Enviro Infra Engineers Q1 FY26 Results: PAT up 42%, On-track FY26 Guidance

Guidance of 35-40% CAGR for FY25-30. At 9x FY28E PE, attractive valuations for a ₹2,500 Cr business growing at 35%+ and delivering 22-24% EBITDA margins

1. EPC Specializing in Water and Wastewater

www.eiel.in | NSE: EIEL

Other Offerings

Hybrid Annuity Model (HAM) Projects

Renewable Energy (New Diversification)

Business Model & Revenue Mix

EPC (Engineering, Procurement & Construction): 75–80% of revenues.

HAM Projects: 10–15% of revenues, with long-term annuity visibility.

O&M Services: 3–5% currently, expected to rise sharply as more projects enter operations.

Renewables: New line, currently small, but positioned for long-term growth.

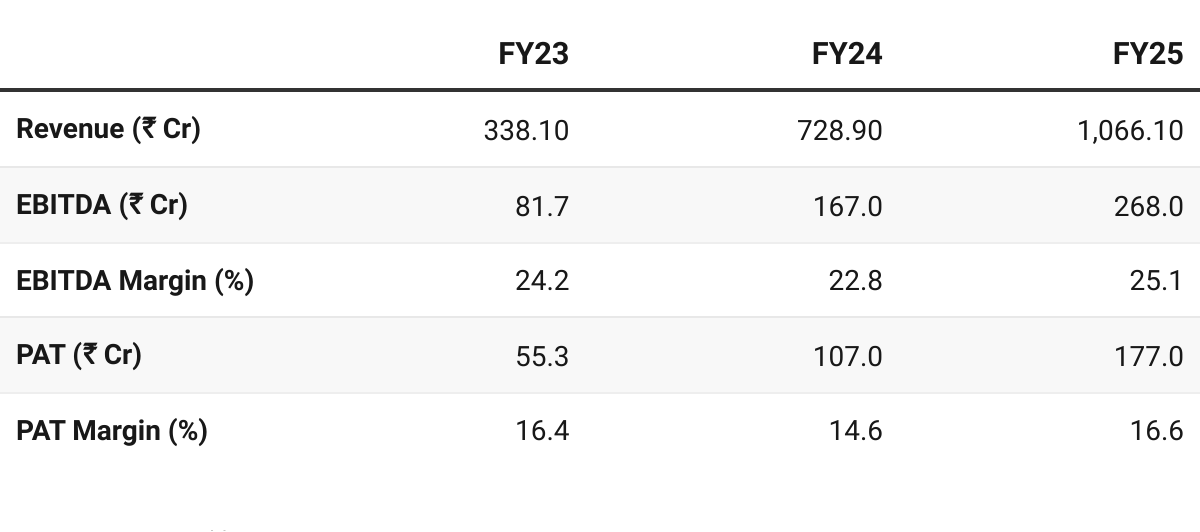

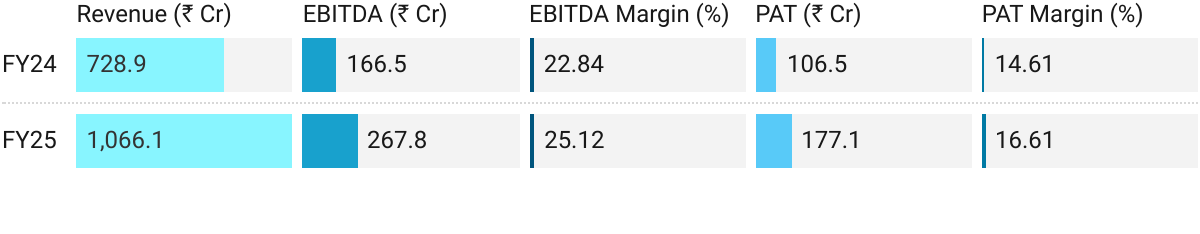

2. FY23–25: PAT CAGR of 79% & Revenue CAGR of 78%

3. FY25: PAT up 66% & Revenue up 46% YoY

Strong growth in execution despite challenges in JJM funding delays.

Emphasis on diversifying away from JJM toward AMRUT 2.0, Namami Gange, CETPs, and multilateral-funded projects.

Completed projects on/before time; Bareilly HAM project completed 2+ months early (earned bonus).

FY25 marked as a turnaround year in cash flows and balance sheet strength.

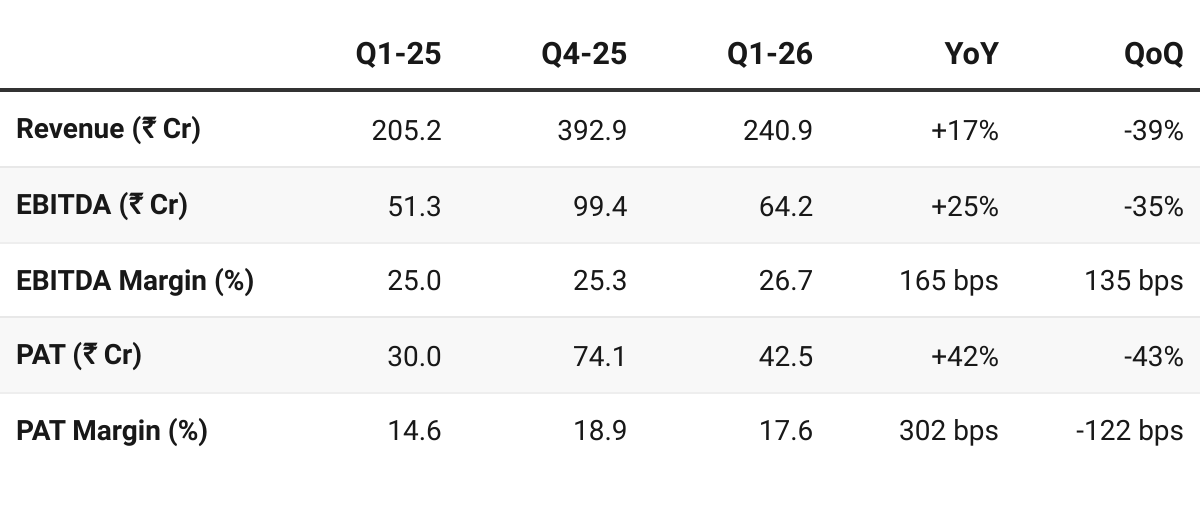

4. Q1 FY26: PAT up 42%, Revenue up 17% YoY

PAT down 43% & Revenue down 39% QoQ

Strong start to FY26 with robust revenue and margin expansion.

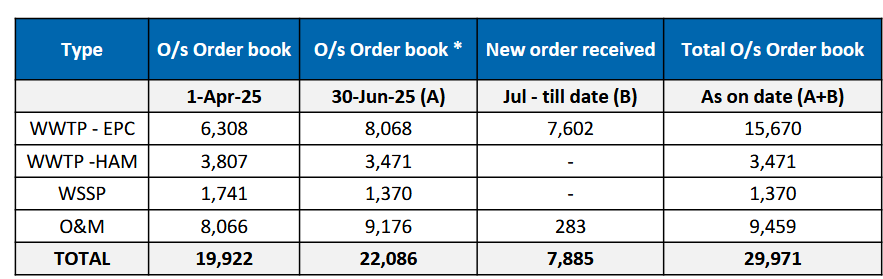

Order inflows in Q1 already covered ~47% of FY26 order guidance (₹2,500 Cr).

Execution to accelerate in H2 FY26, as new large projects commence.

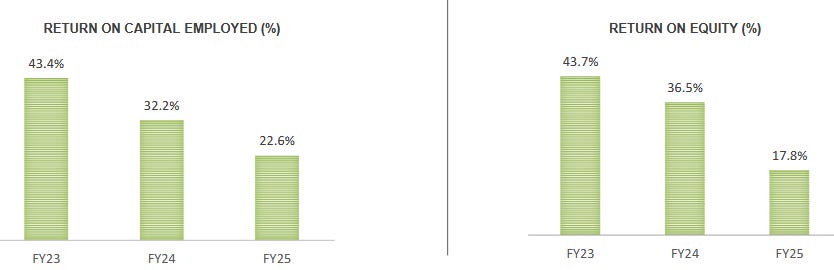

5. Business Metrics: Strong & Improving Returns

As PAT grows into the expanded equity base after its IPO in FY25 with earnings compounding 35–40% CAGR return ratios will start trending up

6. Outlook: 35-40% Revenue CAGR till FY30

6.1 Guidance

We look forward to having this 35%, 40% CAGR growth for at least next five years. So, we understand till 2030, definitely we have that vision and we can look forward to this type of growth.

Our guidance on the EBITDA margins will always remain to be in the range of 22% to 24%.

However, we have been in a position to have still better margins against this guidance what we are giving.

We can continue with the same margin profile and we can have that revenue visibility of 35%, 40% similar type of margins which we are having right now and with good cash flows.

For this financial year, we have given an order guidance in the range of Rs. 2,500 crores. So, around Rs. 1,200 crores is the order book which we have got. So, there is a balance of around Rs. 1,300 crores which we are expecting. We do expect that we will be in a position to outdo this number as well. So, at least for the time being, I will say, another Rs. 1,300 crores is the order book what we are looking for as soon as possible.

FY26 Guidance

Revenue Growth: 35–40% CAGR growth — led by demand in water & wastewater projects and entry into ZLD (Zero Liquid Discharge)

EBITDA Margins: Guided at 22–24% sustainable range. Actual margins have been higher (25–27%), and management believes these levels can continue.

PAT Growth: Expected to broadly track revenue, at 35–40% CAGR

Strategic Outlook (FY26–FY30)

Core Water & Wastewater Business

Scaling STP capacity projects from 50 MLD → 200 MLD, CETPs from 20 → 50 MLD, improving margins via higher complexity work.

AMRUT 2.0 (₹3 lakh Cr outlay till 2029) gives strong project visibility; only ~₹30,000 Cr spent so far, leaving huge headroom.

ZLD (Zero Liquid Discharge) identified as biggest growth lever, mandated by NGT for industrial clusters. First ₹395 Cr ZLD CETP project won in FY26 Q1.

Diversification into Renewables

Subsidiary EIE Renewables formed; acquired 69 MW solar assets in Odisha & Maharashtra. Revenue contribution to begin in FY26 but will scale up FY27+.

Exploring hybrid 24x7 renewable, green hydrogen, and waste-to-energy (CBG plants) for future growth.

EBITDA margins in renewables expected at 18–20% vs 22–24% in core EPC.

O&M Expansion (High-Margin Recurring Revenue)

Current O&M order book ~₹950 Cr; revenue to grow from ₹30 Cr (FY25) → ₹70–75 Cr by FY27, with 30–35% margins.

Geographic Expansion & Risk Mitigation

Revenue is getting de-risked from high concentration in MP; new wins in Maharashtra, Odisha, Chhattisgarh, Gujarat.

Possible international foray (Middle East / SE Asia) under evaluation.

Tailwinds

Large, under-penetrated wastewater market (only ~33% treated in India today).

Policy tailwinds: AMRUT 2.0, Namami Gange, NRCP, NGT’s ZLD mandates.

Margin accretive move into ZLD + renewables + O&M ensures long-term profitability.

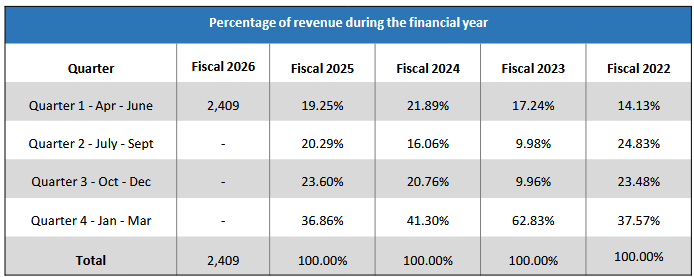

6.2 Q1 FY26 vs FY26 Guidance

On-track FY26 guidance on revenue growth

Revenue:

Q1-26 — 16–17% of full-year guidance

EIEL is a H2 heavy business ramp-up key

EBITDA Margin — Above guidance; strong execution in STPs & ZLD

PAT Margin — 17% vs 16–18% (implied) In line with full-year expectations

Order Inflows:

₹1,178 Cr in Q1-26 vs ₹2,500 Cr for FY26

~47% of FY26 target already secured in Q1

Order Book = ₹2,051 Cr + ₹946 Cr O&M ~₹3,000 Cr+ order book visibility Provides 2–2.5 years of revenue visibility

O&M Revenues:

₹6–7 Cr in Q1 ~₹40–45 Cr for FY26 Long-term trajectory to ₹70–75 Cr by FY27

Renewables:

Initial acquisitions; no major revenue yet

Small FY26 contribution, scaling FY27+ Strategic diversification underway

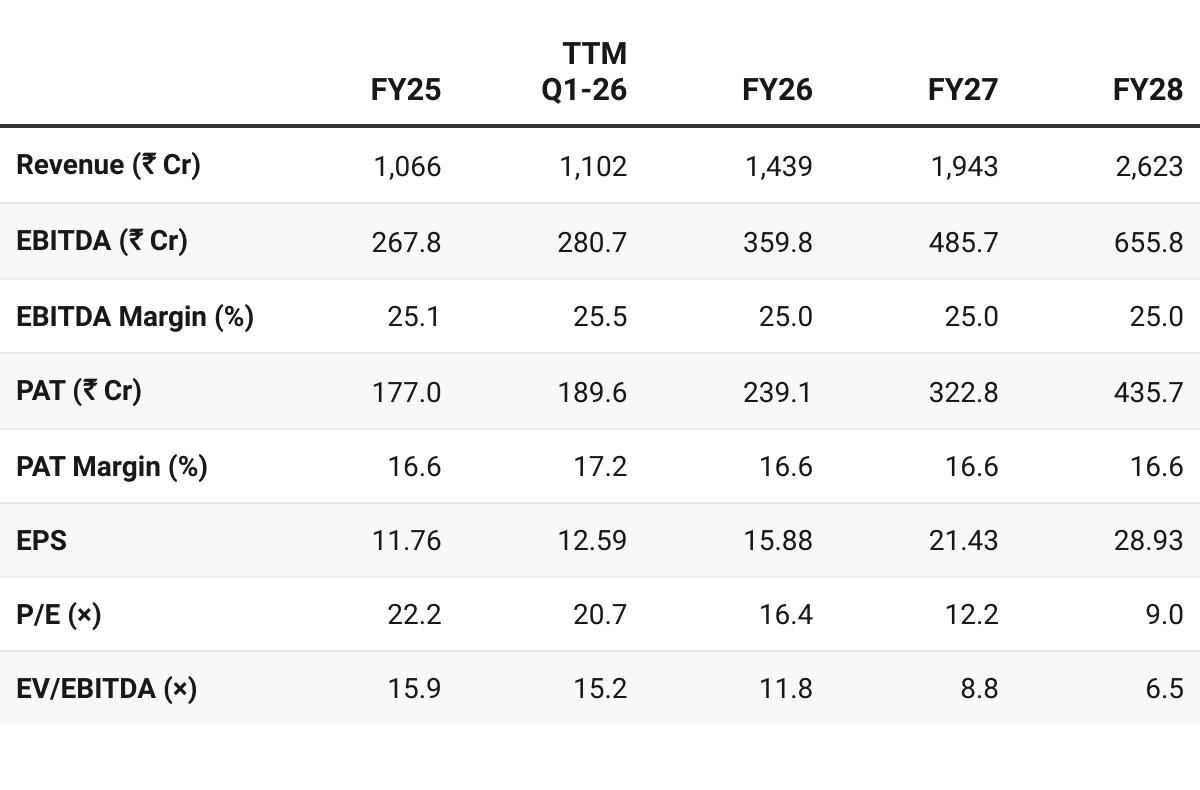

7. Valuation Analysis

7.1 Valuation Snapshot — SRM Contractors

CMP ₹260.65; Mcap ₹4567.3 Cr;

Revenue growth assumed at lower end of 35-40% growth guidance

Margins assumed to be stable

Attractive Forward Valuation:

At 16.4× FY26E P/E and 11.8× EV/EBITDA, EIEL appears fairly valued in the near term

P/E de-rating from 22× in FY25 → 9× by FY28E

Indicates valuation comfort and rerating potential if growth sustains.

EV/EBITDA compression: Attractive for long-term investors as multiples are moving to single digits.

7.2 Opportunity at Current Valuation

Conservative Growth Projections:

Forward valuations are conservative so an opportunity for upside still exists

EIEL is guiding for 35–40% CAGR revenue till 2030, the analysis is not considering the growth beyond FY28 as current order book ad FY26 guidance provides revenue visibility till FY28

Growth assumed at the lower end of the guidance

Sector Tailwinds:

Policy-driven demand via AMRUT 2.0 (₹3 lakh Cr till 2029), Namami Gange, NRCP, and NGT’s ZLD mandates ensures sustained project flow.

India’s water treatment gap is massive: only ~33% wastewater treated, with growing regulatory push for reuse.

Margin Strength:

Sustained 22–24% EBITDA margin guidance, consistently beating at ~25%.

ZLD and CETP projects are more complex and margin-accretive (~30%).

O&M revenues expected to rise from ₹30 Cr in FY25 → ₹70–75 Cr by FY27, at 30–35% EBITDA margins.

Diversification into Renewables:

Acquired 69 MW solar assets in Odisha & Maharashtra.

Opens up new revenue streams; strategic optionality in green energy, hybrid 24x7 renewable, and waste-to-energy (CBG plants).

7.3 Risk at Current Valuation

Execution Risks:

Scaling from 50 MLD to 200 MLD STPs and large CETPs may pose execution challenges.

Timely completion critical to maintain margins and reputation.

Working Capital & Receivable Risks:

Sector is government-funded; delays (e.g., in JJM scheme) impacted FY25 cash flows.

Although exposure to JJM is now small (~₹110 Cr), future policy or budget delays could strain liquidity.

Customer Concentration:

Revenue is almost entirely from government/municipal projects; limited private-sector diversification increases dependence on state/central agencies.

Renewable Foray:

Solar/waste-to-energy diversification is new; near-term returns uncertain.

Renewable projects may offer lower margins (18–20% EBITDA vs 22–24% core EPC).

Execution and financing risks in scaling renewable portfolio.

Competition: Bidding intensity remains high in water infra. While EIEL has strong win ratios (35–40%), increased competition could pressure margins.

HAM Exposure: HAM projects though capped at ~25% of project mix to avoid over-leverage adds equity-funding and lifecycle risks beyond EPC.

Valuation Execution Risk: FY26 multiples already price in growth. Any shortfall in FY26 delivery could pressure stock performance.

Help your group stay ahead. Share now!

Don’t like what you are reading? Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer