definitely we have that vision and we can look forward to this type of growth.

Renewables provide an upside:

The 35-40% growth does include does not include the revenue from renewables. Adding the renewables revenue will add an upside in the valuations

This INR200 crore revenue guidance which we are giving from the renewable sector, it is entirely different from that top line guidance which we are giving for water and wastewater sector.

Strong Order Pipeline:

Confidence to “outdo” the INR 2,500 Cr inflow guidance for FY26

Provides revenue visibility for FY27

7.3 Risk at Current Valuation

Poor quality of earnings

Negative OCF: Negative ~INR 100 Cr Operating Cash Flow in H1 FY26.

Unbilled Revenue: If these do not convert to billing and cash in Q3, the working capital cycle will deteriorate rapidly. The company is currently “funding growth” from its own pocket rather than internal accruals.

Extreme H2 Dependence:

To meet guidance, H2 revenue must nearly double compared to H1. Any delay in site clearances, labor availability, or regulatory approvals in Q3/Q4 will lead to a guidance miss and potential stock de-rating.

Margin Dilution from New Segments:

Renewable segment will have lower margins (18-20%) compared to the Water segment (25%+).

Blended EBITDA margin of the company may structurally decline, potentially compressing valuation multiples.

Client Concentration:

Order book is almost 100% government/municipal bodies (e.g., MP Jal Nigam, Bhopal Municipal Corp).

Historically prone to payment delays — previous JJM delays

Previous Coverage of EIEL

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer